The post GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market appeared first on Wing Tai Holdings Singapore.

]]>

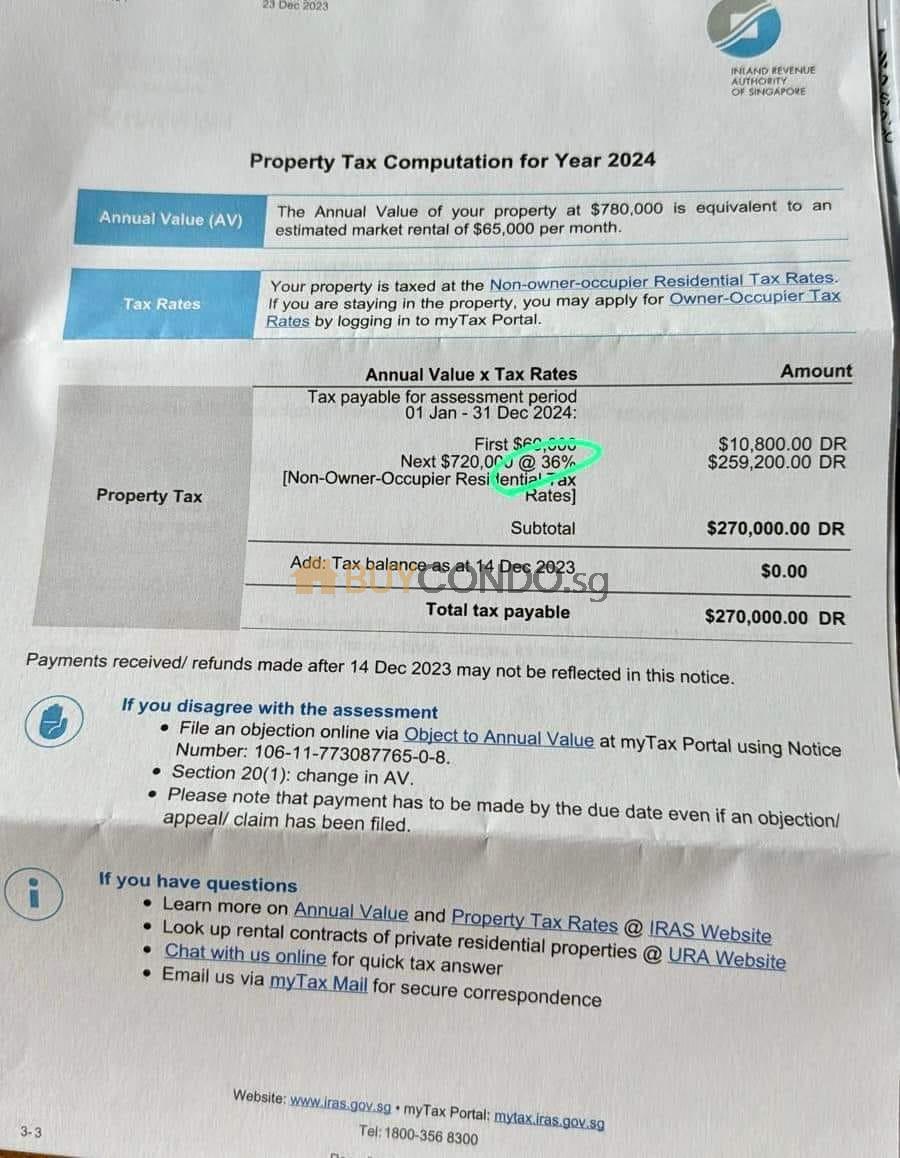

There are heavy discussions online that one of the luxury home owners shared that she is required to pay a whopping S$270,000 in Taxes so much more than the years before.

This is still not including the Income Tax payable for the Rental income (Highest tier of 24% for Ultra High Income earners)

Lets dive into the Case Study.

(Non-Owner Occupier Tax. First $60,000 is 18%; in excess of the $60,000, the next $720,000 is taxable at the rate of 36%)

Assume the GCB is renting out at $65,000 per month.

Annually the Rental Income shall be $780,000 per annum.

( Net Income before property maintenance and bank loan with interest if any)

$780,000(Annual Rent) – $270,000 (Property Tax) – $187,200 ( Income Tax) = Net Rental Income $322,800.

( Holding Cost of such Ultra Luxury Landed Property)

$270,000 + $187,200 = Holding Cost $457,200.

Some Points Gathered:

Holding Cost for a rented out property is higher than the total rental income.

What are this kind of Properties that falls into this Bracket?

Good Class Bungalows(GCB) with an average of 15,000sqft land with the built up 8,000 ~ 12,000sqft

Such GCB can be in the market valued around $30,000,000 to $60,000,000.

Ultra Luxury Apartments in CCR.

Le Nouvel Ardmore ~ $80,000 per month, 4 bedroom 4058sqft.

Four Seasons Park Penthouse $78,000 per month, 9 Bedroom 6150sft.

Nassim Park Residences Penthouse $65,000 per month, 4 Bedroom 6800sft.

If you have a Desire to Own Such Property Would You Buy a GCB or Ultra High Luxury Apartment? Lets Compare

Annualized Capital Appreciation for Ultra High Luxury Apartments

Le Nouvel Ardmore ~ Rental $80,000 per month, 4 bedroom 4058sqft.

(Owner Bought $18,500,000 ($4559psf/4058sqft) in 2021, Based on the latest Transaction of $5,800psf today’s Market Value is worth $23,536,400.

$23,536,400 – $18,500,000 = Approx $5,000,000 in 3 Years.

Annualized Capital Appreciation for Le Nouvel Ardmore: Approx $1,600,000, 8.6% per annum.

If we factor in the holding cost of say estimate of $600,000. There is still a net $1m per year before mortgage interest.

