The post GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market appeared first on Wing Tai Holdings Singapore.

]]>

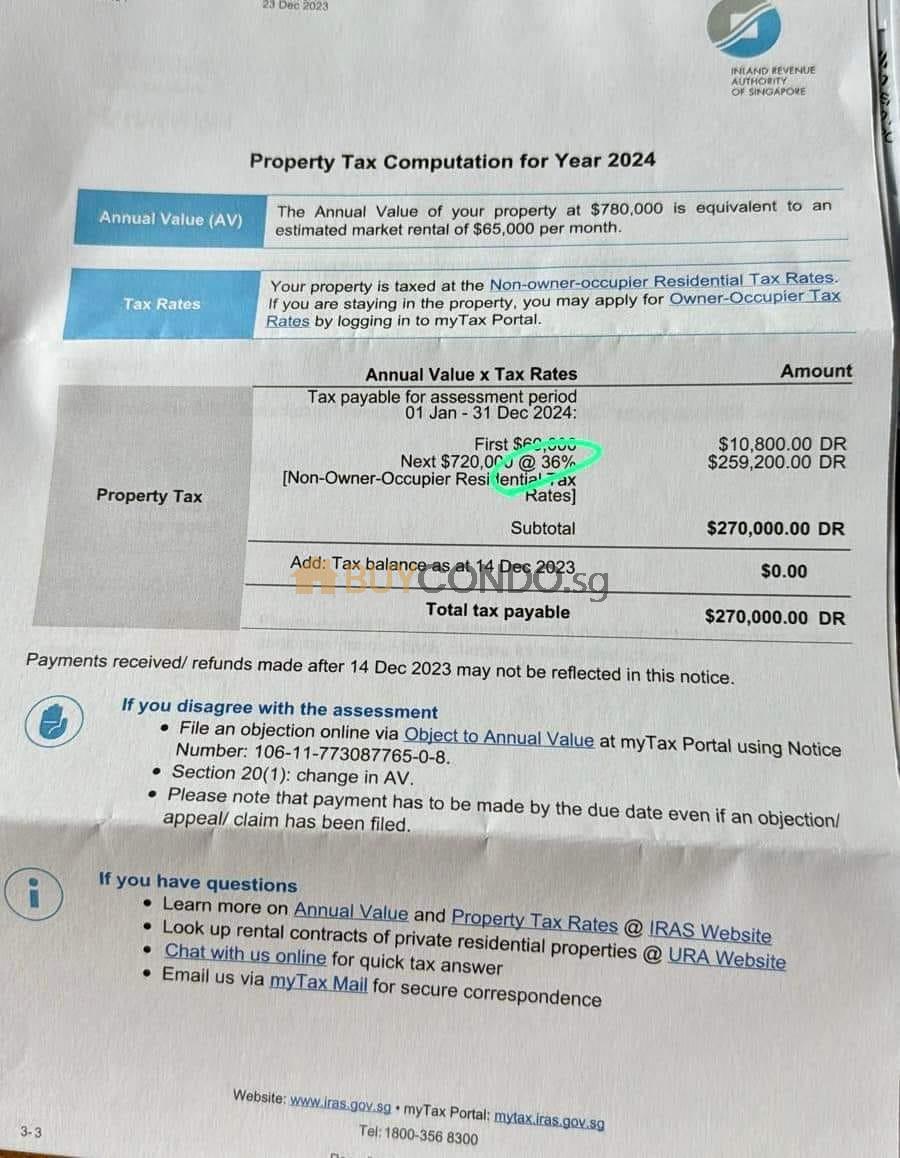

There are heavy discussions online that one of the luxury home owners shared that she is required to pay a whopping S$270,000 in Taxes so much more than the years before.

This is still not including the Income Tax payable for the Rental income (Highest tier of 24% for Ultra High Income earners)

Lets dive into the Case Study.

(Non-Owner Occupier Tax. First $60,000 is 18%; in excess of the $60,000, the next $720,000 is taxable at the rate of 36%)

Assume the GCB is renting out at $65,000 per month.

Annually the Rental Income shall be $780,000 per annum.

( Net Income before property maintenance and bank loan with interest if any)

$780,000(Annual Rent) – $270,000 (Property Tax) – $187,200 ( Income Tax) = Net Rental Income $322,800.

( Holding Cost of such Ultra Luxury Landed Property)

$270,000 + $187,200 = Holding Cost $457,200.

Some Points Gathered:

Holding Cost for a rented out property is higher than the total rental income.

What are this kind of Properties that falls into this Bracket?

Good Class Bungalows(GCB) with an average of 15,000sqft land with the built up 8,000 ~ 12,000sqft

Such GCB can be in the market valued around $30,000,000 to $60,000,000.

Ultra Luxury Apartments in CCR.

Le Nouvel Ardmore ~ $80,000 per month, 4 bedroom 4058sqft.

Four Seasons Park Penthouse $78,000 per month, 9 Bedroom 6150sft.

Nassim Park Residences Penthouse $65,000 per month, 4 Bedroom 6800sft.

If you have a Desire to Own Such Property Would You Buy a GCB or Ultra High Luxury Apartment? Lets Compare

Annualized Capital Appreciation for Ultra High Luxury Apartments

Le Nouvel Ardmore ~ Rental $80,000 per month, 4 bedroom 4058sqft.

(Owner Bought $18,500,000 ($4559psf/4058sqft) in 2021, Based on the latest Transaction of $5,800psf today’s Market Value is worth $23,536,400.

$23,536,400 – $18,500,000 = Approx $5,000,000 in 3 Years.

Annualized Capital Appreciation for Le Nouvel Ardmore: Approx $1,600,000, 8.6% per annum.

If we factor in the holding cost of say estimate of $600,000. There is still a net $1m per year before mortgage interest.

