The post How to apply HDB HFE Steps (9 May 2023) appeared first on Wing Tai Holdings Singapore.

]]>

Updates : 23/11/2023 Please note changes on the HFE applicant occupiers is not allowed.

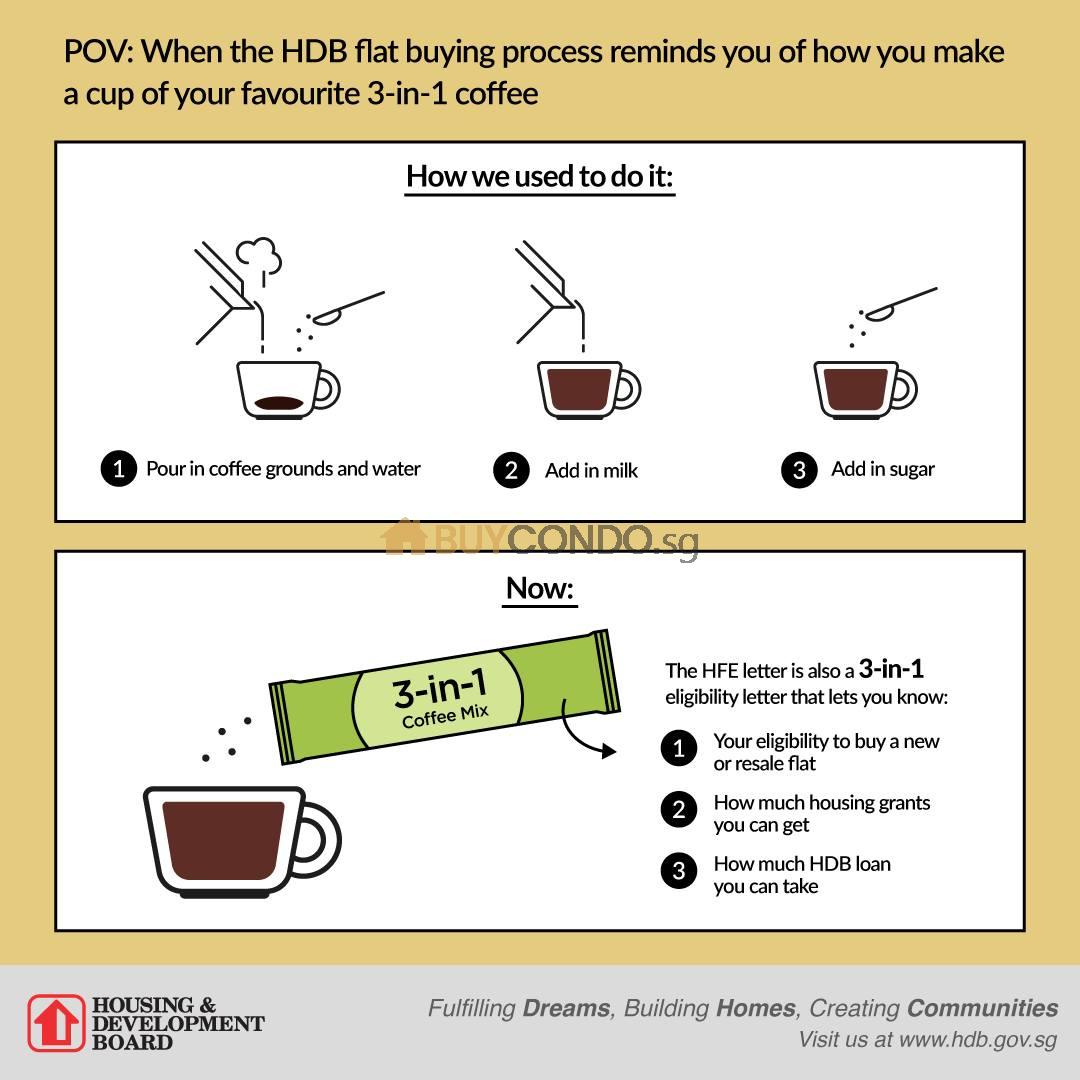

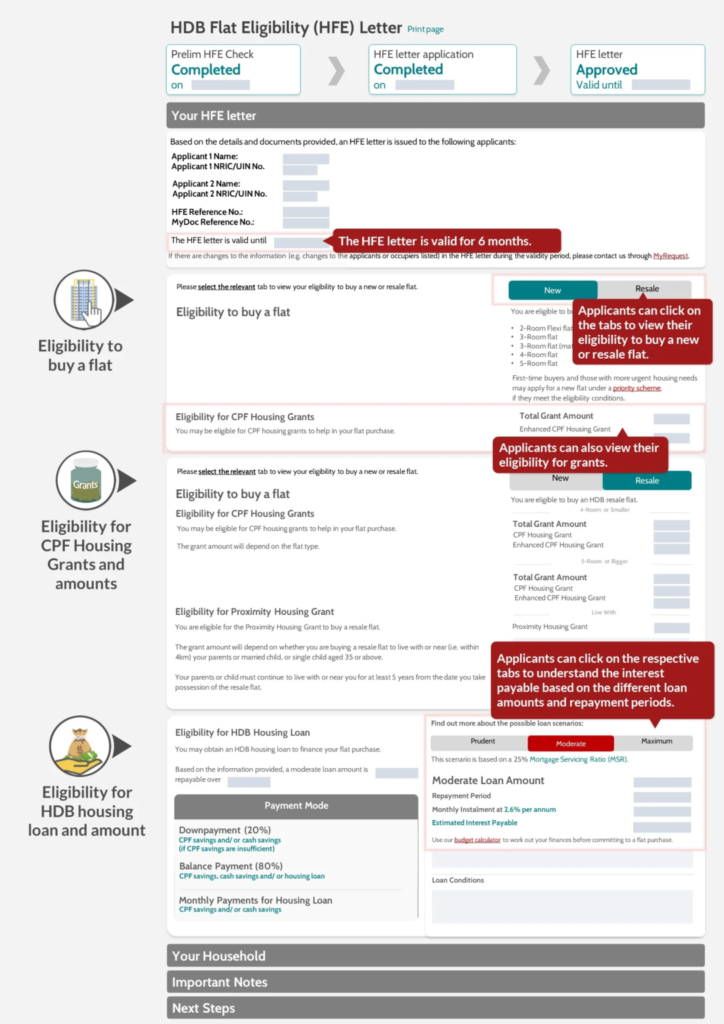

Thinking of buying an HDB flat soon? You will need an HDB Flat Eligibility (HFE) Letter before you set off on your home-buying journey. HFE letter streamlines the flat buying process. With the HFE letter, you will know upfront your eligibility to:

