The post Newly MOP HDB vs Older Resale HDB appeared first on Wing Tai Holdings Singapore.

]]>Hey there, homebuyers! Are you ready to dive into the exciting world of HDB flats in Singapore? Well, get ready for a dilemma! When it comes to purchasing a home, Singaporeans face a tough choice between newly MOP HDB flats and older resale HDB flats. It’s a decision that can make your head spin faster than a ferris wheel in Marina Bay Sands.

But fear not, my fellow homebuyers, for I am here to shed some light on this perplexing predicament. In this article, we’ll explore the factors that you need to consider in order to make an informed decision. From the core differences between newly MOP HDB flats and older resale HDB flats to the impact of the Minimum Occupation Period (MOP) on property value, we’ve got you covered.

So strap in, grab your kopi from the nearest kopi tiam, and let’s embark on this HDB adventure together!

Key Takeaways:

- Choosing between newly MOP HDB flats and older resale HDB flats can be a daunting task for homebuyers in Singapore.

- Factors such as property age, lease considerations, and pricing differentiate these two options.

- The Minimum Occupation Period (MOP) plays a significant role in the value and eligibility of HDB flats.

- Consider your life stage, room requirements, and investment potential when making your decision.

- Don’t forget to factor in amenities, location, and long-term returns to ensure a well-rounded evaluation.

Introduction: The Quest for Affordable Homeownership in Singapore

Affordable homeownership is no small feat in Singapore, where the high cost of real estate has left many aspiring homeowners grappling with the challenge of finding a place to call their own. As a homebuyer in Singapore, the dream of owning a property that meets both your budget and your needs requires careful consideration and a thorough understanding of the housing market. In this article, we will explore the various factors that contribute to the affordability of homeownership in Singapore, helping you navigate the complexities of the real estate landscape.

One of the key drivers behind the quest for affordable homeownership is the significant financial burden that comes with purchasing a property. The demand for housing in Singapore, coupled with limited land availability, has driven property prices to unprecedented heights. As a result, many homebuyers find themselves in a constant struggle to secure a home that fits their budget without compromising on quality and location.

“Affordable homeownership is not just about finding a property at a lower price. It’s about finding a balance between price, location, and the long-term financial implications of owning a home,” says John Tan, a real estate expert in Singapore.

In addition to the financial aspects, the scarcity of available housing options also contributes to the challenge of affordable homeownership. Singapore’s housing market is primarily dominated by public housing, known as HDB (Housing and Development Board) flats, which are typically more affordable compared to private properties. However, factors such as location, size, and leasehold status further influence their price and availability.