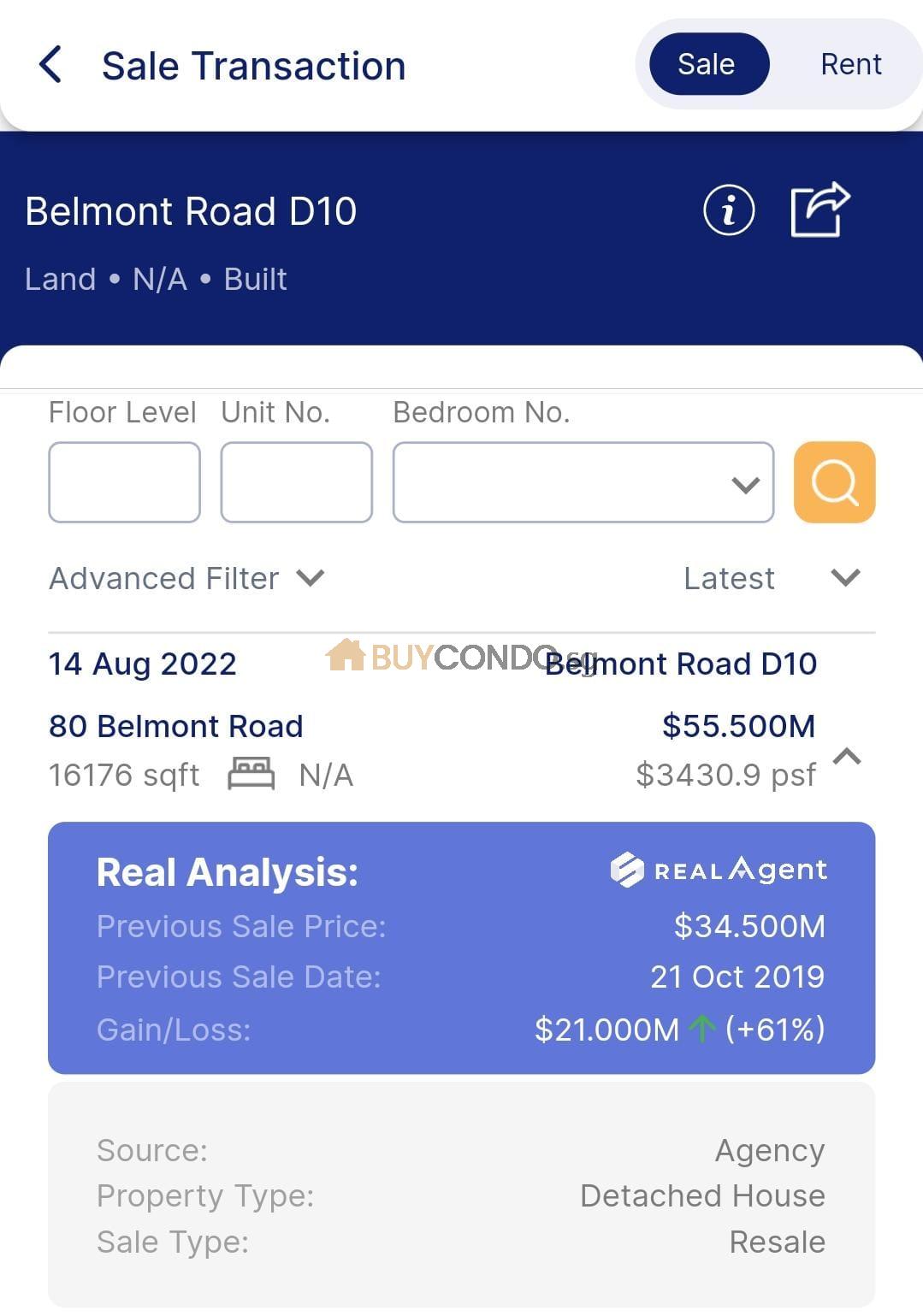

Annualized Capital Appreciation for Good Class Bungalow

80 Belmont Road. $55.5m – $34.5m = $21m Gains in 3 years.

Annualized Capital Appreciation for Le Nouvel Ardmore: Approx $7,000,000, 20% per annum.

From these comparison of Facts it will be quite clear where is better to place your money.

https://buycondo.sg/property-management-services/

Non-owner-occupier residential tax rates (residential properties) in 2024

Non-owner occupied residential properties are condominiums, HDB flats or other residential properties that the owner does not live in (“occupy”). Hence, owner-occupier tax rates do not apply.

The following tax rates apply to non-owner occupied properties except for those in the exclusion list.

Excluded properties

- Accommodation facilities within any sports and recreational club

- Chalet

- Child care centre, student care centre, or kindergarten

- Welfare home

- Hospital, hospice, or place for rehabilitation, convalescence, nursing care or similar purposes

- Hotel, backpackers’ hostel, boarding house or guest house

- Serviced apartment

- Staff quarters that are part of any property exempted from tax under S6(6) of the Property Tax Act

- Student’s boarding house or hostel

- Workers’ dormitory

The property must have received planning approval for the above use. No application to IRAS is required.

Non-owner-occupier residential tax rates

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

|---|---|---|

| First 30,000 Next $15,000 |

12% 20% |

$3,600 $3,000 |

| First $45,000 Next $15,000 |

– 28% |

$6,600 $4,200 |

| First $60,000 Above $60,000 |

– 36% |

$10,800 |

| Annual Value ($) | Tax rate effective from 1 Jan 2023 to 31 Dec 2023 | Property tax payable |

|---|---|---|

| First $30,000

Next $15,000 |

11%

16% |

$3,300

$2,400 |

| First $45,000

Next $15,000 |

–

21% |

$5,700

$3,150 |

| First $60,000

Above $60,000 |

–

27% |

$8,850

|

Owner-occupier tax rates (residential properties) in 2024

Owner-occupied residential properties are condominiums, HDB flats or other residential properties where the owner lives in (“occupies”) the property. Owner-occupied residential properties enjoy owner-occupier tax rates.

Owner-occupier tax rates

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

|---|---|---|

| First $8,000 Next $22,000 |

0% 4% |

$0 $880 |

| First $30,000 Next $10,000 |

– 6% |

$880 $600 |

| First $40,000 Next $15,000 |

– 10% |

$1,480 $1,500 |

| First $55,000 Next $15,000 |

– 14% |

$2,980 $2,100 |

| First $70,000 Next $15,000 |

– 20% |

$5,080 $3,000 |

| First $85,000 Next $15,000 |

– 26% |

$8,080 $3,900 |

| First $100,000 Above $100,000 |

– 32% |

$11,980

|

| Annual Value ($) | Tax rate effective from 1 Jan 2023 to 31 Dec 2023 | Property tax payable |

|---|---|---|

| First $8,000

Next $22,000 |

0%

4% |

$0

$880 |

| First $30,000

Next $10,000 |

–

5% |

$880

$500 |

| First $40,000

Next $15,000 |

–

7% |

$1,380

$1,050 |

| First $55,000

Next $15,000 |

–

10% |

$2,430

$1,500 |

| First $70,000

Next $15,000 |

–

14% |

$3,930

$2,100 |

| First $85,000

Next $15,000 |

–

18% |

$6,030

$2,700 |

| First $100,000

Above $100,000 |

–

23% |

$8,730

|

IRAS Income Tax rates (residential properties) in 2024

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 Next $180,000 |

– 22 |

44,550 39,600 |

| First $500,000 Next $500,000 |

– 23 |

84,150 115,000 |

| First $1,000,000 In excess of $1,000,000 |

– 24 |

199,150 |

From YA 2017 to YA 2023

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 In excess of $320,000 |

– 22 |

44,550 |

The Property Value Paradox: Rising Tax Versus Housing Market Gains

The increase in property tax raises the question of the property value paradox. While homeowners may experience higher tax obligations, they may also witness gains in the housing market. Understanding the relationship between rising property taxes and housing market gains is essential to evaluate the overall impact on homeowners’ finances.

As property taxes rise, homeowners might worry about the financial burden it presents. However, it’s important to consider the potential gains in the housing market. The property tax paradox emerges when higher taxes coincide with a robust housing market. While the tax burden increases, homeowners still benefit from appreciation in property value, creating a delicate balance.

Property values are influenced by various factors, including location, demand, and market trends. While property taxes are based on property values, the housing market can drive significant gains in property value over time. This creates a paradoxical situation where higher taxes are accompanied by increasing property values, raising questions about the overall financial impact on homeowners.

When property values increase, homeowners may consider the potential gains in equity and future resale value. These gains can offset the higher tax obligations, providing a positive aspect to the property value paradox. However, it’s crucial to assess the specific circumstances of each homeowner and evaluate the net impact of rising taxes and housing market gains.

The interplay between property taxes and market value highlights the complexity of homeowners’ financial considerations. While higher taxes can place a burden on homeowners, they should also consider the potential gains in property value, leading to increased wealth and financial stability.

Understanding the property value paradox and its implications is crucial for homeowners navigating the current landscape. By analyzing market trends, consulting with real estate professionals, and staying informed about property tax regulations, homeowners can make informed decisions about their investments and financial future.

| Housing Market Gains | Property Tax Paradox |

|---|---|

| Positive | Increase in tax obligations |

| Potential for equity gains | Potential for increased property value |

| Future resale value | Complex financial considerations |

Predicting Rental Income Tax Implications for Landlords

As a result of the property tax increase, landlords may encounter potential implications on their rental income taxes. It is crucial for landlords to navigate these changes and implement strategies to maintain profitability despite the increased tax burden.

Maintaining Profitability with Increased Property Taxes

With the rise in property taxes, landlords need to evaluate their financial position and explore ways to sustain profitability. This requires careful budgeting and analysis of rental income and expenses. Landlords should consider the impact of the increased property taxes on their rental yield and assess the feasibility of adjusting rental pricing to offset the higher tax obligations.

Cost-Passing Strategies: Rental Pricing Adjustments

One possible approach to manage the increased property taxes is to make rental pricing adjustments. Landlords may need to pass on a portion of the tax burden to tenants through reasonable rental price increases. However, it is essential to strike a balance between maintaining profitability and tenant affordability. Landlords should carefully analyze the rental market, competition, and demand before implementing any pricing adjustments.

Projected Effects on Rental Yield and Market Competition

The property tax increase can impact the rental yield, which measures the return on investment for landlords. Higher taxes may lower the overall rental yield, making it challenging for landlords to maintain expected returns. Additionally, market competition could intensify as landlords make pricing adjustments to address the increased tax burden. Consequently, landlords must monitor market dynamics closely and adapt to changing trends to remain competitive.

In summary, predicting the rental income tax implications for landlords in light of the property tax increase is crucial for their financial planning and decision-making. By maintaining profitability, implementing cost-passing strategies, and assessing the effects on rental yield and market competition, landlords can navigate these tax changes effectively and make informed choices for their rental properties. Let your Property Manager Handle for your properties today.

Is It Still Profitable to Rent Out or Sell in 2024?

With the significant increase in property taxes, homeowners must assess whether renting out or selling their property remains a profitable venture. The higher tax obligations may impact the potential returns for landlords, leading to a reconsideration of renting out properties. Similarly, homeowners may question whether selling their property is a more financially viable option in light of the property tax implications.