- Buy a new and/ or resale flat

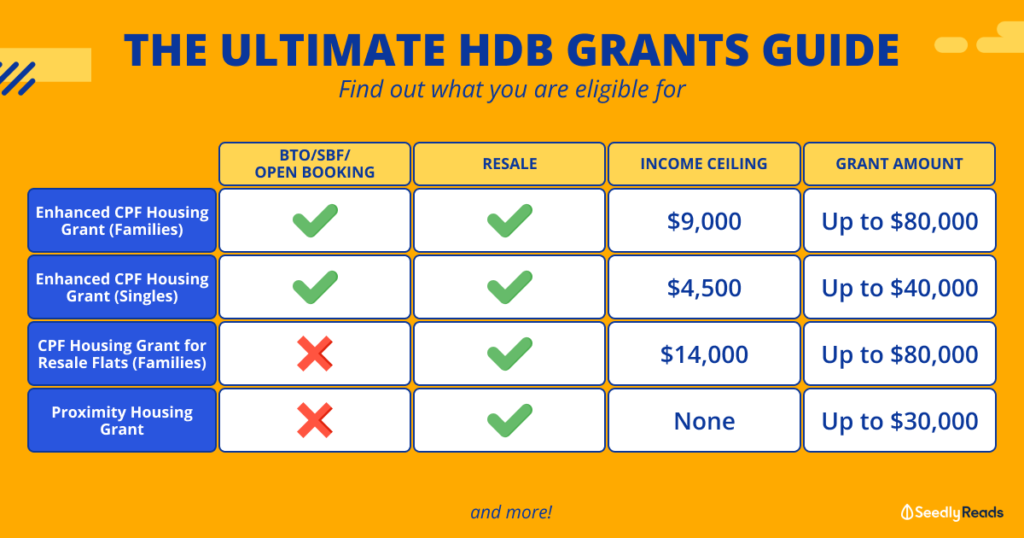

- Receive CPF housing grants and the amount

- Take up an HDB housing loan, and the amount

If you are interested in taking up a loan from a financial institution (FI), you can also concurrently apply for an In-Principle Approval from participating FIs when applying for an HFE letter. The letter will also give you an indicative loan assessment.

If you are interested in taking up a loan from a financial institution (FI), you can also concurrently apply for an In-Principle Approval from participating FIs when applying for an HFE letter. The letter will also give you an indicative loan assessment.

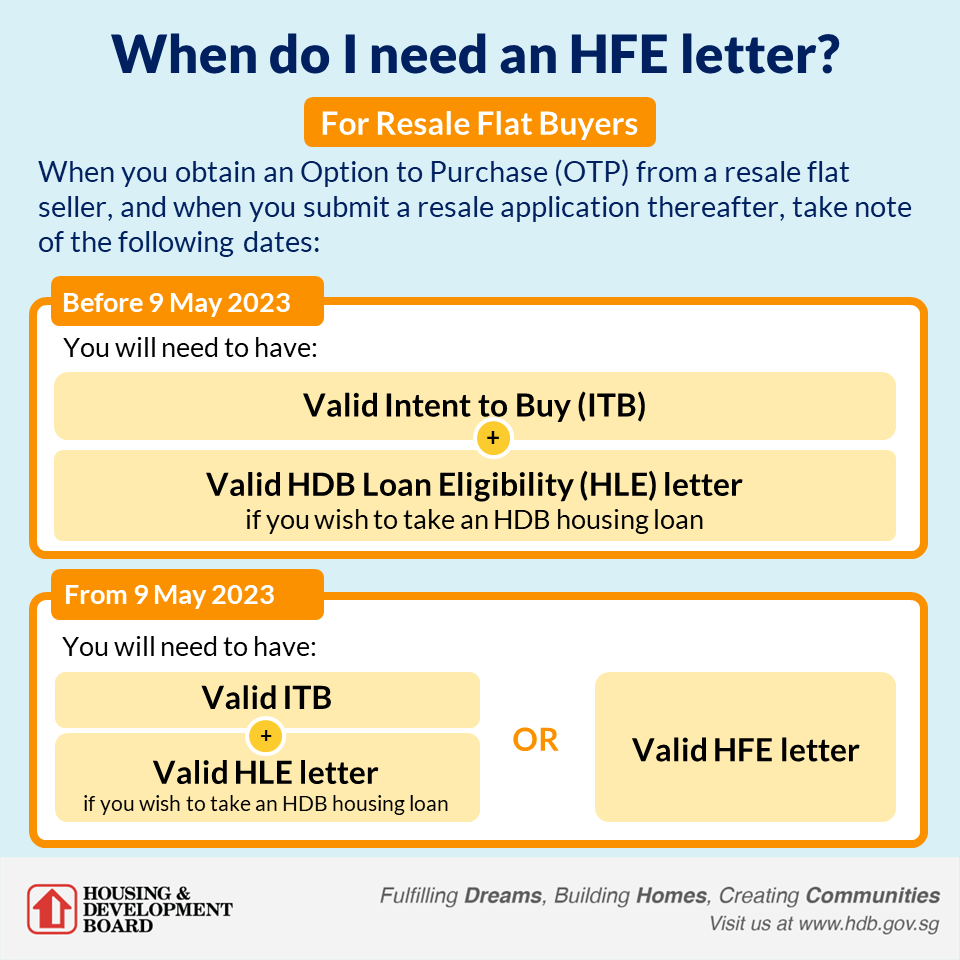

When will I need an HFE letter?

You will need a valid HFE letter when you:

- Apply for a flat from HDB during a sales launch or open booking of flats

- Obtain an Option to Purchase from a flat seller for a resale flat and when you submit a resale application to HDB.

