The post 7 Tips for Home Sellers to Gain More Profitability appeared first on Wing Tai Holdings Singapore.

]]>Hey there, fellow home sellers! Are you looking to maximize your profits in the competitive real estate market? Well, you’ve come to the right place. As an experienced home seller, I’ve picked up some valuable tips along the way that can help boost your selling profits and ensure a successful sale. So, let’s dive in!

Key Takeaways:

- Implement value-adding improvements to your home to increase its appeal and asking price.

- Timing is key, so consider selling during seasons that are more favorable for buyers.

- Present your home in its best condition through staging and create competition with the right asking price.

- Use digital marketing tools to reach a wider audience and generate more interest in your property.

- Understanding the local real estate market and its trends is crucial for a successful sale.

Staging Your Home for a Quick Sale

Staging your home is a crucial step in the selling process. By arranging and decorating your home to showcase its potential, you can make a lasting impression on potential buyers and increase the likelihood of a quick sale. Staged homes are known to attract buyers and sell faster compared to unstaged homes. The impact of staging on a buyer’s perception cannot be underestimated.

The Impact of Staging on Buyer’s Perception

When buyers walk into a staged home, they can see themselves living in the space. Staging creates an inviting and visually appealing environment that allows buyers to envision their own belongings and lifestyle fitting seamlessly into the home. This positive first impression can significantly influence a buyer’s perception and increase their emotional connection to the property.

Staged homes tend to highlight the potential of different areas, making them appear spacious, functional, and well-maintained. By creating a desirable atmosphere, staging can help buyers imagine themselves living in the home, which can lead to higher offers and a quicker sale.

Staging Essentials: Prioritizing Living Room and Kitchen

While staging the entire home is important, certain areas deserve special attention. The living room and kitchen are two spaces that often play a significant role in a buyer’s decision-making process. To make the best impression, these rooms should be clean, decluttered, and decorated in a way that appeals to potential buyers.

In the living room, focus on creating a cozy and welcoming atmosphere. Arrange furniture to maximize space and flow, add tasteful decorations, and use lighting strategically to create an inviting ambiance. In the kitchen, highlight its functionality and cleanliness. Clear the countertops of unnecessary items, organize cabinets and drawers, and consider adding fresh flowers or a bowl of fruit to add a touch of vibrancy.

Staging Costs vs. Return on Investment

While staging may require some upfront investment, it is often considered a worthwhile expense with a high return on investment. According to the National Association of Realtors, staged homes sell faster and for a higher price compared to non-staged homes. The cost of staging can vary depending on factors such as the size of the home and the extent of the staging required.

Professional staging services are available for those who prefer a hands-off approach, but the costs can add up. Alternatively, sellers can opt for DIY staging with guidance from real estate agents or staging professionals. With some careful planning and creativity, sellers can transform their homes into appealing and welcoming spaces without breaking the bank.

Staging your home is a powerful tool in the selling process. By creating an atmosphere that appeals to buyers and showcases the home’s potential, you can significantly increase your chances of selling a staged home quickly and at a higher price.

Targeting the Ideal Buyer

Different types of properties attract different types of buyers with varying preferences. As a savvy home seller, it’s important to understand your target buyer in order to tailor your marketing and home improvements to appeal to the right audience.

For instance, if you have a move-in ready home, your ideal buyer might be someone looking for convenience and a ready-to-live-in space. On the other hand, fixer-uppers may attract investors or cash buyers who are willing to put in the work to transform the property.

Researching the ideal buyer for your property can inform your decision-making process. It will guide you when it comes to making repairs or upgrades that resonate with potential buyers. By catering to buyer preferences, you increase the chances of selling to the right audience and maximizing your profitability.

Emphasizing Maintenance History for Buyer Confidence

Highlighting the maintenance history of your home is crucial for buyer confidence. When potential buyers have access to detailed records of regular maintenance, periodic inspections, and any repairs carried out, they are more likely to feel reassured about the property’s overall condition.

By emphasizing the proactive approach you’ve taken in maintaining your home, you are positioning it as a well-cared-for and trustworthy investment. This can give buyers peace of mind and increase their willingness to make a competitive offer.

Boosting Your Home’s Profile with Online Tools

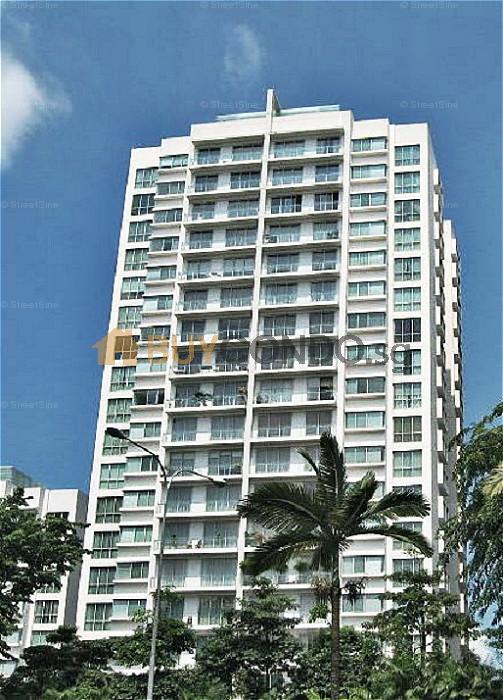

In today’s digital age, it’s essential to leverage online tools to boost your home’s profile and increase its online presence. By utilizing platforms and websites such as www.buycondo.sg that cater specifically to home selling, you can reach a wider audience of potential buyers.

Maximize your home’s online presence by utilizing professional photography and virtual tours. These visual assets can create a lasting impression and generate more interest in your property. Additionally, by showcasing your home’s digital history, maintenance records, and other pertinent information on online platforms, you can attract more qualified buyers.

Remember, the more visible your home is online, the greater the chances of connecting with buyers who are actively searching for properties like yours. By optimizing your home’s profile using online tools, you can boost its visibility, increase buyer interest, and ultimately improve your chances of a successful sale.

Curb Appeal: Your Home’s First Impression

The exterior of your home plays a crucial role in capturing the attention of potential buyers. It’s the first thing they see, and as they say, first impressions matter. That’s why improving your home’s curb appeal is essential to attract more buyers and increase the chances of a quick sale.

There are simple enhancements you can make to improve your home’s exterior and create a lasting impression. Start by giving your home a fresh coat of paint to make it look clean and well-maintained. A new paint job can instantly transform the appearance of your home and make it more inviting.

Investing in landscaping is another effective way to improve curb appeal. Keep your lawn well-manicured and consider adding some colorful flowers and plants to create an attractive and vibrant look. Landscaping not only enhances the visual appeal but also shows that you’ve taken good care of your property.

Don’t forget about the details! Small updates like replacing your front door, updating house numbers, or pressure washing your driveway can make a big impact on the overall appearance of your home. These small changes can give your home a fresh and modern look, instantly attracting buyers.

By focusing on improving your home’s curb appeal, you can create a memorable first impression that will catch the eye of potential buyers. Remember, a well-maintained and visually appealing exterior sets the stage for what awaits inside your home. So, invest in improving your curb appeal and reap the rewards of attracting more buyers and achieving a quick sale.