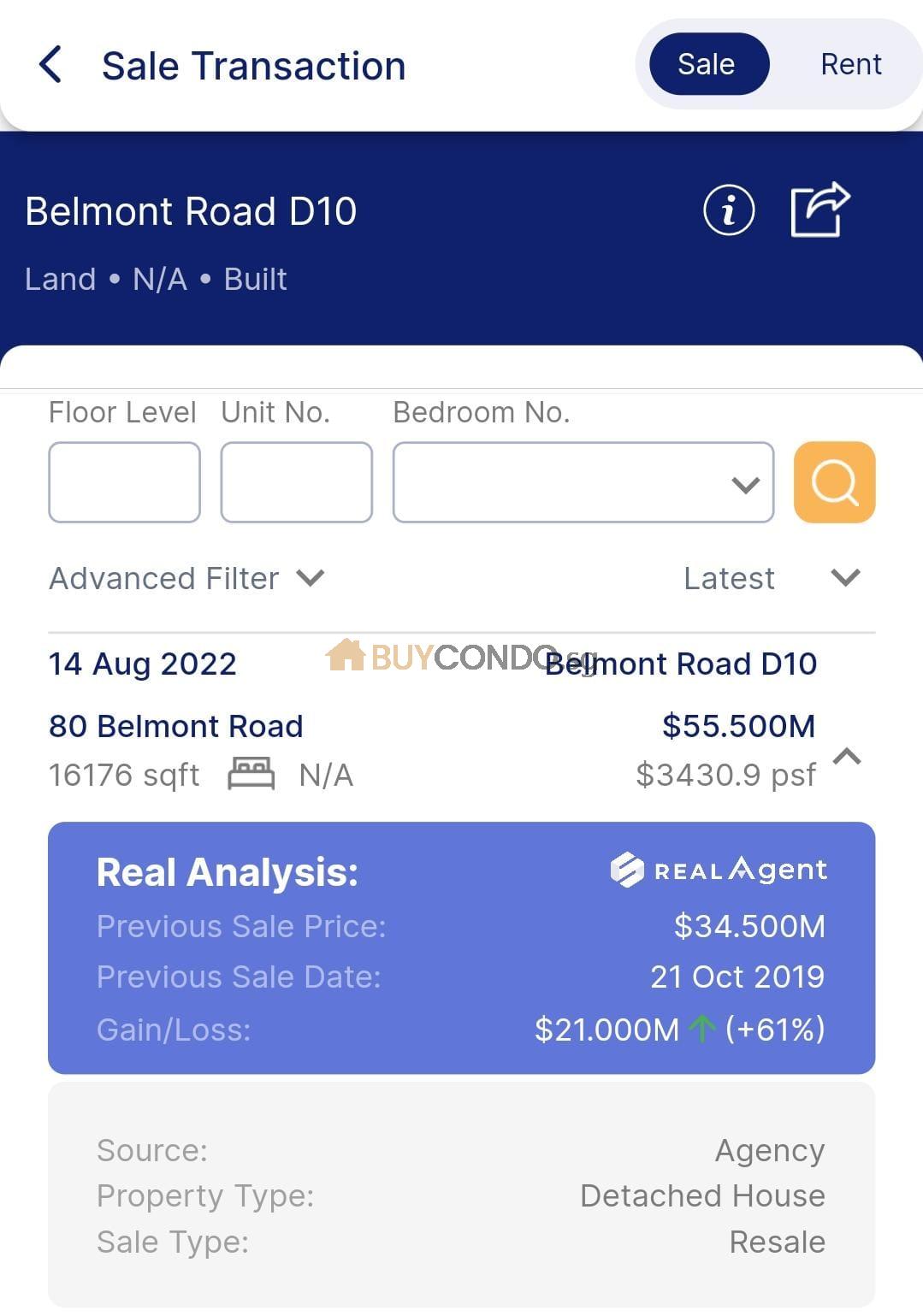

Annualized Capital Appreciation for Good Class Bungalow

80 Belmont Road. $55.5m – $34.5m = $21m Gains in 3 years.

Annualized Capital Appreciation for Le Nouvel Ardmore: Approx $7,000,000, 20% per annum.

From these comparison of Facts it will be quite clear where is better to place your money.

https://buycondo.sg/property-management-services/

Non-owner-occupier residential tax rates (residential properties) in 2024

Non-owner occupied residential properties are condominiums, HDB flats or other residential properties that the owner does not live in (“occupy”). Hence, owner-occupier tax rates do not apply.

The following tax rates apply to non-owner occupied properties except for those in the exclusion list.

Excluded properties

- Accommodation facilities within any sports and recreational club

- Chalet

- Child care centre, student care centre, or kindergarten

- Welfare home

- Hospital, hospice, or place for rehabilitation, convalescence, nursing care or similar purposes

- Hotel, backpackers’ hostel, boarding house or guest house

- Serviced apartment

- Staff quarters that are part of any property exempted from tax under S6(6) of the Property Tax Act

- Student’s boarding house or hostel

- Workers’ dormitory

The property must have received planning approval for the above use. No application to IRAS is required.

Non-owner-occupier residential tax rates

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

|---|---|---|

| First 30,000 Next $15,000 |

12% 20% |

$3,600 $3,000 |

| First $45,000 Next $15,000 |

– 28% |

$6,600 $4,200 |

| First $60,000 Above $60,000 |

– 36% |

$10,800 |

| Annual Value ($) | Tax rate effective from 1 Jan 2023 to 31 Dec 2023 | Property tax payable |

|---|---|---|

| First $30,000

Next $15,000 |

11%

16% |

$3,300

$2,400 |

| First $45,000

Next $15,000 |

–

21% |

$5,700

$3,150 |

| First $60,000

Above $60,000 |

–

27% |

$8,850

|

Owner-occupier tax rates (residential properties) in 2024

Owner-occupied residential properties are condominiums, HDB flats or other residential properties where the owner lives in (“occupies”) the property. Owner-occupied residential properties enjoy owner-occupier tax rates.

Owner-occupier tax rates

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

|---|---|---|

| First $8,000 Next $22,000 |

0% 4% |

$0 $880 |

| First $30,000 Next $10,000 |

– 6% |

$880 $600 |

| First $40,000 Next $15,000 |

– 10% |

$1,480 $1,500 |

| First $55,000 Next $15,000 |

– 14% |

$2,980 $2,100 |

| First $70,000 Next $15,000 |

– 20% |

$5,080 $3,000 |

| First $85,000 Next $15,000 |

– 26% |

$8,080 $3,900 |

| First $100,000 Above $100,000 |

– 32% |

$11,980

|

| Annual Value ($) | Tax rate effective from 1 Jan 2023 to 31 Dec 2023 | Property tax payable |

|---|---|---|

| First $8,000

Next $22,000 |

0%

4% |

$0

$880 |

| First $30,000

Next $10,000 |

–

5% |

$880

$500 |

| First $40,000

Next $15,000 |

–

7% |

$1,380

$1,050 |

| First $55,000

Next $15,000 |

–

10% |

$2,430

$1,500 |

| First $70,000

Next $15,000 |

–

14% |

$3,930

$2,100 |

| First $85,000

Next $15,000 |

–

18% |

$6,030

$2,700 |

| First $100,000

Above $100,000 |

–

23% |

$8,730

|

IRAS Income Tax rates (residential properties) in 2024

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 Next $180,000 |

– 22 |

44,550 39,600 |

| First $500,000 Next $500,000 |

– 23 |

84,150 115,000 |

| First $1,000,000 In excess of $1,000,000 |

– 24 |

199,150 |

From YA 2017 to YA 2023

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 In excess of $320,000 |

– 22 |

44,550 |

The Property Value Paradox: Rising Tax Versus Housing Market Gains

The increase in property tax raises the question of the property value paradox. While homeowners may experience higher tax obligations, they may also witness gains in the housing market. Understanding the relationship between rising property taxes and housing market gains is essential to evaluate the overall impact on homeowners’ finances.

As property taxes rise, homeowners might worry about the financial burden it presents. However, it’s important to consider the potential gains in the housing market. The property tax paradox emerges when higher taxes coincide with a robust housing market. While the tax burden increases, homeowners still benefit from appreciation in property value, creating a delicate balance.