The HFE letter helps you make an informed decision and reduces the guesswork as you plan the budget for your flat. We encourage you to plan ahead and apply for the HFE letter early – after all, the HFE letter is valid for 6 months.

The HFE letter helps you make an informed decision and reduces the guesswork as you plan the budget for your flat. We encourage you to plan ahead and apply for the HFE letter early – after all, the HFE letter is valid for 6 months.

What happened to the HLE letter?

The HFE letter replaces the old HDB Loan Eligibility (HLE) letter. Whereas buyers’ eligibility to buy an HDB flat, receive grants, and take up a housing loan used to be assessed at various stages in the flat-buying journey, the process is now streamlined into a single application for greater convenience.

If you are currently in the midst of buying a flat, learn more about whether and when you would need an HFE letter.

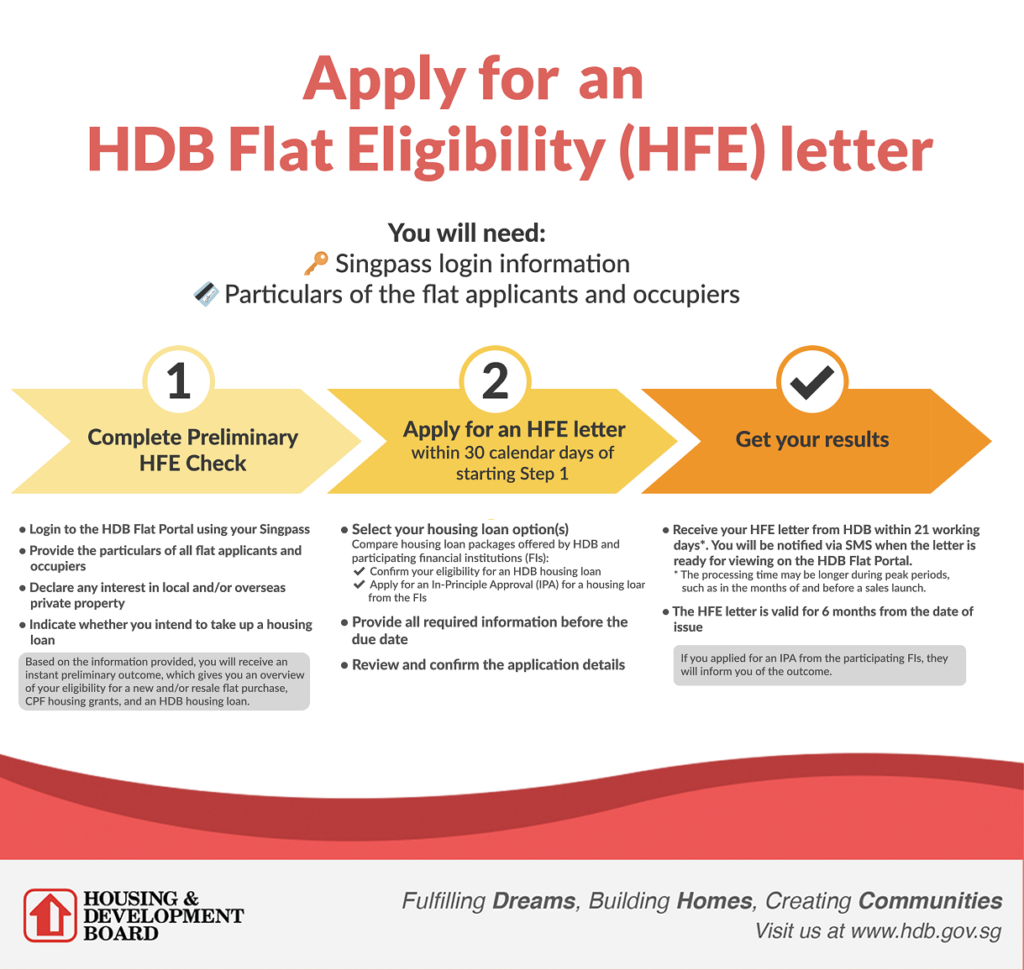

How do I apply for an HFE letter?

There are just 2 steps to apply for an HFE letter:

- Step 1: Preliminary HFE Check. Based on the information you provide, you will receive a quick overview of your eligibility to buy an HDB flat, receive CPF housing grants, and take up an HDB housing loan. This is a preliminary assessment to guide your financial planning. If you have decided to buy a flat, proceed to the next step to apply for an HFE letter.

- Step 2: Apply for an HFE Letter. Note that you will need to apply for an HFE letter within 30 calendar days of starting the preliminary HFE check. If not, you will need to start the preliminary HFE check afresh. You can use your HFE letter to work out your flat budget before beginning your home search.

If you can, apply for the HFE letter within the same calendar month that you started the preliminary HFE check. Otherwise, you will need to update the employment details for all persons listed in your application.

If you can, apply for the HFE letter within the same calendar month that you started the preliminary HFE check. Otherwise, you will need to update the employment details for all persons listed in your application.

You will be guided along both Step 1 and Step 2 by the HDB Flat Portal. Remember to have the required information (e.g. Singpass login info and details of all applicants and/ or occupiers) ready for a smoother process.

Read on to understand what you need to note for each step in the HFE process.

| Step 1: Preliminary HFE check Provide your household particulars and income details Submit declarations State housing loan intent Review details and receive preliminary HFE assessmentStep 2: Apply for an HFE letter Choose loan options Provide additional details Review details Upload documents Submit application |