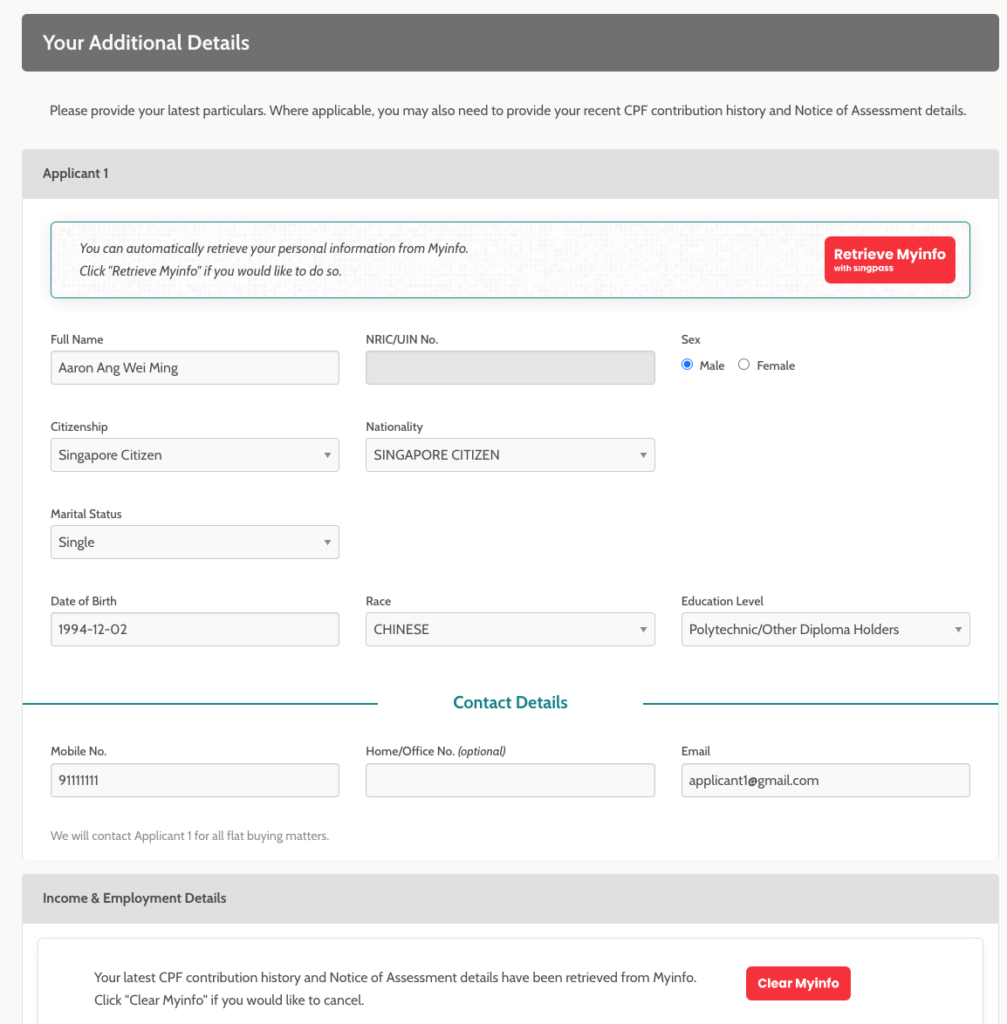

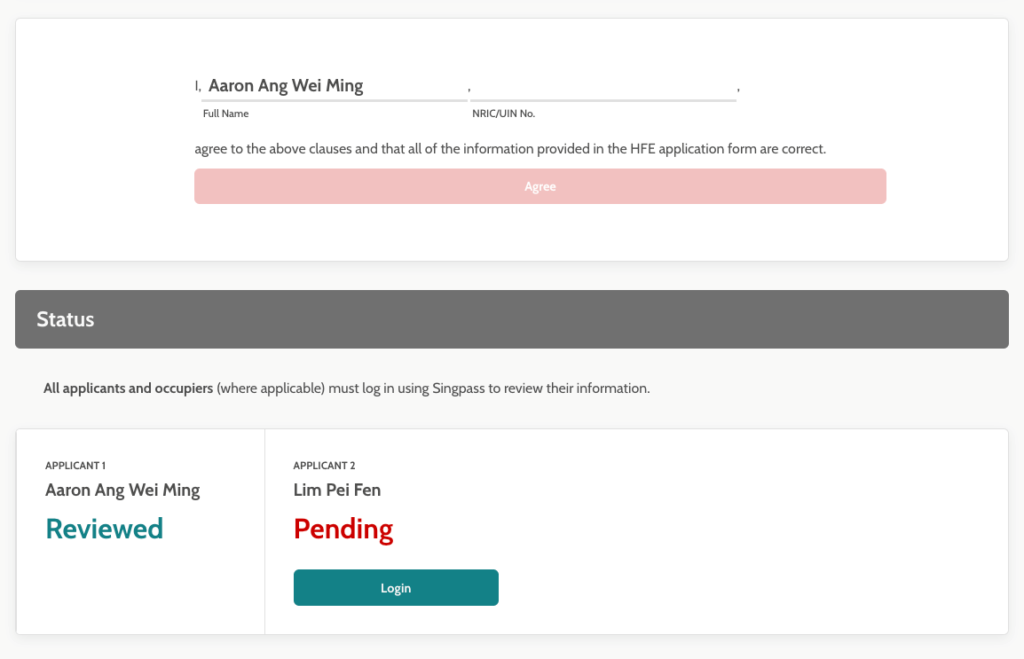

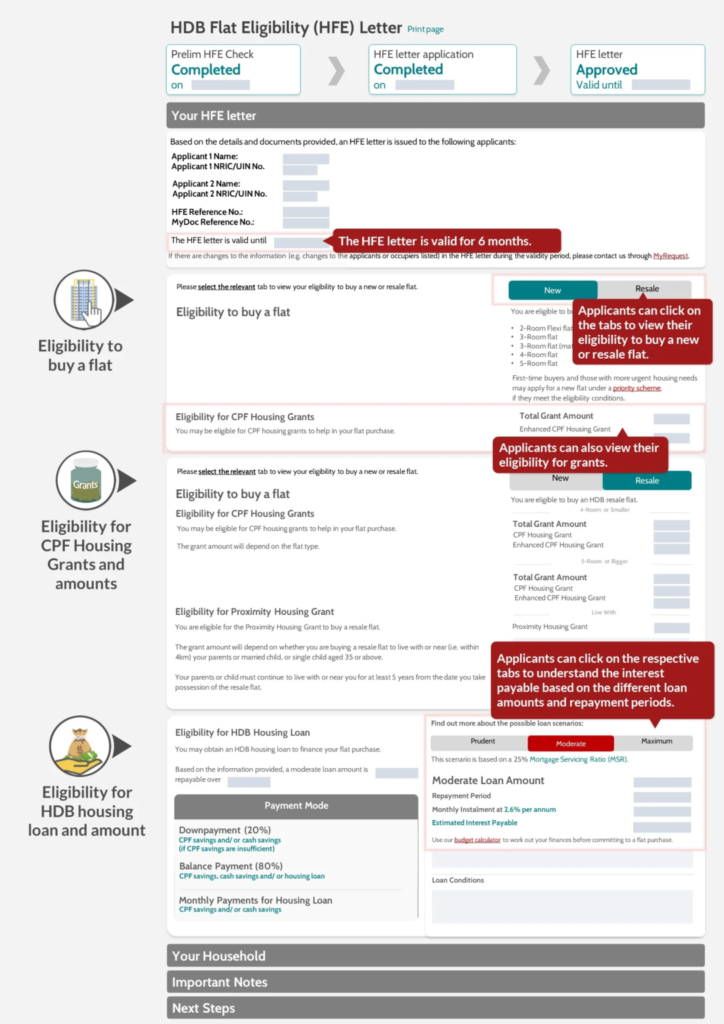

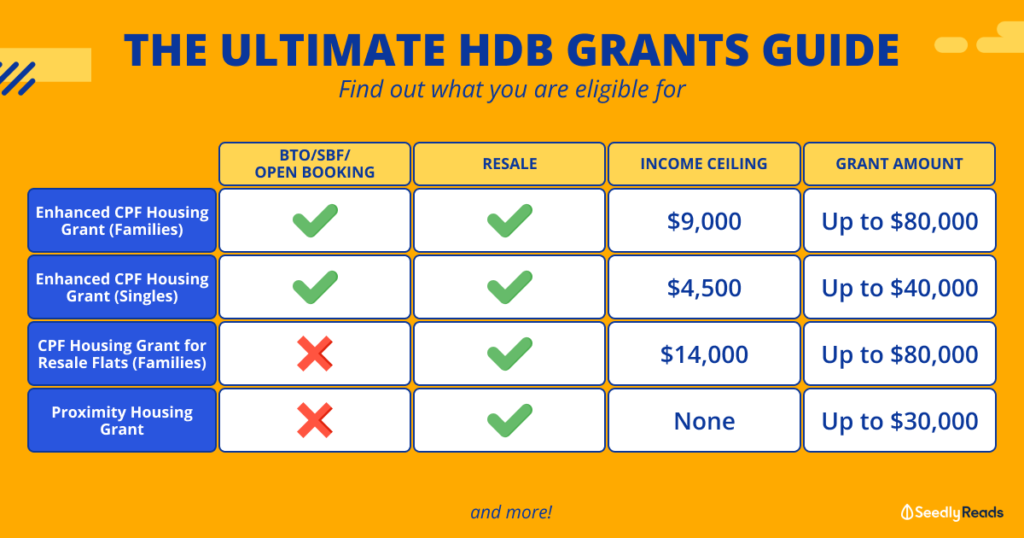

Despite these challenges, the Singaporean government has implemented various measures to support and promote affordable homeownership. These include grants, subsidies, and loan schemes aimed at helping first-time homebuyers overcome financial barriers. Additionally, the government has introduced policies to ensure a balanced and sustainable housing market, such as the Minimum Occupation Period (MOP) requirement for HDB flats.

Throughout this article, we will explore the factors that influence affordable homeownership in Singapore, providing insights and practical advice to help you make informed decisions in your quest for the perfect home. From understanding the core differences between newly MOP HDB flats and older resale HDB flats, to evaluating lease considerations and exploring property value trends across different regions, we will guide you through the complexities of the Singapore property market. So, let’s dive in and discover the path to affordable homeownership in Singapore!

Newly MOP HDB vs. Older Resale HDB: The Core Differences

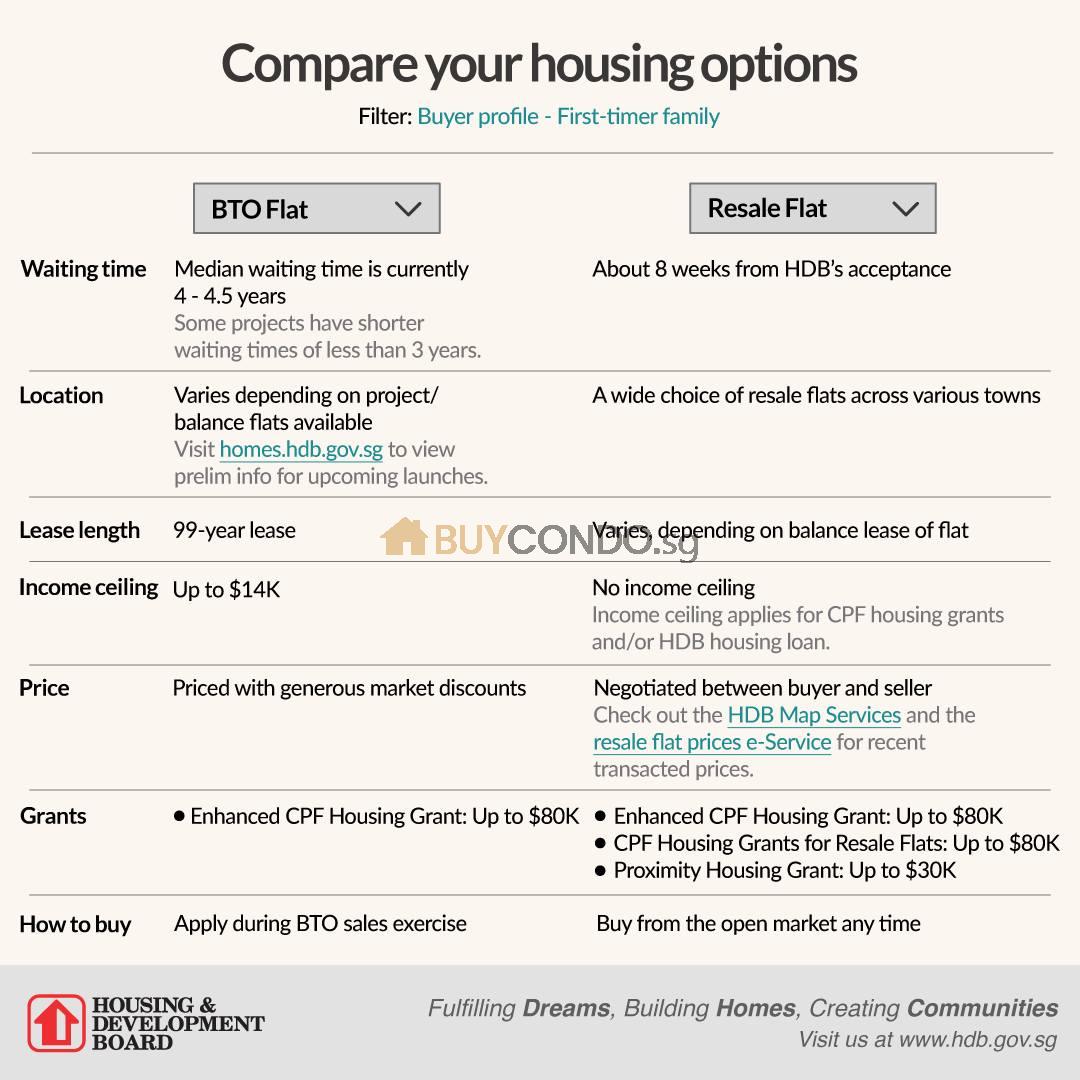

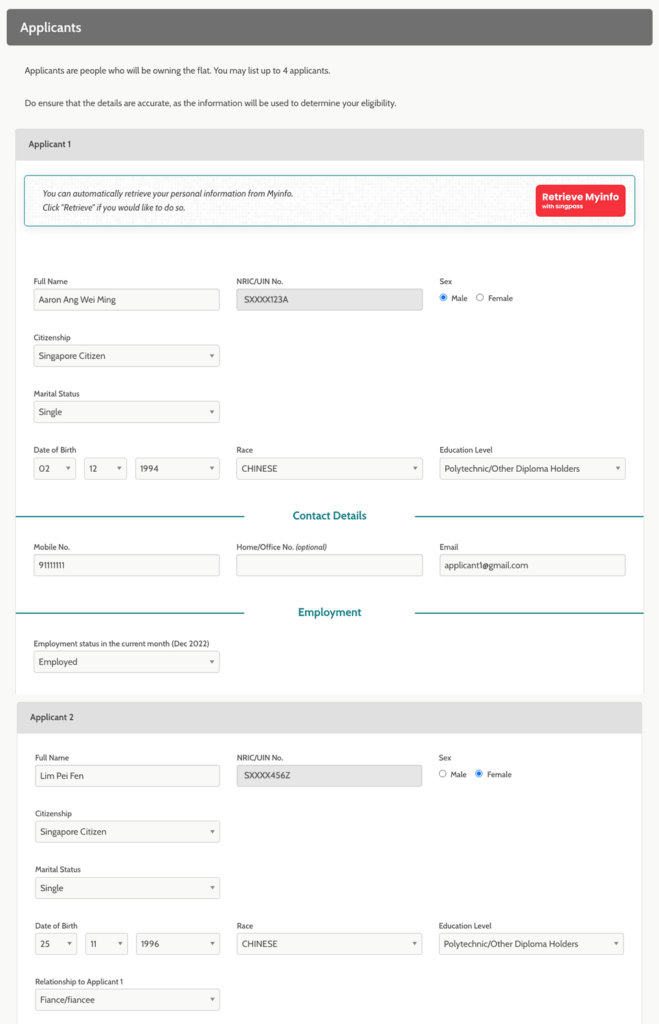

When it comes to purchasing a home in Singapore, there is a crucial decision that homebuyers have to make: choosing between newly Minimum Occupation Period (MOP) HDB flats and older resale HDB flats. Understanding the core differences between these two options is essential in making an informed choice.

To begin with, one of the key distinctions between newly MOP HDB flats and older resale HDB flats is their property age. Newly MOP HDB flats typically refer to those that have completed the MOP period and are ready for occupancy, while older resale HDB flats have been previously owned and can vary in terms of age and condition.

Another critical factor to consider is the lease. Newly MOP HDB flats generally come with a longer remaining lease, offering more years of ownership. On the other hand, older resale HDB flats may have a shorter remaining lease, which could impact their value and the ability to secure financing.

Pricing is also an important aspect to compare. Newly MOP HDB flats tend to have a higher price due to their newer condition and longer remaining lease. Older resale HDB flats, on the other hand, may come at a relatively lower price, taking into account factors such as property age and remaining lease.

Understanding these core differences between newly MOP HDB flats and older resale HDB flats is crucial for homebuyers to evaluate and prioritize their needs and preferences. Whether it’s prioritizing a longer remaining lease, a lower price, or a newer property, each option has its own advantages and considerations.

Ultimately, the choice between newly MOP HDB flats and older resale HDB flats will depend on individual circumstances, financial capabilities, and future plans. It is recommended to carefully evaluate these factors and seek professional advice before making a decision.

Visual representation of the core differences between newly MOP HDB and older resale HDB.

| Factors | Newly MOP HDB | Older Resale HDB |

|---|---|---|

| Property Age | Newer | Varies |

| Lease | Longer Remaining Lease | Shorter Remaining Lease |

| Pricing | Higher | Relatively Lower |

Understanding the Minimum Occupation Period (MOP) and Its Impact on Property Value

When considering the purchase of a newly MOP HDB flat or an older resale HDB flat, it is essential to understand the concept of the Minimum Occupation Period (MOP) and its influence on property value. The MOP is a crucial factor that directly affects the marketability and value of your home.

What is MOP and Why Does It Matter?