Profitability Comparison: Renting Out vs. Selling

In order to determine whether it is still profitable to rent out or sell in 2024, homeowners need to evaluate the financial implications of both options. Here is a breakdown of the key factors to consider:

| Renting Out | Selling | |

|---|---|---|

| Potential Rental Income | Homeowners can generate a steady stream of income through rental payments from tenants. | Selling the property can result in a lump sum cash infusion. |

| Property Tax Obligations | Rental income is subject to property tax, and the recent tax increase may impact profitability. | Selling the property may trigger capital gains tax, which needs to be factored into the financial calculations. |

| Maintenance and Upkeep | Landlords are responsible for ongoing maintenance and repairs, which can impact overall profitability. | Selling the property relieves homeowners of the financial and time commitments associated with maintenance. |

| Market conditions | The rental market conditions, demand, and competition can influence the rental income potential. | The current state of the housing market may impact the selling price and time it takes to sell the property. |

“The decision to rent out or sell a property requires a careful analysis of the financial implications and market dynamics. Homeowners should weigh the potential rental income against property tax obligations, maintenance costs, and market conditions in order to make an informed decision that aligns with their financial goals.”

By considering these factors, homeowners can assess whether renting out or selling their property is the most profitable choice in the current landscape of increased property taxes. It is advisable to consult with financial advisors or real estate professionals to fully understand the implications and make a well-informed decision.

Conclusion ; GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market

In the wake of the significant increase in property tax for 2024, homeowners in Singapore are facing a challenging financial burden. The implications of this tax hike extend far beyond what was initially anticipated. It is imperative for homeowners to fully grasp the impact on their finances and explore potential strategies to manage the increased tax burden.

To navigate these changes effectively, homeowners must stay well-informed about payment deadlines and take advantage of advancements in digital tax billing. Embracing electronic property tax bills and utilizing the new interactive bill system can streamline the payment process and enhance convenience.

Furthermore, homeowners should consider the available government assistance options, such as the one-time rebate for owner-occupied properties. Assessing eligibility criteria for tax rebates will help homeowners determine if they are qualified for this crucial financial support.

In conclusion, the property tax increase for 2024 presents a significant challenge for homeowners, affecting their overall financial well-being. By understanding the implications, exploring strategies for managing the increased tax burden, and considering government assistance options, homeowners can navigate these changes with greater confidence. Staying abreast of payment deadlines, embracing digital tax billing advancements, and remaining proactive in tackling the property tax landscape are key to minimizing the burden of the tax hike and securing a stable financial future.

FAQ

What is the impact of the dramatic increase in property tax on homeowners?

The dramatic increase in property tax for 2024 has significant implications for homeowners in Singapore. It raises concerns about the affordability of homeownership and increases the financial burden on homeowners.

How can homeowners understand the new property tax rates for 2024?

Homeowners can understand the new property tax rates by reviewing the latest assessments and tax bills provided by the government. It is essential to stay informed about any changes in the tax rates.

How does the tax hike affect owner-occupied residences?

The tax hike specifically affects owner-occupied residences, leading to increased financial burdens for homeowners. They will have to bear the brunt of the higher tax obligations.

How can homeowners compare their tax obligations between 2023 and 2024?

Homeowners can compare their tax obligations between 2023 and 2024 by reviewing their previous tax bills and assessments. They can analyze the differences in the tax rates, assessments, and overall tax burden.

Are landlords likely to raise rental prices due to the property tax increase?

Due to the property tax increase, landlords may face pressure to raise rental prices. They may need to pass on the increased costs to tenants, which could impact the rental market and affordability for tenants.

How can homeowners calculate their home’s annual value (AV)?

Homeowners can calculate their home’s annual value by considering the estimated market rentals of similar properties in the rental market. This calculation is crucial for determining their property tax obligations.

What role do rental market trends play in annual value (AV) determination?

Rental market trends play a significant role in annual value (AV) determination. The estimated market rentals of similar properties impact the calculation of a home’s AV, which directly affects the property tax bill.

Will the annual value (AV) vary for different property types?

Yes, the annual value (AV) may vary for different property types. Different property types have unique features and attributes that can impact their estimated market rentals and, subsequently, the AV and property tax bill.

What is the relationship between rising property taxes and housing market gains?

While rising property taxes may increase the tax burden on homeowners, they may also witness gains in the housing market. It is essential to understand this relationship to evaluate the overall impact on homeowners’ finances.

How can landlords maintain profitability with increased property taxes?

Landlords can maintain profitability with increased property taxes by implementing cost-passing strategies, such as rental pricing adjustments. These adjustments help offset the higher tax burden and ensure profitability for landlords.

What are the potential effects on rental yield and market competition due to the property tax hike?

The property tax hike may have potential effects on rental yield and market competition. Landlords may need to adjust rental prices, which can impact rental yield, and increased costs may influence market competition.

Should homeowners reconsider renting out or selling their property in light of the property tax implications?

With the significant increase in property taxes, homeowners must assess whether renting out or selling their property remains a profitable venture. The higher tax obligations may impact potential returns for landlords, leading to a reconsideration of renting out properties.

What government assistance is available to alleviate the financial burden on homeowners?

The government provides property tax rebates as a form of assistance to alleviate the financial burden on homeowners. A one-time rebate is available for owner-occupied properties, and homeowners can apply for this rebate to reduce their tax obligations.

How can homeowners understand if they qualify for property tax rebates?

Homeowners can assess their eligibility for property tax rebates by reviewing the criteria set by the government. They need to determine if their property qualifies as an owner-occupied property and if they meet the income and ownership requirements.

What are the payment deadlines and processes for property tax in 2024?

Homeowners need to be aware of the payment deadlines and processes for property tax in 2024. It is essential to know when the tax payment is due and to familiarize themselves with the various payment options available.

What advancements in digital tax billing and payments can benefit homeowners?

Homeowners can benefit from advancements in digital tax billing and payments. They can adopt electronic property tax bills and utilize the new interactive bill system, which streamlines the process for homeowners. It is also important to stay informed about any enhancements in property tax digital services for added convenience.

The post GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market appeared first on Wing Tai Holdings Singapore.

]]>The post ONE Pass in Singapore appeared first on Wing Tai Holdings Singapore.

]]>ONE Pass in Singapore, including its purpose, benefits, application process, eligibility criteria, successful collaborations, and comparisons to the Employment Pass, highlighting its role in elevating Singapores global workforce.

Overview of the ONE Pass in Singapore

The Overseas Networks & Expertise Pass (ONE Pass) is a highly sought-after 5-year renewable work pass designed for top talent across diverse professional fields, allowing them to work for multiple companies in Singapore without the need for employer sponsorship. This pass has been introduced as part of the Ministry of Manpower’s commitment to enhancing Singapore’s attractiveness to high-skilled individuals, and it is benchmarked to the top 5 percent of Employment Pass holders in Singapore.

For example, a multinational engineering firm leveraged the ONE Pass to attract a team of skilled engineers and technical experts from various countries. The streamlined processes and the flexibility of the pass allowed the company to seamlessly onboard these professionals, thereby enhancing its research and development capabilities. Moreover, the simplified administrative procedures facilitated a swift transition for the foreign employees, enabling them to focus on their work without the burden of extensive paperwork and bureaucratic processes.

Purpose and Function of the ONE Pass

The Overseas Networks & Expertise Pass (ONE Pass) in Singapore serves the pivotal function of enhancing the nation’s attractiveness to top talent by introducing a streamlined process for both employers and foreign employees. By simplifying administrative procedures, the ONE Pass effectively streamlines the processes for employers and foreign employees, doing away with the need for multiple passes and cards that were previously required for work in Singapore. This initiative also aligns with the Ministry of Manpower’s efforts to digitize and simplify processes for businesses and workers in Singapore, reflecting a commitment to modernization and efficiency in the workforce.

This functionality has greatly benefitted professionals and businesses alike. For instance, a renowned technology firm recently leveraged the ONE Pass to attract a team of accomplished data scientists and engineers from various parts of the world. The streamlined processes and the flexibility of the pass allowed the company to seamlessly onboard these experts, thereby bolstering its research and development capabilities. Moreover, the simplified administrative procedures facilitated a swift transition for the foreign employees, enabling them to focus on their work without the burden of extensive paperwork and bureaucratic processes.

In addition, the ONE Pass has significantly contributed to the nation’s efforts to attract global expertise and international networking, fostering an environment of collaboration and innovation within various industries in Singapore. This is evident in the success stories of companies and professionals who have harnessed the benefits of the ONE Pass to establish meaningful partnerships and drive impactful projects in the country.