Step 1: Preliminary HFE Check

Provide your household particulars and income details

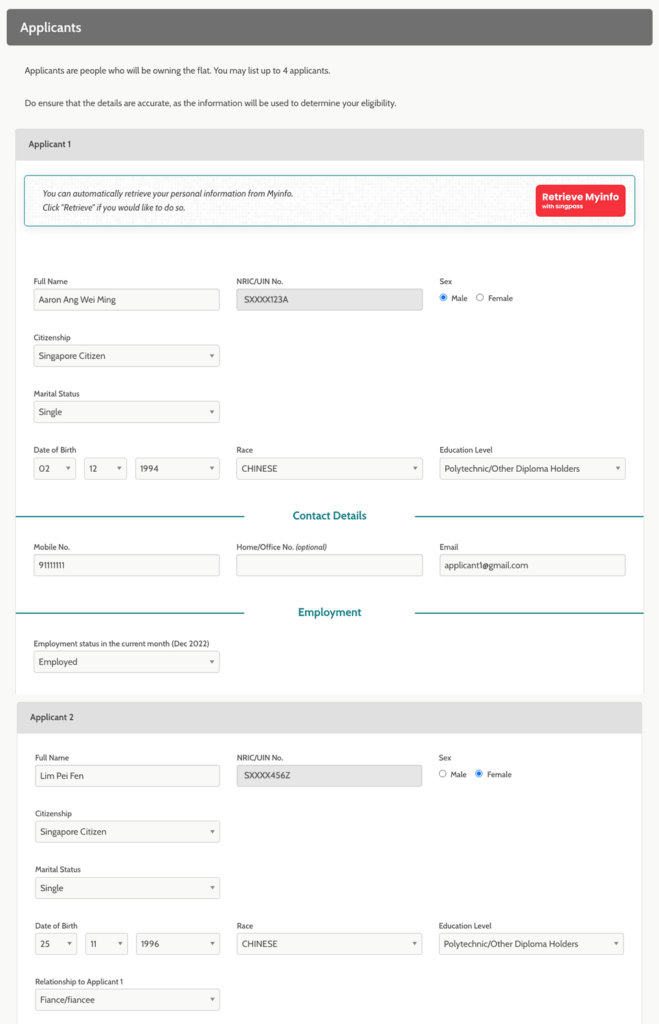

Begin by logging in on the HDB Flat Portal with your Singpass. You can save time by using Myinfo to retrieve your particulars, and update them if there are any changes. You will also need to enter the particulars of the co-applicants and occupiers in the application.

If you need more time, you can save a draft copy at any time during your application. The draft will be available for 30 calendar days from the date you start the preliminary HFE check.

If you need more time, you can save a draft copy at any time during your application. The draft will be available for 30 calendar days from the date you start the preliminary HFE check.

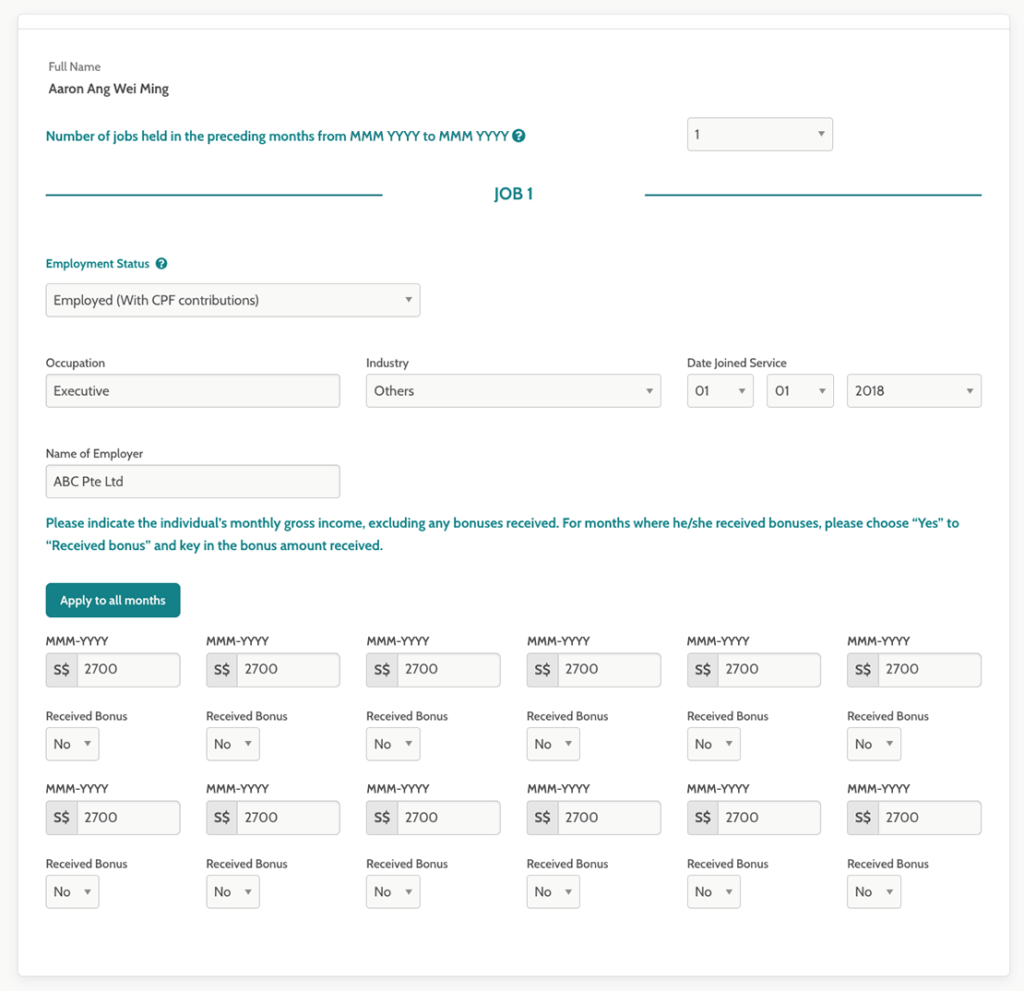

Next, provide the employment details, monthly income and bonuses received for all persons listed in the application.