Property values are influenced by various factors, including location, demand, and market trends. While property taxes are based on property values, the housing market can drive significant gains in property value over time. This creates a paradoxical situation where higher taxes are accompanied by increasing property values, raising questions about the overall financial impact on homeowners.

When property values increase, homeowners may consider the potential gains in equity and future resale value. These gains can offset the higher tax obligations, providing a positive aspect to the property value paradox. However, it’s crucial to assess the specific circumstances of each homeowner and evaluate the net impact of rising taxes and housing market gains.

The interplay between property taxes and market value highlights the complexity of homeowners’ financial considerations. While higher taxes can place a burden on homeowners, they should also consider the potential gains in property value, leading to increased wealth and financial stability.

Understanding the property value paradox and its implications is crucial for homeowners navigating the current landscape. By analyzing market trends, consulting with real estate professionals, and staying informed about property tax regulations, homeowners can make informed decisions about their investments and financial future.

| Housing Market Gains | Property Tax Paradox |

|---|---|

| Positive | Increase in tax obligations |

| Potential for equity gains | Potential for increased property value |

| Future resale value | Complex financial considerations |

Predicting Rental Income Tax Implications for Landlords

As a result of the property tax increase, landlords may encounter potential implications on their rental income taxes. It is crucial for landlords to navigate these changes and implement strategies to maintain profitability despite the increased tax burden.

Maintaining Profitability with Increased Property Taxes

With the rise in property taxes, landlords need to evaluate their financial position and explore ways to sustain profitability. This requires careful budgeting and analysis of rental income and expenses. Landlords should consider the impact of the increased property taxes on their rental yield and assess the feasibility of adjusting rental pricing to offset the higher tax obligations.

Cost-Passing Strategies: Rental Pricing Adjustments

One possible approach to manage the increased property taxes is to make rental pricing adjustments. Landlords may need to pass on a portion of the tax burden to tenants through reasonable rental price increases. However, it is essential to strike a balance between maintaining profitability and tenant affordability. Landlords should carefully analyze the rental market, competition, and demand before implementing any pricing adjustments.

Projected Effects on Rental Yield and Market Competition

The property tax increase can impact the rental yield, which measures the return on investment for landlords. Higher taxes may lower the overall rental yield, making it challenging for landlords to maintain expected returns. Additionally, market competition could intensify as landlords make pricing adjustments to address the increased tax burden. Consequently, landlords must monitor market dynamics closely and adapt to changing trends to remain competitive.

In summary, predicting the rental income tax implications for landlords in light of the property tax increase is crucial for their financial planning and decision-making. By maintaining profitability, implementing cost-passing strategies, and assessing the effects on rental yield and market competition, landlords can navigate these tax changes effectively and make informed choices for their rental properties. Let your Property Manager Handle for your properties today.

Is It Still Profitable to Rent Out or Sell in 2024?

With the significant increase in property taxes, homeowners must assess whether renting out or selling their property remains a profitable venture. The higher tax obligations may impact the potential returns for landlords, leading to a reconsideration of renting out properties. Similarly, homeowners may question whether selling their property is a more financially viable option in light of the property tax implications.

Profitability Comparison: Renting Out vs. Selling

In order to determine whether it is still profitable to rent out or sell in 2024, homeowners need to evaluate the financial implications of both options. Here is a breakdown of the key factors to consider:

| Renting Out | Selling | |

|---|---|---|

| Potential Rental Income | Homeowners can generate a steady stream of income through rental payments from tenants. | Selling the property can result in a lump sum cash infusion. |

| Property Tax Obligations | Rental income is subject to property tax, and the recent tax increase may impact profitability. | Selling the property may trigger capital gains tax, which needs to be factored into the financial calculations. |

| Maintenance and Upkeep | Landlords are responsible for ongoing maintenance and repairs, which can impact overall profitability. | Selling the property relieves homeowners of the financial and time commitments associated with maintenance. |

| Market conditions | The rental market conditions, demand, and competition can influence the rental income potential. | The current state of the housing market may impact the selling price and time it takes to sell the property. |

“The decision to rent out or sell a property requires a careful analysis of the financial implications and market dynamics. Homeowners should weigh the potential rental income against property tax obligations, maintenance costs, and market conditions in order to make an informed decision that aligns with their financial goals.”

By considering these factors, homeowners can assess whether renting out or selling their property is the most profitable choice in the current landscape of increased property taxes. It is advisable to consult with financial advisors or real estate professionals to fully understand the implications and make a well-informed decision.

Conclusion ; GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market

In the wake of the significant increase in property tax for 2024, homeowners in Singapore are facing a challenging financial burden. The implications of this tax hike extend far beyond what was initially anticipated. It is imperative for homeowners to fully grasp the impact on their finances and explore potential strategies to manage the increased tax burden.

To navigate these changes effectively, homeowners must stay well-informed about payment deadlines and take advantage of advancements in digital tax billing. Embracing electronic property tax bills and utilizing the new interactive bill system can streamline the payment process and enhance convenience.

Furthermore, homeowners should consider the available government assistance options, such as the one-time rebate for owner-occupied properties. Assessing eligibility criteria for tax rebates will help homeowners determine if they are qualified for this crucial financial support.

In conclusion, the property tax increase for 2024 presents a significant challenge for homeowners, affecting their overall financial well-being. By understanding the implications, exploring strategies for managing the increased tax burden, and considering government assistance options, homeowners can navigate these changes with greater confidence. Staying abreast of payment deadlines, embracing digital tax billing advancements, and remaining proactive in tackling the property tax landscape are key to minimizing the burden of the tax hike and securing a stable financial future.

FAQ

What is the impact of the dramatic increase in property tax on homeowners?

The dramatic increase in property tax for 2024 has significant implications for homeowners in Singapore. It raises concerns about the affordability of homeownership and increases the financial burden on homeowners.

How can homeowners understand the new property tax rates for 2024?

Homeowners can understand the new property tax rates by reviewing the latest assessments and tax bills provided by the government. It is essential to stay informed about any changes in the tax rates.

How does the tax hike affect owner-occupied residences?

The tax hike specifically affects owner-occupied residences, leading to increased financial burdens for homeowners. They will have to bear the brunt of the higher tax obligations.

How can homeowners compare their tax obligations between 2023 and 2024?

Homeowners can compare their tax obligations between 2023 and 2024 by reviewing their previous tax bills and assessments. They can analyze the differences in the tax rates, assessments, and overall tax burden.

Are landlords likely to raise rental prices due to the property tax increase?

Due to the property tax increase, landlords may face pressure to raise rental prices. They may need to pass on the increased costs to tenants, which could impact the rental market and affordability for tenants.

How can homeowners calculate their home’s annual value (AV)?

Homeowners can calculate their home’s annual value by considering the estimated market rentals of similar properties in the rental market. This calculation is crucial for determining their property tax obligations.