Landscaping for Profit: A Wise Investment

When it comes to selling your home, don’t overlook the power of landscaping. A well-maintained and visually appealing outdoor space can significantly increase the value and appeal of your property. By investing in landscaping, you not only enhance the overall aesthetics of your home but also attract buyers who appreciate outdoor living. It’s a wise investment that can yield profitable returns.

Recommended Upgrades for Outdoor Spaces

If you want to go above and beyond in improving your outdoor spaces, consider some recommended upgrades. Adding a patio or deck can create additional living space, making your home more attractive to buyers. Outdoor kitchens, fire pits, and well-designed seating areas are also great options that can elevate the functionality and appeal of your outdoor spaces. These upgrades not only enhance your lifestyle but also increase the overall value of your home.

Smart Updates to Kitchens and Bathrooms

When it comes to selling a home, kitchens and bathrooms are the areas that potential buyers pay close attention to. These rooms can make or break a sale, so it’s important to prioritize smart updates that can significantly increase the value and appeal of your home.

If your kitchen or bathroom is outdated or showing signs of wear and tear, investing in renovations and updates is a wise choice. Here are some key areas to focus on:

- Countertops: Consider replacing old and worn-out countertops with durable and stylish materials like granite or quartz. This can give your kitchen or bathroom a fresh and modern look that buyers will appreciate.

- Cabinets: If your cabinets are outdated or in poor condition, consider refacing or replacing them. This can instantly transform the entire space and make it more appealing to potential buyers.

- Fixtures: Upgrading fixtures such as faucets, showerheads, and light fixtures can make a significant difference in the overall look and functionality of your kitchen or bathroom.

- Appliances: Adding new appliances to the kitchen, such as a sleek refrigerator or a state-of-the-art stove, can not only improve its functionality but also attract buyers who are looking for modern amenities.

- Plumbing and lighting: Consider upgrading the plumbing and lighting fixtures in your kitchen or bathroom. This can not only enhance their functionality but also give them a fresh and inviting appeal.

By making these smart updates, you can increase the value and desirability of your home, making it more attractive to potential buyers. Remember, a well-designed and updated kitchen or bathroom can be a major selling point that sets your home apart from the competition.

Minor Upgrades, Major Impact

When it comes to selling your home, it’s the small details that can make a big difference. By focusing on minor upgrades and changes, you can maximize your home’s appeal and increase its value without breaking the bank. Let’s explore two effective strategies: hardware refresh and decluttering.

Hardware Refresh: Small Details Matter

Have you ever noticed how changing a doorknob or cabinet pull can completely transform the look of a room? These small details may seem insignificant, but they can have a significant impact on your home’s overall aesthetic. Consider refreshing your hardware by replacing outdated or worn-out doorknobs, cabinet pulls, and drawer handles with stylish and modern options.

Decluttering: Simplify to Amplify

In order to make a strong impression on potential buyers, it’s essential to create a clean and spacious environment. Decluttering is a simple yet powerful way to achieve this. Start by removing personal items, unnecessary furniture, and clutter from your home. Organize spaces and simplify your decor to create a sense of openness and allow buyers to envision themselves living in the space.

By focusing on these minor upgrades and decluttering, you can maximize your home’s appeal and increase its value with minimal time and effort. Remember, sometimes it’s the smallest changes that make the biggest impact.

Pricing and Timing in the Market

The Importance of Pricing in the Market

Pricing your home correctly is crucial to attract buyers and maximize the sale price. It’s essential to understand market conditions and trends that can impact the value of your property. By pricing your home competitively, you can position it as an attractive option for potential buyers and generate interest in the market.

When setting the asking price, consider factors such as comparable sales in your area, the condition of your home, and current market demand. A well-priced home can create a sense of urgency among buyers, leading to multiple offers and potentially driving up the final sale price.

Working with a real estate agent who has a deep understanding of the local market is key. They have invaluable insights into current market conditions and can provide expert guidance on how to price your home effectively to maximize your sale price.

Maximizing Your Sale with the Right Real Estate Agent

Choosing the right real estate agent is crucial to help you navigate the selling process and maximize your sale price. A skilled agent who understands the local market can provide expertise and insights that will help you make informed decisions.

Look for a real estate agent who has a track record of success in your area and specializes in selling homes similar to yours. They should have a deep understanding of market conditions, pricing strategies, and effective marketing techniques.

A good real estate agent will provide a comprehensive marketing plan to attract potential buyers and maximize the exposure of your home. They will leverage their network and digital marketing tools to reach a wide audience and generate interest in your property.

Additionally, a skilled agent will handle negotiations on your behalf, ensuring that you receive the best possible offer. Their expertise and market knowledge can help you navigate complex negotiations and achieve a successful sale.

By working with the right real estate agent, you can optimize your selling experience and increase your chances of achieving the highest possible sale price for your home.

Conclusion : 7 Tips for Home Sellers to Gain More Profitability

In conclusion, selling a home for maximum profitability requires careful planning and execution. By implementing the tips and strategies mentioned throughout the article, sellers can increase their profits and sell their home quickly.

Staging the home, improving curb appeal, and targeting the ideal buyer are key steps in the selling process. Leverage on an exclusive online property platform to feature the nice condos can also help attract more buyers and generate interest in the property.

Additionally, setting the right asking price, understanding market timing, and working with a skilled real estate agent are crucial factors in maximizing profits. By following these tips and utilizing effective selling strategies, sellers can navigate the real estate market with confidence and unlock higher profitability.

FAQ

What are some tips for home sellers to gain more profitability?

Implementing these tips can help sellers maximize their profits and sell their home quickly.

How does staging impact a buyer’s perception of a home?

Staging creates a positive first impression and helps buyers envision themselves living in the home, increasing its appeal.

What are the essentials of staging a home?

When staging, prioritize the living room and kitchen, as these areas have a significant impact on buyers’ impressions of the home.

Are staging costs worth the investment?

Staging costs can vary, but they are generally a worthwhile investment with a high return on investment, attracting more buyers and commanding higher offers.

How can I target the ideal buyer for my home?

Understanding the preferences of your target buyer can help you tailor your marketing and home improvements to appeal to the right audience.

How can I improve my home’s curb appeal?

Simple enhancements like fresh paint, landscaping, and maintaining a well-manicured lawn can significantly improve curb appeal, attracting more buyers and increasing the chances of a quick sale.

What are some smart updates I can make to my kitchens and bathrooms?

Smart updates like replacing countertops, cabinets, fixtures, and adding new appliances can give these rooms a fresh and modern look, increasing their functionality and desirability.

Can minor upgrades have a significant impact on my home’s appeal?

Yes, refreshing small details like hardware and decluttering the space can have a major impact on the home’s appeal, making it more enticing to potential buyers and increasing its value.

How important is pricing and timing in the real estate market?

Pricing the home right is crucial to attract buyers and create competition, and understanding market conditions and trends can help determine the optimal time to list a home for sale.

What is the importance of working with the right real estate agent?

Working with a skilled real estate agent who understands the local market can make a significant difference in the selling process, helping sellers maximize their profits and navigate the real estate market effectively.

The post 7 Tips for Home Sellers to Gain More Profitability appeared first on Wing Tai Holdings Singapore.

]]>The post How to Determine When is a Good Time to Sell My Property appeared first on Wing Tai Holdings Singapore.

