The post GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market appeared first on Wing Tai Holdings Singapore.

]]>

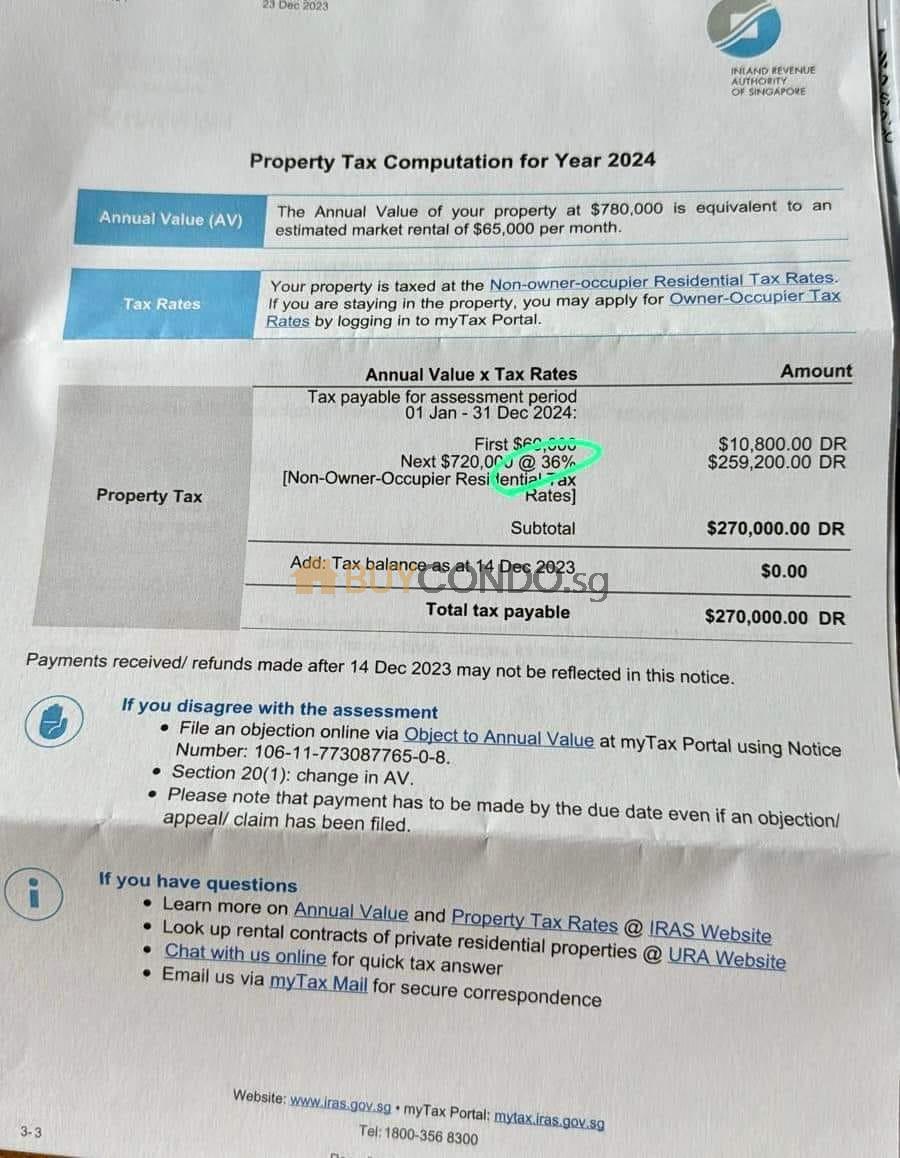

There are heavy discussions online that one of the luxury home owners shared that she is required to pay a whopping S$270,000 in Taxes so much more than the years before.

This is still not including the Income Tax payable for the Rental income (Highest tier of 24% for Ultra High Income earners)

Lets dive into the Case Study.

(Non-Owner Occupier Tax. First $60,000 is 18%; in excess of the $60,000, the next $720,000 is taxable at the rate of 36%)

Assume the GCB is renting out at $65,000 per month.

Annually the Rental Income shall be $780,000 per annum.

( Net Income before property maintenance and bank loan with interest if any)

$780,000(Annual Rent) – $270,000 (Property Tax) – $187,200 ( Income Tax) = Net Rental Income $322,800.

( Holding Cost of such Ultra Luxury Landed Property)

$270,000 + $187,200 = Holding Cost $457,200.

Some Points Gathered:

Holding Cost for a rented out property is higher than the total rental income.

What are this kind of Properties that falls into this Bracket?

Good Class Bungalows(GCB) with an average of 15,000sqft land with the built up 8,000 ~ 12,000sqft

Such GCB can be in the market valued around $30,000,000 to $60,000,000.

Ultra Luxury Apartments in CCR.

Le Nouvel Ardmore ~ $80,000 per month, 4 bedroom 4058sqft.

Four Seasons Park Penthouse $78,000 per month, 9 Bedroom 6150sft.

Nassim Park Residences Penthouse $65,000 per month, 4 Bedroom 6800sft.

If you have a Desire to Own Such Property Would You Buy a GCB or Ultra High Luxury Apartment? Lets Compare

Annualized Capital Appreciation for Ultra High Luxury Apartments

Le Nouvel Ardmore ~ Rental $80,000 per month, 4 bedroom 4058sqft.

(Owner Bought $18,500,000 ($4559psf/4058sqft) in 2021, Based on the latest Transaction of $5,800psf today’s Market Value is worth $23,536,400.

$23,536,400 – $18,500,000 = Approx $5,000,000 in 3 Years.

Annualized Capital Appreciation for Le Nouvel Ardmore: Approx $1,600,000, 8.6% per annum.

If we factor in the holding cost of say estimate of $600,000. There is still a net $1m per year before mortgage interest.