What role do rental market trends play in annual value (AV) determination?

Rental market trends play a significant role in annual value (AV) determination. The estimated market rentals of similar properties impact the calculation of a home’s AV, which directly affects the property tax bill.

Will the annual value (AV) vary for different property types?

Yes, the annual value (AV) may vary for different property types. Different property types have unique features and attributes that can impact their estimated market rentals and, subsequently, the AV and property tax bill.

What is the relationship between rising property taxes and housing market gains?

While rising property taxes may increase the tax burden on homeowners, they may also witness gains in the housing market. It is essential to understand this relationship to evaluate the overall impact on homeowners’ finances.

How can landlords maintain profitability with increased property taxes?

Landlords can maintain profitability with increased property taxes by implementing cost-passing strategies, such as rental pricing adjustments. These adjustments help offset the higher tax burden and ensure profitability for landlords.

What are the potential effects on rental yield and market competition due to the property tax hike?

The property tax hike may have potential effects on rental yield and market competition. Landlords may need to adjust rental prices, which can impact rental yield, and increased costs may influence market competition.

Should homeowners reconsider renting out or selling their property in light of the property tax implications?

With the significant increase in property taxes, homeowners must assess whether renting out or selling their property remains a profitable venture. The higher tax obligations may impact potential returns for landlords, leading to a reconsideration of renting out properties.

What government assistance is available to alleviate the financial burden on homeowners?

The government provides property tax rebates as a form of assistance to alleviate the financial burden on homeowners. A one-time rebate is available for owner-occupied properties, and homeowners can apply for this rebate to reduce their tax obligations.

How can homeowners understand if they qualify for property tax rebates?

Homeowners can assess their eligibility for property tax rebates by reviewing the criteria set by the government. They need to determine if their property qualifies as an owner-occupied property and if they meet the income and ownership requirements.

What are the payment deadlines and processes for property tax in 2024?

Homeowners need to be aware of the payment deadlines and processes for property tax in 2024. It is essential to know when the tax payment is due and to familiarize themselves with the various payment options available.

What advancements in digital tax billing and payments can benefit homeowners?

Homeowners can benefit from advancements in digital tax billing and payments. They can adopt electronic property tax bills and utilize the new interactive bill system, which streamlines the process for homeowners. It is also important to stay informed about any enhancements in property tax digital services for added convenience.

The post GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market appeared first on Wing Tai Holdings Singapore.

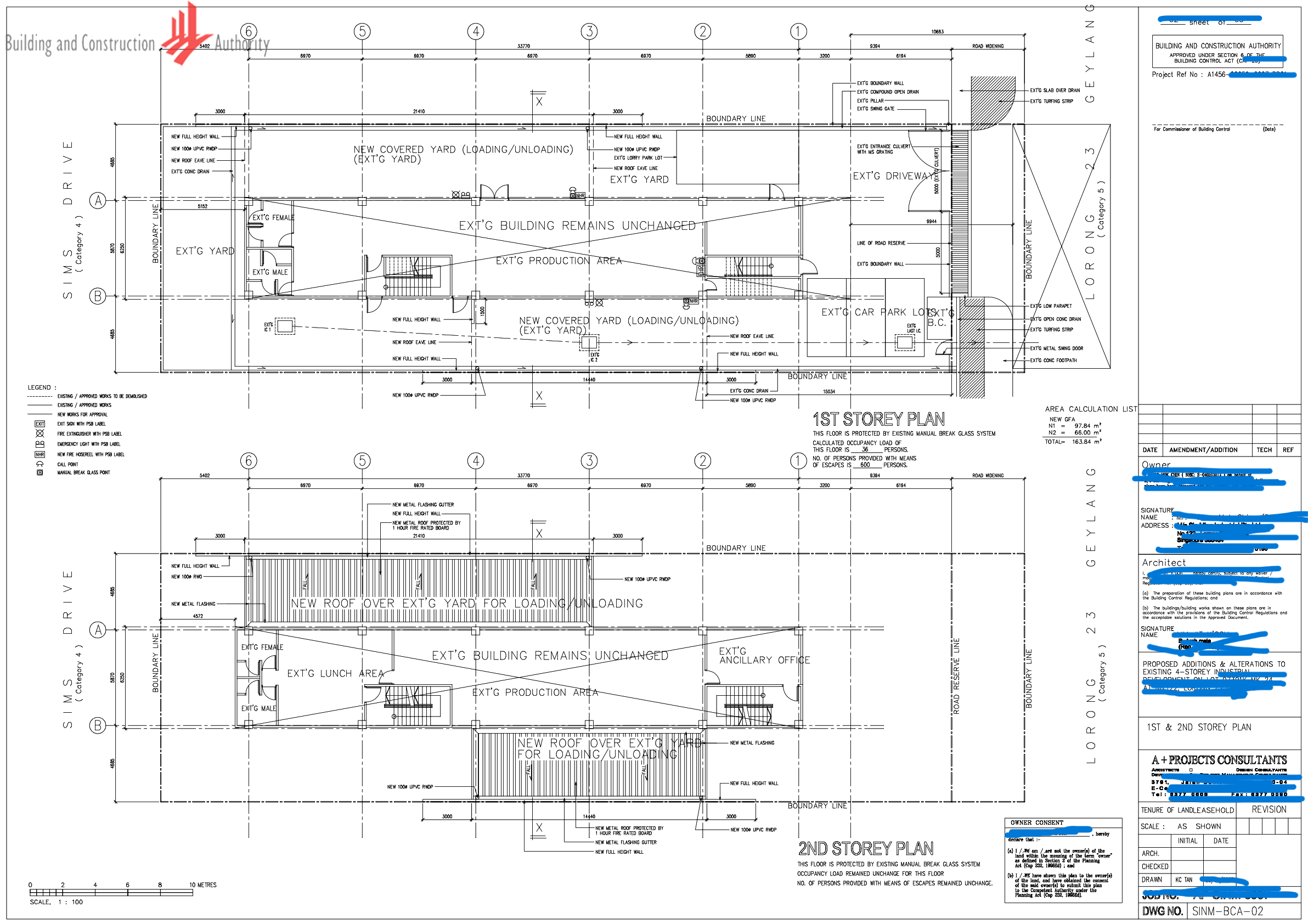

]]>The post How to buy Landed Floor Plan Purchase from BCA appeared first on Wing Tai Holdings Singapore.

]]>Not limited to only Landed but Bungalow, Semi-Detached, Terraced, Condominium floor plan, Shopping Complex, Office Building/Shophouse, Factory/Warehouse, Government Building

What You Need to Know and Prepared with.

1) Only for Properties Obtained (CSC) – How to buy Landed Floor Plan Purchase from BCA

Purchase the approved building and structural plans for an existing property that has been issued with a Certificate of Statutory Completion (CSC). Please note that this is subject to the availability of plans.

2) Valid Singpass log-in with Email address – How to buy Landed Floor Plan Purchase from BCA

for the Acknowledgement of the floor plans.