]]>

Hey there, fellow property owners! Thinking about selling your property, but not sure when is the best time to do so? Well, you’ve come to the right place. Determining the perfect timing to sell your property can make all the difference in maximizing your profits and ensuring a smooth selling process. So, let’s dive in and explore some key factors that can help you make an informed decision.

First things first, let’s talk about the current property market. Understanding the market trends, evaluating interest rates, and analyzing economic forecasts are essential in determining the opportune time to sell. By keeping a close eye on these factors, you can gain insights into the overall selling conditions and make a more informed decision.

Assessing the value of your property is another crucial aspect. Knowing the fair market value of your property through methods like appraisal and analyzing market comparables can help you price it competitively and attract potential buyers. And of course, we’ll also chat about the emotional side of selling your beloved property and how to navigate the journey.

All in all, my aim is to provide you with insights and strategies that can help you determine the best time to sell your property based on your specific circumstances. So, whether you’re a homeowner looking to upgrade or downsize or an investor capitalizing on market trends, let’s make the right move together!

Key Takeaways:

- Understanding the current property market trends is vital in determining the best time to sell.

- Assessing the value of your property through methods like appraisal and market comparables can help you price it competitively.

- Considering your personal financial goals and aligning them with market conditions is crucial in making an informed choice.

- Don’t forget to consider the emotional aspect of selling your property and prepare yourself for letting go.

- Observing property market trends and upcoming developments can provide insights into future predictions and help you make the right move.

Understanding the Current Property Market

Before making the decision to sell your property, it’s imperative to have a clear understanding of the current state of the property market. By evaluating market trends, analyzing interest rates and economic forecasts, and considering the impact of a seller’s versus buyer’s market, you can make informed decisions that align with your selling goals.

Evaluating Market Trends

One of the key factors in understanding the current property market is evaluating market trends. This involves closely monitoring price movements, supply and demand dynamics, and the overall sentiment of buyers and sellers. By gaining insights into these trends, you can assess the potential demand for your property and determine if it’s a favorable time to sell.

Analyzing Interest Rates and Economic Forecasts

In addition to market trends, analyzing interest rates and economic forecasts is crucial in understanding the current property market. Interest rates directly impact the affordability of mortgages, which in turn affects the demand for properties. Economic forecasts can provide insights into the stability and growth potential of the real estate market. By considering these factors, you can gauge the overall health of the market and make strategic selling decisions.

Impact of Seller’s versus Buyer’s Market

Whether it’s a seller’s market or a buyer’s market can significantly influence your selling strategy. In a seller’s market, where demand exceeds supply, you may have more negotiating power and the potential to secure higher offers. On the other hand, in a buyer’s market, where supply exceeds demand, you may need to be more competitive with pricing and marketing strategies to attract potential buyers. Understanding the current market conditions and adapting your approach accordingly can optimize the outcome of your property sale.

| Market Factors | Seller’s Market | Buyer’s Market |

|---|---|---|

| Supply and Demand | Low supply, high demand | High supply, low demand |

| Pricing | Potential for higher prices | Need to be competitive with pricing |

| Negotiating Power | More negotiating power for sellers | Buyers may have more negotiating power |

| Time on Market | Properties may sell more quickly | Properties may take longer to sell |

Understanding the current property market, evaluating market trends, analyzing interest rates and economic forecasts, and recognizing the impact of a seller’s versus buyer’s market are essential steps in determining the right time to sell your property. By staying informed and adapting your approach as needed, you can position yourself for success in maximizing your property’s value and achieving your selling goals.

Assessing Your Property’s Value

Before selling your property, it is crucial to assess its value accurately. Proper valuation ensures that you price your property competitively and attract potential buyers. There are various methods to determine the fair market value of your property, such as property appraisal and market comparables.

One common method is property appraisal, where a licensed appraiser evaluates your property’s characteristics, condition, and location to determine its value. Appraisals provide an expert assessment based on industry standards and can be used as a reliable estimate of your property’s worth.

To get a comprehensive understanding of your property’s value, you can also analyze market comparables. This involves researching recent sales data of comparable properties in your area. By comparing factors such as location, size, condition, and selling price of similar properties, you can gauge the market value of your property.

When conducting a property value assessment, it’s important to consider both objective and subjective factors. Objective factors include those that can be quantified, such as square footage, number of rooms, and recent sales data. Subjective factors, on the other hand, encompass elements like design, finishes, and the overall condition of the property. By considering these factors, you can arrive at a more accurate assessment of your property’s value.

Remember, property valuation methods provide a snapshot of the market, and the final selling price can be influenced by various factors, including buyer demand, negotiation skills, and market conditions. However, conducting a thorough property value assessment can give you a solid foundation for pricing your property competitively and maximizing your chances of a successful sale.

Selling in Peak Seasons: Timing Matters

When it comes to selling your property, timing can make a significant difference in the success of your sale. Selling during peak seasons, when demand is high, can lead to faster sales and potentially higher prices. Understanding historical data on high-demand periods can provide valuable insights into when buyer activity is at its peak, allowing you to strategically time your sale for maximum impact.

Historical Data on High-Demand Periods

By analyzing historical data, you can identify trends and patterns in the real estate market. This data reveals when buyer demand tends to be highest, giving you a clear advantage when deciding when to list your property. Whether it’s the spring when buyers are eager to move before the start of the school year or the holiday season when people may be searching for a new home, historical data can guide your timing decisions.

Benefits of Off-Season vs Peak-Season Selling

While selling during peak seasons can be advantageous, there are also benefits to off-season selling. During quieter periods, there may be less competition, allowing your property to stand out to potential buyers. Additionally, buyers who are searching during off-peak seasons may be more motivated, increasing the likelihood of a successful sale.

Ultimately, the decision to sell in a peak season or an off-season depends on various factors, including your timeline, market conditions, and personal circumstances. By carefully considering the timing of peak seasons and weighing the advantages of different selling periods, you can make an informed decision that aligns with your goals.

Seller’s Market Strategies: When Demand Is High

In a seller’s market, where demand for properties is high, it’s crucial to employ strategic tactics to maximize your profits and achieve a higher selling price. Here, I will explore various seller’s market strategies, including effective pricing techniques and negotiation tactics. By understanding how to leverage a seller’s market to your advantage, you can increase your chances of attracting competitive offers and achieve optimal results.

One of the most important aspects of selling in a seller’s market is setting the right price for your property. Pricing techniques can help you position your property competitively, attracting potential buyers while still ensuring a profitable sale. Consider using a comparative market analysis to evaluate recent sales of similar properties in your area. This will provide valuable insights into the current market value and allow you to price your property accordingly.

Furthermore, negotiation tactics play a crucial role in a seller’s market. As a seller, you have the upper hand, but it’s important to approach negotiations strategically. Start by setting your minimum acceptable price and be prepared to confidently negotiate to maximize your profits. Consider employing tactics such as highlighting the unique features and benefits of your property, emphasizing scarcity, and creating a sense of urgency among potential buyers.

Remember, in a seller’s market, demand is high, and buyers may be willing to make competitive offers. By showcasing the value of your property and utilizing effective negotiation tactics, you can increase your chances of achieving a higher selling price and maximizing your profits.