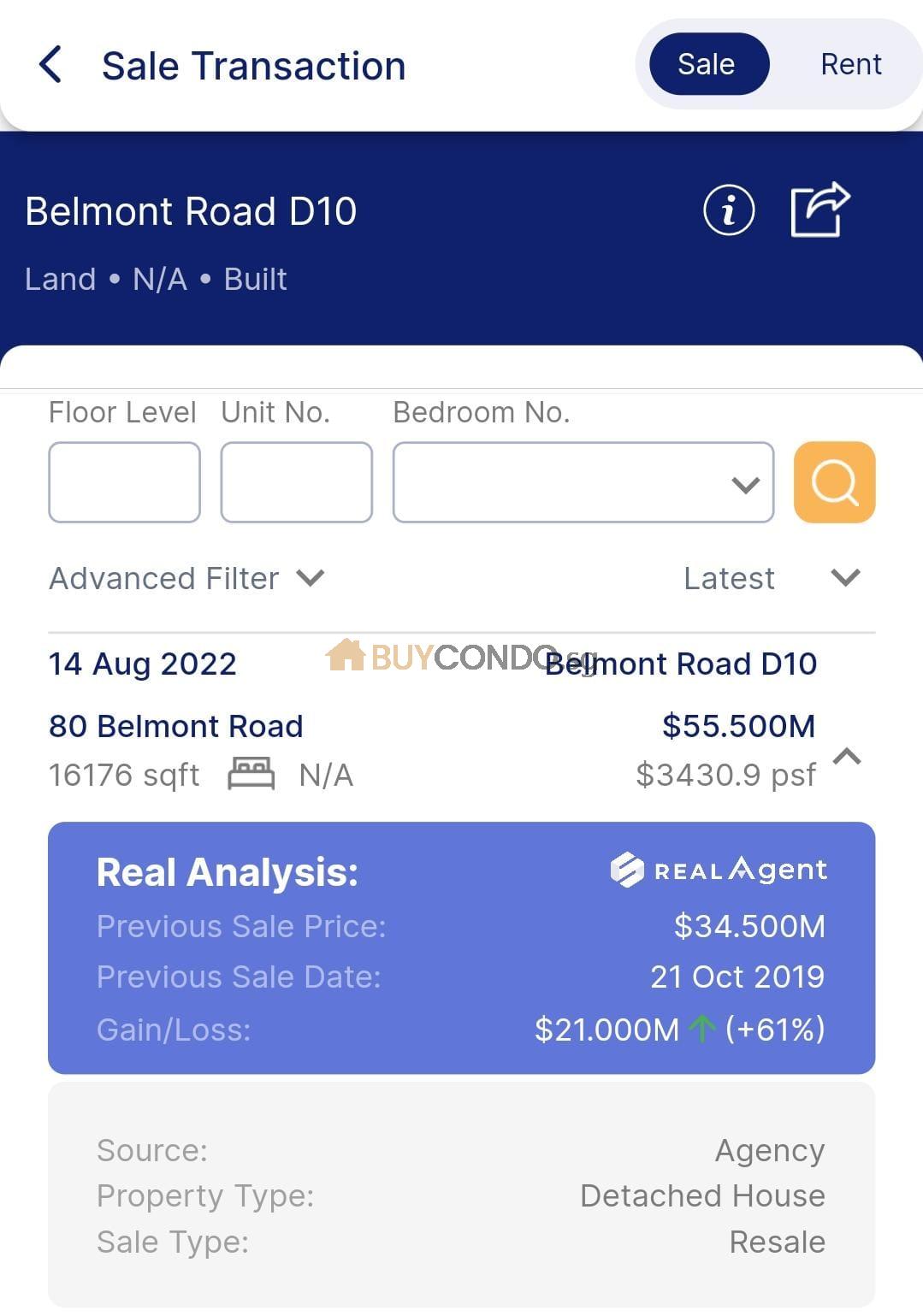

Annualized Capital Appreciation for Good Class Bungalow

80 Belmont Road. $55.5m – $34.5m = $21m Gains in 3 years.

Annualized Capital Appreciation for Le Nouvel Ardmore: Approx $7,000,000, 20% per annum.

From these comparison of Facts it will be quite clear where is better to place your money.

https://buycondo.sg/property-management-services/

Non-owner-occupier residential tax rates (residential properties) in 2024

Non-owner occupied residential properties are condominiums, HDB flats or other residential properties that the owner does not live in (“occupy”). Hence, owner-occupier tax rates do not apply.

The following tax rates apply to non-owner occupied properties except for those in the exclusion list.

Excluded properties

- Accommodation facilities within any sports and recreational club

- Chalet

- Child care centre, student care centre, or kindergarten

- Welfare home

- Hospital, hospice, or place for rehabilitation, convalescence, nursing care or similar purposes

- Hotel, backpackers’ hostel, boarding house or guest house

- Serviced apartment

- Staff quarters that are part of any property exempted from tax under S6(6) of the Property Tax Act

- Student’s boarding house or hostel

- Workers’ dormitory

The property must have received planning approval for the above use. No application to IRAS is required.

Non-owner-occupier residential tax rates

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

|---|---|---|

| First 30,000 Next $15,000 |

12% 20% |

$3,600 $3,000 |

| First $45,000 Next $15,000 |

– 28% |

$6,600 $4,200 |

| First $60,000 Above $60,000 |

– 36% |

$10,800 |

| Annual Value ($) | Tax rate effective from 1 Jan 2023 to 31 Dec 2023 | Property tax payable |

|---|---|---|

| First $30,000

Next $15,000 |

11%

16% |

$3,300

$2,400 |

| First $45,000

Next $15,000 |

–

21% |

$5,700

$3,150 |

| First $60,000

Above $60,000 |

–

27% |

$8,850

|

Owner-occupier tax rates (residential properties) in 2024

Owner-occupied residential properties are condominiums, HDB flats or other residential properties where the owner lives in (“occupies”) the property. Owner-occupied residential properties enjoy owner-occupier tax rates.

Owner-occupier tax rates

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

|---|---|---|

| First $8,000 Next $22,000 |

0% 4% |

$0 $880 |

| First $30,000 Next $10,000 |

– 6% |

$880 $600 |

| First $40,000 Next $15,000 |

– 10% |

$1,480 $1,500 |

| First $55,000 Next $15,000 |

– 14% |

$2,980 $2,100 |

| First $70,000 Next $15,000 |

– 20% |

$5,080 $3,000 |

| First $85,000 Next $15,000 |

– 26% |

$8,080 $3,900 |

| First $100,000 Above $100,000 |

– 32% |

$11,980

|

| Annual Value ($) | Tax rate effective from 1 Jan 2023 to 31 Dec 2023 | Property tax payable |

|---|---|---|

| First $8,000

Next $22,000 |

0%

4% |

$0

$880 |

| First $30,000

Next $10,000 |

–

5% |

$880

$500 |

| First $40,000

Next $15,000 |

–

7% |

$1,380

$1,050 |

| First $55,000

Next $15,000 |

–

10% |

$2,430

$1,500 |

| First $70,000

Next $15,000 |

–

14% |

$3,930

$2,100 |

| First $85,000

Next $15,000 |

–

18% |

$6,030

$2,700 |

| First $100,000

Above $100,000 |

–

23% |

$8,730

|

IRAS Income Tax rates (residential properties) in 2024

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 Next $180,000 |

– 22 |

44,550 39,600 |

| First $500,000 Next $500,000 |

– 23 |

84,150 115,000 |

| First $1,000,000 In excess of $1,000,000 |

– 24 |

199,150 |

From YA 2017 to YA 2023

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 In excess of $320,000 |

– 22 |

44,550 |

The Property Value Paradox: Rising Tax Versus Housing Market Gains

The increase in property tax raises the question of the property value paradox. While homeowners may experience higher tax obligations, they may also witness gains in the housing market. Understanding the relationship between rising property taxes and housing market gains is essential to evaluate the overall impact on homeowners’ finances.

As property taxes rise, homeowners might worry about the financial burden it presents. However, it’s important to consider the potential gains in the housing market. The property tax paradox emerges when higher taxes coincide with a robust housing market. While the tax burden increases, homeowners still benefit from appreciation in property value, creating a delicate balance.

Property values are influenced by various factors, including location, demand, and market trends. While property taxes are based on property values, the housing market can drive significant gains in property value over time. This creates a paradoxical situation where higher taxes are accompanied by increasing property values, raising questions about the overall financial impact on homeowners.

When property values increase, homeowners may consider the potential gains in equity and future resale value. These gains can offset the higher tax obligations, providing a positive aspect to the property value paradox. However, it’s crucial to assess the specific circumstances of each homeowner and evaluate the net impact of rising taxes and housing market gains.

The interplay between property taxes and market value highlights the complexity of homeowners’ financial considerations. While higher taxes can place a burden on homeowners, they should also consider the potential gains in property value, leading to increased wealth and financial stability.

Understanding the property value paradox and its implications is crucial for homeowners navigating the current landscape. By analyzing market trends, consulting with real estate professionals, and staying informed about property tax regulations, homeowners can make informed decisions about their investments and financial future.

| Housing Market Gains | Property Tax Paradox |

|---|---|

| Positive | Increase in tax obligations |

| Potential for equity gains | Potential for increased property value |

| Future resale value | Complex financial considerations |

Predicting Rental Income Tax Implications for Landlords

As a result of the property tax increase, landlords may encounter potential implications on their rental income taxes. It is crucial for landlords to navigate these changes and implement strategies to maintain profitability despite the increased tax burden.

Maintaining Profitability with Increased Property Taxes

With the rise in property taxes, landlords need to evaluate their financial position and explore ways to sustain profitability. This requires careful budgeting and analysis of rental income and expenses. Landlords should consider the impact of the increased property taxes on their rental yield and assess the feasibility of adjusting rental pricing to offset the higher tax obligations.

Cost-Passing Strategies: Rental Pricing Adjustments

One possible approach to manage the increased property taxes is to make rental pricing adjustments. Landlords may need to pass on a portion of the tax burden to tenants through reasonable rental price increases. However, it is essential to strike a balance between maintaining profitability and tenant affordability. Landlords should carefully analyze the rental market, competition, and demand before implementing any pricing adjustments.

Projected Effects on Rental Yield and Market Competition

The property tax increase can impact the rental yield, which measures the return on investment for landlords. Higher taxes may lower the overall rental yield, making it challenging for landlords to maintain expected returns. Additionally, market competition could intensify as landlords make pricing adjustments to address the increased tax burden. Consequently, landlords must monitor market dynamics closely and adapt to changing trends to remain competitive.

In summary, predicting the rental income tax implications for landlords in light of the property tax increase is crucial for their financial planning and decision-making. By maintaining profitability, implementing cost-passing strategies, and assessing the effects on rental yield and market competition, landlords can navigate these tax changes effectively and make informed choices for their rental properties. Let your Property Manager Handle for your properties today.

Is It Still Profitable to Rent Out or Sell in 2024?

With the significant increase in property taxes, homeowners must assess whether renting out or selling their property remains a profitable venture. The higher tax obligations may impact the potential returns for landlords, leading to a reconsideration of renting out properties. Similarly, homeowners may question whether selling their property is a more financially viable option in light of the property tax implications.

Profitability Comparison: Renting Out vs. Selling

In order to determine whether it is still profitable to rent out or sell in 2024, homeowners need to evaluate the financial implications of both options. Here is a breakdown of the key factors to consider:

| Renting Out | Selling | |

|---|---|---|

| Potential Rental Income | Homeowners can generate a steady stream of income through rental payments from tenants. | Selling the property can result in a lump sum cash infusion. |

| Property Tax Obligations | Rental income is subject to property tax, and the recent tax increase may impact profitability. | Selling the property may trigger capital gains tax, which needs to be factored into the financial calculations. |

| Maintenance and Upkeep | Landlords are responsible for ongoing maintenance and repairs, which can impact overall profitability. | Selling the property relieves homeowners of the financial and time commitments associated with maintenance. |

| Market conditions | The rental market conditions, demand, and competition can influence the rental income potential. | The current state of the housing market may impact the selling price and time it takes to sell the property. |

“The decision to rent out or sell a property requires a careful analysis of the financial implications and market dynamics. Homeowners should weigh the potential rental income against property tax obligations, maintenance costs, and market conditions in order to make an informed decision that aligns with their financial goals.”

By considering these factors, homeowners can assess whether renting out or selling their property is the most profitable choice in the current landscape of increased property taxes. It is advisable to consult with financial advisors or real estate professionals to fully understand the implications and make a well-informed decision.

Conclusion ; GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market

In the wake of the significant increase in property tax for 2024, homeowners in Singapore are facing a challenging financial burden. The implications of this tax hike extend far beyond what was initially anticipated. It is imperative for homeowners to fully grasp the impact on their finances and explore potential strategies to manage the increased tax burden.

To navigate these changes effectively, homeowners must stay well-informed about payment deadlines and take advantage of advancements in digital tax billing. Embracing electronic property tax bills and utilizing the new interactive bill system can streamline the payment process and enhance convenience.

Furthermore, homeowners should consider the available government assistance options, such as the one-time rebate for owner-occupied properties. Assessing eligibility criteria for tax rebates will help homeowners determine if they are qualified for this crucial financial support.

In conclusion, the property tax increase for 2024 presents a significant challenge for homeowners, affecting their overall financial well-being. By understanding the implications, exploring strategies for managing the increased tax burden, and considering government assistance options, homeowners can navigate these changes with greater confidence. Staying abreast of payment deadlines, embracing digital tax billing advancements, and remaining proactive in tackling the property tax landscape are key to minimizing the burden of the tax hike and securing a stable financial future.

FAQ

What is the impact of the dramatic increase in property tax on homeowners?

The dramatic increase in property tax for 2024 has significant implications for homeowners in Singapore. It raises concerns about the affordability of homeownership and increases the financial burden on homeowners.

How can homeowners understand the new property tax rates for 2024?

Homeowners can understand the new property tax rates by reviewing the latest assessments and tax bills provided by the government. It is essential to stay informed about any changes in the tax rates.

How does the tax hike affect owner-occupied residences?

The tax hike specifically affects owner-occupied residences, leading to increased financial burdens for homeowners. They will have to bear the brunt of the higher tax obligations.

How can homeowners compare their tax obligations between 2023 and 2024?

Homeowners can compare their tax obligations between 2023 and 2024 by reviewing their previous tax bills and assessments. They can analyze the differences in the tax rates, assessments, and overall tax burden.

Are landlords likely to raise rental prices due to the property tax increase?

Due to the property tax increase, landlords may face pressure to raise rental prices. They may need to pass on the increased costs to tenants, which could impact the rental market and affordability for tenants.

How can homeowners calculate their home’s annual value (AV)?

Homeowners can calculate their home’s annual value by considering the estimated market rentals of similar properties in the rental market. This calculation is crucial for determining their property tax obligations.

What role do rental market trends play in annual value (AV) determination?

Rental market trends play a significant role in annual value (AV) determination. The estimated market rentals of similar properties impact the calculation of a home’s AV, which directly affects the property tax bill.

Will the annual value (AV) vary for different property types?

Yes, the annual value (AV) may vary for different property types. Different property types have unique features and attributes that can impact their estimated market rentals and, subsequently, the AV and property tax bill.

What is the relationship between rising property taxes and housing market gains?

While rising property taxes may increase the tax burden on homeowners, they may also witness gains in the housing market. It is essential to understand this relationship to evaluate the overall impact on homeowners’ finances.

How can landlords maintain profitability with increased property taxes?

Landlords can maintain profitability with increased property taxes by implementing cost-passing strategies, such as rental pricing adjustments. These adjustments help offset the higher tax burden and ensure profitability for landlords.

What are the potential effects on rental yield and market competition due to the property tax hike?

The property tax hike may have potential effects on rental yield and market competition. Landlords may need to adjust rental prices, which can impact rental yield, and increased costs may influence market competition.

Should homeowners reconsider renting out or selling their property in light of the property tax implications?

With the significant increase in property taxes, homeowners must assess whether renting out or selling their property remains a profitable venture. The higher tax obligations may impact potential returns for landlords, leading to a reconsideration of renting out properties.

What government assistance is available to alleviate the financial burden on homeowners?

The government provides property tax rebates as a form of assistance to alleviate the financial burden on homeowners. A one-time rebate is available for owner-occupied properties, and homeowners can apply for this rebate to reduce their tax obligations.

How can homeowners understand if they qualify for property tax rebates?

Homeowners can assess their eligibility for property tax rebates by reviewing the criteria set by the government. They need to determine if their property qualifies as an owner-occupied property and if they meet the income and ownership requirements.

What are the payment deadlines and processes for property tax in 2024?

Homeowners need to be aware of the payment deadlines and processes for property tax in 2024. It is essential to know when the tax payment is due and to familiarize themselves with the various payment options available.

What advancements in digital tax billing and payments can benefit homeowners?

Homeowners can benefit from advancements in digital tax billing and payments. They can adopt electronic property tax bills and utilize the new interactive bill system, which streamlines the process for homeowners. It is also important to stay informed about any enhancements in property tax digital services for added convenience.

The post GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market appeared first on Wing Tai Holdings Singapore.

]]>The post What to Expect for a Property Handover at the End of Lease appeared first on Wing Tai Holdings Singapore.

]]>

During the handover, you will need to assess the condition of the property, answer any inquiries from the landlord, and address any necessary repairs or cleaning. It’s crucial to have a clear understanding of your obligations and rights as a tenant to ensure a fair and satisfactory handover.

Key Takeaways:

- Understanding the property handover process is crucial for a smooth transition at the end of your lease.

- Property inspections play a vital role in assessing the condition of the property and addressing any necessary repairs.

- Tenants should familiarize themselves with their responsibilities and rights to avoid disputes with landlords.

- Securing the return of your security deposit requires careful documentation and communication with your landlord.

- Preparing for the handover process by deep cleaning, addressing minor repairs, and removing personal belongings is essential.

Understanding the Handover Process

The handover process is a crucial stage that both tenants and landlords must navigate when the lease comes to an end. To ensure a smooth transition, it’s essential to have a clear understanding of the key aspects involved in the handover process. This section will delve into the role of the tenancy agreement, the distinction between fair wear and tear and the need for repairs, and the importance of joint inspections in mitigating disputes with landlords.

The Role of the Tenancy Agreement in Handover

The tenancy agreement serves as a critical document that outlines the rights and responsibilities of both tenants and landlords. It provides the framework for determining the condition of the property at the time of handover. By referring to the terms specified in the tenancy agreement, both parties can establish a baseline for assessing the property’s condition and identifying any damages or repairs that need attention.

Navigating Fair Wear and Tear vs. Need for Repairs

Understanding the distinction between fair wear and tear and damages that require repairs is essential for tenants during the handover process. Fair wear and tear refers to the natural deterioration of the property that occurs over time through ordinary use. Tenants are not responsible for repairing fair wear and tear. On the other hand, damages that go beyond fair wear and tear, such as broken fixtures or excessive stains, will likely require repairs and may be the responsibility of the tenant to rectify.

Joint Inspections: Mitigating Disputes with Landlords

Conducting joint inspections with the landlord is a crucial step in the handover process. Joint inspections involve both parties physically inspecting the property together, documenting its condition, and resolving any disagreements or concerns. By conducting joint inspections, tenants and landlords can address any disputes or discrepancies regarding the property’s condition in a fair and transparent manner. It is recommended to document the inspection findings with photographs or videos to provide evidence if disputes arise later.

Preparing for Lease End: Tenant’s Checklist

Deep Cleaning: Ensuring a Spotless Return

As the lease end approaches, it’s crucial for tenants to prioritize deep cleaning to ensure a spotless return of the property. A thorough cleaning can help avoid unnecessary charges from the landlord and maintain a positive relationship. Here are key areas to focus on:

- Remove all personal items and declutter the space.

- Thoroughly clean all surfaces, including floors, countertops, and appliances.

- Pay attention to high-touch areas, such as light switches, doorknobs, and faucets.

- Clean windows, blinds, and curtains to remove any dirt or dust.

- Deep clean carpets and rugs, or consider hiring a professional cleaning service for a more thorough job.

By investing time and effort in deep cleaning, tenants can ensure a pristine handover and increase the chances of receiving their security deposit in full.

Minor Repairs: Avoiding Last-Minute Expenses

Prior to the lease end, tenants should inspect the property for any minor repairs that need attention. Addressing these repairs promptly can help avoid last-minute expenses and potential disputes with the landlord. Consider these tips:

- Check for any loose or damaged fixtures, such as doorknobs, faucets, or cabinet handles, and repair or replace them if necessary.

- Inspect walls for scuffs, nail holes, or other minor damages, and touch up the paint as needed.

- Repair any minor damages to flooring, such as scratches or chips.

- Ensure all light bulbs are working properly and replace any that are burnt out.

- Replace worn-out air filters and clean vents for proper air circulation.

By taking care of these minor repairs, tenants can avoid unexpected expenses and demonstrate their commitment to maintaining the property in good condition.

Personal Belongings: Leaving No Trace Behind

Before the lease end, tenants should remove all personal belongings from the property to facilitate a smooth transition for the next tenant. Here are some important steps:

- Collect all personal items, including furniture, decorations, and appliances.

- Dispose of any unwanted or unused items to declutter the space.

- Arrange for storage if needed for belongings that cannot be taken with you.

- Remove any wall hangings, adhesive hooks, or other fixtures that were added during your tenancy.

- Ensure all storage areas, such as attics, basements, and garages, are completely emptied.

By leaving the property empty and free of personal belongings, tenants can help facilitate a seamless handover and make it easier for the landlord to prepare the property for new tenants.

Property Management Services in Singapore

Landlord’s Expectations vs. Tenant’s Responsibilities

Understanding the expectations of landlords and the responsibilities of tenants is crucial for a successful property handover. As a tenant, it is important to be aware of what your landlord expects in terms of property condition and upkeep. This section will explore common landlord expectations and tenant responsibilities during the handover process.

Landlords generally expect tenants to:

- Maintain the property in a clean and tidy condition throughout the lease period

- Report any damages or necessary repairs promptly

- Follow the terms of the tenancy agreement, including restrictions on modifications or subletting

- Abide by any rules and regulations set by the building management or homeowners’ association

Tenants have several responsibilities when it comes to property handover:

- Returning the property in the same condition as it was received, taking into account fair wear and tear

- Ensuring all personal belongings and trash are removed from the premises

- Completing any necessary cleaning and minor repairs

- Cooperating with the landlord during joint inspections and addressing any concerns raised

By understanding and fulfilling these expectations and responsibilities, tenants can ensure a smooth handover process and maintain a positive relationship with their landlord. Open communication and cooperation between both parties are key to a successful property handover.

Property Inspections at Lease End: A Step-by-Step Guide

When it comes to the lease end and the property handover, property inspections play a crucial role in ensuring a smooth transition between tenants. In this step-by-step guide, I will walk you through the process of conducting property inspections at lease end, from aligning expectations with the actual property condition to securing an agreement on the handover state.

Aligning Expectations with Actual Property Condition

Before the lease end, it’s important to align expectations with the actual condition of the property. This involves understanding the landlord’s expectations in terms of cleanliness, repairs, and any specific requirements. By having a clear understanding of what is expected, you can ensure that the property is in the best possible condition for handover.

Documenting the State of the Premises with Evidence

To protect yourself and the landlord, it is essential to document the state of the premises at the time of handover. This documentation should include detailed evidence such as photographs and videos that clearly depict the condition of the property. By capturing this evidence, you have a reference point to verify the property’s condition and defend against any false claims or disputes that may arise in the future.

Securing Agreement on Property’s Handover State

Once the property has been inspected and documented, it is important to secure an agreement with the landlord on the handover state. This agreement should specify that both parties have reviewed the property’s condition, and it should be signed by both the tenant and the landlord. This agreement serves as a legally binding document that protects both parties’ interests and ensures a smooth handover process.

By following this step-by-step guide for property inspections at lease end, you can ensure that the handover process is fair, transparent, and free from disputes. Proper inspections and documentation provide a solid foundation for a successful handover and help protect your rights as a tenant.

Ensuring Return of Your Security Deposit

The return of the security deposit is a significant concern for tenants. To ensure a smooth process and maximize the chances of getting your security deposit back, it’s crucial to understand the steps involved and your rights as a tenant. Let’s explore some essential considerations:

Understanding Security Deposit Deductions

When you move out of a rental property, your landlord may deduct certain amounts from your security deposit to cover any damages or unpaid rent. It’s important to understand what deductions are permissible under the lease agreement and local laws. Common deductions may include unpaid rent, cleaning fees, repairs beyond normal wear and tear, and any outstanding utility bills.

Handling Disputes Effectively

If you disagree with the deductions made from your security deposit, it’s essential to handle the dispute professionally. Start by reviewing your lease agreement to ensure you fully understand the terms related to security deposit deductions. Document any disputes in writing and provide evidence, such as photographs or videos, to support your case. Consider engaging in open and constructive communication with your landlord to reach a resolution.

Knowing Your Rights

Familiarize yourself with the laws and regulations governing security deposits in your jurisdiction. Certain legal protections may exist to ensure fair handling of security deposits. For example, some areas require landlords to provide an itemized list of deductions and return any remaining deposit within a specific timeframe. By understanding your rights, you can assert them effectively if necessary.

By following these steps, you can increase the likelihood of a prompt and fair return of your security deposit. Remember to maintain open and clear communication with your landlord throughout the process to address any concerns or disputes that may arise.

Moving Out Day: Final Steps for a Smooth Transition

Moving out day marks the culmination of the property handover process, and it’s essential to ensure a smooth transition for both tenants and landlords. In this section, we will explore the final steps you need to take to facilitate a successful handover.

Taking Precaution: Photographic and Video Record

Before you vacate the premises, it is crucial to document the condition of the property. Creating a photographic and video record serves as evidence of the property’s state at the time of handover. By taking precautionary measures, such as capturing visual evidence, you can protect yourself in case of any disputes regarding damages or repairs that you are not responsible for. It’s advisable to document all areas of the property, paying special attention to any existing issues or areas that may be contentious.

Final Walkthrough: The Importance of a Signed Confirmation

Conducting a final walkthrough with the landlord or their representative is a crucial step in the handover process. This walkthrough provides an opportunity to address any concerns or discrepancies regarding the property’s condition. It’s important to meticulously inspect the property, checking for any damages or areas that need attention. By conducting the walkthrough together, both parties can reach an agreement on the property’s condition.

After the final walkthrough, it is essential to obtain a signed confirmation from the landlord or their representative. This document serves as proof that both parties have agreed on the property’s condition and can help prevent future disputes. Make sure to keep a copy of the signed confirmation for your records.

By taking these final steps, including creating a photographic and video record and conducting a thorough final walkthrough, you can ensure a seamless handover and a smooth transition for all parties involved.

Handling Disputes and Deductions Professionally

During the handover process, it is not uncommon for disputes to arise regarding the condition of the property or deductions made from the security deposit. It is crucial to handle these disputes in a professional and constructive manner in order to reach a fair resolution. Effective communication with the landlord or property manager is key to minimizing conflicts and ensuring a smooth transition.

When encountering a dispute or disagreement, it is important to remember the following:

- Remain calm and composed: Emotional reactions can escalate tensions and hinder effective communication. Stay composed and approach the situation with a level-headed mindset.

- Understand your rights: Familiarize yourself with the terms of your tenancy agreement and the relevant local laws regarding security deposit deductions. This knowledge will help you advocate for your rights and make informed arguments.

- Gather evidence: Collect all relevant documentation, photographs, or videos that support your position. This evidence can be crucial in substantiating your claims or challenging unjust deductions.

- Professional communication: Engage in courteous and professional communication with the landlord or property manager. Clearly state your concerns, provide supporting evidence, and suggest potential solutions in a respectful manner.

- Seek mediation if necessary: If direct communication fails to resolve the dispute, consider involving a neutral third party, such as a mediator or a relevant authority, to facilitate a fair resolution.

Remember, handling disputes and deductions professionally is essential to maintain a positive relationship with the landlord and ensure a smooth handover process. By effectively communicating your concerns, providing evidence, and following the appropriate procedures, you increase the likelihood of reaching a fair resolution.

Legal Perspectives on Unwarranted Security Deposit Deductions

When it comes to security deposit deductions, tenants have legal rights that protect them from unwarranted deductions. Understanding these legal perspectives is crucial for tenants to ensure a fair and proper return of their security deposit. This section will explore the different aspects of the law related to challenging deductions and seeking legal advice for tenancy disputes.

Recognizing When to Challenge Deductions

Challenging security deposit deductions requires tenants to have a clear understanding of their rights and obligations. It is essential to recognize situations where deductions may be unwarranted and ensure that tenants are not being held responsible for damages beyond fair wear and tear. By understanding the legal criteria that determine the validity of deductions, tenants can effectively challenge any unfair deductions and seek a full refund of their security deposit.

Seeking Legal Advice for Tenancy Disputes

Tenancy disputes can become complex and overwhelming, especially when it comes to security deposit deductions. In cases where negotiations with the landlord fail to yield a satisfactory resolution, seeking legal advice is crucial. A qualified lawyer specializing in tenancy law can provide guidance and representation throughout the dispute resolution process. They can help tenants understand their legal rights, navigate complex legal procedures, and ensure a fair and just outcome in the case of unwarranted security deposit deductions.

Property Handover Checklist: Ensuring All Is in Order

A comprehensive property handover checklist is essential to ensure that everything is in order. This section will provide guidance on assessing the condition of fixtures for return or replacement and understanding the landlord’s expectations regarding renovations and restorations.

Assessing Fixtures Condition for Return or Replacement

One important aspect of the property handover checklist is assessing the condition of fixtures. Fixtures refer to permanent installations in the property such as light fixtures, faucets, and built-in appliances. It is crucial to thoroughly inspect each fixture to determine if it is in good working condition or if it requires repair or replacement.

During the assessment, make note of any damages, malfunctions, or signs of wear and tear on the fixtures. Take photographs or videos as evidence to support your findings. This documentation will serve as a reference during the handover process and can help resolve any disputes regarding the condition of the fixtures.

If any fixtures are found to be damaged or not functioning properly, notify your landlord or property manager as soon as possible. Discuss whether repairs or replacements are necessary and agree on the appropriate course of action.

Renovation Restorations: Understanding Landlord’s Expectations

Another important aspect of the property handover checklist is understanding the landlord’s expectations regarding renovations and restorations. If you have made any modifications to the property during your tenancy, such as painting the walls or installing new fixtures, it is essential to determine whether these changes need to be reverted to their original state.

Review your tenancy agreement and any additional agreements or documentation related to renovations. These documents will outline the specific requirements for restoring the property to its original condition. Pay close attention to any guidelines regarding paint colors, flooring materials, or other modifications you may have made.

Discuss with your landlord or property manager the necessary steps for restoring the property. This may involve repainting the walls, removing any additional fixtures, or repairing any damages caused by the modifications. It is important to follow these guidelines to ensure a smooth handover and the return of your security deposit.

Lasting Impressions: The Significance of a Proper Handover

A proper handover at the end of a lease not only ensures a smooth transition but also leaves a lasting impression on both tenants and landlords. It sets the tone for future rental opportunities and establishes the reputation of both parties involved. Therefore, it is crucial to approach the handover process with thoroughness and professionalism.

For tenants, a proper handover demonstrates their responsibility and respect for the property. By returning the property in good condition, tenants leave a positive impression on landlords, increasing their chances of receiving positive references or recommendations for future rentals. On the other hand, landlords who conduct a proper handover showcase their professionalism and commitment to maintaining their properties, attracting reliable and responsible tenants in the future.

The significance of a proper handover also extends to the property condition. A well-maintained property reflects the care and attention given by both the tenant and the landlord throughout the lease period. It demonstrates a mutual understanding of the importance of preserving the property’s value and aesthetics. This can lead to higher rental rates and a more attractive property for potential tenants in the future.

Furthermore, a smooth handover process minimizes disputes and misunderstandings. By documenting the property’s condition and reaching an agreement, both parties can avoid unnecessary conflicts and ensure a fair and hassle-free return of the security deposit. This fosters trust and goodwill between tenants and landlords, establishing a positive relationship that may benefit them in future leasing endeavors.

In conclusion, a proper handover is not just a formality but a pivotal step that can influence future rental opportunities. By approaching the handover process with thoroughness, professionalism, and a focus on property condition, tenants and landlords can leave a lasting impression on each other while fostering trust and positive relationships.

Property Manager Responsibilities

If you have appointed a Property manager, you will enjoy a lot of perks since they will play a crucial role in ensuring a smooth and successful handover process at the end of a lease. They have specific responsibilities that help facilitate the transition between tenants and maintain the property’s condition. Let’s explore the key responsibilities of property managers during lease ends:

- Coordinating inspections: Property managers are responsible for scheduling and conducting thorough inspections of the rental property at the end of the lease. These inspections involve assessing the condition of the property and documenting any damages or necessary repairs.

- Addressing repairs: If the inspection reveals any damages or maintenance issues, property managers must promptly address them. They are responsible for coordinating repairs or arranging for professional services to ensure the property is in good condition for the next tenant.

- Ensuring a smooth transition: Property managers play a vital role in facilitating the handover process between outgoing and incoming tenants. They ensure all necessary paperwork and documentation are completed, guide tenants through the move-out process, and provide assistance and support as needed.

By entrusting the handover process to a property manager, both landlords and tenants can have peace of mind knowing that experienced professionals are overseeing the process. Property managers strive to protect the interests of all parties involved and ensure that the handover is handled efficiently and in accordance with the terms of the lease agreement.

Conclusion : What to Expect for a Property Handover at the End of Lease

In conclusion, the property handover at the end of a lease is a critical process that requires careful preparation and understanding of both tenant responsibilities and landlord expectations. By following the steps outlined in this article, tenants can ensure a smooth handover and the return of their security deposit.

Throughout the lease end process, tenants should prioritize deep cleaning, handling minor repairs, and removing personal belongings to ensure a spotless return and avoid additional expenses. It is essential to document the condition of the property through photographic and video evidence during inspections, securing agreement with the landlord on the handover state, and conducting a final walkthrough with a signed confirmation.

By understanding the expectations of landlords and recognizing the difference between fair wear and tear and the need for repairs, tenants can navigate the handover process more effectively. Communication and professional handling of disputes are crucial in securing the return of the security deposit.

A thorough property handover checklist ensures that all aspects are in order, including assessing the condition of fixtures and understanding the landlord’s expectations for renovation restorations. A proper handover not only leaves a lasting impression but also sets the groundwork for future rental opportunities.

Overall, by following the guidance provided in this article, tenants can successfully navigate the property handover process at the end of their lease, protect their interests, and maintain a positive relationship with their landlords.

Frequently Asked Questions (FAQ)

Here, I’ve compiled some frequently asked questions related to the property handover process. I understand that this can be a confusing and overwhelming time, so I hope these answers will provide you with the guidance you need for a smooth lease end and property handover.

Q: What is the property handover process?

A: The property handover process refers to the final stage of your lease, where you return the property to the landlord or property manager. It involves conducting inspections, documenting the condition of the premises, and resolving any disputes or deductions before your lease officially ends.

Q: How can I ensure the return of my security deposit?

A: To increase your chances of getting your full security deposit back, you should thoroughly clean the property, address any minor repairs, and remove all personal belongings. It’s also important to attend the final walkthrough with the landlord or property manager and agree on the condition of the property. By following these steps and ensuring open communication, you can help secure the return of your security deposit.

Q: What should I do if I disagree with deductions made from my security deposit?

A: If you disagree with the deductions made from your security deposit, it’s important to communicate professionally and provide evidence to support your claim. Start by reviewing your lease agreement and understanding the landlord’s rights regarding deductions. If negotiation with the landlord does not resolve the dispute, you may consider seeking legal advice or mediation to help resolve the issue.

I hope these answers have helped address some of your concerns about the property handover process. Remember, each situation may have its unique circumstances, so it’s always advisable to consult with a legal professional or property expert for personalized advice.

What should I expect during the property handover process at the end of my lease?

The property handover process involves understanding the role of the tenancy agreement, differentiating between fair wear and tear and repairs, conducting joint inspections, and preparing for the final move-out.

How does the tenancy agreement affect the property handover?

The tenancy agreement sets expectations for the condition of the property at the time of handover and outlines the responsibilities of both the tenants and the landlord.

What is the difference between fair wear and tear and damages that require repairs?

Fair wear and tear refers to the normal deterioration of the property due to everyday use, which tenants are not responsible for repairing. Damages that require repairs, on the other hand, are beyond normal wear and tear and are the tenant’s responsibility to fix.

How can joint inspections prevent disputes during the property handover?

Joint inspections involve both the tenant and the landlord assessing the property’s condition together, creating an opportunity to discuss any discrepancies and come to an agreement on the property’s handover state.

What should be included in the tenant’s checklist for lease end?

The tenant’s checklist should include deep cleaning the property, taking care of minor repairs, and removing all personal belongings to ensure a smooth handover.

What are the landlord’s expectations and the tenant’s responsibilities during the property handover?

Landlords expect the property to be in good condition and free from damages beyond normal wear and tear. Tenants are responsible for repairing damages they caused and leaving the property in a clean and presentable state.

What are the steps to conduct a property inspection at lease end?

The steps include aligning expectations with the actual condition of the property, documenting the state of the premises with evidence such as photographs and videos, and securing an agreement with the landlord on the property’s handover state.

How can I ensure the return of my security deposit?

To ensure the return of your security deposit, you should fulfill your responsibilities as a tenant, maintain the property in good condition, and align with the landlord on the property’s handover state. Deposit will be refunded usually within 14 Days.

What precautions should I take on moving out day?

Precautions on moving out day include creating a photographic and video record of the property’s condition and conducting a final walkthrough with the landlord, ensuring a signed confirmation of the handover condition.

How should I handle disputes and deductions during the handover process?

It’s important to handle disputes professionally by effectively communicating with the landlord and presenting evidence. If necessary, seeking legal advice can help resolve tenancy disputes.

What is the significance of a proper handover?

A thorough and professional handover process leaves a lasting impression on both tenants and landlords and can impact future rental opportunities for tenants.

What are the responsibilities of property managers during the lease end?

Property managers are responsible for coordinating inspections, addressing repairs, and ensuring a smooth transition between tenants during the handover process.

What are some common questions and concerns related to the property handover process?

Common questions and concerns include understanding the expectations for the property’s condition, how to prepare for the handover, and how to navigate disputes or deductions.

The post What to Expect for a Property Handover at the End of Lease appeared first on Wing Tai Holdings Singapore.

]]>The post Mini-Landlord in Singapore: A.k.a Co-living appeared first on Wing Tai Holdings Singapore.

]]>In this article, we will delve into the rising trend of becoming a mini-landlord in Singapore, also known as co-living. We will explore the phenomenon of co-living and the opportunities it presents in the city-state.

Key Takeaways:

- Co-living is a growing trend in Singapore, offering opportunities for individuals or companies to become mini-landlords.

- Renting out rooms in a larger-sized condo is a popular option for mini-landlords.

- Living with family or relatives while renting out the additional rooms or dual key concept for mini-landlords.

- Utilities and cost of wear and tear expenses should be considered when budgeting as a mini-landlord.

- Effective communication and addressing rental challenges promptly are crucial for a successful co-living experience.

The Cost of Rent and Utilities

Rent and utility expenses are key considerations for mini-landlords in Singapore. The cost of rent can vary based on factors such as location, property type, and amenities. Some mini-landlords choose luxury condos in the central business district (CBD) area, which can come with higher rental costs. Others opt for co-living arrangements in shared rooms on the outskirts of the city, offering a more affordable alternative.

When calculating expenses, it is important to factor in utility costs as well. These include electricity, water, gas, and internet bills. Utility rates can fluctuate, so it’s essential to budget accordingly and account for potential variations in usage. Additionally, mini-landlords should consider other expenses such as air conditioning servicing and servicing fees for appliances.

Table:

| Property Type | Location | Average Monthly Rent |

|---|---|---|

| Condos with 1000sqft above | CBD/Outskirts | $4,000 – $7,000 |

| Co-living in Shared Rooms | Outskirts of the city | $1200 – $2,500 |

By considering the rental costs and utilities, mini-landlords can make informed decisions to manage their expenses effectively while providing comfortable living spaces for tenants.

Living with Family or Relatives

Living with family or relatives can be a cost-effective option for mini-landlords in Singapore. This arrangement allows for shared living expenses and the opportunity to save on rent. Additionally, living with loved ones can provide a sense of familiarity and support, creating a comforting home environment.

While living with family or relatives can be a cost-saving option, it is crucial to carefully consider the implications. Longer commute times and limited options for privacy and personal space may be among the challenges faced in such living situations. It is important to have open and honest communication with family members or relatives to establish boundaries and ensure a harmonious co-living experience.

| Pros | Cons |

|---|---|

| Cost-saving option | Longer commute times |

| Sense of home and support | Limited options for privacy |

| Opportunity for home-cooked meals | Dependent on availability of empty rooms |

In conclusion, living with family or relatives can be an attractive option for mini-landlords in Singapore looking to save on rent and create a sense of home. While it may come with certain challenges, effective communication and setting boundaries can help maintain a positive living environment. Consider the availability of empty rooms and the potential for longer commute times when exploring this cost-saving option.

Renting a Room in a Condo

For mini-landlords in Singapore, renting a room in a condo is a popular option that provides a range of benefits and considerations. Sharing a living space in a condo offers access to shared amenities such as swimming pools, gyms, and common areas, creating a luxurious and convenient lifestyle. However, it’s important to be aware of the potential challenges and take necessary precautions to ensure a harmonious living environment.

Living in a condo with shared spaces requires effective communication and mutual respect with fellow housemates. Establishing clear rules and routines can help maintain a comfortable and organized living arrangement. It’s crucial to discuss expectations regarding cleaning responsibilities, noise levels, and the use of common areas to avoid conflicts and promote a positive living experience.

Additionally, mini-landlords should consider the size of the living space when renting a room in a condo. Condos often offer smaller living areas compared to other housing options, necessitating efficient use of space and minimalistic lifestyles. However, this can also be an opportunity for individuals who prefer a more minimalist and clutter-free living environment.

Comparison of Condo Rental Options

| Advantages | Disadvantages | |

|---|---|---|

| Larger Condos | – Can Create up to 6 bedrooms. | – Upfront Cost – High Density sharing of toilet |

| Shared Rooms in Condos | – Split rental costs – Opportunities for social interaction – Greater flexibility in choosing locations |

– Potential conflicts with housemates – Shared responsibilities for utilities and cleanliness |

Considering the advantages and disadvantages of renting a room in a condo, mini-landlords in Singapore can make informed decisions based on their preferences and budget. Effective communication, respect for shared spaces, and careful consideration of the living arrangements are essential for a positive co-living experience in a condo.

Despite these considerations, renting a whole HDB unit can offer the freedom and flexibility to design and personalize the living space. Usually for HDBs, the rental is using signed by a single name and he/she will be sharing among their friends or relative.

Mini-landlords can enjoy the benefits of having their own home while also having the opportunity to cultivate a sense of community within the HDB estate. It is important for mini-landlords to weigh the costs and responsibilities against the desired level of privacy and independence to make an informed decision.

| Advantages of Renting a Whole HDB Unit | Disadvantages of Renting a Whole HDB Unit |

|---|---|

| More privacy and control over the living space | Higher rental costs than other co-living options |

| Ability to personalize and design the living space | Additional responsibilities for utilities, aircon servicing, internet, and cleaning fees |

| Potential to create a sense of community within the HDB estate |

The Cost of Food

When it comes to the cost of living as a mini-landlord in Singapore, food expenses play a significant role. Singapore offers a diverse culinary scene, catering to all tastes and budgets. One popular and budget-friendly option is visiting hawker centers, which are open-air food courts offering a wide variety of affordable dishes. These hawker centers are scattered throughout the city and offer a taste of Singapore’s multicultural cuisine. From local favorites like Hainanese chicken rice to flavorful Laksa, there is something for everyone at these bustling food hubs.

While hawker centers provide delicious and affordable meals, dining out at restaurants can significantly increase food expenses. Singapore is home to numerous world-class restaurants, offering a range of cuisines from Southeast Asian flavors to international delicacies. However, dining at these establishments can be expensive, especially in upscale areas like Marina Bay Sands or Orchard Road. It is important for mini-landlords to budget and plan their dining experiences according to their financial situation.

Table: Price Comparison of Dining Options

| Dining Option | Average Cost per Meal |

|---|---|

| Hawker Center | Around $4 to $6 |

| Mid-Range Restaurant | Average of $20 to $40 |

| Upscale Restaurant | Average of $50 and above |

Overall, mini-landlords in Singapore have the flexibility to choose between affordable hawker center meals and more extravagant dining experiences. By balancing these options and making conscious decisions, mini-landlords can effectively manage their food expenses and maintain a comfortable lifestyle within their budget.

Transportation Costs

When it comes to transportation in Singapore, mini-landlords have several options to consider. Public transport, including buses and the Mass Rapid Transit (MRT) system, is the most popular and cost-effective choice. The extensive network of buses and trains makes it easy to navigate the city-state. Public transport fares are affordable, and the use of contactless payment methods such as EZ-Link cards or mobile payment apps like GrabPay further simplifies the process.

Taxi services are also readily available in Singapore, offering convenience and comfort. However, taxis can be more expensive compared to public transport, especially during peak hours or when traveling longer distances. Ride-hailing services like Grab provide an alternative to traditional taxis, offering competitive prices and the convenience of booking a ride with just a few taps on a smartphone.

Car ownership in Singapore can be costly due to high taxes, road congestion charges, and limited parking spaces. Owning a car involves various expenses, including the purchase price, road tax, insurance, parking fees, and maintenance costs. Mini-landlords should carefully consider their transportation needs and budget before deciding to own a car in Singapore.

Public Transport vs. Taxi vs. Car Ownership: A Comparison

| Public Transport | Taxi Services | Car Ownership | |

|---|---|---|---|

| Cost | Affordable fares | Higher fares | High upfront and recurring costs |

| Convenience | Extensive network, easy access | Convenient door-to-door service | Personalized mobility |

| Flexibility | Fixed routes and schedules | Flexible pick-up and drop-off | Freedom to travel at any time |

| Environmental Impact | Low carbon footprint | Higher carbon footprint | Higher carbon footprint |

“While public transport offers affordability and convenience, taxis provide door-to-door service. Car ownership offers personalized mobility but comes with high costs. Consider your transportation needs and budget carefully before making a decision.” – Transport Expert

By considering the various transportation options available in Singapore, mini-landlords can make informed decisions that align with their lifestyle and financial goals. Whether opting for the cost-effective and efficient public transport system, the convenience of taxi services, or the personal freedom of car ownership, each choice comes with its own advantages and considerations. It is essential to weigh the costs, convenience, flexibility, and environmental impact to determine the most suitable mode of transportation in Singapore.

Real-Life Tenant Experiences

Renting a property and living with others can sometimes lead to challenging situations. Mini-landlords in Singapore may encounter difficult landlords or difficult housemates, which can make the co-living experience stressful. It is essential to navigate these renting challenges effectively to maintain a harmonious living environment.

One common issue that mini-landlords may face is dealing with difficult landlords. Some landlords may be slow in their responses, such as delaying repairs or failing to address concerns promptly. This can create frustration and inconvenience for the tenants. Effective communication is crucial in addressing these issues. Mini-landlords should document any problems or requests in writing and discuss them with the landlord to find a resolution.

“Living with difficult housemates is another challenge that mini-landlords may encounter. Differences in lifestyle, cleanliness habits, or personal preferences can lead to conflicts. It is important to establish clear house rules and communicate openly to avoid misunderstandings. If issues persist, involving the landlord or seeking mediation can help resolve conflicts.”

Table: Common Renting Challenges Faced by Mini-Landlords in Singapore

| Renting Challenges | Impact | Solutions |

|---|---|---|

| Problematic Landlords | Delayed repairs, neglect of responsibilities | Document concerns in writing, communicate with the landlord, seek resolution |

| Difficult Housemates | Conflicts, differences in lifestyle or habits | Establish clear house rules, communicate openly, involve the landlord or seek mediation if needed |

| Subleasing Without Consent | Legal and financial implications | Regularly check the property, communicate with the landlord, seek legal advice if necessary |

Another renting challenge that mini-landlords need to be aware that they requires landlord’s consent in writing and clearly states in the tenancy agreement.

Subleasing a property without consent can have legal and financial implications. Mini-landlords should regularly check the property and report any suspicious activities to the landlord. If subleasing is discovered, it is important to communicate with the landlord and, if necessary, seek legal advice to address the situation properly.

By being proactive, communicating effectively, and seeking appropriate solutions, mini-landlords can navigate renting challenges and maintain a positive co-living experience in Singapore.

Dealing with Rental Challenges

When renting a property, it is not uncommon for mini-landlords in Singapore to encounter various challenges along the way. These may include difficult landlords, conflicts with housemates, or unexpected issues with the rental property. Addressing these challenges promptly and effectively is crucial in maintaining a positive living environment. Here are some tips for addressing conflicts, communicating with landlords, and resolving issues:

Open Communication

Effective communication is key to resolving rental challenges. When faced with conflicts or issues, it is important to communicate openly and honestly with all parties involved. Clearly express your concerns and listen to the perspectives of others. This can help foster understanding and find common ground for a resolution.

Propose Solutions

Instead of dwelling on the problem, focus on finding practical solutions. Propose ideas that can help address the issue at hand and contribute to a positive resolution. Be open to compromise and consider the needs of both parties involved.

Seek Assistance

If you are unable to resolve the issue on your own, don’t hesitate to seek assistance. Reach out to your landlord or landlady and explain the situation in detail. They may be able to provide guidance, mediate the conflict, or take necessary steps to address the issue. Remember to document all communication and keep records of any actions taken.

Resolving rental challenges requires proactive communication, problem-solving skills, and a willingness to work towards a resolution. By addressing conflicts, communicating with landlords, and seeking assistance when necessary, mini-landlords in Singapore can navigate rental challenges and maintain a positive living experience.

The Cost of Repairs and Responsibilities

As a mini-landlord in Singapore, it’s important to be prepared for potential repair costs and understand your responsibilities as outlined in the tenancy agreement. From minor repairs to major renovations, these expenses can quickly add up and impact your overall profitability. Additionally, documenting damages before and after a tenancy can help protect both parties involved in case of disputes.

When it comes to repair costs, it’s crucial to understand what falls under your responsibility as a mini-landlord. Typically, you are responsible for repairs resulting from wear and tear or damage caused by the tenant. On the other hand, major structural repairs or issues related to the property’s infrastructure are often the responsibility of the landlord. It’s essential to review your tenancy agreement thoroughly to have a clear understanding of these responsibilities.

Documenting damages is a vital step in protecting yourself as a mini-landlord. Before a tenant moves in, take detailed photos or videos of the property’s condition, highlighting any existing damages or issues. This documentation serves as evidence, preventing disputes about who is responsible for specific damages. Similarly, when a tenant moves out, conduct a thorough inspection and document the condition of the property at that time. This will help you assess any new damages and determine if repair costs should be deducted from the tenant’s security deposit.

Table: Responsibilities for Repair Costs

| Repair Type | Mini-Landlord Responsibility | Tenant Responsibility |

|---|---|---|

| Minor Repairs (e.g., broken fixtures) | Mini-landlord | Shared Cost |

| Damages caused by the tenant | Mini-landlord | — |

| Structural repairs | Landlord | — |

| Wear and tear | Mini-landlord | — |

By understanding your responsibilities and documenting damages, you can navigate repair costs effectively as a mini-landlord in Singapore. Remember to communicate with your tenants openly and address any repair issues promptly. This will help maintain a positive landlord-tenant relationship and ensure a smooth co-living experience.

Conclusion

Becoming a mini-landlord in Singapore, also known as co-living, presents a range of experiences and challenges. When considering co-living options, it is crucial to carefully evaluate factors such as rental costs, living arrangements, and potential conflicts.

Effective communication and setting boundaries are essential for maintaining a positive living environment. Mini-landlords should proactively address any rental challenges and conflicts that may arise, seeking assistance from landlords or landladies when necessary.

By understanding the responsibilities outlined in the tenancy agreement and documenting the condition of the property, mini-landlords can protect themselves and navigate repair costs. It is important to remember that successful co-living experiences require active participation and mutual respect from all parties involved.

In conclusion, co-living in Singapore as a mini-landlord can be a rewarding experience with the right approach. By considering the renting tips mentioned throughout this article and being prepared for potential challenges, individuals can create a harmonious and fulfilling co-living experience in the city-state.

FAQ

What is co-living?

Co-living, also known as becoming a mini-landlord, is the trend of renting out spare rooms or properties in Singapore to offset living expenses.

How much does it cost to be a mini-landlord in Singapore?

The cost of rent and utilities can vary depending on the chosen lifestyle, location, and type of accommodation. It is important to consider factors such as luxury condos in the CBD area or shared rooms in the outskirts of the city, as well as food expenses and transportation costs.

Can I live with family or relatives to save on rent?

Yes, living with family or relatives can be a cost-saving option for mini-landlords in Singapore. However, it may result in longer commute times and limited options depending on the availability of empty rooms.

What are the pros and cons of renting a room in a condo?

Renting a room in a condo provides access to shared facilities such as swimming pools and gyms. However, it can come with smaller living spaces and potential challenges with housemates. Effective communication and establishing rules are important for maintaining a comfortable living environment.

What are the advantages of renting a whole HDB unit?

Renting a whole HDB unit provides more privacy and control over the living space. However, it may come with higher rental costs and additional responsibilities, such as paying for utilities, aircon servicing, internet, and cleaning fees.

How much should I budget for food expenses?

The cost of food can significantly impact overall expenses. Mini-landlords in Singapore have various options, ranging from affordable meals at hawker centers to dining at restaurants or indulging in fine dining experiences. It is important to budget accordingly.

What are the transportation options for mini-landlords in Singapore?

Public transportation, such as buses and MRT, is the most affordable and preferred choice for mini-landlords in Singapore. Taxis or ride-hailing services like Grab can be more expensive, while owning a car incurs the highest costs. Consider the proximity to public transportation and the need for a vehicle when calculating transportation expenses.

What kind of rental challenges can mini-landlords in Singapore face?

Mini-landlords in Singapore may encounter challenging situations with landlords or housemates, such as living with conspiracy theorists or discovering unauthorized subleasing. Effective communication, setting boundaries, and addressing problems promptly are important for navigating these situations.

How should I deal with rental challenges?

When faced with rental challenges, it is crucial to address the issues promptly. Open communication, proposing solutions, and seeking assistance from the landlord or landlady can help mitigate conflicts. If all else fails, it may be necessary to consider moving out.

Who is responsible for repair costs in a rental property?

Understanding the responsibilities outlined in the tenancy agreement is essential in determining who is responsible for repair costs. Documenting the condition of the property before and after the tenancy can provide evidence and protection for the tenant.

What should I consider when becoming a mini-landlord in Singapore?

Becoming a mini-landlord in Singapore presents both opportunities and challenges. It is important to consider various factors, such as rental costs, living arrangements, and potential conflicts. Effective communication, setting boundaries, and maintaining a positive living environment are key to a successful co-living experience.

The post Mini-Landlord in Singapore: A.k.a Co-living appeared first on Wing Tai Holdings Singapore.

]]>The post Condo Specialists in Singapore appeared first on Wing Tai Holdings Singapore.

]]>Looking for condo specialist in Singapore for personalized solutions, hassle-free transactions, and tailored strategies when buying or selling a condominium property? Engage a prominent example such as the BuyCondo Team.

Overview of Condo Specialists in Singapore

Condo specialists in Singapore play a pivotal role in the real estate sector, offering expertise tailored specifically to the unique nuances of condominium properties. These professionals are equipped with in-depth knowledge and specialized skills that cater to the distinct requirements of condo buyers and sellers in the Singaporean market.

For instance, the BuyCondo Team stands as a prominent example of a condo specialist that excels in providing tailored solutions for clients navigating the condo market. Their comprehensive understanding of the intricacies of the Singaporean condo landscape enables them to offer strategic guidance and support to individuals seeking to engage in condo transactions. By leveraging their expertise, the BuyCondo Team ensures that clients receive personalized advice and assistance, leading to a more efficient and informed real estate experience.

It’s essential to recognize the distinction between condo specialists and regular real estate agents. While conventional real estate agents may possess general knowledge of diverse property types, condo specialists specialize exclusively in the condo market, allowing them to offer highly targeted and tailored services to their clients. This focused expertise sets condo specialists apart, enabling them to navigate the unique challenges and opportunities presented by the condominium sector with precision and proficiency.

The Value of Engaging a Condo Specialist in Singapore

The value of engaging a condo specialist in Singapore cannot be overstated, particularly when dealing with condo properties. These specialists bring a wealth of expertise and insights that are specifically honed to address the complexities of the condo market, ensuring a smoother and more efficient buying or selling process.

An illustrative example of the benefits of working with condo specialists can be seen through the personalized solutions and hassle-free transactions offered by the BuyCondo Team. Their tailored strategies cater to the individual needs of condo buyers and sellers, ensuring that clients receive targeted and effective guidance throughout their real estate transactions. By engaging the expertise of condo specialists, clients can expect a level of service that is uniquely attuned to the intricacies of the condo market, leading to a more streamlined and rewarding real estate experience.

Advantages of Utilizing Condo Specialist Services

The advantages of utilizing condo specialist services extend beyond the standard offerings of regular real estate agents, emphasizing the added value they bring to the table. Condo specialists, such as the BuyCondo Team, provide access to personalized solutions, in-depth market insights, and a genuine approach that resonates with the specific needs of condo buyers and sellers.

Moreover, condo specialists are adept at navigating the legal and financial intricacies that are inherent to the condo market, offering clients a level of expertise that is tailored to the unique considerations of condominium properties. By harnessing their specialized knowledge, clients can benefit from a more informed and strategic approach to their condo transactions, ultimately optimizing their real estate endeavors.

Incorporating the insights and expertise offered by condo specialists can provide clients with a competitive advantage in the condo market, equipping them to make well-informed decisions that align with their investment or divestment objectives. The comprehensive understanding of the condo market offered by specialists like the BuyCondo Team empowers clients to navigate the dynamic landscape of condominium properties with confidence and clarity, ultimately enhancing the overall outcome of their real estate ventures.

Integration of Proptech in Condo Specialist Services