3) Applicant Type For Home Owners is under Type 1

Usually, for landed, buyers want to buy the floor plans from BCA will still have to go through the Seller. The applicant will also need to show Proof of Ownership, such as the Current Property Tax Statement.

4) Full Address –How to buy Landed Floor Plan Purchase from BCA

House No, Unit No (If applicable), Street Name.

5) Type Property Floor Plan –How to buy Landed Floor Plan Purchase from BCA

Landed floor plans included Bungalow, Semi-Detached, Terraced. Condominium floor plan, Commercial Shopping Complex, Office Building/Shophouse, Factory/Warehouse, Government Building

6) Reason for purchase – How to buy Landed Floor Plan Purchase from BCA

7) Direct Link to Buy – https://www.bca.gov.sg/pps

Supporting Documents are required for BCA to process the application. If documents are not in order, there may be delay in processing the application.

Type of Applicant – How to buy Landed Floor Plan Purchase from BCA

| Types of applicants who can apply to view and purchase the approved building and structural plans | |||

| Types of Applicant | Supporting Documents Required for the application (For * items, all documents must be attached with the application) |

Authorization Forms for Authorized Persons |

|

| Type 1 : I am a Registered Proprietor | *(1) My current Property Tax Statement contains my full name (as in my NRIC) and the property address as Documentary Proof of Ownership |

Authorization Form | |

| (Note: My name is currently registered as a Sole-owner | (use when required by type 1 | ||

| / Co-owner in SLA’s property ownership record) | applicant only) | ||

| Type 2 : I am the Staff from a Registered Proprietor of a Corporation/ an Organisation (Note: Name of the Corporation / Organisation which I am working with is currently registered as a proprietor in SLA’s property ownership record – This includes the religious organisation / non-profit organisation) | *(1) Corporate Owner’s Authorization Form authorizing me to buy plans | Authorization Form | |

| *(2) Current Property Tax Statement contains Corporate Owner’s full name (as in the Authorization Form) and the Property address as Documentary Proof of Ownership *(3) ACRA Biz File of Corporate Owner |

(must be signed by type 2 applicant only, and attach in the application) |

||

| Type 3 : I am the Chairman of Management | (1) Current Property Tax statement for the address as Documentary Proof of Ownership [The tax statement contains the name of MCST] |

Authorization Form | |

| Corporation Strata Title (MCST) | (use when required by type 3 applicant only) |

||

| If you are authorized by Type 1 : A Registered Proprietor | |||

| Type 4: I am the Authorized Person representing the Proprietor (one of the 3 types): | *1. The registered proprietor’s NRIC (front only) showing full name, NRIC number and photo *2. Current Property Tax Statement for the property address as Documentary Proof of Ownership (Tax Statement should contain registered proprietor’s full name as in NRIC) |

||

| (Note: Signed authorization and | *3. Authorization Form signed by the registered proprietor (Use Type 1 Authorization Form above) | ||

| obtained from the owner type that you choose before making the application) | If you are authorized by Type 2 : A Registered Proprietor of A Corporation/An Organization (This includes the religious organization / non- profit organization | ||

| *1. Current Property Tax Statement for the property address as Documentary Proof of ownership (Tax Statement should contain existing Corporate Owner’s full name) *2. Authorization Form signed by existing Corporate Owner with authorised signatory (Use Type 2 Authorization Form above) *3. ACRA Biz File of the existing Corporate Owner |

|||

| If you are authorized by Type 3 : Chairman Of Management Corporation Strata Title (MCST) | |||

| *1. Authorization Form signed by the Chairman of MCST (Use Type 3 Authorization Form above) 2. Current Property Tax Statement for the property address as Documentary Proof of Ownership (Tax Statement should contain name of MCST) |

|||

Please read the Eligibility and Supporting Documents Required (https://www.bca.gov.sg/pps/Doc/Eligibility%20and%20Supporting%20Documents%20Required.pdf).

When the plans are available, our officer will contact you within 5 working days on the arrangements to view and purchase the plans.

Fees Payable:

• Search Fee: $ 35.00 Per Address Payable upon submission of this application.

• Plan Purchase Fee: $ 45.00 Per Plan Reference Number (per set) Payable after selection of plans for purchase. Note:

• Please note that individual plans for the unit may not be available, especially for high-rise developments and terrace developments.

• New buyer of a property may submit an E-Notice of Transfer or obtain an authorization from the current property owner if the property has not been transferred under their name.

• All purchased plans will be in pdf format and not all plans may be in good condition due to the source of the product. You are advised to view and select the plans carefully before purchase. • The plans do not include electrical, piping and plumbing plans. We seek your understanding that there will be no refund of all fees.

The post How to buy Landed Floor Plan Purchase from BCA appeared first on Wing Tai Holdings Singapore.

]]>The post Home Owner, Mr Simon who bought 99 year lease terrace (Case Study) appeared first on Wing Tai Holdings Singapore.

]]>

HOME for Simon Ang’s family of seven, spanning three generations, is a three storey terrace house along Jalan Rindu near Bartley MRT station. Simon and his wife paid S$1.82 million for the property in August 2017, with close to 75 years left on the property’s 99- year lease.

1) Affordability and Size (Price Difference between 99 years and freehold)

He paid S$1.82m for the Jalan Rindu property to house his family of seven. Ang estimates that a comparable property across the road with a similar site area, but freehold tenure, would have cost about S$2.6 million at the time.

Rather than spring a fortune for a freehold property, the couple decided they could overcome the “stigma” relating to lease decay for 99-year landed properties.

“We would have loved to have a freehold home, but my immediate concerns were more about affordability and size. We needed a lot of bedrooms,” Ang said. “For the same budget, we could have bought a freehold house with a much smaller land size – maybe 1,600 square feet (sq ft)- but that would not have catered to our space requirements.”

“My most important consideration was that I did not want to overstretch myself by taking a massive mortgage and having difficulty paying it off. We are now seeing the dangers of this amid rising interest rates.”

Today, the Jalan Rindu house with a balance lease of 69.5 years under his wife’s name.

2) Challenges of Lease Decay for a 99-year Landed

The couple is open to selling the property if they can get a reasonable price. Still, Ang is cognisant of the challenges facing potential buyers: “The loan quan tum that a bank would grant for this pur chase may not be that big due to the shorter balance lease; so a buyer would.

3) Renovations

The couple spent nearly S$100,000 renovating the property, including replacing all the toilets.

Renovation cost Varies depending on the family’s needs.

The couple took advantage of the relatively large site area of 2,174 sq ft of the intermediate terrace house to boost the property’s count of five bedrooms by creating a granny room.

4) Location Upside Potential

“Paya Lebar Airbase is nearby. When it relocated in the 2030s, I believe the plot ratio in the surrounding areas, including Jalan Rindu, may be adjusted upwards accordingly,”

5) Rent Out as a Co-living Space. (Or Multi-Generation House)

“What is beautiful about co-living, as a landlord, is that you enjoy a higher rate of return than renting out the whole house to one family. I know the market for co-living, and this location has its plus points.”