To illustrate these strategies, let’s take a look at the following table:

| Strategy | Description |

|---|---|

| Pricing Competitively | Setting the right price based on market comparables to attract potential buyers. |

| Emphasizing Unique Features | Highlighting the distinctive qualities of your property to differentiate it from others on the market. |

| Creating Urgency | Instilling a sense of urgency among potential buyers through limited-time offers or exclusive incentives. |

| Negotiating Confidently | Approaching negotiations with confidence, setting a minimum acceptable price, and leveraging your position as a seller. |

Property Upkeep and Investment Returns

Proper property maintenance is essential for maximizing its value and attracting potential buyers. By staying on top of property upkeep, you can ensure that your property remains in top condition, increasing its appeal and potential resale value.

Maintaining Property for Maximum Value

Regular maintenance tasks, such as landscaping, exterior repairs, and interior updates, are crucial for preserving your property’s value. By keeping your property well-maintained, you can create a positive first impression and make it more desirable to prospective buyers. Remember, a well-maintained property sends a strong message that it has been cared for and is worth investing in.

“A beautifully maintained property not only maximizes its value but also creates a lasting impression on potential buyers. It’s a reflection of the level of care and attention that has been given to the property over time.”

– Property Maintenance Expert

Aside from regular upkeep, consider investing in improvements that can enhance your property’s value. This may include upgrading outdated features, renovating key areas such as kitchens and bathrooms, or adding energy-efficient elements like solar panels. These improvements can attract buyers and potentially increase your return on investment when it comes time to sell.

Calculating Potential Profit from Property Improvements

When considering property improvements, it’s important to evaluate the potential return on investment (ROI) they can generate. Not all improvements will offer a significant increase in property value, so it’s crucial to prioritize those that will provide the best returns.

To calculate potential profit from property improvements, consider factors such as the cost of the improvement, the estimated increase in property value, and the local real estate market conditions. It’s advisable to consult with a real estate expert or a professional appraiser who can provide insights on the potential ROI for specific improvements in your area.

A sensible approach is to focus on improvements that address the most critical areas, such as updating the kitchen or improving curb appeal. These enhancements are more likely to attract buyers and lead to a higher sale price.

Remember, property improvements should be strategic and aligned with market trends and buyer preferences. By understanding the potential returns and making informed decisions, you can optimize the value of your property and increase your chances of a profitable resale.

The Emotional Aspect of Selling Your Property

Selling a property is not only a financial transaction; it can also have emotional implications, especially if you have a sentimental attachment to the property. Letting go of a place filled with memories and personal experiences can evoke a mix of emotions, and it’s important to acknowledge and address these feelings during the selling process.

Preparation for Letting Go

Before putting your property on the market, take the time to prepare yourself emotionally for the transition. Reflect on the reasons behind your decision to sell and remind yourself of the goals you hope to achieve by letting go of the property. This will help you stay focused and motivated throughout the selling process.

Additionally, decluttering and depersonalizing the space can assist in detaching yourself emotionally. Pack away personal items, photographs, and mementos that may remind you of past experiences and create a neutral and welcoming environment for potential buyers.

Seeking emotional support from friends, family, or even professional counselors can also be beneficial during this period. Talking about your feelings and concerns can provide clarity and reassurance, helping you navigate the emotional journey of selling your property.

The Weight of Sentimentality in Sales Timing

Understanding the influence of sentimentality on sales timing is crucial. While it’s important to consider market conditions and financial goals, it’s equally important to find a balance between practicality and emotional readiness.

Take the time to evaluate your emotional attachment to the property and determine if you’re truly ready to let go. Rushing into a sale when you’re not emotionally prepared may lead to regrets or feelings of loss. On the other hand, waiting indefinitely due to sentimentality can hinder your ability to move forward and achieve your broader goals.

By acknowledging the emotional aspects of selling your property and finding a balance between practicality and sentimentality, you can navigate the process with confidence and make decisions that align with your overall goals.

“Selling a property is not just a transaction; it’s an emotional journey of letting go and embracing new possibilities.”

| Emotional Aspect of Selling Your Property | Preparation for Letting Go | The Weight of Sentimentality in Sales Timing |

|---|---|---|

| Involves acknowledging and addressing emotions | Declutter and depersonalize the space | Find a balance between practicality and emotional readiness |

| Reflect on reasons for selling and goals | Seek emotional support from friends and family | Evaluate emotional attachment and readiness to let go |

| Emphasize the importance of preparation | Talk about feelings and concerns | Achieve a balance between sentimentality and practicality |

Personal Financial Goals Alignment and Market Analysis

When it comes to selling your property, aligning your personal financial goals with market conditions is crucial. By understanding the current market analysis and utilizing real-time market data, you can make informed decisions about the timing of your property sale.

Personal Financial Goals Alignment

Before selling your property, it’s essential to assess your personal financial goals and how they align with your decision to sell. Consider factors such as your desired profit, investment strategy, and future financial plans. Are you looking to upgrade to a larger property, downsize, or invest in other ventures? Understanding your financial objectives will help you determine the right time to sell and ensure that your property sale supports your long-term financial goals.

Market Analysis and Real-Time Data Utilization

Market analysis plays a significant role in determining the ideal time to sell your property. Keeping a close eye on market trends, such as property prices, inventory levels, and buyer demand, can provide valuable insights into the current selling conditions. In addition, utilizing real-time market data, such as recent sales data and comparable property prices, can help you accurately assess the value of your property and set a competitive listing price.

By staying informed about market conditions and utilizing real-time data, you can strategically time your property sale to maximize your profits and achieve your personal financial goals.

Impact of Evolving Life Priorities

When it comes to deciding the best time to sell a property, evolving life priorities can have a profound impact. For instance, individuals may find themselves in a situation where they need to move closer to schools or workplaces due to changing family dynamics or career opportunities. The need to reduce commuting time and provide better educational opportunities for children can become a pressing factor in determining the urgency of selling a property.

Furthermore, evolving life priorities can also encompass lifestyle changes, such as the desire to upgrade to a larger home, downsize to a more manageable property, or relocate to a different neighborhood that better aligns with one’s current lifestyle. For example, a family may consider selling their current home to upgrade to a larger house to accommodate a growing family or to downsize to a more compact, low-maintenance property after children have moved out. These shifting priorities can significantly influence the decision to sell a property and underscore the importance of carefully evaluating the optimal timing for such a move.

Moreover, evolving life priorities can also be influenced by external factors, such as changes in employment, family dynamics, or educational opportunities. For example, a career advancement that requires relocation to a different city or country may prompt individuals to consider selling their property and moving to a new location. Similarly, changes in family dynamics, such as children leaving for college or elderly parents moving in, can also impact the decision to sell a property. By considering these evolving life priorities and their implications, individuals can make informed decisions about the right time to sell their property, ensuring that it aligns with their current and future lifestyle needs.

Addressing Depreciating Property Value

When it comes to addressing depreciating property value, sellers should be aware of the potential impact on their decision to sell. For instance, new properties may experience a dip in value due to supply surges, while aging properties may also face depreciation over time. It’s essential to understand how these factors can influence the timing of a property sale and the potential financial outcome.