The Minimum Occupation Period (MOP) refers to the mandatory period during which HDB flat owners are required to live in their property before they are eligible to sell or rent it out. This policy aims to ensure stable communities and provide homeowners with the opportunity to establish roots in their neighborhood. The MOP duration typically ranges from 5 years.

“The MOP is like a commitment period, where homeowners are encouraged to settle down and contribute to the community without the distractions of property speculation.”

During the MOP, homeowners are not allowed to sell, transfer ownership, or rent out their flat. Violating the MOP regulations can result in penalties or legal repercussions. Therefore, it is crucial to understand and comply with the MOP guidelines to avoid any complications in the future.

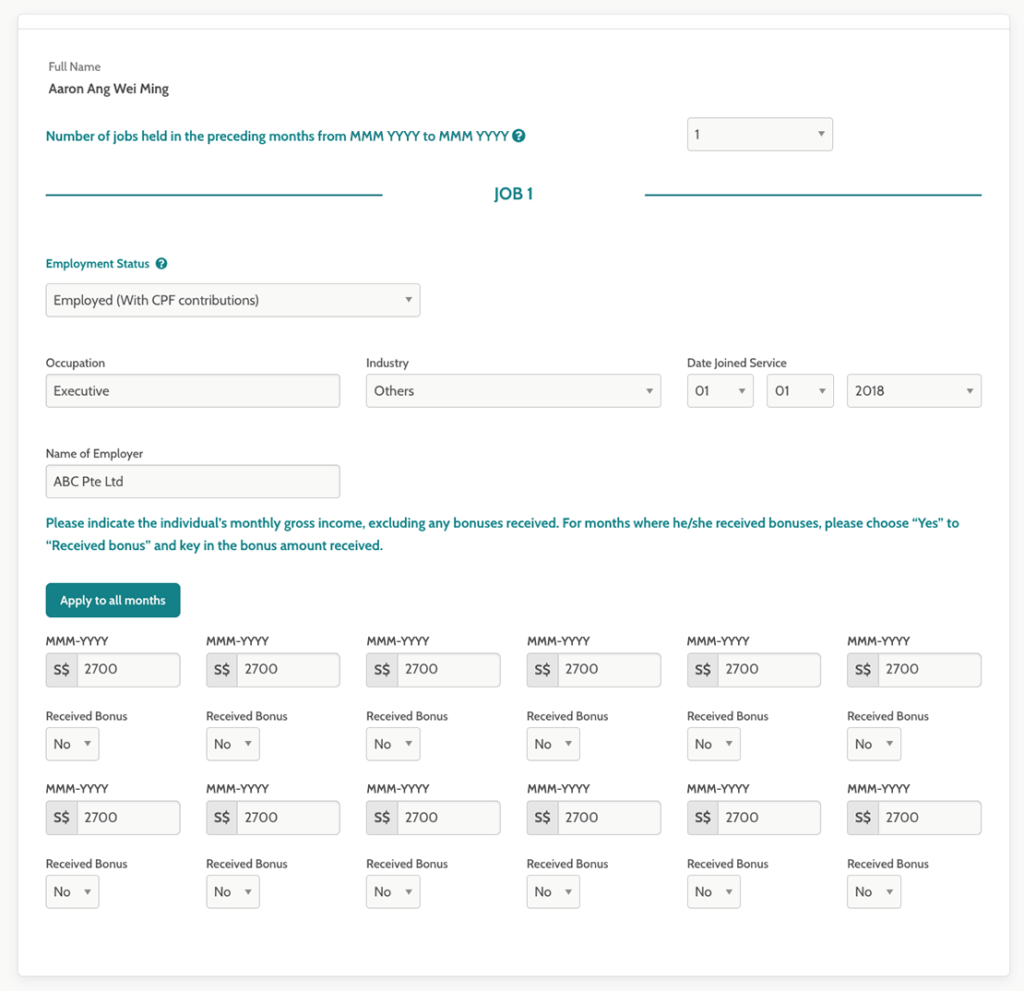

The Influence of MOP on Newly Acquired HDBs

For those looking to purchase a newly MOP HDB flat, it is important to consider the impact of the MOP on the property value. Newly MOP HDB flats are still within the MOP period, which means that their marketability is limited. Buyers who plan to sell the flat before the MOP ends may face challenges in finding potential buyers due to the restrictions imposed.

However, it’s worth noting that once the MOP period is over, the value and marketability of the HDB flat may increase significantly. The completion of the MOP allows homeowners to explore various options, such as selling or renting out the property, thereby increasing its potential value. Additionally, being in a mature estate or a desirable location can further enhance the overall value of the HDB flat once the MOP is fulfilled.

| MOP Status | Implications on Property Value |

|---|---|

| Before MOP | Limited marketability and restricted selling options |

| After MOP | Potential increase in value and marketability, more selling and renting options available |

As with any property investment, it is important to consider your long-term goals and financial capability when deciding between newly MOP HDB flats and older resale HDB flats. Understanding the MOP and its implications on property value can help you make a more informed decision.

https://buycondo.sg/hdb-vs-private-condominium-which-is-more-significant/

Evaluating Property Lifespan: Lease Considerations for HDB Flats

When considering purchasing an HDB flat, it is essential for homebuyers to evaluate the lifespan of the property and take into account the lease considerations. The property lifespan and lease remaining on HDB flats can significantly impact the value and longevity of the property, making it a crucial factor in the decision-making process.

One of the key aspects to consider is the remaining lease on the HDB flat. HDB flats have a lease of 99 years, and it is important to assess how many years are left on the lease before making a purchase. The lease remaining affects both the potential resale value of the property and the buyer’s ability to enjoy the property over the long term.

With a shorter lease remaining, the property may become less desirable in the resale market as its value decreases over time. Additionally, as the lease gets closer to expiry, the HDB flat may become less attractive to potential buyers, making it harder to sell in the future. Therefore, considering the lease remaining is crucial for buyers who are looking for a property with long-term investment potential.

However, it’s important to note that the remaining lease does not solely determine the value of an HDB flat. Other factors such as location, amenities, and the overall condition of the flat also play a significant role. Buyers should evaluate the lease considerations in conjunction with these factors to make a well-rounded assessment of the property’s value and potential.

Moreover, for buyers who plan to live in the HDB flat for the entire lease duration, the remaining lease may be less of a concern. In such cases, the focus may be more on the suitability of the flat for the buyer’s current and future needs, rather than its potential resale value.

“The lease considerations for HDB flats require careful evaluation. It’s not just about the number of years remaining, but also the overall condition, location, and amenities of the property. It’s important to find the right balance that aligns with your long-term goals and preferences.”

| Lease Considerations | Impact |

|---|---|

| Shorter remaining lease | – Decreased resale value – Potential difficulty in finding buyers – Limited long-term investment potential |

| Longer remaining lease | – Higher resale value – Increased attractiveness to potential buyers – Extended long-term investment potential |

| Living in the property for entire lease duration | – Focus on suitability for current and future needs – Resale value may be of less priority |

Assessing the property lifespan and taking lease considerations into account is a critical step in making an informed decision when buying an HDB flat. By carefully evaluating the remaining lease and considering other factors that influence the value of the property, homebuyers can ensure that their investment aligns with their long-term goals and preferences.

Life Stages and Housing Choices: From Singles to Young Families

Different life stages present unique housing challenges and considerations. As individuals transition through various stages of life, their housing needs and preferences naturally evolve. From singles seeking youthful independence to young families in need of space and stability, each life stage brings its own set of housing choices.

When Youthful Independence Clashes with Housing Rules

Singles often value their independence and desire a housing arrangement that aligns with their lifestyle. However, in Singapore, housing rules can pose challenges for single individuals. The Housing and Development Board (HDB) sets specific eligibility criteria for purchasing certain types of housing, such as public housing flats. Singles may face restrictions or limitations when it comes to buying a home that suits their preferences.

However, there are alternative housing choices available for singles in Singapore. Private rental options, such as condominiums or apartments, provide greater flexibility and fewer restrictions compared to HDB flats. These options allow singles to enjoy the freedom and independence they desire without being confined by the housing rules that apply to public housing. Additionally, co-living arrangements are gaining popularity among singles, offering a cost-effective and communal living experience.

Advantages for Married Couples in the HDB Market

Married couples, on the other hand, often enjoy certain advantages in the HDB market. The HDB offers various housing schemes and grants specifically designed for married couples, making it easier for them to own a home. These schemes include the Married Child Priority Scheme, the Parenthood Priority Scheme, and the Proximity Housing Grant, among others.

Married couples can also benefit from the stability and affordability of HDB flats. HDB estates typically provide a range of amenities, such as schools, parks, and community centers, which are ideal for families with young children. The strong sense of community within HDB estates can also contribute to a fulfilling family-oriented lifestyle.

Ultimately, the housing choices available to singles and young families depend on individual circumstances, preferences, and financial capabilities. Considering the clash between youthful independence and housing rules for singles, as well as the advantages offered to married couples in the HDB market, can help individuals make informed decisions about their housing options.

Envisioning Your Long-Term Residence: Newly MOP-ed HDB vs. Aging Resale Options

Projection of Home Value Over Time

When choosing between newly MOP-ed HDB flats and aging resale options, it’s essential to consider the projection of home value over time. Investing in a property is a long-term decision, and understanding how it may appreciate or depreciate in value can have a significant impact on your financial future.

Considering Comfort and Community Ties in Your Decision

It’s not just about the monetary aspect when deciding between newly MOP-ed HDB flats and aging resale options. The comfort and sense of belonging that come with living in a community should also play a crucial role in your decision-making process.

When you envision your long-term residence, think about the amenities, facilities, and neighborhood characteristics that matter most to you. Are you looking for a vibrant, bustling neighborhood with a diverse range of shops and restaurants? Or do you prefer a quieter, close-knit community with plenty of green spaces for relaxation?

Consider the proximity to essential amenities such as schools, healthcare facilities, and transportation options. Furthermore, think about the availability of recreational centers, parks, and community spaces that foster social interaction and the building of lasting relationships with your neighbors.

Your long-term residence isn’t just a physical structure; it’s where you’ll create memories, forge friendships, and establish community ties. Don’t underestimate the importance of finding a place that aligns with your lifestyle and offers the support and camaraderie that contribute to a fulfilling living experience.

With the projection of home value over time and the consideration of comfort and community ties, you’ll be better equipped to make an informed decision about your long-term residence. So take the time to analyze the factors that matter most to you and choose the option that aligns with your goals and aspirations.

Size Matters: Room Requirements for Different Buyer Profiles

When it comes to purchasing a home, the size of the rooms can make a big difference. Homebuyers have different room requirements based on their profiles, and it’s important to consider these needs before making a decision.