The Jalan Rindu house is about 250 metres from Bartley station, which is one stop from Serangoon station, where Nex mall is.

6) Will they be able to sell the Property in Future?

“Even though a 99-year landed residential property may not be so saleable as the lease runs down, one can spruce it up and rent it out to generate passive income. In a way, this helps to recoup what you have paid for the house,” said Ang, 56, a forex trader.

Ang said the couple are “happy” to keep the house if they cannot sell it.

“Our three children are in their 20s in 10 years. Hopefully, they

would be out on their own, getting their flats. And I won’t need such a big house after that. My wife and I could move into an apartment, and then we would probably rent out this entire three-storey house as a co-living offering.

7) Collective Sale of Stretch of 99-Year Landed Tenure.

Not Ruling out the possibilities, There is still possibilty the potential for a collective sale for the stretch of 99-year leasehold terrace houses.

The land price will also depend on the URA land zoning and plot ratio, whether it is a two-storey Mix Zone or 3 Storey Mix Zone.

Of course, URA would need the consent of all owners for an en bloc sale involving a row of landed properties. And there is no certainty the state would agree to top up the combined site’s land lease to 99 years for a developer keen on redeveloping the site.

“It’s not a guarantee that URA can make an en bloc sale here, but this is a possibility that all the owners can come together to explore.”

Lastly, for home buyers looking for the landed estates which is 99 year here are some choices.

Villa Verde ( 99 years from 1997)

Poh Huat Terrace ( 99 years from1996)

Almond Crescent. ( 99 years from1994)

Presenting Our Home Tour at Almond Crescent

Reference: _BT_Simon says – ‘Here’s why I bought a 99-year terrace house

The post Home Owner, Mr Simon who bought 99 year lease terrace (Case Study) appeared first on Wing Tai Holdings Singapore.

]]>The post Buying a 99 year Landed Property appeared first on Wing Tai Holdings Singapore.

]]>Buying a 99-year landed property

Generally, the value of 99-year leasehold properties would decline as their balance leasehold tenures shrink. However, the median price of

99-year terrace houses in the first nine months of this year rose to a record S$1,214 per square foot (PSF) on land area, as an analysis by List Sothe by’s International Realty (List SIR) using URA Realis data shows.

The latest median price reflects a 1.53 per cent increase from S$1.053 PSF for 2021, up by 1.32 per cent from 2020.

The newest price is above the pre-Covid median price of S$1.007 psf in 2019.

The median price gap between 99-year and freehold terrace houses has risen to $715 psf in the first nine months of this year. As this price gap widens, 99-year terrace houses have become an attractive option. In particular, Intermediate terrace houses are the entry-level for condominium and HOB(Housing Board►dwellers looking to upgrade to landed property. The Covid outbreak accentuated the need for more extensive living space, with work-from-home made mandatory for most office workers. Students were also required to do home·based learning.

Budget-Friendly Vs Similar-Sized Freehold ones

- More livable space spread across in 3 and a half storeys compared to Condo.

- For multi-generational families who need a larger living space than an apartment or condo unit could provide. Still, their budget may be too small to buy a freehold landed house.

- Growing families prefer much larger areas than condominiums can provide and see value for money in getting a much bigger home at a relatively affordable price.

- Attractive especially for young professionals getting their first landed.

With or without a pandemic, there has always been a segment of property buyers drawn to 99-year terrace houses.

These group of buyers would probably prioritise the quality of life in terms of liveable space over investment considerations

Compared with freehold terrace houses, 99-year terrace houses are priced more attractively to meet functional needs. For example. If a buyer needs a home with four or five bedrooms,

“For example, Buying a 99-year landed property terrace house ln Park Villas in the Hougang area with a floor area of 2,800 sq ft could cost about SS2.3 million, but the same value can only fetch a unit of below 1,600sq ft in nearby The Florence Residences Condo.”

Some buyers are attracted to the low cost of psf of floor area for such landed homes.”(Park Villas is a conventional landed project on a site with a 99-year leasehold tenure starting May, 1994.

He compares a 99-year leasehold terrace house with a 99-year condo and a free hold terrace house; a 99-year terrace house is still more affordable,

Mindful if the balance lease on the site can meet one’s needs

For retirees, a shorter balance lease of 30 or 40 years could meet their needs till age 95.

But for a young family, it is suggested to look for a leasehold property with 60 years balance lease.

Financial complications and procedures

A short-balance lease does have implications for funding the property purchase.

-

Buyers can’t use CPF savings to buy a private residential property if it is land is left with a remaining lease of 20 years or less at the time of purchase.

-

In excess of 20 years of balance leases, CPF savings that can be used (for purchase).

-

Median age (Using IWAA Calculation) of the owner and youngest owner in the case of a joint purchase.

-

The Property should outlive the Youngest owner till age 95, allowing them to age in place.

If this condition is met:

the owner(s) can use their CPF Ordinary Account (OA) savings for up to 100 per cent of the property purchase price or the property valuation price at the time of purchase, whichever is lower.

If this condition is met:

the owner(s) can still use their CPF OA savings, but at a pro-rated amount. Potential buyers may ascertain the amount of CPF OA savings one can operate utilising a housing usage calculator on the CPF website.

For the banks to grant a housing loan for private residential property, the property should have a tenure of at least 30 years at loan maturity.

The maximum tenure for the housing loan may be reduced for older leases.

Lease Decay for 99-year lease

There are other issues for a property with a leasehold tenure that is running down.

With owners buying a 99-year landed property, it will be challenging to find buyers as the lease run downs. Due to economic downturns, prices could deteriorate faster than freehold ones.

Similarly, there is still a strong preference for freehold properties among landed homebuyers, so it may be more challenging to sell a 99-year leasehold landed property, especially when the market is weak or the leasehold has depreciated substantially.

The bright side of 99-year landed property terrace houses

- The rental yield would also be higher, compared with that for a freehold property,

- Should the owners eventually decide to lease it out due to the lower purchase price or outlay.

- New pool of buyers or users could emerge for retirement.

An example would be retirees who have a shorter time frame and are looking for ample living space to house their multi generation family for a sometime-but not long-term basis without overstretching their finances.

Short-tenured terrace houses can also make ideal rental properties if the owners (or buyers) are willing to spruce them up.

Another finding from the analysis is that buyers with HDB addresses make up a higher proportion of those who picked up 99-year ter race houses than those who bought freehold/999-year leasehold terrace houses.

Such a trend may indicate price resistance setting in the prediction that prices for 99-year terrace houses could remain at current levels for the rest of this year.

However, amid overall price gains in terrace houses, HDB dwellers’ share of purchases.

Prior to this, there is the cooling measures to could be addressed to this.

Property owner or buyers will continue to monitor on how it will impact on the pricings.