For example, let’s consider a scenario where an individual owns a new property in an area that has experienced a surge in new developments. The increased supply of properties in the area could lead to a drop in the value of existing properties, including the one owned by the individual. In such a situation, the owner may need to evaluate whether waiting for a market correction or selling at the current value would be more beneficial in the long run. This decision would be influenced by various factors, including the owner’s financial goals, investment strategy, and the urgency of the sale.

It’s also important to consider the impact of aging properties on depreciation. Over time, older properties may experience a natural decrease in value due to wear and tear, changing neighborhood dynamics, or evolving market preferences. Sellers need to take into account these potential depreciation factors and assess whether the current market conditions align with their selling objectives. By carefully analyzing the impact of depreciating property values, sellers can make informed decisions about the optimal timing for selling their properties.

Moreover, the impact of depreciating property value on the decision to sell underscores the need for a comprehensive evaluation of market trends and individual financial goals. By recognizing the potential implications of property depreciation and considering the long-term financial outcomes, sellers can make well-informed decisions about the timing of their property sales, ensuring that it aligns with their investment objectives and market dynamics.

Lifestyle Changes and Property Selling

Lifestyle changes can be a significant catalyst for property sales. When our circumstances shift, so too does our housing needs and preferences. Whether you find yourself wanting to upsize, downsize, or relocate to a new area, lifestyle changes play a crucial role in influencing your decision to sell a property.

Understanding the impact of lifestyle changes on property sales is essential for making informed choices about timing and maximizing your selling potential. By considering your evolving needs and priorities, you can determine when is the right time to make a move.

Upsizing allows you to accommodate a growing family or enjoy a larger living space. It might be that you need additional bedrooms, a dedicated home office, or more room for recreational activities. Whatever the reason, selling your current property to upgrade to a bigger space can meet your changing requirements and enhance your overall quality of life.

On the other hand, downsizing can offer numerous benefits, especially if you are an empty-nester or looking to simplify your lifestyle. Smaller properties require less maintenance and can be more cost-effective, freeing up financial resources for other priorities. Downsizing can also allow you to live in a location that better suits your current needs and preferences.

Relocating to a new area for work, family, or personal reasons is another lifestyle change that often leads to property sales. Whether it’s moving to a different city or even a new country, selling your property can provide the necessary funds and flexibility to start a new chapter in your life.

Ultimately, lifestyle changes offer opportunities for growth and transformation, and selling your property can be a practical step towards realizing your evolving aspirations. By assessing your current lifestyle, considering your future goals, and evaluating the market conditions, you can make well-informed decisions about when to sell your property to align with your changing lifestyle.

Observing Property Market Trends for Future Predictions

When it comes to selling your property, it’s essential to keep a close eye on property market trends. By observing these trends, you can gain valuable insights into future market predictions and make informed decisions about your property sale.

Gauging Upcoming Developments and Neighborhood Changes

One important aspect of observing property market trends is to gauge upcoming developments and neighborhood changes. This information can help you understand how the property market in your area is evolving and identify potential opportunities or challenges for your property sale.

To stay updated on upcoming developments, pay attention to local news and announcements from relevant authorities. Keep an eye out for new infrastructure projects, such as transportation improvements, commercial developments, or urban revitalization efforts. These developments can have a significant impact on property values and buyer demand.

Neighborhood changes can also influence the desirability of your property. Look for signs of gentrification, new amenities, or changes in demographics that may attract or deter potential buyers. Understanding these changes can help you position your property effectively in the market and attract the right audience.

Real Estate Cycles: When to Take Action

In addition to observing property market trends, understanding real estate cycles is crucial for timing your property sale. Real estate markets go through cycles of highs and lows, and being aware of these cycles can help you identify the right time to take action and sell your property.

Real estate cycles consist of four phases: expansion, peak, contraction, and trough. During the expansion phase, property prices and demand increase. It’s an ideal time to sell if you want to capitalize on rising prices. The peak phase is when the market reaches its highest point, and demand starts to cool off. It’s important to monitor market trends closely during this phase to determine if it’s still a favorable time to sell.

During the contraction phase, prices start to decline, and buyer demand decreases. Selling during this phase may not be ideal unless you have strong reasons, such as personal financial circumstances. The trough phase is the lowest point of the real estate cycle, and it’s usually a buyer’s market. It may not be the best time to sell unless you’re willing to accept lower offers.

By understanding these different phases of the real estate cycle, you can make better-informed decisions about when to list your property for sale. Timing your sale according to the market cycle can maximize your chances of achieving a favorable outcome.

Real Estate Market Cycle Phases

| Phase | Description |

|---|---|

| Expansion | Increasing property prices and demand |

| Peak | Highest point of the market; demand starts to cool off |

| Contraction | Declining prices and decreased buyer demand |

| Trough | Lowest point of the market; buyer’s market |

Observing property market trends and understanding real estate cycles are essential tools for making informed decisions about selling your property. By staying informed and monitoring the market closely, you can position yourself strategically and increase your chances of achieving a successful property sale.

Property Selling Indicators and Decision Making

When it comes to selling a property, there are numerous indicators that can inform your decision-making process. By analyzing market indicators, you can make informed choices that will help you navigate the selling process with confidence and achieve your desired outcomes.

One crucial property selling indicator to consider is the current market conditions. Understanding whether it is a buyer’s or seller’s market can significantly impact your selling strategy. In a seller’s market, where demand outweighs supply, you may have more flexibility in pricing and negotiation. Conversely, in a buyer’s market, where supply exceeds demand, you may need to be more strategic to attract potential buyers.

Additionally, analyzing market trends can provide valuable insights into the dynamics of the real estate market. Look for indicators such as price movements, average days on the market, and inventory levels to gauge market activity and assess the optimal time to sell your property.

Another important aspect of decision-making in property sales is understanding the financial aspects. Consider your personal financial goals and align them with the market conditions. Are you looking to maximize profits or sell quickly? Assessing your financial goals will help you determine the right time to sell and set appropriate pricing strategies.

Furthermore, conducting a thorough analysis of real-time market data can provide you with valuable information to support your decision-making process. Keep track of property prices in your area, follow economic forecasts, and stay informed about local developments that may impact the value of your property.

In conclusion, when selling a property, it is essential to analyze property selling indicators and make informed decisions based on market conditions, trends, and your own financial goals. By understanding these indicators and conducting thorough research, you can position yourself for success in the property market.

Conclusion – How to Determine When is a Good Time to Sell My Property

Summarizing Key Factors in Property Sales Timing

Making an Informed Choice for Your Unique Situation

When it comes to selling your property, timing is everything. Throughout this article, we have explored the key factors that influence the right time to sell your property. By considering market trends, personal financial goals, and lifestyle changes, you can make an informed choice that aligns with your unique situation.

Understanding the current property market is essential for determining the optimal timing of your sale. By evaluating market trends, analyzing interest rates and economic forecasts, and recognizing the impact of a seller’s versus a buyer’s market, you can better navigate the real estate landscape.

Assessing your property’s value is another crucial aspect. Conducting a thorough property appraisal, examining market comparables, and considering the potential return on investment from property improvements will help you price your property competitively and attract potential buyers.

Timing is also influenced by whether you choose to sell in peak seasons or off-seasons. Historical data on high-demand periods can guide your decision, and understanding the benefits of each selling period can help you strategically time your sale for optimal results.