For families with children, spacious bedrooms are a top priority. Kids need space to play, study, and grow. Having enough room for a bed, a desk, and storage is essential for their comfort and development.

On the other hand, young professionals or couples without children may prioritize a home office or a spare room for hobbies. Whether it’s for remote work, creative pursuits, or a small home gym, having an extra space can enhance the overall livability of the home.

For elderly individuals or those with mobility challenges, a well-designed bedroom and bathroom that are easily accessible and can accommodate assistive devices can greatly improve comfort and quality of life.

Decoding the Singapore Property Market: Ideal Regions for HDB Flats

When it comes to investing in HDB flats, understanding the Singapore property market is crucial. Different regions offer unique advantages and property value trends that can greatly impact your investment decision. In this section, I will help you decode the Singapore property market and identify the ideal regions for HDB flats.

Property Value Trends Across Different Regions

The property value trends across different regions in Singapore can vary significantly. Factors such as location, amenities, and accessibility can greatly influence the value of HDB flats. It’s important to consider both current market conditions and potential future developments when assessing property value trends.

To illustrate the varying property value trends, let’s take a look at the following table:

| Region | Average HDB Flat Price | Property Value Trend |

|---|---|---|

| Central Region | $800,000 | Stable |

| North Region | $450,000 | Stable |

| East Region | $550,000 | Slightly increasing |

| West Region | $450,000 | Moderately increasing |

As you can see, the Central Region has experienced rapid property value growth, making it an ideal region for HDB flat investments. The North and East Regions offer stability and moderate growth, while the West Region provides more affordable options with moderate value increases. Understanding these trends can help you make an informed decision based on your budget and investment goals.

Finding the Sweet Spot: Location vs. Property Age

When choosing an ideal region for your HDB flat, it’s important to strike a balance between location and property age. While a prime location can offer convenience and potential for higher property value appreciation, the age of the property plays a significant role in maintenance costs and potential renovations.

Remember, it’s not just about the location – it’s about finding the sweet spot where location aligns with your property age preferences.

For example, if you prefer a vibrant city lifestyle, the Central Region might be your sweet spot, where newer developments offer modern amenities and easy access to downtown attractions. On the other hand, if you value a more tranquil environment and are willing to invest in renovations, an older HDB flat in the North Region might be suitable for you.

By carefully considering the location and property age, you can find the sweet spot that aligns with your lifestyle, budget, and long-term investment goals.

Considering Renovations: Additional Costs for Your Dream Home

When it comes to purchasing your dream home, renovations can be a crucial factor to consider. While you may have found the perfect HDB flat, it’s important to evaluate the additional costs and financial implications that come with upgrading and personalizing your space.

Determining Your Readiness for Property Makeovers

Before diving into renovations, it’s essential to assess your readiness for property makeovers. Consider the following factors:

- Time: Renovations require time and effort. Assess whether you have the bandwidth to manage the process or if you need to hire professionals.

- Budget: Establish a realistic budget for your renovation project. Evaluate your financial readiness and ensure you have sufficient funds to cover the additional costs.

- Personal Preferences: Understand your design preferences and the extent of changes you desire. Determine if you’re open to minor upgrades or if you’re looking for a complete overhaul.

- Practical Considerations: Evaluate the practicality of renovations, taking into account your lifestyle, family needs, and any future plans that may affect the longevity of the improvements.

By carefully considering these factors, you can determine if you’re truly ready to take on property makeovers and make an informed decision based on your individual circumstances.

The Financial Implications of Upgrading an HDB Flat

Upgrading an HDB flat involves financial implications that should not be overlooked. Apart from the cost of the renovations themselves, there are other considerations to keep in mind:

- Additional Costs: Renovations often come with unforeseen expenses such as permits, contractor fees, and potential delays. Factor in these additional costs to avoid any surprises.

- Value-Added: While renovations can enhance your living experience, it’s important to assess whether they will add value to your HDB flat. Consider the potential increase in property value and the overall market demand for upgraded units in your area.

- Selling or Renting: If you plan to sell or rent out your HDB flat in the future, evaluate the return on investment (ROI) of your renovations. Will the upgrades significantly impact the rental or resale value of your property?

Understanding the financial implications of upgrading an HDB flat will help you make smart decisions and ensure you stay within your budget while still achieving your dream home.

Amenity Considerations: What’s Important in Your HDB Living Experience?

When it comes to choosing the perfect HDB flat, amenity considerations can make all the difference in creating a comfortable and convenient living experience. As a savvy homebuyer, it’s important to evaluate the amenities available in the surrounding area and within the HDB estate itself to ensure you’re making the right decision.

One of the key amenity considerations is the proximity to essential facilities such as schools, healthcare centers, and shopping malls. Having these amenities nearby can greatly enhance your daily life, offering convenience and accessibility to everything you need.

Furthermore, recreational amenities play a significant role in improving your overall living experience. Look out for nearby parks, sports facilities, and community centers that offer opportunities for leisure activities, exercise, and socializing. These amenities not only promote a healthier lifestyle but also encourage a sense of community and connection.

In addition to external amenities, it’s important to consider the facilities within the HDB estate itself. Many newer HDB flats come equipped with a wide range of facilities such as playgrounds, fitness corners, and swimming pools. These on-site amenities provide convenience and entertainment right at your doorstep, ensuring that there’s always something to do within the estate.

When assessing amenity considerations, it’s essential to prioritize your personal preferences and lifestyle needs. Consider what amenities are most important to you and align them with your daily routine and long-term goals. By doing so, you’ll be able to make a well-informed decision that caters to your unique living experience.

Remember, an HDB flat is not just a physical dwelling, but a place where you’ll be building a life. So, take the time to carefully evaluate the amenity considerations and create a living experience that meets your expectations and enhances your quality of life.

Assessing Investment Potential: Understanding Long-term Returns on HDB Properties

When it comes to purchasing a home, it’s not just about finding the perfect place to live. Homebuyers also need to consider the investment potential of their property. In the case of HDB properties, understanding the long-term returns is crucial to making a wise decision.

Investing in an HDB property offers unique opportunities for long-term growth and stability. With Singapore’s strong real estate market, HDB properties have the potential to appreciate in value over time, providing homeowners with significant returns on their investment.

One of the key factors that contribute to the investment potential of HDB properties is the location. HDB flats located in desirable neighborhoods with good amenities and accessibility tend to appreciate at a higher rate. These properties attract a larger pool of potential buyers, which can drive up their value over time.

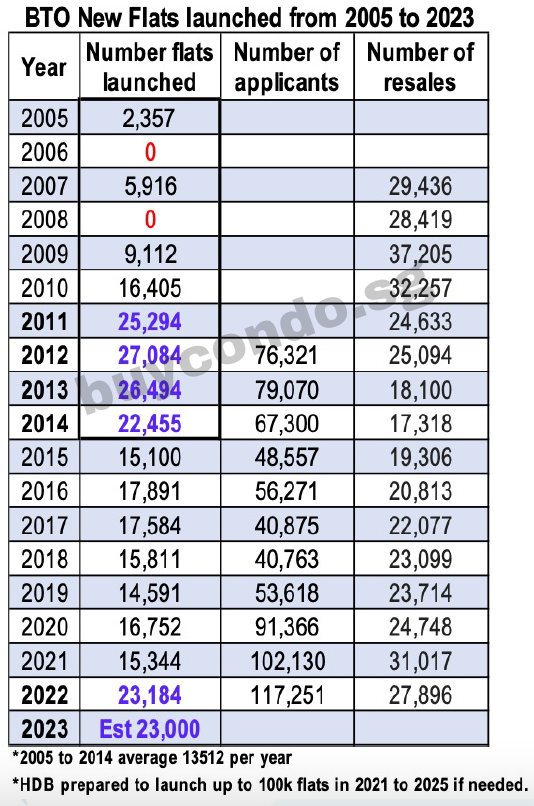

Additionally, the supply and demand dynamics of the HDB market play a role in determining the long-term returns. HDB flats with limited supply and high demand are more likely to experience price appreciation. As the population in Singapore continues to grow, the demand for HDB properties is expected to remain strong.

It’s also important to consider the lease of the HDB property when assessing its investment potential. HDB flats have a leasehold tenure, and the length of the lease remaining can impact the value of the property. Homebuyers should take into account the remaining lease and consider how it aligns with their long-term investment goals.

In addition to potential capital appreciation, HDB properties can also provide a steady rental income. With the growing demand for rental properties in Singapore, homeowners have the opportunity to generate passive income by renting out their HDB flats. This can contribute to the overall long-term returns of the investment.

However, it’s important to note that while HDB properties have strong investment potential, they are subject to certain restrictions. For example, homeowners are not allowed to sublet their entire HDB flat if they have not met the Minimum Occupation Period (MOP). This limitation should be taken into account when evaluating the investment potential of an HDB property.

In conclusion, assessing the investment potential of HDB properties is essential for homebuyers looking to make a wise and profitable purchase. By considering factors such as location, supply and demand, lease considerations, and rental income, homebuyers can gain a better understanding of the long-term returns they can expect from their HDB investment.

Conclusion: Making an Informed Choice Between Newly MOP HDB and Older Resale HDB

Well, here we are at the end of our journey through the world of HDB flats in Singapore. It’s been quite a ride, hasn’t it? We’ve explored the core differences between newly MOP HDB flats and older resale options, learned about the Minimum Occupation Period (MOP), and dived into the importance of lease considerations. But now, it’s time to make that crucial decision: which path will you choose?

When it comes to buying a home, making an informed choice is key. It’s not just about the property itself but also about your personal circumstances and goals. Take some time to reflect on what truly matters to you. Consider your budget, your lifestyle, and your long-term plans. Think about the pros and cons of each option and how they align with your needs.

For some, the allure of a brand-new HDB flat, waiting eagerly after the Minimum Occupation Period (MOP), might be too hard to resist. The idea of a fresh start with modern amenities and facilities can be exciting. On the other hand, older resale options have their own charm – more spacious layouts, established communities, and the possibility of scoring a great location.

Ultimately, there is no right or wrong answer. It all boils down to what you value most. So, take your time, consult with your loved ones, and weigh the pros and cons. Make that informed choice that will bring you closer to your dream home. Good luck, and may your newly MOP HDB or older resale HDB be everything you’ve ever wished for!

FAQ

What are the main differences between newly MOP HDB flats and older resale HDB flats?

Newly MOP HDB flats are newly developed and have not reached the Minimum Occupation Period (MOP) required by the government. Older resale HDB flats are previously owned and have already passed the MOP. This means that newly MOP HDB flats are generally newer and may have a longer lease, while older resale HDB flats may have a shorter lease but may be available in more established areas.