For Home Valuation and Home Report, Strongly suggest you to request a copy from us if you have plans to buy or sell a landed property.

https://www.youtube.com/watch?v=lfp6joxsrachttps://youtu.be/lfp6joxsrac

Reference to 2022.10.08_BT.

At buycondo.sg, we have help home Owners and Home Buyers to Secure 99 year lease tenure landed properties.

They Emerged as a Happy Family living in a spacious property.

The post Buying a 99 year Landed Property appeared first on Wing Tai Holdings Singapore.

]]>The post If I own a bungalow house is redeveloped into 2 semi-D, Do I need to pay ABSD for the additional unit after it is developed? appeared first on Wing Tai Holdings Singapore.

]]>Answer: No.

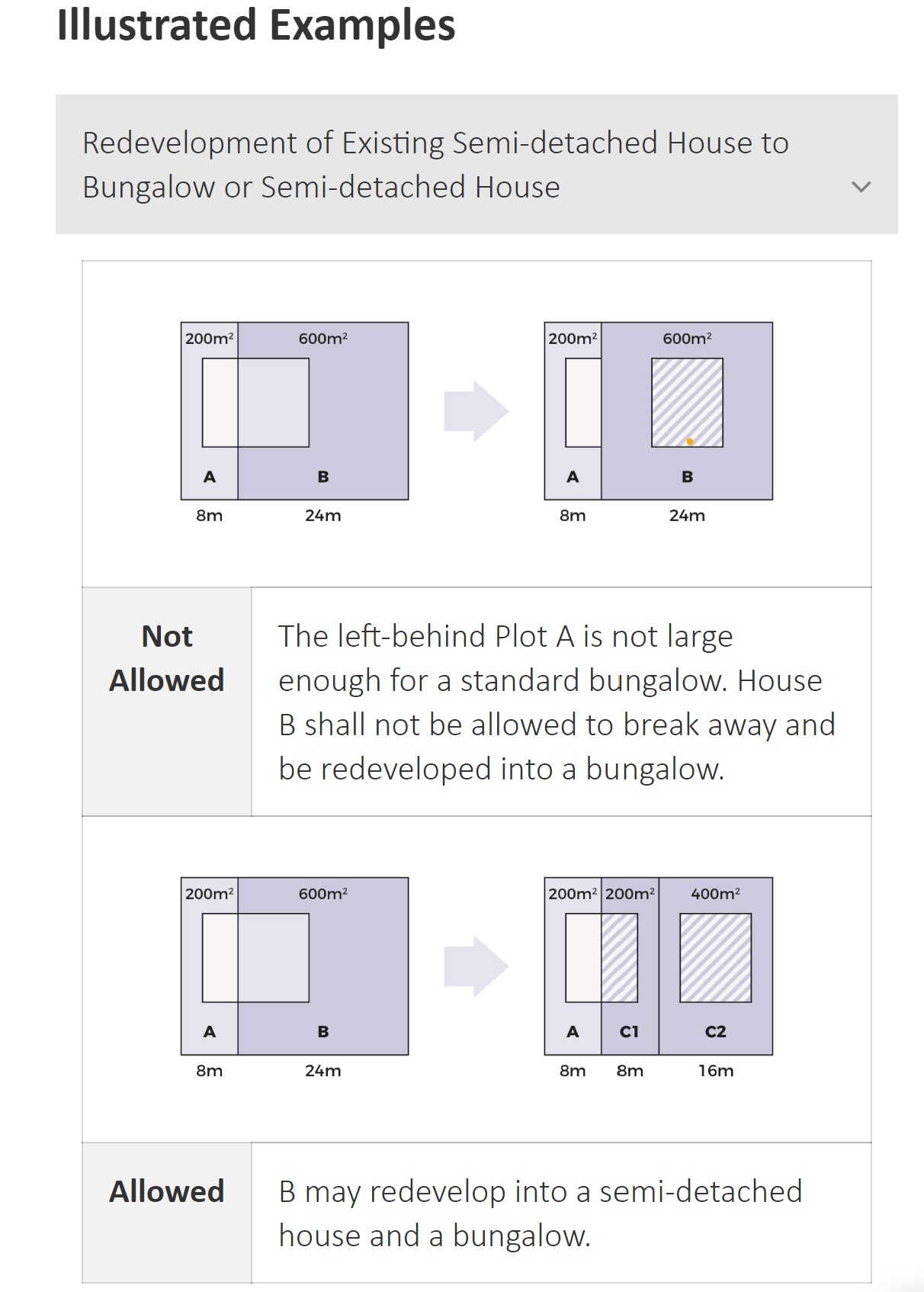

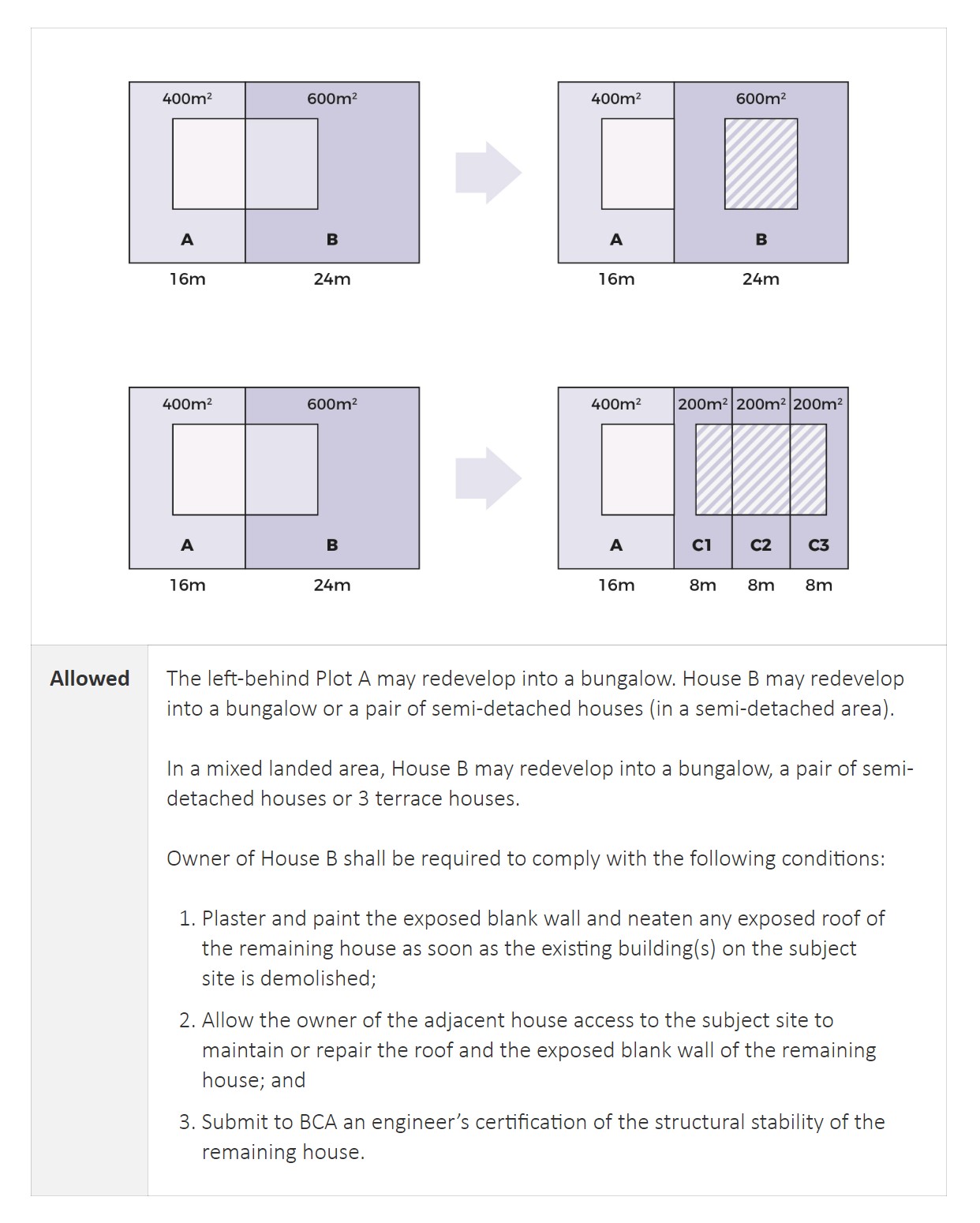

Redeveloping to a Semi-Detached House

A corner terrace house plot may be redeveloped into a new pair of semi-detached houses, provided:

- It can comply with the minimum plot width and size, and

- The adjoining terrace plot has 8m plot width and 200sqm plot size.

Any unit in a row of intermediate terrace houses may be redeveloped to a semi-detached house provided:

- The plot size and width are sufficient to allow the change, and

- The adjacent affected unit that the subject unit is detaching from, maybe rebuilt into a corner terrace unit in the future (ie has a minimum plot size of 200sqm and width of 8m).