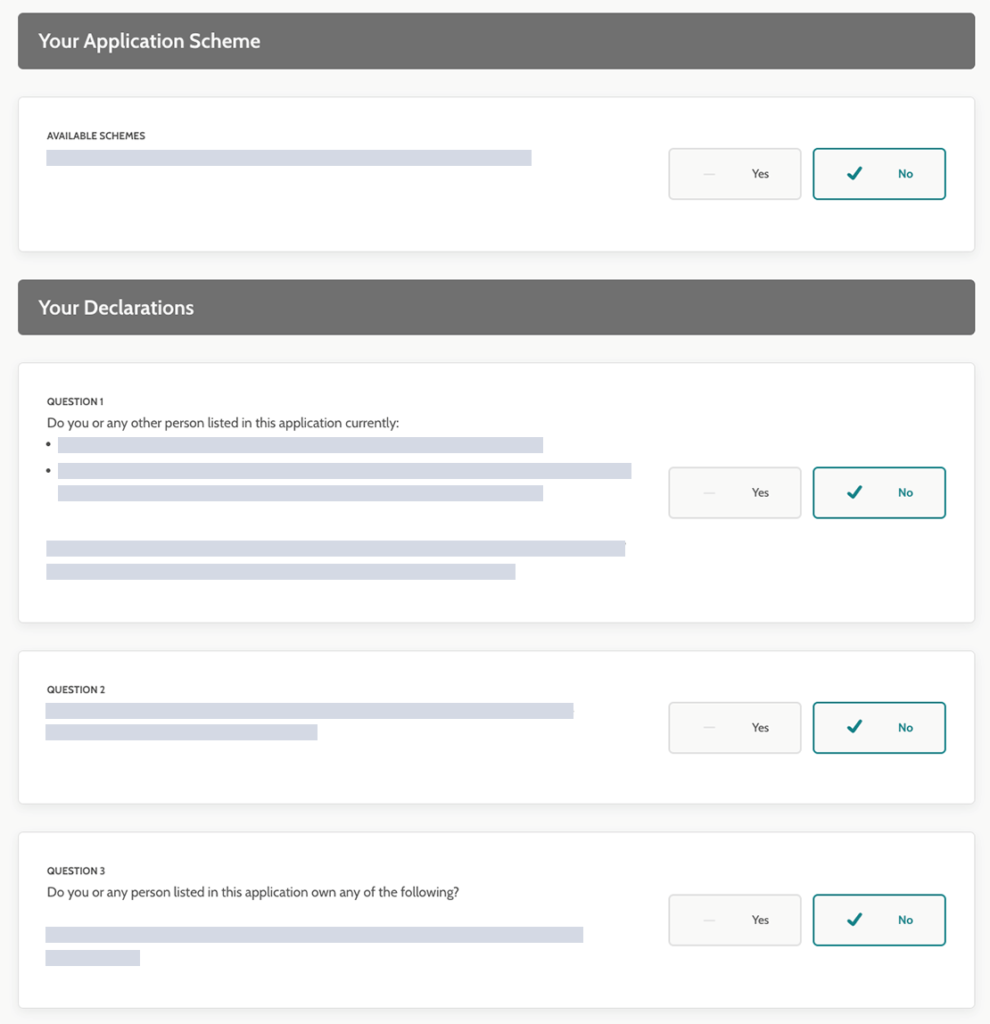

Submit declarations

You will then need to declare any interest in private properties for all persons listed in the application.

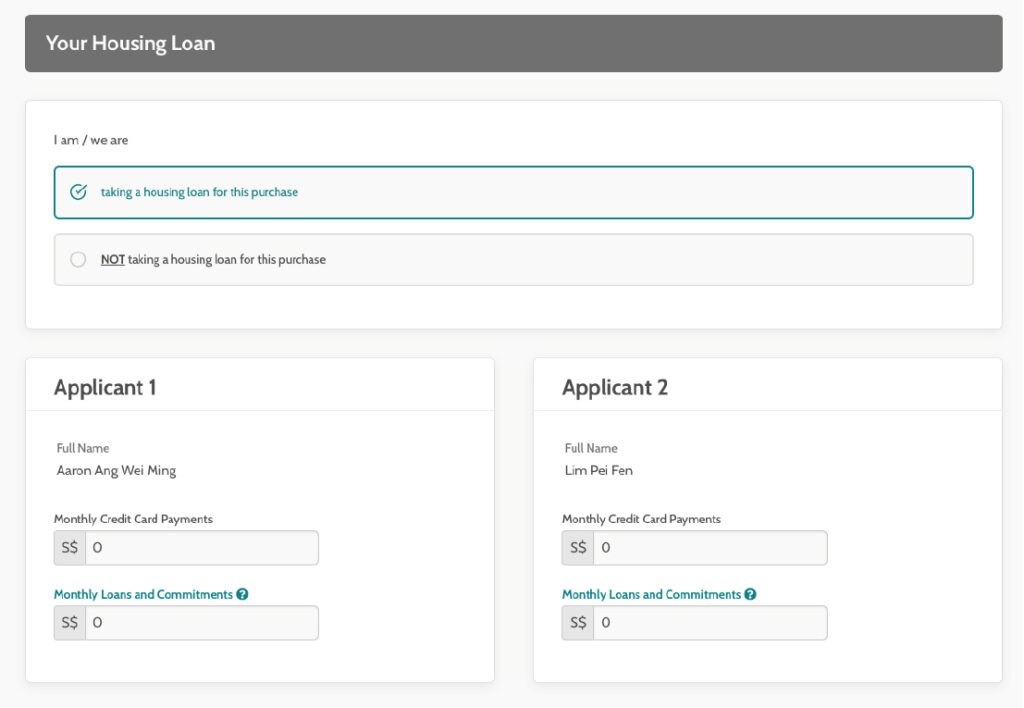

State housing loan intent(HDB or Bank Loan)

Indicate whether you intend to take up a housing loan for the flat purchase. If you do, you will also need to declare any monthly financial commitments, such as instalment plans, bills, insurance premiums, and other loan payments.