What is the Minimum Occupation Period (MOP) and why does it matter?

The Minimum Occupation Period (MOP) is the minimum period of time that homeowners are required to live in their HDB flat before they are eligible to sell it in the open market. The MOP is enforced by the government to ensure that HDB flats are primarily used for housing purposes and not for speculative investment. The MOP is important because it affects the resale value and marketability of the HDB flat.

How does the remaining lease on an HDB flat affect its value and longevity?

The remaining lease on an HDB flat affects its value and longevity. As the lease gets shorter, the value of the HDB flat may decrease as potential buyers may be concerned about the limited remaining lease. Additionally, the lease determines the duration of ownership, and a shorter lease may mean that the HDB flat may not be a long-term housing option.

What housing choices are available for singles?

Singles in Singapore have limited housing choices. They are only eligible to purchase resale HDB flats or rent housing in the open market. However, there are certain restrictions and guidelines that singles need to adhere to when purchasing or renting a home, which can clash with their desire for youthful independence.

What advantages do married couples have in the HDB market?

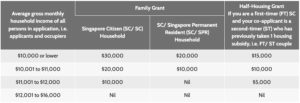

Married couples have certain advantages in the HDB market. They are eligible to purchase both newly MOP HDB flats and resale HDB flats. Additionally, they may be eligible for housing grants and subsidies provided by the government to assist with the purchase of their first HDB flat.

How does the projection of home value over time differ between newly MOP HDB flats and aging resale options?

The projection of home value over time can differ between newly MOP HDB flats and aging resale options. Newly MOP HDB flats may have a longer lease and may hold their value better in the long run. However, the location and demand for the specific resale HDB flat can also play a significant role in its value appreciation or depreciation.

What are the room requirements for different buyer profiles?

The room requirements for different buyer profiles can vary. For example, singles may prioritize a smaller unit or a studio apartment, while families may require multiple bedrooms to accommodate their members. It is important for homebuyers to assess their own needs and preferences in terms of room size and layout.

How can I identify ideal regions for HDB flats in Singapore?

To identify ideal regions for HDB flats in Singapore, you can consider property value trends across different regions. Certain regions may have higher demand and better amenities, which can impact the value of HDB flats in those areas. Additionally, finding the balance between location and property age is crucial in determining an ideal region for HDB flats.

What are the additional costs of renovations when purchasing an HDB flat?

When purchasing an HDB flat, there are additional costs to consider for renovations. These costs can vary depending on the extent of the renovations and the desired upgrades. Homebuyers should assess their readiness for property makeovers and consider the financial implications of upgrading an HDB flat.

What amenity considerations should I keep in mind when choosing an HDB flat?

When choosing an HDB flat, it is important to consider the nearby amenities. These can include access to public transportation, shopping centers, schools, parks, and recreational facilities. Having convenient access to these amenities can greatly enhance the HDB living experience.

How can I assess the investment potential of HDB properties?

To assess the investment potential of HDB properties, it is important to understand the long-term returns. This involves analyzing historical price appreciation, rental demand, and potential future developments in the surrounding area. It is important to evaluate the investment potential based on your specific goals and financial situation.

How can I make an informed choice between newly MOP HDB flats and older resale HDB flats?

To make an informed choice between newly MOP HDB flats and older resale HDB flats, you need to consider factors such as property age, lease considerations, pricing, personal circumstances, and long-term goals. Evaluating these factors will help you make a decision that aligns with your needs and preferences.

The post Newly MOP HDB vs Older Resale HDB appeared first on Wing Tai Holdings Singapore.

]]>The post Joint Tenancy vs Tenancy in Common appeared first on Wing Tai Holdings Singapore.

]]>

When it comes to property ownership in Singapore, it’s important to be familiar with the different forms of co-ownership. Knowing your rights is crucial to making informed decisions whether you’re considering joint tenancy or tenancy in common. In this article, we’ll explore the key differences between joint tenancy and tenancy in common, as well as the implications of each form of co-ownership.

Joint tenancy and tenancy in common are two popular forms of co-ownership in Singapore. While sole ownership allows for complete control over a property, co-ownership brings its own set of considerations. Let’s delve deeper into the specifics of each form and understand how they differ.

Key Takeaways: Joint Tenancy vs Tenancy in Common

- Joint tenancy and tenancy in common are two forms of co-ownership in Singapore.

- Joint tenancy does not allow for specific shares, and the right of survivorship ensures automatic transfer of ownership upon the death of a joint tenant.

- Tenancy in common allows for undivided shares in the property, and ownership can be transferred to beneficiaries according to the co-owner’s will or the Intestate Succession Act.

- Understanding the differences between joint tenancy and tenancy in common is crucial for making informed decisions regarding property ownership and estate planning.

- Seek legal advice to fully understand your rights and responsibilities as a co-owner in Singapore.

Tenancy in Common – Dividing Shares in Property

Tenancy in common is a form of co-ownership where each co-owner has an ‘undivided share’ in the property, which is specified in the title deed. This means that although the property remains physically undivided, each owner can identify their own distinct share. In the event of a co-owner’s death, their ownership in the property is transferred to their beneficiaries according to their will or the Intestate Succession Act.

For example, if three people own a house, they can agree to divide their shares based on their rate of contribution. If one co-owner passes away, their share is transferred to their beneficiaries while the ownership of the remaining co-owners remains unchanged.

To illustrate, here is an example of how shares can be divided:

| Co-owner | Rate of Contribution | Share in Property |

|---|---|---|

| Co-owner A | 40% | 40% |

| Co-owner B | 30% | 30% |

| Co-owner C | 30% | 30% |

“Tenancy in common allows for the division of shares based on each co-owner’s rate of contribution, ensuring a fair distribution of ownership interests.”

In this example, Co-owner A contributed 40% of the purchase price, while Co-owners B and C contributed 30% each. This division of shares provides clarity and transparency regarding each co-owner’s interest in the property, and ensures that the ownership percentages are proportional to their respective contributions.

Joint Tenancy – No Specific Shares, Right of Survivorship

When it comes to co-owning a property, joint tenancy is a popular option that offers unique advantages. In joint tenancy, the co-owners do not have specific shares in the property. Instead, they collectively own the entire property, undivided. This means that the property does not physically have separate portions assigned to each co-owner. The right of survivorship is a key feature of joint tenancy. If one of the joint tenants passes away, their share automatically transfers to the remaining joint tenants, without the need for probate or a will.

“In joint tenancy, you and your co-owners share an undivided interest in the whole property. When one co-owner passes away, their share automatically transfers to the surviving co-owners. This ensures a seamless transfer of ownership and avoids complications.”

Unlike tenancy in common, where each co-owner has a specified share that can be willed to beneficiaries, joint tenancy does not allow for the distribution of individual shares. Instead, it ensures that the surviving co-owners retain full ownership of the property. This makes joint tenancy a popular choice for spouses and family members who want to ensure that their loved ones can continue to own and enjoy the property without legal complexities.

Comparing Joint Tenancy and Tenancy in Common

Joint tenancy and tenancy in common are two forms of co-ownership with distinct characteristics. While joint tenancy emphasizes equal ownership and the right of survivorship, tenancy in common focuses on individual shares and the ability to will them to beneficiaries. Here’s a quick comparison:

| Joint Tenancy | Tenancy in Common |

|---|---|

| Co-owners do not have specific shares | Co-owners have specified shares |

| Right of survivorship | No right of survivorship |

| Seamless transfer of ownership | Shares can be willed to beneficiaries |

| Common among spouses and family members | Allows for division of shares based on contributions |

Both joint tenancy and tenancy in common have their benefits and considerations. Understanding the differences can help you make the right choice based on your co-ownership goals and preferences.

Tenancy in Common vs Joint Tenancy: Pros and Cons

When considering property ownership in Singapore, it’s essential to understand the pros and cons of tenancy in common and joint tenancy. Both forms of co-ownership have unique characteristics that can significantly impact flexibility, transfer of ownership, and estate planning.

Advantages of Tenancy in Common:

- Flexibility: Tenancy in common allows co-owners to divide shares based on contributions, providing flexibility when purchasing high-value properties.

- Liquidity: With each co-owner having an undivided share, tenancy in common allows for easy transfer of ownership to beneficiaries upon death.

- Estate Planning: By specifying shares and allowing for individual control, tenancy in common offers more options for estate planning, ensuring assets are distributed according to the owner’s wishes.

Advantages of Joint Tenancy:

- Right of Survivorship: Joint tenancy includes the right of survivorship, allowing the remaining joint tenants to automatically take over the property without referring to a will or the Intestate Succession Act.

- Spousal Relationship: Joint tenancy is particularly beneficial for married couples, as it simplifies estate planning and allows for seamless transfer of ownership, avoiding estate duty.

Comparison of Tenancy in Common and Joint Tenancy

| Tenancy in Common | Joint Tenancy | |

|---|---|---|

| Flexibility | Allows division of shares based on contributions | Equal ownership rights, no specified shares |

| Liquidity | Enables easy transfer of ownership to beneficiaries | Right of survivorship, property automatically transfers to remaining joint tenants |

| Estate Planning | Offers more options for estate planning, allows for individual control | Simplifies estate planning, avoids estate duty for married couples |

Choosing between tenancy in common and joint tenancy depends on your specific needs and circumstances. If you value flexibility, control over shares, and estate planning options, tenancy in common may be the right choice. On the other hand, joint tenancy is advantageous for those seeking seamless transfer of ownership and who are in a spousal relationship.

It’s crucial to assess eligibility requirements, consult with legal professionals, and carefully consider the implications of each form of co-ownership before making a decision. By understanding the pros and cons of tenancy in common and joint tenancy, you can make an informed choice that aligns with your ownership goals and estate planning objectives.

How Joint Tenancy Works for HDB Property Ownership

When it comes to property ownership in Singapore, joint tenancy is a popular option for HDB flats. In joint tenancy, all joint tenants have equal ownership rights and benefit from the right of survivorship. This means that if one joint tenant passes away, their share automatically transfers to the surviving joint tenants. It offers a seamless transfer of ownership without the need for a will or the Intestate Succession Act.

To apply for joint tenancy for an HDB property, all co-owners must be Singapore Citizens. The application process involves filling out forms and providing supporting documents to the HDB. It’s important to meet the eligibility requirements and ensure that you have a spousal relationship or a legal arrangement in place. Seeking legal advice is highly recommended to ensure a smooth application process and a clear understanding of your rights and obligations as joint tenants.