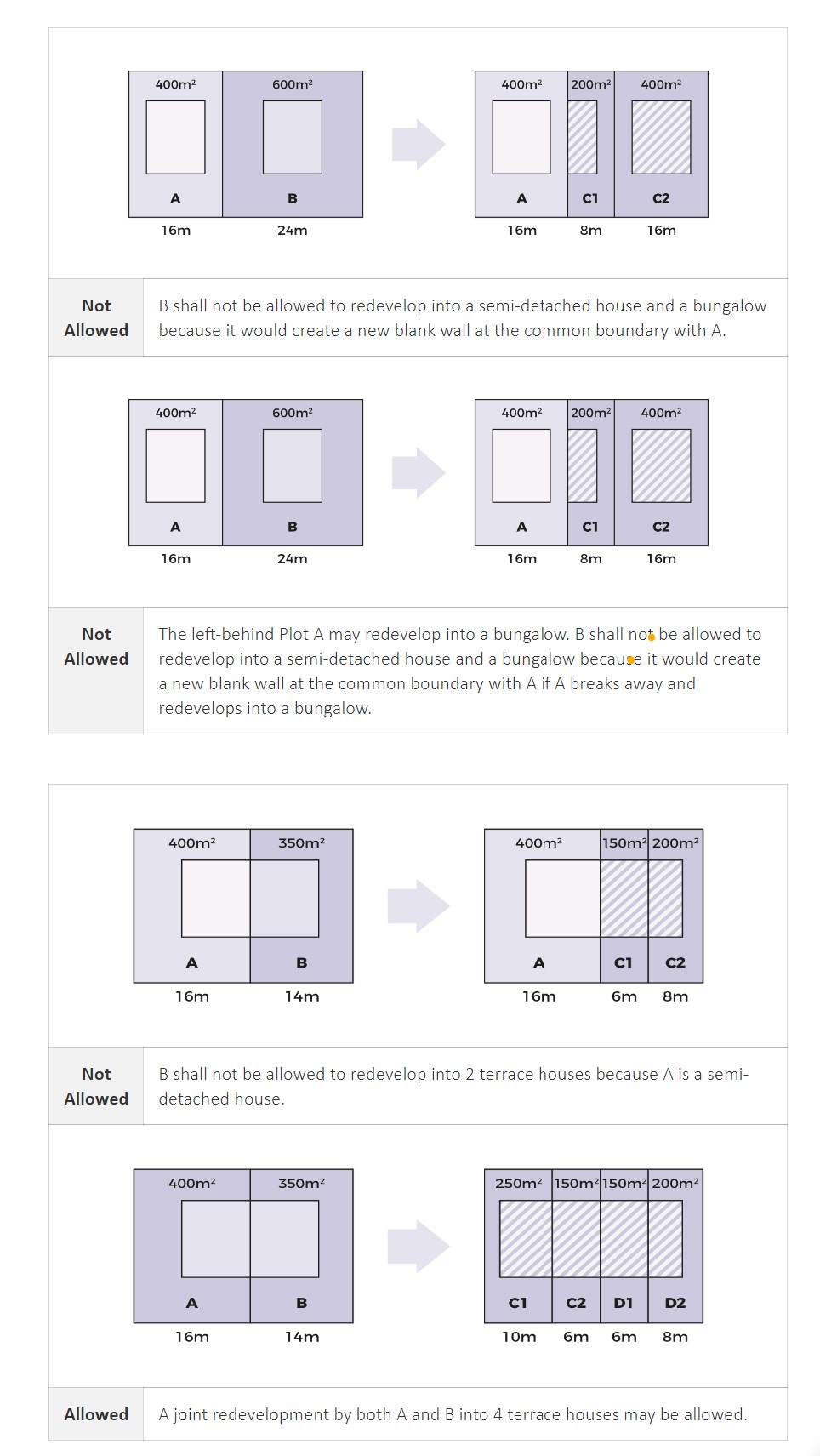

Illustration of a Semi-Detached House

A semi-detached house is one half of a pair of two houses, each with its own land title, separated by a common party wall along one side of the premises. The pair of semi-detached houses is attached either side-to-side or back-to-back as illustrated above.

If an adjoining semi-detached house is demolished or redeveloped into a different housing form (eg to a bungalow), the left-behind (or existing) semi-detached house shall remain a semi-detached house as originally approved.

Semi-detached houses may be built in either the areas are designated for semi-detached housing or mixed landed housing if the development site area can meet the requisite minimum plot size and plot width.

A semi-detached house shall adhere to the applicable storey height, envelope control guidelines, and building setback requirements under the envelope control guidelines. The permissible Gross Floor Area (GFA) for landed housing is the resultant of the allowable building height and envelope.

Guidelines: Summary-Semi-Detached

We are working with Consultancy Companies that provide professional advice and Reconstruction and A & A Works. Feel Free to Call us today to discuss further.

The post If I own a bungalow house is redeveloped into 2 semi-D, Do I need to pay ABSD for the additional unit after it is developed? appeared first on Wing Tai Holdings Singapore.

]]>