Benefits of the ONE Pass

The ONE Pass, as a 5-year renewable work pass for top talent in various fields, offers a multitude of benefits that contribute to Singapore’s appeal as a global business hub. Apart from providing top-tier professionals with the flexibility to work for multiple companies without employer sponsorship, the pass also enhances security through biometric features. This not only ensures the safety of the pass holder but also contributes to the overall safety and security of the work environment in Singapore, promoting a conducive atmosphere for professionals and businesses alike.

Moreover, the ONE Pass streamlines processes for employers and foreign employees, replacing multiple passes and cards currently required for work in Singapore. This streamlined approach not only simplifies administrative processes but also increases efficiency in hiring and managing foreign employees. Employers have access to an online portal to manage their employees’ passes, which is part of the Ministry of Manpower’s efforts to digitize and simplify processes for businesses and workers in Singapore. This modern approach facilitates the seamless integration of top talent into the Singaporean workforce, promoting a collaborative and productive environment for both employers and employees.

Furthermore, the ONE Pass contributes to the overall economic growth and development of Singapore by attracting global expertise and fostering international networking. This is evident in the numerous success stories of professionals and organizations that have utilized the ONE Pass to establish impactful collaborations and drive innovation within the country.

To explore the full range of benefits and understand the eligibility criteria for the ONE Pass, visit the Ministry of Manpower’s website at Ministry of Manpower for more details.

Applying for the ONE Pass

Applying for the ONE Pass

The application process for the ONE Pass is designed to be thorough and comprehensive, ensuring that only highly skilled and qualified individuals can obtain this prestigious work pass. The process involves several steps to evaluate the eligibility and suitability of the applicants, contributing to the enhancement of Singapore’s global talent pool.

To begin the application process, individuals interested in the ONE Pass need to prepare and submit essential documents, including but not limited to educational certificates, professional qualifications, and employment records. The submission of these documents allows the authorities to assess the applicant’s qualifications, experience, and expertise in their respective fields, ensuring that they meet the stringent criteria set for the pass.

Once the initial documentation is submitted, applicants are required to complete a detailed application form, providing comprehensive information about their professional background, employment history, and intended scope of work in Singapore. Additionally, applicants may need to furnish a detailed employment proposal outlining their role and responsibilities, as well as the potential contributions they aim to make to the Singaporean economy and society. This step helps the authorities gauge the value and impact that the applicant could bring to the country, reflecting the purpose of the ONE Pass in attracting top talent.

Furthermore, the application process for the ONE Pass may involve interviews or additional assessments to further evaluate the candidate’s expertise, experience, and potential impact on Singapore’s economy and society. This rigorous approach ensures that the ONE Pass is awarded to individuals who not only meet the minimum requirements but also possess exceptional skills and expertise that can contribute significantly to the country’s growth and development.

Moreover, the ONE Pass application process plays a crucial role in promoting international networking and collaboration, as it serves as a gateway for top talent to bring their expertise to Singapore and engage in impactful projects and partnerships.

For individuals interested in exploring the ONE Pass application process further, the Ministry of Manpower’s website provides comprehensive information and guidance on the required documentation, procedures, and relevant resources.

Eligibility Criteria for the ONE Pass

The eligibility criteria for the Overseas Networks & Expertise Pass (ONE Pass) in Singapore are designed to attract top talent in various fields. To qualify for the ONE Pass, individuals must meet specific requirements. Firstly, it is essential to earn a fixed monthly salary of at least S$30,000 for the last 12 consecutive months. This salary benchmark is set to ensure that the pass is targeted at high-skilled and experienced professionals who can contribute significantly to the Singaporean workforce.

Additionally, individuals can also qualify for the ONE Pass by being employed by an established company in Singapore. The definition of an established company is determined by specific financial metrics, including market capitalization or annual revenue. This criterion is put in place to ensure that individuals working for reputable and financially robust organizations are also considered for the ONE Pass.

Furthermore, the eligibility for the ONE Pass extends beyond financial considerations. Individuals who have demonstrated outstanding achievements in sports, arts, culture, academia, or research may also be eligible for the pass. This provision acknowledges the importance of expertise and talent in diverse fields, contributing to the enrichment and advancement of Singapore’s cultural and intellectual landscape. For instance, an accomplished academic researcher making significant contributions to a specialized field or an acclaimed artist elevating Singapore’s cultural identity could be eligible for the ONE Pass, recognizing their valuable expertise and potential contributions to the nation.

Moreover, the ONE Pass eligibility criteria play a significant role in attracting global talent and fostering international networking in Singapore, as it encourages individuals with diverse skills and expertise to consider the country as a hub for impactful professional opportunities and collaborations.

In conclusion, the eligibility criteria for the ONE Pass in Singapore are comprehensive, encompassing financial benchmarks, professional expertise, and contributions to various domains. These criteria aim to attract exceptional talent from around the world, enriching Singapore’s workforce and fostering a vibrant environment for innovation and growth. For more details on the ONE Pass eligibility and application process, visit the Ministry of Manpower’s website at Ministry of Manpower for comprehensive information and guidance.

Successful Collaborations and Partnerships through the ONE Pass

Real-life examples of successful collaborations and partnerships facilitated through the ONE Pass serve as a testament to the effectiveness of this program. These collaborations highlight how the ONE Pass has been instrumental in fostering global expertise and international networking within Singapore.

For instance, a renowned biotechnology firm based in the United States leveraged the ONE Pass to establish its regional headquarters in Singapore. This move not only brought cutting-edge research and development capabilities to the country but also created numerous high-skilled job opportunities for local talent. Additionally, the company’s collaboration with local universities and research institutions has contributed to knowledge transfer and the development of innovative solutions in the biotech sector. These achievements underscore the ONE Pass’s role in attracting top-tier organizations and fostering meaningful collaborations for the advancement of various industries in Singapore.

Furthermore, a prominent multinational technology company utilized the ONE Pass to bring together a diverse team of experts from around the world to drive digital transformation initiatives in Singapore. By leveraging the unique flexibility of the ONE Pass, the company was able to seamlessly integrate global talent into its local operations, leading to the successful launch of innovative products and services tailored to the Southeast Asian market. This collaboration demonstrates how the ONE Pass facilitates the cross-pollination of ideas and expertise, ultimately contributing to the expansion and diversification of Singapore’s knowledge-based economy.

Moreover, the successful collaborations and partnerships facilitated through the ONE Pass play a crucial role in promoting Singapore as a global hub for innovation and expertise, as they showcase the country’s ability to attract and support impactful projects and international collaborations.

Comparison: Employment Pass vs. ONE Pass

The Employment Pass and the ONE Pass are both important work passes in Singapore, each with its own unique features and benefits. The Employment Pass is designed for foreign professionals, managers, and executives who wish to work in Singapore, while the ONE Pass is specifically tailored for top talent in various fields, allowing them to work for multiple companies without employer sponsorship.

One of the major differences between the two passes is the salary threshold. While the Employment Pass has its own set of salary criteria, the ONE Pass’s salary requirement is benchmarked to the top 5 percent of Employment Pass holders in Singapore, thus making it more exclusive in terms of the financial eligibility. This distinction ensures that the ONE Pass is targeted at individuals with exceptional skills and expertise, contributing to the overall enhancement of Singapore’s global workforce.

Additionally, the renewal criteria for the Employment Pass and the ONE Pass differ significantly. While the Employment Pass renewal is based on specific employment conditions, the ONE Pass offers a more flexible renewal process, which includes earning a fixed monthly salary of at least SGD 30,000 on average over the past 5 years in Singapore or starting and operating a Singapore-based company employing at least 5 locals with a fixed monthly salary of at least SGD 5,000. This renewal criterion reflects the intention of the ONE Pass to attract and retain long-term top talent in Singapore, contributing to the country’s economic growth and development.

Furthermore, the distinct features of the Employment Pass and the ONE Pass cater to different segments of the workforce, providing individuals with diverse career opportunities and pathways in Singapore. This ensures that professionals with varying expertise and career goals can find suitable work pass options that align with their qualifications and aspirations.

Understanding the differences between the Employment Pass and the ONE Pass is crucial for individuals considering working in Singapore. It allows them to make an informed decision based on their qualifications, professional goals, and the specific benefits each pass offers. To explore the various work pass options in Singapore further, individuals can visit the Ministry of Manpower’s website for comprehensive details and guidance [Customer Product Context].

Renewal Process for the ONE Pass

The renewal process for the Overseas Networks & Expertise Pass (ONE Pass) in Singapore is designed to ensure that top talent continues to contribute to the nation’s growth and development. To be eligible for renewal, ONE Pass holders must meet specific criteria, including maintaining a fixed monthly salary of at least S$30,000 on average over the past 5 years in Singapore. This requirement underscores Singapore’s commitment to attracting and retaining high-caliber professionals who significantly contribute to the country’s economy and innovation landscape.

For instance, consider a successful finance executive who has been working in Singapore under the ONE Pass for the past five years. Throughout this period, the executive has consistently earned a fixed monthly salary of S$35,000, demonstrating the individual’s invaluable expertise and contribution to the financial sector in Singapore. This example illustrates how ONE Pass holders can meet the salary requirement for renewal, showcasing the pass’s role in maintaining a talented and high-earning workforce.

Moreover, ONE Pass holders are also eligible for renewal by starting and operating a Singapore-based company that employs at least 5 locals with a fixed monthly salary of at least S$5,000. This provision aligns with Singapore’s strategic focus on entrepreneurial innovation and job creation, allowing ONE Pass holders to transition into entrepreneurial endeavors and contribute to the local workforce. This aspect of the renewal process highlights the pass’s flexibility and support for diverse career pathways, emphasizing Singapore’s commitment to nurturing entrepreneurial talent within its borders.

Additionally, the renewal process for the ONE Pass reflects the country’s commitment to fostering a vibrant and competitive environment that thrives on the contributions of exceptional individuals. By providing a clear and structured pathway for renewal, the ONE Pass ensures the continuity of high-skilled talent in Singapore, ultimately contributing to the country’s sustainable economic growth and development.

To learn more about the renewal process and eligibility criteria for the ONE Pass, individuals can explore the Ministry of Manpower’s website for detailed information and guidance on sustaining their eligibility for this prestigious work pass.

Family Members and the ONE Pass

Family members of ONE Pass holders are eligible to join them in Singapore. This includes the pass holder’s spouse and children under the age of 21. Additionally, unmarried children above the age of 21 who have disabilities may also be considered for the Dependant’s Pass, allowing them to join the pass holder in Singapore.

For example, an accomplished professional who has been granted the ONE Pass may want to relocate to Singapore with their spouse and two young children. The entire family would be eligible to move to Singapore, and the pass holder’s children could attend schools in Singapore while the spouse may also have the option to work in the country under the Dependant’s Pass.

To bring family members to Singapore, the pass holder must submit an application for each family member along with the required supporting documents. The process may involve obtaining medical insurance for the family members and providing evidence of the pass holder’s ability to financially support their dependents while residing in Singapore. This ensures that the relocation process for the pass holder and their family members is seamless and in accordance with the guidelines set by the Ministry of Manpower.

Moreover, the inclusion of family members under the ONE Pass scheme reflects Singapore’s commitment to fostering an inclusive and supportive environment for top talent, ensuring that their relocation to the country is smooth and facilitates their seamless integration into the local community.

Conclusion: ONE Pass In Singapore

The ONE Pass is a significant addition to Singapore’s work pass landscape, designed to attract and retain top talent from around the world. By offering a 5-year renewable work pass for high-skilled individuals in various fields, the ONE Pass provides opportunities for these individuals to work for multiple companies in Singapore without the need for employer sponsorship. This not only benefits the individuals by providing them with greater flexibility and career opportunities, but it also enriches the local workforce by bringing in diverse expertise and knowledge.

For example, an accomplished researcher in the field of artificial intelligence can now collaborate with multiple organizations on cutting-edge projects, contributing to Singapore’s position as a global tech hub. This kind of collaboration not only elevates the local research and development efforts but also fosters international partnerships, driving innovation and economic growth in Singapore.

Moreover, the ONE Pass aligns with the Ministry of Manpower’s broader efforts to digitize and simplify processes for businesses and workers in Singapore. This commitment to modernizing the work pass system not only enhances the experience for foreign employees and employers but also demonstrates Singapore’s dedication to embracing technological advancements and creating a progressive, future-ready work environment.

Individuals interested in exploring the ONE Pass further are encouraged to visit the Ministry of Manpower’s website, where they can find detailed information, application procedures, and relevant resources to guide them through the process. This will allow them to gain a comprehensive understanding of the benefits and eligibility criteria associated with the ONE Pass, empowering them to make informed decisions about their career and potential opportunities in Singapore.

The post ONE Pass in Singapore appeared first on Wing Tai Holdings Singapore.

]]>The post Hdb and Condo is now allowed to rent up to 8 person unrelated (Updated for 2024) appeared first on Wing Tai Holdings Singapore.

]]>

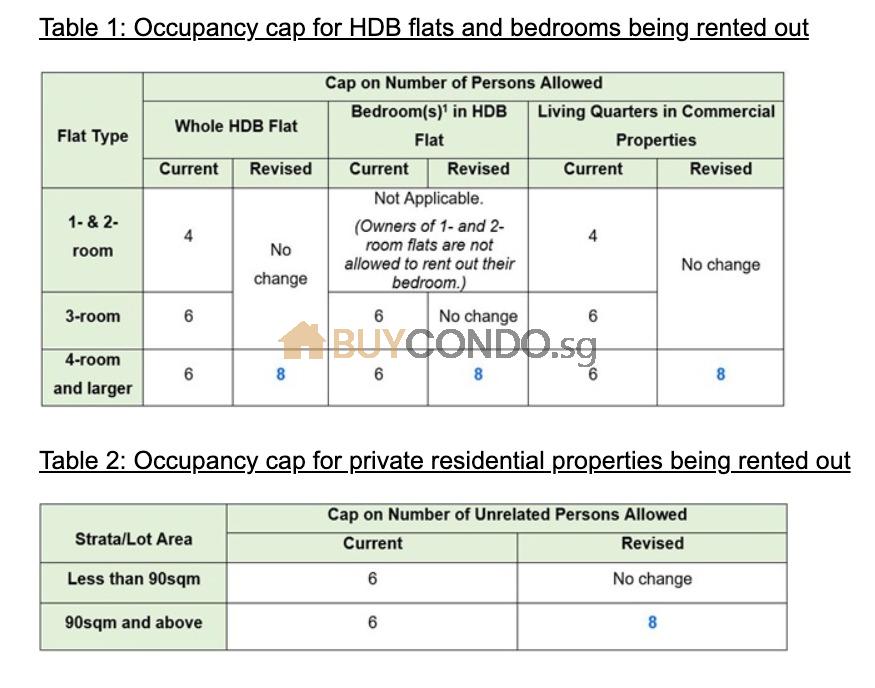

Prior approval/registration required

For landlords who is planning to get a higher rental this will be a good news.

This comes in handy as I have landlord have just appointed us to rent out their Executive HDB flat which is 147sqm / 1582sqft in Blk 603 Choa Chu Kang Street 62 Singapore 680603.

Which Category of Tenant will benefit from this news for the new

temporary occupancy cap for a period effective 22 January 2024 to 31 December 2026,

Temporary relaxation of occupancy cap Criterias

(a) 4-room and larger HDB flats

(b) Living quarters of HDB commercial properties (where the living quarters are equivalent to or larger than a 4-room flat)

(c) Larger private residential properties of at least 90sqm

For example, a one-bedroom condo may be suitable for a single person or a couple, while a five-bedroom condo can comfortably accommodate a larger family or a group of friends, offering flexibility and choice to prospective tenants.

Moreover, the maximum occupancy limit for condos in Singapore of 90sqm and/or above is set at eight occupants as part of the temporary relaxation of occupancy cap from URA.

Providing tenants with the flexibility to share the space with a larger group of individuals, making it an ideal option for families, roommates, or friends looking to reside together in a single unit. This regulatory framework underscores the importance of understanding the capacity of different condo types and the maximum occupancy regulations for both landlords and tenants in Singapore.

Can Landlords benefit to get your place rented out Faster and Higher Rent?

1) Co-living Operators.

( Condo Landlords looking to rent out, WING TAI HOLDINGS Team helps to recommend and filter the companies are keen and obtaining good rental rates for landlords. Speak to us to find out more)

2) Co-sharing Foreign Tenants holding on to S-Pass or PR status.

( Leverage by having 2 more person to share on the rent)

Who are these Groups of Tenants?

This is a vast group of tenant that will be mainly renting HDB whole units. Usually the sharing can be among Friends, Colleagues or relatives or cousins from the same hometown.

Examples of Condos with Big Floor Plates that will Benefit

Etc Tan Tong Meng the sizes offered is 3,240sqft. We are doing property management services for Landlords and the rent was affect due to the reduce cap for each apartment.