Joint tenancy is a beneficial form of co-ownership for HDB flats, providing equal ownership rights and the right of survivorship. It simplifies the transfer of ownership, especially in the event of the death of a co-owner. However, it’s important to carefully consider your options and seek appropriate legal advice to understand the implications and make informed decisions regarding joint tenancy for HDB property ownership.

Table: Advantages and Considerations of Joint Tenancy for HDB Property Ownership

| Advantages | Considerations |

|---|---|

| Seamless transfer of ownership | Requires all co-owners to be Singapore Citizens |

| Right of survivorship | Strict eligibility requirements |

| Clear ownership rights | Must have a spousal relationship or legal arrangement |

| Estate planning benefits | Legal advice is highly recommended |

Joint tenancy offers numerous advantages for HDB property ownership, but it’s crucial to fulfill the eligibility requirements and seek professional advice to ensure a smooth and legally sound process. By understanding how joint tenancy works and the rights and responsibilities involved, you can make informed decisions and protect your interests as a joint tenant.

Joint Tenancy vs Tenancy in Common – Understanding Ownership of a Property

When it comes to owning property together, there are two main forms of ownership: joint tenancy and tenancy in common. Each has its own set of characteristics and considerations, making it essential to understand the differences before making a decision. Let’s explore the key aspects of shared ownership and how they can impact your property ownership experience.

Differences in Ownership

In joint tenancy, all co-owners have an equal share in the property, and there is a right of survivorship. This means that if one joint tenant passes away, the property automatically transfers to the surviving joint tenants. On the other hand, tenancy in common allows for separate shares in the property, meaning each co-owner can have a specific portion. In the event of a co-owner’s death, their share is passed on according to their will or the Intestate Succession Act.

Decision-making is another area where joint tenancy and tenancy in common differ. In joint tenancy, decisions regarding the property must be made unanimously by all co-owners. In contrast, tenancy in common allows individual co-owners to make decisions regarding their own shares independently. This can offer more flexibility but may also lead to potential conflicts.

Property Types and Benefits

Joint tenancy is often favored by spouses and family members who want a seamless transfer of ownership. It ensures that the property passes smoothly to the surviving joint tenants, avoiding the need for lengthy legal processes. Tenancy in common, on the other hand, may be more suitable for unrelated parties or individuals who want to invest in a property together. It allows for flexible division of shares and the ability to freely dispose of those shares.

It’s important to note that the choice between joint tenancy and tenancy in common depends on your specific circumstances and goals. Consider factors such as the desired level of ownership, the need for seamless transfer of ownership, and the ability to freely dispose of shares. Seeking professional advice can help you make an informed decision that aligns with your needs and objectives.

Conclusion

Well, now you have a solid understanding of joint tenancy and tenancy in common, and the different aspects of property ownership in Singapore. These two forms of co-ownership offer unique rights and considerations that can greatly impact your estate planning and HDB property ownership.

For those looking for equal ownership and a seamless transfer of ownership, joint tenancy with its right of survivorship is the way to go. It’s especially beneficial for spouses and ensures that the property automatically transfers to the surviving owners when one joint tenant passes away.

On the other hand, if you prefer more flexibility and the ability to freely dispose of your shares, tenancy in common allows for separate shares and individual ownership. This form of co-ownership is suitable for unrelated parties or individuals who want to invest in property together.

Remember, when it comes to property ownership, it’s crucial to understand the differences between joint tenancy and tenancy in common. Seek legal advice to receive specific guidance tailored to your unique circumstances. Whether you’re considering joint tenancy or tenancy in common, make informed decisions about property ownership and estate planning in Singapore.

FAQ

What is the difference between joint tenancy and tenancy in common?

Joint tenancy involves equal ownership rights and the right of survivorship, where the property automatically transfers to the surviving owners upon the death of a joint tenant. Tenancy in common allows for separate shares in the property and does not have the right of survivorship.

How does tenancy in common work for dividing shares in a property?

Tenancy in common allows each co-owner to have an ‘undivided share’ in the property, with the ability to will their share to beneficiaries. The shares can be divided based on contributions and the specified ownership percentages in the title deed.

How does joint tenancy work with no specific shares and the right of survivorship?

In joint tenancy, all co-owners collectively own the entire property with no specific shares. If one joint tenant passes away, their share automatically transfers to the remaining joint tenants through the right of survivorship.

What are the pros and cons of tenancy in common and joint tenancy?

Tenancy in common provides flexibility, allowing for shared ownership of high-value properties and the transfer of shares to beneficiaries upon death. Joint tenancy is advantageous for HDB owners, simplifying ownership transfer without referring to a will or Intestate Succession Act. It also avoids estate duty and simplifies estate planning for those in spousal relationships. However, joint tenancy may limit flexibility and control over individual ownership shares.

How does joint tenancy work for HDB property ownership?

Joint tenancy is a common form of property ownership for HDB flats in Singapore. All joint tenants have equal ownership rights and the right of survivorship. If one joint tenant passes away, their share automatically transfers to the surviving joint tenants. To apply for joint tenancy for an HDB property, all co-owners must be Singapore Citizens, and the application process involves filling out forms and providing supporting documents.

What are the main differences between joint tenancy and tenancy in common?

Joint tenancy involves equal ownership and the right of survivorship, suitable for spouses and seamless ownership transfer. Tenancy in common allows for separate shares and more flexibility, making it suitable for unrelated parties or individuals investing in property together.

The post Joint Tenancy vs Tenancy in Common appeared first on Wing Tai Holdings Singapore.

]]>The post Inheriting an HDB Property in Singapore: What Taxes Involved appeared first on Wing Tai Holdings Singapore.

]]>This article provides an overview of the tax implications and considerations when inheriting an HDB property in Singapore.

Overview of Inheriting HDB Property in Singapore

In Singapore, the process of inheriting a Housing Development Board (HDB) property involves various legal and financial considerations. These include understanding the tax implications, potential maintenance fees, property taxes, and potential restrictions due to existing property ownership. Further, the inheritance may also impact future property ownership and related costs.

Case Study: Inheriting a Property with Siblings

Inheriting a property with siblings can introduce additional complexities, particularly concerning potential stamp duty issues when transferring shares of the property. For instance, if a property is inherited equally by three siblings and one of them wants to transfer their share to another sibling, this transfer may attract stamp duty.

This case study highlights the importance of proper estate planning, especially when multiple beneficiaries are involved. By setting clear terms regarding the division and management of the property in the will, potential disputes and legal complications can be minimized.

Background on Inheritance Tax in Singapore

In Singapore, the abolishment of inheritance tax in 2008 has significantly simplified the process of inheriting properties, including HDB flats. Beneficiaries no longer have to worry about this tax, which has removed a considerable burden. This tax reform has been a significant relief for many Singaporeans, as it allows them to inherit properties without the additional financial burden of inheritance tax.

However, it’s essential to understand that the cessation of inheritance tax doesn’t imply that there are no other financial implications. Other costs such as maintenance fees, property taxes, and potential stamp duties may still apply. These costs will depend largely on the type of property, its location, and whether the beneficiary decides to keep or sell the property.

Stamp Duty Implications

One potential cost associated with inheriting a property in Singapore is stamp duty. Generally, beneficiaries do not need to pay stamp duty when inheriting a residential property. For instance, if a person inherits an HDB flat from a deceased parent, they would typically not be required to pay stamp duty on this transaction.

However, certain exceptions exist to this rule. These exceptions can lead to stamp duties being applicable under specific circumstances. For instance, if the beneficiary decides to sell the inherited property within three years of receiving it, they may need to pay Seller’s Stamp Duty (SSD). Similarly, if the beneficiary decides to purchase a new property after inheriting one, they may also need to pay stamp duty as well as ABSD, depending on the timing of the purchase and the type of property bought.

Maintenance Fees and Property Tax

Upon inheriting a property, beneficiaries are required to take over the responsibility of maintenance fees and property tax. For instance, if a person inherits a condo, they will need to cater to the regular maintenance fees for the upkeep of the common areas and facilities. These fees can sometimes be quite substantial, especially for private condos that offer a wide range of facilities.

Furthermore, property tax is another financial obligation that beneficiaries need to consider. This annual tax is imposed on all property owners in Singapore, regardless of whether the property was bought or inherited. The amount of property tax depends on the annual value of the property, which is determined by the potential rental income that the property can generate.

Mortgage Considerations

When inheriting a property with an outstanding mortgage, several considerations come into play. Legally, beneficiaries are not liable for the mortgage if the deceased was the sole borrower. This means that if the original property owner had taken out a mortgage loan on their own, the beneficiaries would not be required to pay off this loan.

However, if there is an outstanding mortgage on the inherited property, the Total Debt Servicing Ratio (TDSR) assessment will come into play. This assessment is conducted by the bank and takes into account the beneficiary’s income and other financial obligations to determine whether they are financially capable of servicing the mortgage. If the beneficiary fails this assessment, they may be unable to inherit the property, highlighting the importance of financial planning when dealing with property inheritance.

Restrictions and Eligibility Criteria

Inheriting an HDB flat in Singapore comes with certain restrictions and eligibility criteria. HDB rules may restrict beneficiaries from keeping an inherited HDB flat if they already own one. For instance, if a person already owns an HDB flat and then inherits another one, they may be required to sell off one of the flats within a specified period.

Similarly, restrictions also apply if a beneficiary owns a private property and inherits an HDB flat. This rule is in line with HDB’s regulations that prohibit the simultaneous ownership of an HDB flat and a private property within the Minimum Occupation Period (MOP). In such scenarios, the beneficiary may need to sell one of the properties to comply with HDB’s rules.

Impact on Future Property Ownership

Inheriting a property can impact future property ownership and potentially result in additional stamp duties or restrictions on buying new properties. For instance, if a person inherits an HDB flat, this will count towards the total number of properties they own. If they then decide to buy another residential property, they may be subject to Additional Buyer’s Stamp Duty (ABSD), which can add a significant cost to their property purchase.

Additionally, the inherited property may affect the beneficiary’s eligibility to purchase certain types of properties. For example, if a Singaporean inherits a private residential property, they must fulfil a five-year Minimum Occupation Period (MOP) before they are eligible to purchase an HDB flat.

Legal and Financial Considerations

There are several hidden costs and financial considerations to be aware of when inheriting a property. For example, if the inherited property is a condominium, the beneficiary will be responsible for paying monthly maintenance fees, which could be quite substantial depending on the facilities and amenities provided by the condominium.