It’s important to remember that in a seller’s market, implementing effective strategies such as pricing techniques and negotiation tactics can maximize your profits. Additionally, proper property upkeep and strategic renovations can enhance your property’s selling potential.

Furthermore, for leasehold properties, considering the expiration of the lease and renewal options is crucial. Selling your property due to lifestyle changes requires careful consideration, as does observing property market trends to predict future developments.

By considering all these factors and making an informed choice, you can achieve the best results when selling your property. Remember, every situation is unique, so it’s essential to understand your own circumstances and align them with the market conditions. With the right timing, you can confidently navigate the property selling process and achieve your desired outcomes.

FAQ

How can I determine when is a good time to sell my property?

There are several factors to consider when determining the right time to sell your property, including understanding the current property market, assessing the value of your property, and aligning your personal financial goals with market conditions.

How do I understand the current property market?

To understand the current property market, you need to evaluate market trends, such as price movements and supply and demand dynamics. Additionally, analyzing interest rates and economic forecasts can provide insights into the stability and growth potential of the real estate market.

How do I assess the value of my property?

You can assess the value of your property by utilizing methods such as property appraisal and market comparables. Factors to consider include location, size, condition, and recent sales data of comparable properties in the area.

Does timing matter when selling property?

Yes, timing can significantly impact the selling process. Selling during peak seasons, understanding historical data on high-demand periods, and weighing the benefits of off-season versus peak-season selling are crucial when determining the timing of your property sale.

What strategies can I use in a seller’s market?

In a seller’s market, you can implement effective strategies such as pricing techniques and negotiation tactics to maximize profits from your property sale.

How important is property upkeep when selling?

Proper property upkeep is essential to maintain its value and appeal to potential buyers. By maintaining your property and considering strategic renovations, you can enhance its selling potential and maximize its value.

When should I sell leasehold properties?

Selling leasehold properties requires considering factors such as lease expiration and renewal options. Understanding the implications of leasehold properties can help you make an informed decision on when to sell and maximize your returns on investment.

How do emotions play a role in selling property?

Selling a property can be an emotional process, especially if you have a sentimental attachment to it. Understanding the weight of sentimentality in sales timing and preparing yourself to let go can help you navigate the emotional journey and make decisions that align with your overall goals.

How do I align my personal financial goals with market conditions?

It’s crucial to align your personal financial goals with market conditions by considering real-time market data and analyzing how it relates to your financial objectives. This will help you make informed decisions about the timing of your property sale.

How can lifestyle changes influence my decision to sell a property?

Lifestyle changes such as upsizing, downsizing, or relocating can influence your decision to sell a property. Considering the impact of lifestyle changes on property sales can help you determine the right time to make a move.

What should I observe to predict future property market trends?

Observing property market trends can provide insights into upcoming developments and neighborhood changes, helping you make informed decisions about property sales. Additionally, understanding real estate cycles can help you identify the right time to take action and sell your property.

What are some indicators to guide property selling decisions?

Key property selling indicators include factors such as market trends, interest rates, economic forecasts, and supply and demand dynamics. Analyzing these indicators can help you make informed decisions about property sales and navigate the selling process with confidence.

The post How to Determine When is a Good Time to Sell My Property appeared first on Wing Tai Holdings Singapore.

]]>The post Using a Friend or Relative as Your Property Agent appeared first on Wing Tai Holdings Singapore.

]]>

For Myself I don’t have good experiences with working with my past experiences with my friends.

Case Study:

I remembered when I come into the industry in 2009, my friend supported me and decides to offer a HDB shophouse for their Retail Business.

However instead of putting a One Month Goodfaith Deposit, my friend suggested to place a $1 as good-faith deposit. It was rejected by the landlord during that, and he informed my friend that was not serious about it. Some arguments took place and no longer in talking terms. Given that the same scenario has happened now, I will know how to handle my friend. Experience does helps.

Key Takeaways:

- Using a friend as your property agent can provide a foundation of trust and emotional ease.

- However, there may be uncertain expertise and market knowledge to consider.

- It’s crucial to evaluate your friend’s professional competence and ability to maintain objectivity.

- Biases and potential conflicts may challenge personal relationships during the transaction.

- Understanding the scope of a property agent’s role is essential.

The Comfort of Trust in Real Estate Transactions

Establishing trust with a property agent is crucial when navigating the complex world of real estate. Trust forms the foundation of a successful buyer-agent relationship, providing the comfort and assurance needed to make informed decisions throughout the transaction. While working with a professional agent is a common choice, using a friend as your property agent can offer added benefits.

Establishing trust with a property agent

Trust is a vital component in any real estate transaction. When using a friend as your property agent, you already have an existing level of trust, which can set a strong foundation for the process. The established bond allows for open communication, honest discussions, and a mutual understanding of your preferences and goals. This trust can create a sense of security, ensuring your friend-agent has your best interests at heart.

The emotional ease of working with someone familiar

One advantage of using a friend as your property agent is the emotional ease that comes with working with someone you already know and are familiar with. Your friend-agent has insights into your personality, lifestyle, and what you’re looking for in a property. This familiarity can lead to better understanding and decision-making, streamlining the process and reducing stress. The emotional ease of working with a friend can make the real estate journey more enjoyable and comfortable.

| Benefits of Trust in Real Estate Transactions |

|---|

| Establishes a strong foundation for the buyer-agent relationship |

| Encourages open communication and honest discussions |

| Provides a sense of security and mutual understanding |

| Streamlines the real estate process and reduces stress |

Uncertain Expertise and Market Knowledge

While using a friend as your property agent may have its advantages, it’s important to consider the potential drawback of uncertain expertise and market knowledge. While your friend may be familiar with real estate, they may not possess the same level of expertise and market knowledge as a professional agent. This could result in missed opportunities and inadequate guidance throughout the process.

When navigating the complex real estate market, it is crucial to have a deep understanding of market trends, property values, and negotiation strategies. Professional agents often have years of experience and access to extensive market data, giving them a competitive edge in representing your interests.

By choosing a friend as your property agent, there is a risk of relying on someone with limited knowledge of the current market conditions. While their intentions may be genuine, their uncertain expertise could negatively impact your buying or selling experience.

When making important financial decisions, it’s essential to have accurate information and guidance from a knowledgeable expert who can help you navigate the complexities of the real estate market. Professional agents bring invaluable market insights, keeping you informed about current trends, pricing dynamics, and potential investment opportunities.

Additionally, professional agents have access to industry resources and networks that can facilitate a smoother transaction. They can connect you with reliable professionals, such as lawyers, mortgage brokers, and inspectors, ensuring all aspects of the process are handled efficiently and effectively.

Before entrusting your real estate transaction to a friend, carefully consider their qualifications and experience in the industry. Assess their ability to provide accurate market analyses, negotiate favorable terms, and guide you through the legal complexities of property transactions.

Remember, while it may be tempting to work with someone you know and trust, the expertise and market knowledge of a professional agent are invaluable in the pursuit of a successful real estate transaction.

Should I Use a Friend as my Property Agent

Before deciding whether to use a friend as your property agent, it’s essential to evaluate their professional competence.

Evaluating the professional competence of a friend

Consider factors such as their knowledge of the local market, negotiation skills, and track record of successful transactions. A competent property agent should have a deep understanding of the market trends and be able to navigate complex negotiations to ensure you get the best deal. Look for evidence of their expertise and past achievements to determine if they are equipped to handle your real estate needs.

How personal relationships might cloud judgment

While using a friend as your property agent offers the comfort of working with someone familiar, it’s important to recognize that personal relationships can sometimes cloud judgment. Emotions and biases may influence decision-making, potentially compromising your best interests in the process. Evaluate whether your friend can maintain objectivity and prioritize your needs above personal considerations. Open communication and clear boundaries can help maintain a professional relationship and ensure that the real estate transaction is handled with the utmost integrity.

Navigating Biases in the Home Selling Process

When using a friend as your property agent, one of the challenges you may encounter is navigating biases in the home selling process. Friends often hesitate to provide candid feedback, fearing that it may strain the relationship. However, it’s crucial to receive honest and objective feedback to make informed decisions in real estate.

The importance of objectivity cannot be overstated in the real estate industry. Your friend may have personal biases or preferences that can influence their advice. To ensure you receive unbiased guidance throughout the home selling process, it’s essential to prioritize the objectivity of your agent.

Objectivity allows for a clear-eyed evaluation of your property’s strengths and weaknesses, pricing strategy, and marketing approach. It helps you see beyond personal attachments and make decisions that are based on market realities. An objective agent can provide valuable insights on staging, potential renovations, or adjustments to maximize your property’s appeal to potential buyers.

By prioritizing objectivity, you can navigate the biases that may arise when using a friend as your property agent. Remember that while their intentions may be well-meaning, it’s crucial to have an agent who can provide impartial advice and recommendations based on market trends and buyer preferences.

Potential Risk to Personal Relationships

When considering using a friend as your property agent, it’s crucial to acknowledge the potential risk it poses to personal relationships. While the idea of working with someone familiar may seem appealing, it’s essential to recognize the potential complications that can arise in a dual-role relationship.

When Business Complications Challenge Friendships

Utilizing a friend as your property agent introduces a layer of business complexity to the friendship. The dynamics of a business relationship can sometimes clash with the expectations and dynamics of a personal friendship. Disagreements or differences in opinion regarding the real estate transaction can strain the friendship and lead to conflicts.

Moreover, disagreements that arise during the property transaction process have the potential to sour the friendship, creating challenges in both the business and personal relationship. For example, if there are differences in opinion on the property’s value or negotiation strategy, it could lead to friction between the friend-agent and the client, causing strain on their personal relationship. These potential conflicts of interest underline the importance of establishing clear boundaries and expectations when engaging a friend as a property agent to minimize the risk of misunderstandings and maintain professionalism throughout the real estate transaction. It is crucial to ensure that both parties are aligned on the professional expectations and responsibilities to safeguard the integrity of the friendship and the success of the property transaction.

Impact on Friendship

Moreover, disagreements related to the property transaction, such as differences in opinions on property choices or negotiation strategies, can create tension between friends. The emotional and financial stakes involved in real estate transactions can escalate conflicts, leading to strained interactions and communication patterns that spill over into personal relationships. These professional disagreements have the potential to impact the trust and mutual respect in the friendship, underscoring the need for careful consideration when opting to involve a friend as your property agent.

Additionally, testimonies from individuals who have engaged friends as their property agents revealed the potential strains on personal relationships. Many emphasized the challenges of managing professional disagreements and conflicts of interest, which subsequently impacted their friendships outside the real estate context. This highlights the need for individuals to carefully assess the potential impact of real estate transactions on their friendships when considering a friend as their property agent.

How to Manage Conflict in Dual-Role Relationships

Managing conflict is essential to preserve both the business and personal aspects of your relationship. To navigate conflicts effectively, open communication is key. Establishing clear boundaries and expectations from the beginning can help mitigate potential conflicts.

Conflicts may arise during the real estate transaction process, but you can handle them effectively by openly discussing your concerns, listening to each other’s perspectives, and finding compromises that satisfy both parties. It’s important to prioritize maintaining a healthy friendship while managing the complexities of a dual-role relationship.

To summarize, using a friend as your property agent can potentially risk personal relationships. By acknowledging and addressing the challenges that business complications can bring and by actively managing conflicts, it is possible to maintain a healthy balance between business and friendship.

Understanding the Scope of a Property Agent’s Role

Before deciding to use a friend as your property agent, it’s crucial to understand the scope of their role. A property agent is responsible for various tasks such as property search, negotiations, and documentation. It’s important to discuss expectations and ensure your friend has the necessary skills and resources to fulfill their role effectively.

When you work with a property agent, they act as your guide throughout the entire real estate process. They assist you in finding suitable properties that meet your criteria, negotiate on your behalf to secure the best deal, and handle all the necessary paperwork and documentation to ensure a smooth transaction.

An experienced property agent has in-depth knowledge of the local market trends, pricing, and legal requirements. They can provide valuable insights and advice to help you make informed decisions. Their expertise extends beyond just finding properties; they also understand the intricacies of the buying or selling process, including financing options, property inspections, and contract terms.

Having a clear understanding of your friend’s capabilities and limitations as a property agent is essential. While they may have good intentions, it’s important to assess whether they have the necessary qualifications and resources to handle the complexities of the real estate market.

Remember, the role of a property agent is multifaceted, and it requires a level of expertise and experience to navigate successfully. Evaluating your friend’s skills and ensuring they can fulfill their role effectively will help you make an informed decision about whether using a friend as your property agent is the right choice for you.

The Role of a Full-Time Agent

When you engage a full-time agent, you benefit from their undivided attention and commitment to your property transaction. Unlike a friend who may have other personal and professional obligations, a full-time agent is dedicated to staying updated with market trends, legal regulations, and property evaluation techniques. This commitment ensures that you receive well-informed guidance and support throughout the entire process, from listing your property to closing the deal.

Moreover, a full-time agent’s accessibility is a crucial advantage. They are readily available to promptly address your concerns, respond to inquiries, and conduct property viewings, ensuring that your property receives the attention it deserves. This level of availability is often challenging to replicate when working with a friend, who may have limited time due to their existing commitments.

For example, a full-time agent can proactively conduct market research to determine the optimal selling price for your property, leveraging their expertise to ensure that you receive the best possible value. On the other hand, a friend who dabbles in real estate part-time may lack the resources and time to conduct comprehensive market analyses, potentially leading to suboptimal pricing strategies. Therefore, the decision to engage a full-time agent is a critical factor in safeguarding the success and efficiency of your real estate transaction.

Influence of Commission on Performance

When choosing a friend as your property agent, it’s crucial to consider the influence of commission on their performance. Selecting an agent solely based on low commission may compromise their incentive to effectively market and advertise the property. For instance, if your friend-agent agrees to a significantly lower commission than the standard rate, they might be inclined to prioritize other properties with higher commission rates, thereby reducing their motivation to dedicate time and effort to effectively promote your property.

A focus on low commission can impact the agent’s motivation and commitment to securing the best deal for the client. This could manifest in reduced enthusiasm in negotiations, limited resources allocated to marketing efforts, and a lack of proactive engagement with potential buyers. Therefore, it’s essential to evaluate your friend’s dedication to achieving the best outcome for you as a client, beyond the commission rate they agree upon. Always ensure that your friend-agent’s commitment to your property’s success is not overshadowed by the commission negotiations, as this can significantly influence the overall performance and outcome of the property transaction.

Incorporating information from real estate experts, it was emphasized that the commission structure significantly impacts an agent’s motivation and commitment to effectively representing their clients. The experts highlighted that selecting an agent solely based on low commission may compromise their incentive to diligently market and advocate for the property, potentially affecting the overall success of the real estate transaction. This underscores the importance of evaluating the friend-agent’s commitment and performance incentives when considering them as a property representative.

Benefits of Using a Friend as a Property Agent

Despite the potential drawbacks, there are also benefits to using a friend as your property agent. A friend may have a deep understanding of your preferences and needs, allowing for a more personalized approach to the real estate process. Trust and open communication can also enhance the overall experience.

When you work with a friend as your property agent, they have insider knowledge of your preferences and specific requirements. This familiarity can lead to a tailored search process, ensuring that you see properties that align with your needs. They may also provide valuable insights and recommendations based on their understanding of your taste and lifestyle.

In addition, the existing trust between you and your friend can create a comfortable and transparent environment for decision-making. You may feel more at ease discussing your concerns and expectations with someone you trust, leading to open and honest communication throughout the process. When challenges arise, your friend may be better equipped to handle them, as they have knowledge of your personal circumstances and priorities.

Furthermore, the friendship aspect of the relationship can add an element of emotional support during what can be a stressful time. Your friend may be more attuned to your emotional needs and provide reassurance throughout the buying or selling process.

However, it’s essential to balance the benefits with the potential risks. Evaluate whether your friend has the necessary skills and expertise to handle the complexities of the real estate market. Discuss their previous experience in transactions similar to yours and how they plan to navigate any hurdles that may arise.

Ultimately, using a friend as your property agent can be a positive and rewarding experience when approached with caution and careful consideration.

The Line Between Professional Advice and Personal Opinions

When working with a friend as your property agent, it’s crucial to differentiate between professional advice and personal opinions. While friends may offer suggestions based on their personal preferences and experiences, it’s important to ensure that professional standards are met to make informed decisions. Striking a balance between friendly input and expert advice is essential for a successful real estate transaction.

Deciphering Solid Advice from Friendly Suggestions

When receiving advice from a friend who is acting as your property agent, it’s important to consider the source and the basis for their recommendations. Assess whether their suggestions are rooted in professional knowledge and expertise or if they are solely based on personal opinions. Professional advice takes into account market trends, legal requirements, and industry standards, providing you with objective recommendations that align with your specific goals.

Deciphering solid advice from friendly suggestions involves critically evaluating the advice against your own requirements and preferences. Consider the reputation and track record of your friend as an agent, as this can serve as an indicator of their ability to provide reliable advice. Taking into account the market conditions and consulting with other industry professionals can also help you make informed decisions.

Ensuring Professional Standards Are Met

While working with a friend as your property agent, it’s essential to ensure that professional standards are met. This means that your friend should adhere to the same level of professionalism, integrity, and ethical conduct expected of any licensed property agent.

Professional standards encompass various aspects of the real estate transaction, including proper documentation, accurate property valuation, effective negotiation skills, and compliance with legal and regulatory requirements. It’s important to have clear communication with your friend-agent about your expectations and to ensure that they are committed to upholding professional standards throughout the entire process.

By differentiating between professional advice and personal opinions, you can navigate the real estate journey more confidently, considering both the insights of your friend-agent and the expertise of a professional. Striking this balance will help you make informed decisions that align with your goals and ensure that your real estate transaction is conducted in a professional and ethical manner.

Consequences of Financial Disclosure Amongst Friends

When considering using a friend as your property agent, it is important to be aware of the consequences of financial disclosure. Real estate transactions involve the sharing of personal financial details, and it is crucial to prioritize the privacy and security of this information.

Financial disclosure can reveal sensitive information that you may not want widely known amongst your friends or acquaintances. It is essential to assess the trustworthiness of your friend-turned-agent and determine whether they can handle this information with utmost discretion.

Setting boundaries with your friend-agent is crucial to maintaining a professional relationship and safeguarding your confidential financial details. Open and clear communication is key to ensuring that both parties understand the importance of privacy and confidentiality. This includes discussing and agreeing upon the level of detail that will be disclosed and how it will be handled.

By setting boundaries from the start, you can establish a foundation of trust and respect in the handling of your financial information. This will not only protect your privacy but also preserve the integrity of your friendship throughout the real estate transaction.

Choosing the Right Property Agent: Qualifications Over Connections

When it comes to finding a property agent, it can be tempting to rely on personal connections. However, choosing an agent based solely on your relationship with them may not always be the best course of action. Instead, it’s essential to prioritize qualifications and experience when selecting a property agent to ensure a successful and smooth real estate transaction.

Assessing Agent Qualifications and Experience

When evaluating potential property agents, take the time to delve into their qualifications and experience. Look for agents who have a strong track record in the industry, with proven success in buying or selling properties similar to yours. Assess their knowledge of the local market, understanding of current market trends, and ability to negotiate effectively.

Remember, a property agent’s qualifications and experience can directly impact the outcome of your transaction. It’s important to establish confidence in their abilities from the start.

Finding a Trustworthy Property Agent in Singapore

In Singapore’s real estate market, finding a trustworthy property agent is paramount. Trust is built on transparency, integrity, and open communication. Look for agents who prioritize your best interests, provide honest advice, and maintain a high level of professionalism throughout the process.

Consider seeking recommendations from friends, family, or colleagues who have recently worked with reliable property agents. Additionally, online reviews and industry accolades can provide valuable insights into an agent’s reputation and trustworthiness.

By focusing on agent qualifications and finding someone you can trust, you can enhance your chances of a successful real estate transaction. Remember, the right property agent will not only guide you through the process but also protect your interests and ensure you make informed decisions.

Conclusion Using a Friend or Relative as Your Property Agent

After weighing the pros and cons, using a friend as your property agent can be a tempting option. The comfort of trust and familiarity can create a strong foundation for the real estate transaction. However, it’s crucial to be aware of the potential risks involved. Uncertain expertise and market knowledge could result in missed opportunities or inadequate guidance. Biases in the home selling process may hinder receiving candid feedback, which is crucial for making informed decisions.

Furthermore, personal relationships can be at risk when business complications arise. It’s essential to evaluate your friend’s professional competence, ensuring they have the necessary qualifications and experience to handle the complexities of a real estate transaction. Striking a balance between personal opinions and professional advice is also important to ensure the best outcome.

When considering using a friend as your property agent, it’s important to carefully evaluate the overall dynamics of your relationship. Setting clear boundaries and maintaining open communication can help manage potential conflicts. Ultimately, the decision should be based on a thorough assessment of your friend’s abilities.

FAQ

Should I use a friend as my property agent?

Using a friend as your property agent can have benefits, such as the comfort of trust. However, there are also potential drawbacks to consider, such as uncertain expertise and the impact on personal relationships. It’s important to carefully evaluate your friend’s professional competence before making a decision.

How can I establish trust with a property agent?