How to Apply for Condo Landlord

Owners of larger private residential properties of at least 90sqm who wish to rent out their properties to up to eight unrelated persons are required to register with URA2. They can do so by registering their properties via URA’s e-services. An administrative fee of $20 is payable with each registration. Upon successful registration, the owner will be informed that they can use the residential property to accommodate up to eight unrelated persons, each subject to a minimum stay duration of three consecutive months.

How to Apply for HDB commercial property owners

HDB commercial property owners and tenants who wish to rent out their living quarters can apply via the GoBusiness Licensing Portal. They must pay a S$100 administrative fee when doing so.

How to Apply for HDB Owners

Applications to rent out HDB flats or bedrooms may be submitted online via its e-services, with applicants required to pay an administrative fee of S$10 per bedroom or S$20 per whole flat rented out.

Who are Not Eligble for the New Occupancy Cap?

These new cap is only applicable to the tenancy have have not commenced. Hence if your tenancy has already commenced you are not not automatically eligible. (Based on what is brief on the official website while landlords may want to check if the Official Authorities and take reference to Condo By-laws to make sure there is no infringe.

Maximum Occupancy Limits for Condos

In Singapore, the regulations governing maximum occupancy limits for condos are designed to maintain a safe and comfortable living environment for all residents. Private residential properties are subject to a strict occupancy cap of six unrelated individuals, and it is imperative for both landlords and tenants to ensure compliance with this rule to avoid any potential legal repercussions. For instance, a three-bedroom condo in Singapore, with its designated occupancy limit, underscores the importance of adhering to these regulations to prevent overcrowding and maintain a balanced residential community.

Additionally, the regulations for HDB flats are contingent on the size of the unit, with the maximum occupancy varying based on factors such as the number of rooms and the property’s dimensions. This highlights the need for tenants and landlords to familiarize themselves with these specific guidelines and ensure compliance to avoid any penalties or legal issues. By understanding and abiding by these rules, tenants and landlords can contribute to a harmonious living environment while also preventing any unnecessary financial or legal consequences. Moreover, the careful adherence to these occupancy limits is essential for fostering a balanced and respectful residential community in Singapore.

Future Changes in Occupancy Rule

The anticipated relaxation of the occupancy cap for larger HDB flats and private residential properties from 22 January 2024 represents a significant development with implications for both landlords and tenants. This relaxation is expected to provide greater flexibility in accommodating larger groups or families within these properties, thereby catering to evolving housing needs. For example, a landlord who owns a large private residential property or HDB flat may find the relaxation of the occupancy cap beneficial in attracting tenants, potentially increasing the demand for their rental units. Conversely, a family looking to rent a larger property may find it easier to secure a suitable living space without being constrained by the current occupancy limits.

As this change is poised to take effect in the near future, both landlords and tenants should stay informed about the specific guidelines and regulations that will govern the relaxed occupancy cap. Understanding the updated rules will be crucial for ensuring compliance and making informed decisions when entering into new lease agreements. Therefore, it is essential for all parties involved to stay updated with the latest information on the relaxation of the occupancy rule to make the most of the opportunities it presents. By staying informed and understanding the implications of these changes, landlords and tenants can navigate the evolving rental landscape in Singapore effectively.

Short-Term Accommodation Policies

The prohibition of short-term accommodation in Singapore underscores the emphasis on stable and long-term rental arrangements, ensuring a sense of permanence and stability within residential communities. Properties must be rented out for a minimum of three consecutive months, aligning with the objective of promoting a stable and secure living environment. For instance, if a group of tourists or visitors plans to stay in Singapore for a short period, they must seek alternative accommodation such as hotels or serviced apartments to comply with the rental policies.

Landlords should communicate the minimum rental period to potential tenants and ensure that their rental agreements reflect this requirement. Additionally, tenants should be aware of the minimum rental duration and plan their accommodation needs accordingly. By understanding and adhering to the minimum rental period, both landlords and tenants can contribute to a transparent and compliant rental process, thereby avoiding any legal issues or penalties. This proactive approach fosters a stable and secure residential community, aligning with the broader goal of maintaining a harmonious living environment for all residents.

Renting Condos to Large Groups

When renting condos to large groups in Singapore, it is essential for both landlords and tenants to understand and adhere to the guidelines set forth in the rental regulations. This involves being mindful of the maximum occupancy limits for private residential properties, which currently stand at six unrelated individuals, ensuring that this cap is not surpassed when renting to large groups. For HDB flats, the maximum occupancy varies depending on the size of the unit. It is crucial for landlords to communicate these limits clearly to tenants, and for tenants to abide by them.

Additionally, both parties should consider the potential implications of renting to large groups, such as the increased wear and tear on the property and the heightened possibility of disturbances within the community. Landlords should establish clear agreements with tenants regarding the responsibilities for maintaining the property and managing any communal facilities in the condo. Moreover, tenants should be mindful of their obligations to uphold the terms of the tenancy agreement, including respecting the property and the rights of other residents within the condo. By understanding and following these guidelines, both landlords and tenants can ensure a harmonious renting experience for large groups in Singapore.

Consequences of Violating Rental Policies

Understanding and adhering to the rental policies in Singapore is essential for both landlords and tenants to avoid potential consequences. Failure to comply with these regulations can result in significant penalties, including hefty fines and even the forfeiture of the rented property. For example, if a landlord exceeds the maximum occupancy limit for their condo by allowing more than the specified number of tenants to reside in the property, they could face substantial fines and legal repercussions. Similarly, tenants who sublet the condo to an excessive number of occupants or engage in unauthorized short-term rentals may find themselves in violation of the rental policies, leading to financial liabilities and potential eviction.

It’s important to note that these penalties are not only financially burdensome but can also have long-term implications on the landlord-tenant relationship and the overall rental experience. Therefore, it is in the best interest of all parties involved to carefully adhere to the stipulated rental regulations to avoid any unfavorable outcomes. By understanding and respecting these policies, both landlords and tenants can create a harmonious and legally compliant rental environment, ensuring a positive and sustainable renting experience for all.

Conclusion: Hdb and Condo is now allowed to rent up to 8 person unrelated (Updated for 2024)

Landlords, on the other hand, should be mindful of the maximum occupancy limits for condos in Singapore, which currently stand at six unrelated individuals for private residential properties and vary depending on the size of the unit for HDB flats. It is important for landlords to communicate and enforce these occupancy limits to avoid any violations that could lead to penalties such as fines or loss of property. Additionally, both parties should pay attention to the upcoming relaxation of the occupancy cap for larger HDB flats and private residential properties from 22 January 2024 to stay abreast of the changing regulations.

Therefore, both tenants and landlords should take proactive measures to understand and comply with the existing regulations while staying informed about any future changes in condo rental policies in Singapore. This will contribute to a harmonious and legally sound rental experience for all parties involved.

More details of this change can be found in the joint press release by HDB and URA. For enquiries, please contact:

-

HDB Branch Service Line at 1800-225-5432/e-Feedback form, for HDB flats.

-

HDB Commercial Enquiry Line at 1800-866-3073, for living quarters of HDB commercial properties.

-

URA Development Control Line at 6223-4811/e-Feedback form, for private residential properties.

Rental Market in Singapore 2023 – 2024

The post Hdb and Condo is now allowed to rent up to 8 person unrelated (Updated for 2024) appeared first on Wing Tai Holdings Singapore.

]]>The post Relocation Support for Expats in Singapore appeared first on Wing Tai Holdings Singapore.

]]>Relocation companies in Singapore provide essential support for expats moving to the country. Whether you’re an individual or a company, these companies offer a range of services to ensure a smooth transition. From pre-departure orientation to visa support and accommodation searches, they handle every aspect of the relocation process. Local companies like Wise Move and Helpxpat, as well as international companies like Santa Fe Relocation and NuCompass Mobility, specialize in providing tailored solutions for expats relocating to Singapore.

Key Takeaways: Relocation Support for Expats in Singapore

- Relocation companies in Singapore offer comprehensive support for expats moving to the country.

- Services include pre-departure orientation, visa support, accommodation searches, and more.

- Local and international relocation companies provide tailored solutions for expats.

- Wise Move, Helpxpat, Santa Fe Relocation, and NuCompass Mobility are some of the prominent companies in Singapore.

- These services ensure a smooth and stress-free transition for expats and their families.

Finding Rental Properties in Singapore for Expats

When it comes to relocating to Singapore, finding suitable rental properties is a top priority for expats. Thankfully, there are several expat relocation agencies and companies that offer comprehensive support services to assist in this process.

Companies like Wise Move and Helpxpat specialize in helping expats find the perfect home in Singapore. They offer a range of services, including conducting property searches, arranging viewings, and assisting with lease negotiations. These experts understand the unique needs of expats and can provide valuable insights and guidance throughout the rental search.

Additionally, there are online platforms and real estate agencies that cater specifically to expat housing needs in Singapore. These platforms provide a convenient way for expats to search for properties that meet their requirements, whether it’s a condo in the city center or a family-friendly house in the suburbs. With the help of these resources, expats can find rental properties that suit their lifestyle and preferences.

It’s important for expats to take advantage of the support services available to them when searching for rental properties in Singapore. Whether it’s through a relocation agency, online platform, or real estate agency, these services can make the process smoother and more efficient. By working with experts in the field, expats can navigate the competitive rental market in Singapore with confidence and find their ideal home in this vibrant city.

Settling into Life in Singapore

Relocation support for expats in Singapore extends beyond just finding a place to live. Companies like Helpxpat and Asian Tigers Group offer comprehensive services to help expats settle into their new life in Singapore. These services aim to make the transition smooth and stress-free for expats and their families.

Neighborhood Orientation and Cultural Training

One important aspect of settling into life in Singapore is getting to know the local neighborhood and culture. Companies like Helpxpat provide neighborhood orientation services to help expats familiarize themselves with the different districts, amenities, and lifestyle options in Singapore. Cultural training sessions may also be available to help expats understand local customs, traditions, and business etiquette.

Language Help and Administrative Assistance

Language can sometimes be a barrier when settling into a new country. That’s why companies like Asian Tigers Group offer language help services to assist expats in learning the local language or providing translation services when needed. Additionally, these companies can provide administrative assistance to expats, helping them navigate important tasks such as setting up utilities, obtaining necessary permits, and dealing with immigration and visa requirements.

Utilities and Immigration Assistance

Setting up utilities like electricity, water, and internet can be a daunting task in a foreign country. Companies like Helpxpat and Asian Tigers Group can take care of these arrangements on behalf of expats, ensuring a smooth transition into their new home. They can also assist with immigration and visa-related matters, providing guidance and support throughout the process.

| Settling into Life in Singapore Services | Service Providers |

|---|---|

| Neighborhood Orientation | Helpxpat, Asian Tigers Group |

| Cultural Training | Helpxpat |

| Language Help | Asian Tigers Group |

| Administrative Assistance | Asian Tigers Group |

| Utilities Setup | Helpxpat, Asian Tigers Group |

| Immigration Assistance | Helpxpat, Asian Tigers Group |

International Relocation Services to and from Singapore

Relocation companies in Singapore don’t just cater to expats moving to the country; they also offer comprehensive services for those relocating from Singapore to other countries. These companies specialize in providing end-to-end moving solutions to ensure a seamless relocation experience for their clients.

Services offered by these companies include packing, transportation, customs clearance, and assistance with finding accommodation in the new destination. They understand the unique challenges involved in international moves and work closely with their clients to address their specific needs.

For expats leaving Singapore, these relocation companies can help alleviate the stress and complexity of the moving process. By entrusting their relocation to professionals, expats can focus on other important aspects of their move and ensure a smooth transition to their new destination.

Conclusion

Comprehensive relocation support for expats in Singapore is essential for a smooth transition. Whether you are moving to Singapore or relocating from the country, there are relocation companies available to provide the necessary assistance. These companies offer a wide range of services, including pre-departure orientation, visa support, accommodation searches, and lease negotiations.

Local relocation companies like Wise Move and Helpxpat, as well as international companies such as Santa Fe Relocation and NuCompass Mobility, can tailor their solutions to meet the unique needs of expats. They ensure that individuals and companies have the support they need to settle into their new lives in Singapore.

Expats can also benefit from online platforms and WING TAI HOLDINGS Team that specialize in expat housing needs. These resources can help in finding suitable rental properties and make the process easier and more efficient.

With the assistance of property manager services, expats can maximize their comfort and minimize the challenges associated with moving to Singapore. By taking advantage of these services, individuals can focus on adapting to their new surroundings and making the most of their expat experience in Singapore.

FAQ

What services do relocation companies in Singapore offer?

Relocation companies in Singapore offer a wide range of services, including pre-departure orientation, visa support, accommodation searches, lease negotiations, pet relocation, and more.

Are there local relocation companies in Singapore?

Yes, some local relocation companies in Singapore include Wise Move and Helpxpat.

Are there international relocation companies in Singapore?

Yes, international companies such as Santa Fe Relocation and NuCompass Mobility also have a presence in Singapore.

How can relocation companies assist in finding rental properties in Singapore?

Companies like Wise Move and Helpxpat offer services to assist with property searches, arranging viewings, and lease negotiations.

Do online platforms and real estate agencies cater specifically to expat housing needs in Singapore?

Yes, there are online platforms and real estate agencies that specialize in catering to expat housing needs in Singapore.

What other services do relocation companies offer to help expats settle into life in Singapore?

Companies like Helpxpat and Asian Tigers Group offer services such as neighborhood orientation, cultural training, language help, and assistance with important tasks like setting up utilities and dealing with immigration and visas.

Do relocation companies also offer services for those relocating from Singapore to other countries?

Yes, companies like Sanelo and Santa Fe Relocation specialize in providing end-to-end moving services for those relocating from Singapore to other countries.

Why is comprehensive relocation support important for expats in Singapore?

Comprehensive relocation support ensures a smooth transition by providing tailored solutions for finding accommodation, settling into life in Singapore, and planning international moves.

The post Relocation Support for Expats in Singapore appeared first on Wing Tai Holdings Singapore.

]]>The post Guide to Work Permits and Visas for Expats in Singapore appeared first on Wing Tai Holdings Singapore.

]]>

Are you an expat looking to work and live in Singapore? Navigating the world of work permits and visas can be daunting, but with the right information, you can easily understand the process and find the right permit for your needs.

Singapore offers a range of work permits and visas tailored to different professional qualifications and job requirements. From the Employment Pass for professionals to the Work Permit for migrant workers, there is a permit specifically designed for your situation.

In this comprehensive guide, we will break down the various types of work permits and visas available in Singapore, their eligibility criteria, application process, and more. By the end, you will have a clear understanding of the options at your disposal and how to go about obtaining them.

Key Takeaways: Guide to Work Permits and Visas for Expats in Singapore

- Understanding the different work permits and visas for expats in Singapore is crucial for a successful relocation.

- Singapore offers a variety of permits tailored to professionals, entrepreneurs, skilled workers, trainees, and family members.

- Each work permit has specific eligibility criteria, benefits, and validity periods.

- The application process involves submitting the necessary documents and may vary in processing time.

- By following the guidelines and meeting the requirements, expats can legally work and reside in Singapore.

Types of Work Permits for Professionals

When it comes to work permits for professionals in Singapore, the Employment Pass (EP) is the most common option. The EP is designed for foreign professionals, managers, and executives who meet certain eligibility criteria. To qualify for an EP, applicants must have a job offer in Singapore, earn a minimum monthly salary of $5,000, and pass the Complementarity Assessment Framework (COMPASS).

The EP is valid for up to two years and can be renewed upon expiration. It allows professionals to work and live in Singapore, making it a popular choice for expats seeking professional opportunities in the country. The EP provides numerous benefits, including the ability to bring dependents, access to healthcare services, and eligibility for certain housing options.

Eligibility Criteria for Singapore Employment Pass

| Criteria | Requirements |

|---|---|

| Educational Qualifications | Applicants must have a recognized degree or professional qualifications. |

| Work Experience | Relevant work experience is preferred, especially in a managerial role. |

| Sponsorship | The EP application must be sponsored by a Singapore-registered company. |

| Salary | Applicants must earn a minimum monthly salary of $5,000. |

It’s important to note that meeting the eligibility criteria does not guarantee approval of the EP. The Ministry of Manpower (MOM) assesses each application on a case-by-case basis. It takes into consideration factors such as the applicant’s qualifications, relevant work experience, and the potential contribution to Singapore’s economy.

In conclusion, the Employment Pass is a widely sought-after work permit for professionals in Singapore. It provides expats with the opportunity to work and live in the country, as well as enjoy various benefits. However, it’s essential to meet the eligibility criteria and submit a strong application to increase the chances of approval.

Work Permits for Skilled and Semi-Skilled Workers

Singapore offers various work permits for skilled and semi-skilled workers, providing opportunities for individuals in sectors such as construction, manufacturing, and marine shipyard. These work permits enable foreign workers to contribute to Singapore’s workforce while ensuring that the labor market remains regulated and protected.

The S Pass is one such work permit available for skilled workers who earn a minimum monthly salary of $3,150. This permit allows eligible workers to stay and work in Singapore for up to two years. It is suitable for individuals with specialized skills or technical expertise who contribute to key industries in Singapore.

In addition to the S Pass, there are also specific work permits tailored for foreign workers in different sectors. The Work Permit for migrant workers is designed for skilled and semi-skilled workers in sectors such as construction, manufacturing, and marine shipyard. This permit allows employers to hire foreign workers to meet the manpower needs of their businesses while ensuring compliance with labor regulations.

Furthermore, there is a Work Permit for migrant domestic workers who work in households, providing essential support in caregiver and domestic roles. This permit allows households to hire foreign domestic workers while adhering to the necessary regulations and guidelines set by the government.

| Work Permit Type | Key Features |

|---|---|

| S Pass | – Minimum monthly salary of $3,150 – Valid for up to two years – Suitable for skilled workers in various industries |

| Work Permit for migrant workers | – Skilled and semi-skilled workers in sectors like construction, manufacturing, and marine shipyard – Valid for up to two years |

| Work Permit for migrant domestic workers | – Domestic workers in households – Provides caregiver and domestic support – Valid for up to two years |

These work permits for skilled and semi-skilled workers play a crucial role in supporting Singapore’s workforce and maintaining economic growth. They ensure that businesses have access to the necessary talent while protecting the rights and welfare of foreign workers. By following the specific requirements and regulations for each work permit, employers and workers can navigate the process smoothly to obtain the necessary permits for legal employment in Singapore.

Work Permits for Trainees and Students

For foreign professionals undergoing practical training in Singapore, the Training Employment Pass provides an excellent opportunity. To be eligible for this pass, individuals must earn a minimum monthly salary of $3,000. The Training Employment Pass allows trainees to gain valuable experience in their field while working in a practical setting.

Similarly, for students and graduates who wish to work and holiday in Singapore, the Work Holiday Pass is the ideal solution. This pass is available to individuals aged 18 to 25 and allows them to work and enjoy their time in Singapore for up to six months. It provides a unique opportunity to gain international work experience and explore the vibrant culture of Singapore.

Furthermore, there are specific work permits available for trainees undergoing practical training and Australian students and graduates under the Work and Holiday Visa Program. These permits cater to individuals who are looking to enhance their skills and broaden their horizons through practical training and work experiences in Singapore.

| Work Permit | Eligibility | Duration |

|---|---|---|

| Training Employment Pass | Foreign professionals undergoing practical training | Varies based on training duration |

| Work Holiday Pass | Students and graduates aged 18 to 25 | Up to 6 months |

| Work Permit for Trainees | Trainees undergoing practical training | Varies based on training duration |

| Work Permit for Australian Students and Graduates | Australian students and graduates under the Work and Holiday Visa Program | Varies based on visa duration |

Work Permits for Family Members

| Work Permit | Eligibility Criteria | Validity |

|---|---|---|

| Dependant’s Pass | Spouses and unmarried children (under 21 years old) of eligible Employment Pass or S Pass holders | 2 years, tied to the validity of the main work pass holder’s pass |

| Long-Term Visit Pass | Parents, common-law spouses, step-children, or handicapped children of eligible Employment Pass or S Pass holders | 1 to 2 years, tied to the validity of the main work pass holder’s pass |

| Dependent’s Pass for holders of LTVP/LTVP+ issued by ICA | Spouses and unmarried children (under 21 years old) of Singapore citizens or permanent residents holding an LTVP/LTVP+ issued by ICA | 1 to 2 years, tied to the validity of the LTVP/LTVP+ |

Expats working in Singapore often have the opportunity to bring their family members to the country. Singapore offers several work permits specifically tailored for family members of eligible Employment Pass or S Pass holders. These permits, known as the Dependant’s Pass and Long-Term Visit Pass, allow spouses, children, parents, or handicapped children to join their loved ones in Singapore.

The Dependant’s Pass is available for spouses and unmarried children under the age of 21. It is valid for up to two years and is tied to the validity of the main work pass holder’s pass. This pass allows family members to live, study, and work in Singapore without the need for a separate work permit.

The Long-Term Visit Pass is designed for parents, common-law spouses, step-children, or handicapped children of eligible Employment Pass or S Pass holders. It offers a longer validity period of one to two years, also tied to the main work pass holder’s pass. Similarly, this pass allows family members to stay in Singapore and engage in various activities, including employment, without the need for an additional work permit.

Additionally, there are specific work passes available for dependents of Singapore citizens or permanent residents holding an LTVP/LTVP+ issued by the Immigration & Checkpoints Authority (ICA). These passes allow the spouse and unmarried children of the LTVP/LTVP+ holder to reside and work in Singapore for one to two years, depending on the validity of the LTVP/LTVP+.

Exemptions and Temporary Work Passes

While Singapore offers a range of work permits and visas for expats, there are also exemptions and temporary passes available for specific situations. These options provide flexibility and convenience for individuals who require short-term work assignments or perform eligible activities without a work pass. Let’s explore two such options: the Miscellaneous Work Pass and Work Pass Exempt Activities.

Miscellaneous Work Pass

The Miscellaneous Work Pass is designed for foreign speakers, religious workers, and journalists who take on short-term work assignments in Singapore, lasting up to 60 days. This pass allows individuals to contribute their expertise and skills without the need for a long-term work permit. It offers a practical solution for professionals who engage in temporary projects, events, or assignments in Singapore.

Foreign journalists, religious workers, and speakers can work in Singapore for up to 60 days with the Miscellaneous Work Pass.

Work Pass Exempt Activities

Work Pass Exempt Activities allow individuals to perform specific short-term activities in Singapore without obtaining a work pass. Examples of exempt activities include attending business meetings, participating in conferences, conducting academic research, and undergoing medical treatment. It’s important to note that individuals engaging in work pass exempt activities still need to notify the Ministry of Manpower (MOM) within 14 days of commencing the activities.

- Attending business meetings and conferences

- Conducting academic research

- Undergoing medical treatment

These exemptions provide individuals with the flexibility to engage in short-term activities while ensuring compliance with Singapore’s regulations. It’s crucial to adhere to the specific guidelines and notify the relevant authorities to avoid any potential issues.

By offering exemptions and temporary work passes, Singapore recognizes the diverse needs of individuals engaging in short-term work or activities within its borders. These options enhance the ease of doing business and contribute to Singapore’s reputation as a global hub for talent and expertise.

Application Process for Work Permits and Visas

Obtaining a work permit or visa in Singapore involves a comprehensive application process. Companies can apply on behalf of their employees, while individuals can apply directly for certain permits. The process typically requires the submission of necessary documents, including passport copies, educational certificates, and company profiles. The duration of the processing time varies depending on the type of pass, ranging from a few days to several weeks.

For individuals applying for work permits, the application process may differ depending on the specific pass they are seeking. It is important to carefully review the requirements and eligibility criteria for each pass before submitting the application. In some cases, applicants may need to undergo a medical examination or obtain additional documentation to support their application.

Employers sponsoring their employees’ work permits must also fulfill certain obligations. This may include demonstrating the company’s financial stability, providing relevant business information, and adhering to the guidelines set by the Ministry of Manpower (MOM). It is crucial for both individuals and employers to follow the application guidelines and submit all required documents accurately to avoid delays or rejections.

| Application process for work permits and visas in Singapore | Applying as an individual | Applying through an employer |

|---|---|---|

| Step 1 | Review the eligibility criteria for the desired work permit or visa. | Ensure the company meets the requirements to sponsor an employee’s work permit. |

| Step 2 | Prepare the necessary documents, such as passport copies, educational certificates, and employment offer letter. | Gather the required documents, including the company’s profile, financial statements, and employment contract. |

| Step 3 | Submit the application online through the relevant government portal. | Submit the application on behalf of the employee through the MOM’s online portal. |

| Step 4 | Pay the application fee and wait for the outcome of the application. | Pay the necessary fees and wait for the outcome of the application. |

| Step 5 | Upon approval, collect the work permit or visa and complete any necessary procedures, such as medical examinations or fingerprinting. | Upon approval, issue a Letter of In-Principle Approval (IPA) to the employee, who can then proceed with the relevant procedures. |

Ensuring a smooth application process requires attention to detail and compliance with the guidelines provided by the MOM. It is advisable to seek professional assistance or consult with the Ministry of Manpower directly for any specific concerns or questions concerning the application process.

Conclusion