Furthermore, it’s also critical to consider potential legal issues that may arise during the inheritance process. For instance, if any disputes arise among beneficiaries regarding the division of the property, legal fees may be incurred to resolve these issues. As such, it’s advisable for beneficiaries to have open discussions with their loved ones and seek legal advice if necessary to ensure a smooth inheritance process.

Conclusion

Inheriting an HDB property in Singapore involves various tax implications and considerations. Potential beneficiaries must be aware of these issues, which include the absence of inheritance tax, potential stamp duties, maintenance fees, and property taxes. Additionally, beneficiaries should also consider how the inherited property might affect their future property ownership and potential restrictions on keeping the inherited property. Lastly, seeking professional advice to navigate the complex legal and financial landscape surrounding property inheritance is always advisable.

The post Inheriting an HDB Property in Singapore: What Taxes Involved appeared first on Wing Tai Holdings Singapore.

]]>The post Maximizing Your Sales Proceeds After Selling Your Home appeared first on Wing Tai Holdings Singapore.

]]>Key Takeaways:

- Check the median price for your flat type and location to set a competitive asking price.

- Research asking prices and competition on property portals to gauge market conditions.

- Consider extending the time frame for selling to maximize gains in a competitive market.

- Weigh the pros and cons of DIY selling versus working with a property agent.

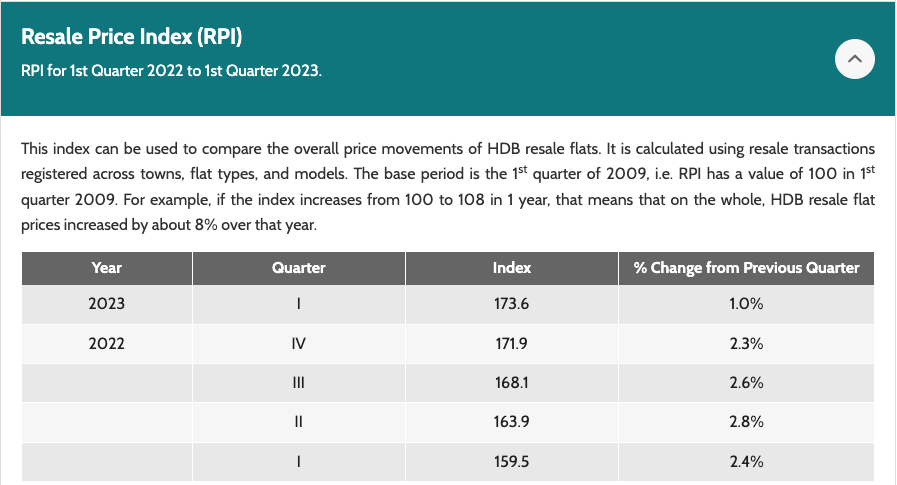

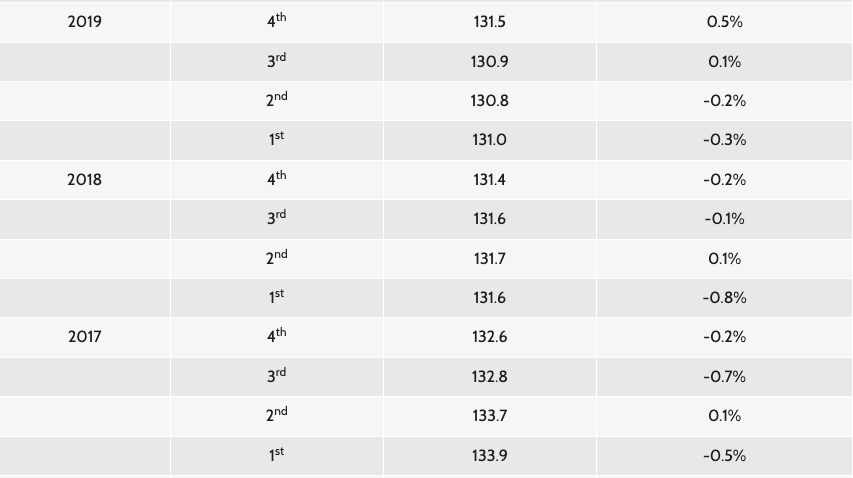

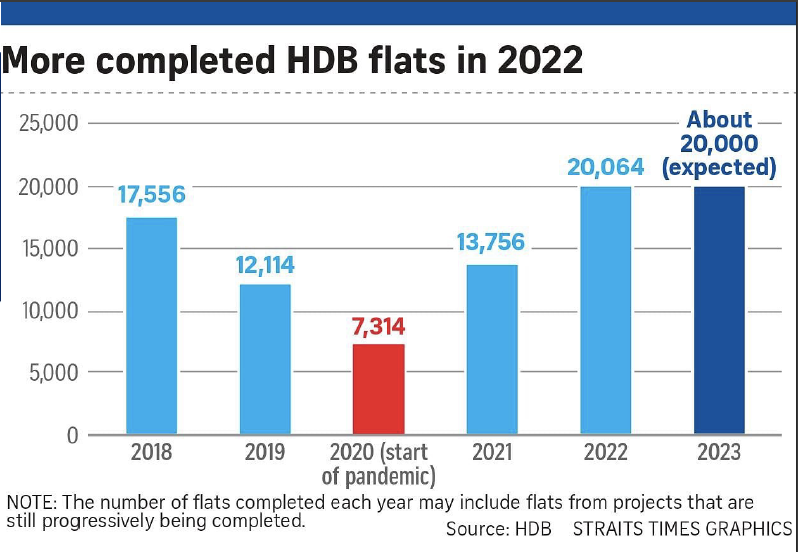

IHDB resale flat market in Singapore has been characterized by some unique trends that sellers should be aware of in order to optimize their sales proceeds. One notable trend is the increase in resale flat prices after several years of decline. According to the latest data, this uptick started in January 2020 and has continued since then.

Transaction volumes in the HDB resale flat market have also been consistently high, indicating strong demand from buyers. This is a positive sign for sellers as it suggests there are potential buyers actively searching for housing options. However, it’s important to note that with a record number of resale flats entering the market, there is potential competition for sellers.

To maximize your sales proceeds, it is crucial to understand these market dynamics. By keeping track of HDB resale flat prices, transaction volumes, and potential competition, you can make informed decisions and strategic moves when selling your home.

Current Market Snapshot:

| Market Indicator | Description |

|---|---|

| HDB Resale Flat Prices | Experiencing an upward trend since January 2020 after several years of decline. |

| Transaction Volumes | Volume and Prices see signs of weakening. |

| Potential Competition | A record number of resale flats entering the market, leading to potential competition for sellers. |

Having a clear understanding of the unique situation will enable you to set realistic expectations, strategize your pricing, and position your property effectively in the market. By staying informed and adapting to the current trends, you can maximize your sales proceeds and achieve your financial goals.

“Understanding the market dynamics and being proactive can make a significant difference in maximizing your sales proceeds in the current HDB resale flat market.”

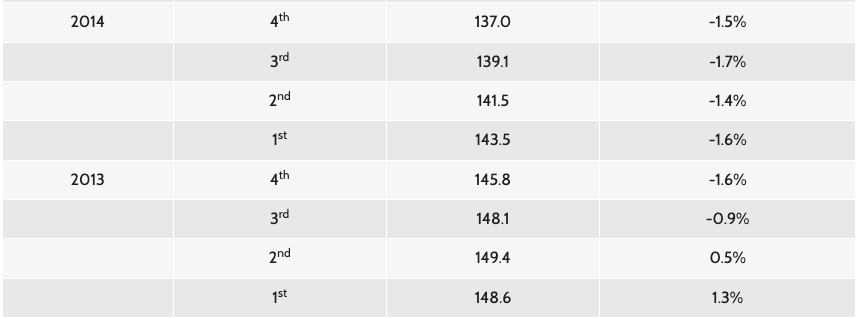

Checking the Median Price for Your Flat Type and Location

Before setting your asking price, it is crucial to check the median price for your flat type and location. The HDB provides quarterly median resale flat prices, which can give you a benchmark to determine the value of your property. By having an accurate understanding of the market value, you can set a competitive asking price that attracts potential buyers.

Knowing the median price for your flat type and location allows you to position your property in the market. If your asking price is significantly higher than the median price, it may deter potential buyers. On the other hand, pricing too low may lead to a loss in potential profits. By finding the right balance, you can maximize your sales proceeds while ensuring that your property remains attractive to buyers.

To illustrate the importance of checking the median price, let’s take a look at the table below:

| Type of Flat | Location | Median Price (Q4 2023) |

|---|---|---|

| 3-room | Tampines | $450,000 |

| 4-room | Jurong West | $550,000 |

| 5-room | Bishan | $850,000 |

Source: https://www.99.co/singapore/hdb-resale-price

As we can see from the table, the median prices vary based on the flat type and location. By comparing these prices to your own flat, you can gauge whether your asking price aligns with market expectations. It’s important to note that the median prices may change over time, so it is recommended to regularly check for updates before finalizing your asking price.

Looking Up Asking Prices and Competition on Property Portals

When selling your home, it’s important to gather information about current asking prices and the level of competition in your area. One effective way to do this is by exploring property portals, which provide valuable insights into the market. While the listed prices on these portals may not always reflect the actual selling prices, they can give you a general idea of the price range in your locality.

By browsing through property portals, you can also assess the number of listings in your area. This can help you gauge the level of competition you may face as a seller. If there’s a high number of listings, it might indicate a more saturated market, which could potentially affect your own selling strategy.

Keep in mind that property portals can be a great source of information, but it’s essential to verify the data and cross-reference it with other sources. Additionally, consulting with a real estate professional can provide you with expert insights and guidance when it comes to pricing and competition.

Example of Asking Prices on Property Portals

| Property | Location | Asking Price (SGD) |

|---|---|---|

| 3-room HDB flat | Tampines | 470,000 |

| 4-room HDB flat | Jurong West | 580,000 |

| 5-room HDB flat | Bishan | 900,000 |

The table above provides an example of asking prices for different types of HDB flats in various locations. It can give you an idea of the price range for similar properties. However, it’s important to note that these prices are for reference purposes only and may vary based on factors such as the flat’s condition, lease remaining, and other market influences.

By leveraging the information available on property portals and combining it with your knowledge of the local market, you can gain valuable insights to help you make informed decisions about pricing and competition when selling your home.

Determining if You Need to Extend the Time Frame

When selling your home, timing can play a crucial role in maximizing your sales proceeds. It’s important to assess the current market conditions and consider whether extending the time frame could potentially enhance your gains. By strategically waiting for the right moment, you can take advantage of buyer competition and potentially secure higher offers for your property.