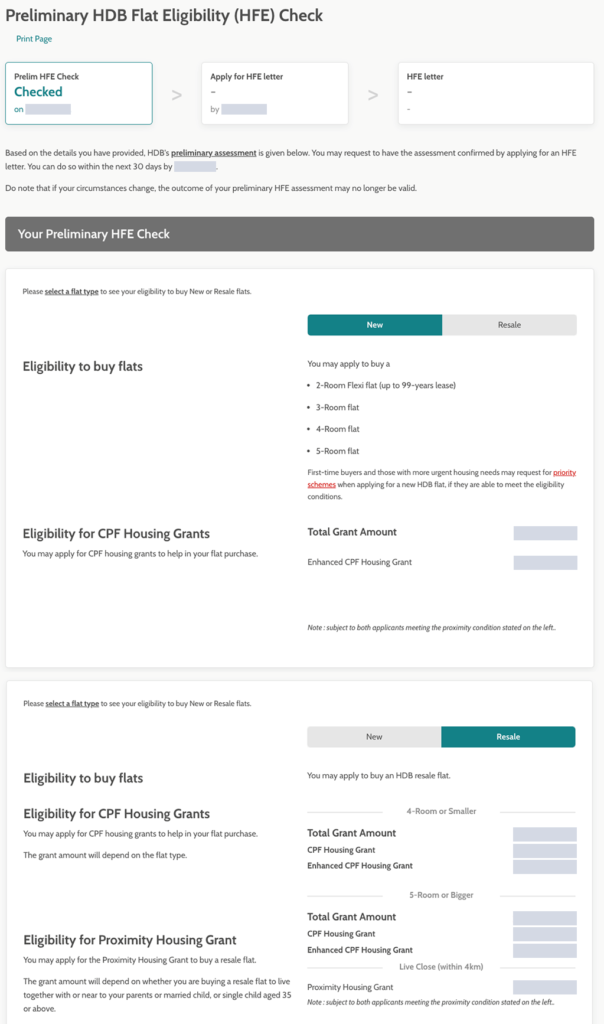

Review details and receive preliminary HFE assessment

Finally, review the information you have provided. Pro-tip: If you want to make any changes after this, you will need to start the preliminary HFE check afresh, so ensure the information is accurate.

You will then receive a preliminary assessment of your eligibility to buy a new and resale flat, receive CPF housing grants, and take up an HDB housing loan. You can log back into the HDB Flat Portal to view your preliminary HFE assessment anytime within the next 30 days.

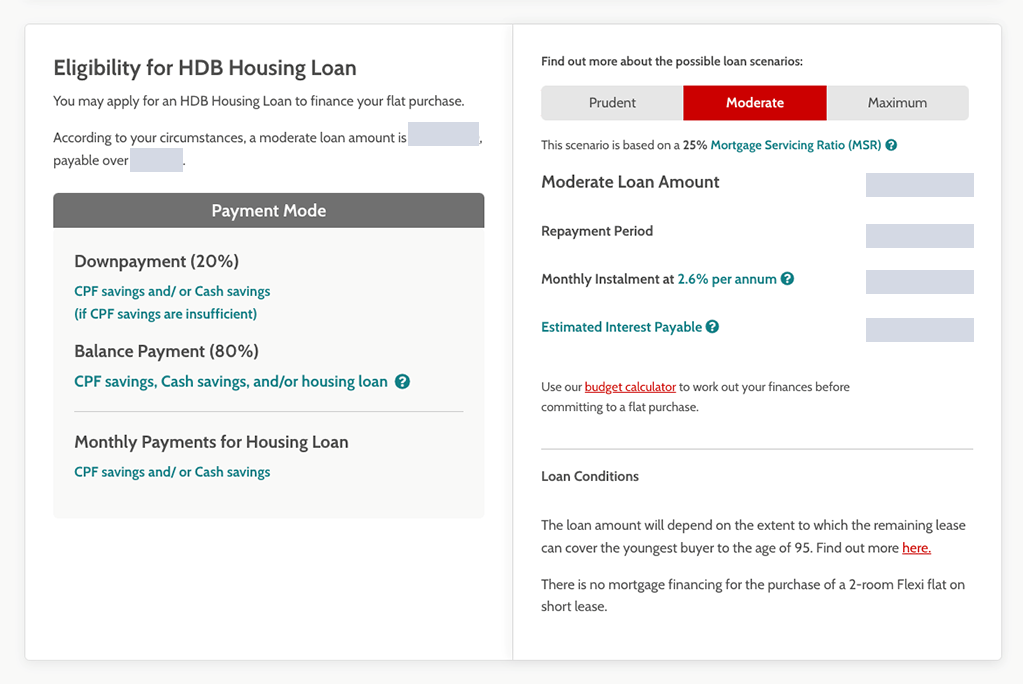

If you are eligible for an HDB housing loan, you can also compare different loan scenarios, including the monthly instalments and interest payable, based on different loan amounts and repayment periods.

If you are eligible for an HDB housing loan, you can also compare different loan scenarios, including the monthly instalments and interest payable, based on different loan amounts and repayment periods.

If there are any changes to the information provided (such as your employment, income, or ownership of private properties), you must start your preliminary HFE check afresh.

If you have decided to buy an HDB flat, you will need to proceed to Step 2, which is to apply for an HFE letter. This must be done within 30 calendar days from starting your preliminary HFE check.

Step 2: Apply for an HFE Letter : How to apply HDB HFE Steps (9 May 2023)

Choose loan options

Start your application by logging in to the HDB Flat Portal using your Singpass.

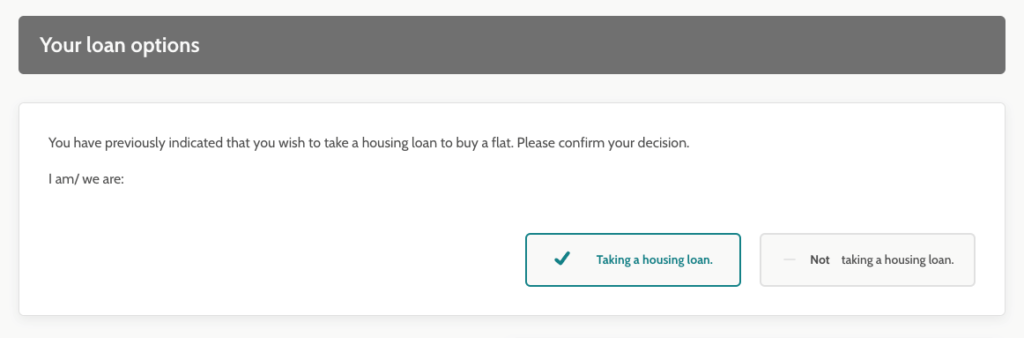

You will first need to confirm whether you intend to take up a housing loan to buy a flat. The option you previously indicated in your preliminary HFE check will be displayed. If you change your mind, you may select a different option.

If you wish to take up a housing loan to finance your flat purchase, you can:

- View your eligibility for an HDB housing loan and the different loan scenarios

- Find out more about the considerations in taking up a housing loan from financial institutions (FIs)

As with the preliminary HFE check, you can save a draft if you need more time to complete the application. Your draft will be available for 30 calendar days from the date you start the preliminary HFE check.

As with the preliminary HFE check, you can save a draft if you need more time to complete the application. Your draft will be available for 30 calendar days from the date you start the preliminary HFE check.

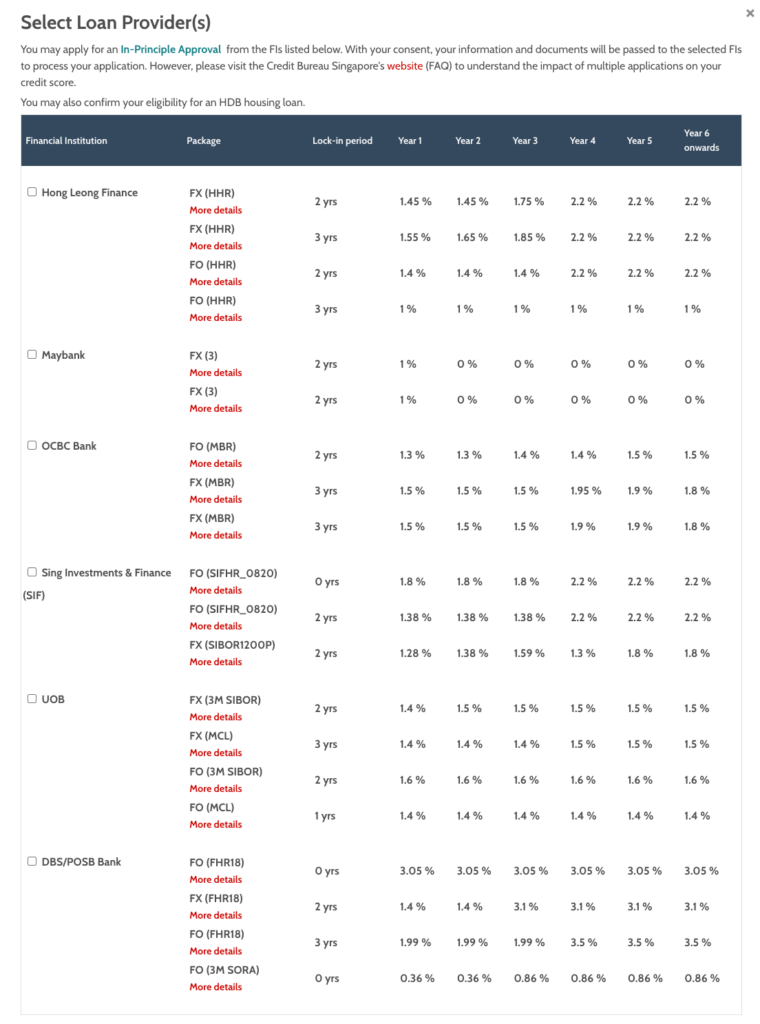

Did you know that you will also be able to compare housing loan packages from HDB and the participating FIs, and request an In-Principle Approval (IPA) for a housing loan from the FIs? The IPA will provide you with the FI’s indicative loan assessment.

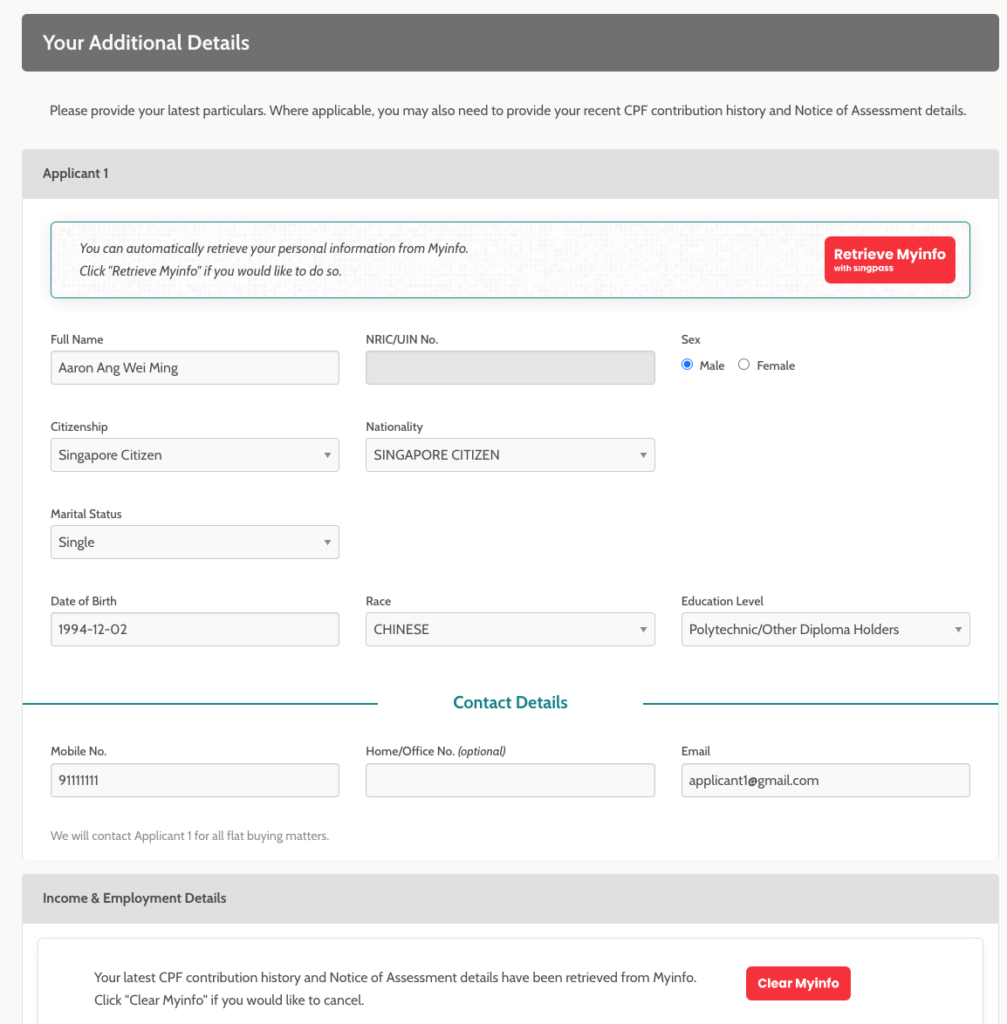

Provide additional details

Next, provide your particulars. To speed things up, you can use Myinfo to retrieve your:

- Particulars and contact details

- CPF contribution history over the past 15 months

- Latest Notice of Assessment from IRAS

Review details

Before submitting your application, review your particulars, income details, and information regarding your household’s ownership of private property declared during your preliminary HFE check. If there are any changes, you must start your preliminary HFE check afresh.

Next, review your chosen financing option and loan provider(s), if you are taking a housing loan. If you need to make any changes, only Applicant 1 can do so by returning to “Choose loan options”.

Finally, please go through the terms and conditions of the application.

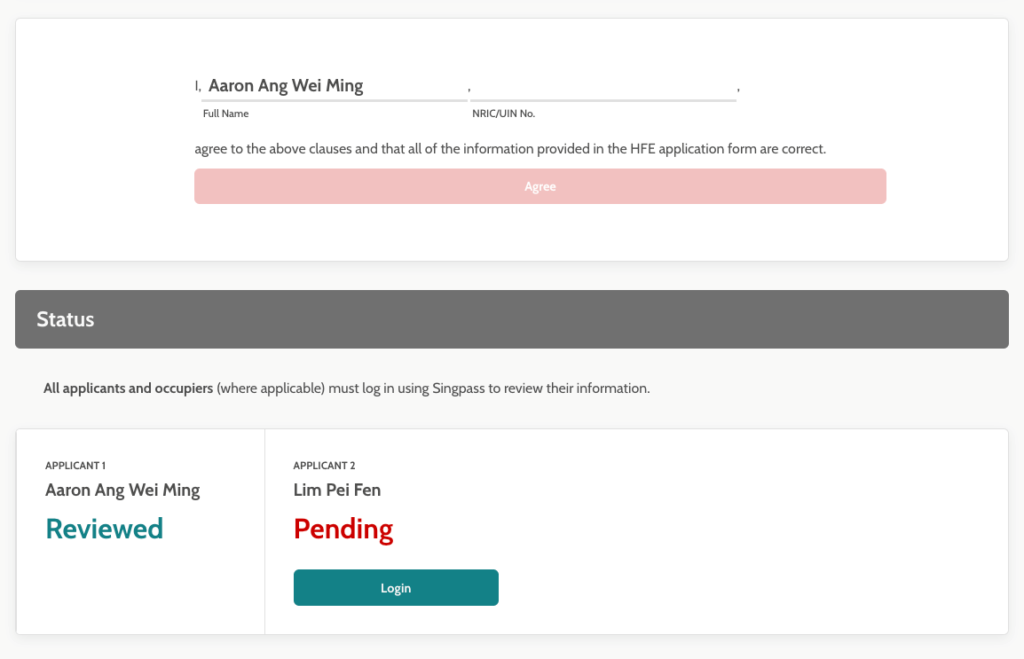

Once you are ready, digitally endorse all the information provided. To submit the application, all applicants and occupiers, if any, must log in using Singpass to verify their details and declarations.

Upload documents

Once all applicants and occupiers have endorsed the application, you will be advised on any supporting documents required.

Submit application

After you have uploaded the required documents and submitted your application, you will see an acknowledgment page. HDB will contact you if any additional information is required for your application. To check the status of your application, you can log in to the HDB Flat Portal at any time.

Typically, HDB will send you the HFE letter within 21 working days of receiving your complete application though the processing time may be longer during peak periods, such as in the months of and before a sales launch.

If you applied for an IPA from the participating FIs, they will liaise with you directly on the outcome of your IPA application. You will be able to confirm the FI’s loan offer through the HDB Flat Portal after securing a flat.

Receive HFE letter

When your HFE letter is ready, you will be notified via SMS to log in to the HDB Flat Portal.

The HFE letter is valid for 6 months.

Registration of HDB Intent to Sell have moved to My Flat Dashboard. Following is the link. https://services2.hdb.gov.sg/web/bp28/TimeLine/my-flat-dashboard

RE: With effect from 9th May 2023, HDB will replace

Home Loan Eligibility(HLE) with HDB Flat

Eligibility(HFE).

HFE streamlines eligibility checks for:

1. Flat Purchase (New or Resale)

2. CPF Housing Grants

3. HDB Housing Loans (Former HLE)

The HFE letter, which will replace the current HDB Loan Eligibility (HLE) letter, will inform flat buyers upfront of their eligibility for a new or resale flat purchase, CPF housing grants, and HDB housing

loan, including the respective grant and loan amounts.

Click here to apply, HDB InfoWEB or through scanning the QR code below.

[1] Second-timers will also be advised on the resale levy/premium payable for the purchase of a second subsidised flat from HDB, if they are eligible for one.

[2] The information provided by the applicants in step 1 will be populated for their confirmation. If there are any changes to the information provided, the applicants may have to start step 1 afresh.

[3] The processing time of an HFE letter application is up to 21 working days. It is expected to be longer during peak periods, such as in the months of and before a sales launch. Flat buyers are advised to apply for an HFE letter early.

[4] The six participating FIs are: DBS Bank Limited, Hong Leong Finance Limited, Maybank Singapore Limited, Overseas-Chinese Banking Corporation Limited, Sing Investments & Finance Limited, and United Overseas Bank Limited.

[5] The FIs will liaise with the flat buyers directly on the outcome of their IPA and LO applications. (You may also contact your Real Estate Salesperson to compare and choose the competitive interest rates)

How your HDB HFE Letter will look.

HDB Grants that remain Unchanged from 9th May 2023.

MOP HDB Sold by Us Recently:

Source: HDB

Source : https://www.mynicehome.gov.sg/hdb-how-to/buy-your-flat/a-guide-to-applying-for-an-hdb-flat-eligibility-hfe-letter/

The post How to apply HDB HFE Steps (9 May 2023) appeared first on Wing Tai Holdings Singapore.

]]>