Extending the time frame can be particularly advantageous when there is a high level of buyer competition in the market. In such situations, buyers may be more willing to offer higher prices to secure a desirable property. By patiently waiting for the right buyer to emerge, you can increase your chances of receiving better offers and ultimately maximize your sales proceeds.

However, it’s important to note that extending the time frame comes with its own considerations. Market conditions can fluctuate, and it’s crucial to stay informed about any potential shifts that could impact your selling strategy. Additionally, prolonging the selling process may require careful financial planning to ensure that you can sustain the costs of maintaining the property while awaiting a favorable offer.

In summary, extending the time frame for selling your home can be a strategic move to maximize your sales proceeds. By carefully assessing buyer competition and staying attuned to market dynamics, you can determine whether waiting for the right timing will lead to higher offers and increased gains.

Weighing the Pros and Cons of DIY Selling

When it comes to selling your HDB flat, one option to consider is DIY selling, which means selling your property without engaging a property agent. This approach can be appealing as it allows you to save on commission fees, which typically range from 1-2% of the property price. However, before making a decision, it is important to weigh the pros and cons of DIY selling.

Pros of DIY Selling:

- You can save on commission fees, potentially maximizing your sales proceeds.

- You have full control over the selling process, from setting the price to negotiating with buyers.

- You can personalize the marketing strategy to showcase the unique features of your property.

Cons of DIY Selling:

- DIY selling requires a certain level of knowledge and skills in marketing, negotiation, and legal aspects of the property transaction.

- You may need to invest time and effort in researching the market, pricing your property accurately, and advertising it effectively.

- Engaging a property agent can provide access to a wider network of potential buyers and professional expertise in navigating the selling process.

Ultimately, the decision to pursue DIY selling or work with a property agent depends on your individual circumstances and preferences. If you are confident in your ability to handle the selling process effectively and are willing to invest time and effort, DIY selling can be a viable option to save on commission fees. However, if you prefer the convenience, expertise, and wider reach that a property agent can offer, it may be worth considering their services.

Expert Tip

“Before opting for DIY selling, assess your own skills and experience in the real estate market. If you have previous experience or knowledge in selling properties, you may be more equipped to handle the challenges that may arise. However, if you are unsure or unfamiliar with the process, seeking professional assistance from a property agent can help you navigate the complexities of the real estate market and potentially achieve a higher selling price.” – Real Estate Expert

Alternatively, Negotiating with an Agent

Working with a property agent can provide valuable expertise and assistance throughout the selling process. While the standard commission rate is typically around 2% of the property price, it is possible to seller to also propose a higher commission rate with the agent if they can secure a higher selling price for your flat. This arrangement can be beneficial for both parties involved.

Offering a higher commission incentivizes the agent to work diligently to maximize your sales proceeds. They will be motivated to negotiate the best possible deal for you, which can result in a higher selling price and ultimately increase your profits. Additionally, agents often have access to a wide network of potential buyers and industry insights, which can further enhance your selling experience.

When negotiating the commission rate, it is important to consider the agent’s track record, experience in your area, and their ability to deliver results. This will ensure that you are partnering with a competent professional who is dedicated to achieving your selling goals. Open and transparent communication is key during the negotiation process to ensure that both parties are aligned on expectations and commitments.

Benefits of paying the standard market Commission Rate:

- Increased motivation: The minimum of standard commission rate can incentivize the agent to work harder to secure a higher selling price for your HDB flat.

- Access to a wider network: Property agents often have an extensive network of potential buyers, which can increase the visibility of your property.

- Industry expertise: Agents have valuable insights into market trends, pricing strategies, and buyer preferences, which can help you make informed decisions.

- Professional guidance: Working with an agent can provide guidance and support throughout the selling process, ensuring a smooth and successful transaction.

Remember to clearly discuss and outline the terms and conditions of the agreement before finalizing any negotiations with the property agent. By establishing a mutually beneficial partnership, you can maximize your sales proceeds and achieve a successful sale of your HDB flat.

Table: Pros and Cons of Negotiating a Higher Commission Rate

| Pros | Cons |

|---|---|

| Increased motivation for the agent to secure a higher selling price | Higher commission fees |

| Access to a wider network of potential buyers | Potential disagreement or misalignment in expectations |

| Benefit from the agent’s industry expertise and insights | Dependency on the agent’s availability and performance |

| Guidance and support throughout the selling process | Unequal distribution of responsibilities and workload |

Being Selective with Maintenance

When selling your home, it’s important to make strategic decisions about maintenance and renovations to improve the property value. While some repairs and upgrades can increase the appeal of your home, it’s crucial to be selective and focus on those that will have the greatest impact on potential buyers.

Firstly, prioritize essential fixes and visible issues that can negatively affect the first impression of your home. This includes repairing any leaks or electrical problems, addressing peeling paint or damaged flooring, and fixing any broken fixtures or appliances. By ensuring that your home is in good working order, you create a positive impression and instill confidence in potential buyers.

When it comes to renovations, consider those that are most likely to add value to your property. This could include upgrading the kitchen or bathroom, which are often key selling points for buyers. However, it’s important to strike a balance and avoid overspending on renovations that may not significantly impact the selling price. Buyers often prefer to personalize their own homes, so focus on improvements that will have broad appeal and provide a good return on investment.

Remember, the goal is to optimize your sales proceeds, so be strategic in your maintenance decisions. By ensuring that your home is well-maintained and making targeted renovations, you can increase its value and attract potential buyers who are willing to pay a premium for a move-in ready property.

Table: Renovations and Their Potential Impact on Property Value

| Renovation | Potential Impact on Property Value |

|---|---|

| Upgraded kitchen | Increased appeal, higher selling price |

| Renovated bathroom | Improved buyer perception, higher selling price |

| Landscaping and outdoor improvements | Enhanced curb appeal, increased property value |

| New flooring | Updated look, improved buyer interest |

| Fresh paint | Improved aesthetics, positive first impression |

| Solar panels or energy-efficient upgrades | Reduced energy costs, increased appeal for eco-conscious buyers |

Source: Author’s own research and analysis

Assessing Your Financial Situation

When it comes to selling your home and maximizing your sales proceeds, it’s important to take a comprehensive look at your financial situation. This assessment should consider factors such as retirement planning, income sources, and the overall goals you have set for your future. By evaluating these aspects, you can make informed decisions that align with your long-term financial objectives.

Retirement planning plays a crucial role in determining the best course of action for your home sale. Consider your retirement goals, timeline, and risk tolerance. Are you planning to downsize or relocate? Will the proceeds from the sale contribute significantly to your retirement savings? These questions will help guide your decisions and ensure that selling your home supports your retirement plans.

Another important aspect to consider is your income sources. Evaluate the stability and reliability of your current sources of income, such as pensions, investments, or rental properties. Understanding your income streams will help you assess how the proceeds from selling your home can contribute to your overall financial well-being.

Throughout this financial assessment, it’s essential to seek professional advice from a financial planner or advisor. They can provide personalized guidance based on your specific circumstances and help you navigate the complexities of maximizing your sales proceeds while considering your long-term financial goals.

Conclusion : Maximizing Your Sales Proceeds After Selling Your Home

After carefully considering various factors, maximizing your sales proceeds after selling your home is within reach. By understanding market trends, pricing strategies, and your own financial situation, you can make informed decisions that maximize your profits. Whether you choose to sell on your own or work with a property agent, staying informed and making strategic choices is key to achieving your financial goals.

When selling your home, it is crucial to plan ahead and be aware of the unique dynamics of Singapore’s real estate market. By checking the median price for your flat type and location, you can set a competitive asking price that attracts potential buyers. Additionally, researching asking prices and competition on property portals can give you valuable insights into the current market and help you gauge the level of competition you may face.

Consider extending the time frame if necessary, especially during periods of high buyer competition or unfavorable market conditions. Waiting for the right timing can increase your chances of receiving better offers and potentially higher prices for your property. Whether you decide to engage a property agent or opt for DIY selling, weigh the pros and cons carefully. Engaging a property agent may allow for negotiation of a higher selling price, which can ultimately result in more money from the sale.

Lastly, be selective with maintenance and renovations. Focus on essential fixes and visible issues that can increase the appeal and value of your property. Assess your financial situation and align your long-term financial objectives before making any decisions. By following these strategies and considering all relevant factors, you can maximize your sales proceeds and achieve your financial goals when selling your home.

FAQ

What factors should I consider when determining the asking price for my HDB flat?

It is crucial to check the median price for your flat type and location provided by the HDB to set a competitive asking price.

How can I gain insights into the current market and competition in my area?

It is advisable to look up asking prices and competitors on property portals to get an idea of the price range in your locality and gauge the level of competition you may face as a seller.

Is it beneficial to extend the time frame for selling my home?

Sometimes, extending the time frame can be beneficial, especially when there is high buyer competition or unfavorable market conditions. Waiting for the right timing can increase your chances of receiving better offers and potentially higher prices for your property.

What are the pros and cons of DIY selling?

DIY selling can help you save on commission fees, but it requires knowledge and skills in marketing and negotiating. It is important to weigh the pros and cons and assess your ability to handle the selling process effectively on your own.

Can I negotiate the commission rate with a property agent?

Yes, it is possible to negotiate the commission rate. While the standard rate is around 2%, you can discuss with the agent the possibility of a higher commission rate if they can fetch a higher selling price for your flat.

How should I prioritize maintenance and renovations when preparing my home for sale?

Focus on essential fixes and visible issues to increase your property’s appeal and value. Avoid overspending on renovations that may not significantly impact the selling price, as buyers often prefer to customize their own homes.

What should I consider when assessing my financial situation before selling my home?

Assess your retirement goals, timeline, risk tolerance, and other sources of income. Having a clear understanding of your financial position will help you make informed decisions that align with your long-term financial objectives.

How can I maximize my sales proceeds after selling my home?

By considering market trends, pricing strategies, and your own financial situation, you can increase your profits and achieve your financial goals. Stay informed and make informed choices to optimize the returns from your home sale.

The post Maximizing Your Sales Proceeds After Selling Your Home appeared first on Wing Tai Holdings Singapore.

]]>The post Should I Keep or Sell My HDB? Exploring Options While Renting a Condo appeared first on Wing Tai Holdings Singapore.

]]>Should I Keep or Sell My HDB? Exploring Options While Renting a Condo? Deciding whether to keep or sell your HDB (Housing Development Board) while renting a condo can be a challenging decision. There are several factors to consider, including the resale value of your HDB, the potential rental yield, and the comparison between HDB and condo living. This article will provide insights and analysis to help you make an informed choice.

Key Takeaways: