The post 10 Self-Ask Questions : Is it is worth it to manage your own rental property? appeared first on Wing Tai Holdings Singapore.

]]>

10 Self-Ask Questions is it is worth it to manage your own rental property

1: Develop a comprehensive financial analysis comparing the costs and benefits of self-managing your investment property versus hiring a property management company.

2: Create a checklist of tasks involved in managing an investment property to help determine if you have the time, skills, and resources to effectively self-manage.

3: Research and compare the fees charged by property management companies to the potential savings of self-managing, considering factors like rental income, maintenance costs, and vacancy rates.

4: Interview and gather testimonials from other property owners who have experience with self-managing their investment properties to gain insights into the pros and cons.

5: Seek advice from financial advisors or real estate professionals to evaluate the potential risks and rewards of self-management based on your specific property and financial goals.

6: Consider the level of control and autonomy you desire as a property owner and weigh it against the convenience and time savings offered by a property management company.

7: Evaluate your own skills and knowledge in areas such as tenant screening, lease agreements, rental market analysis, property maintenance, and legal compliance to determine if you can handle these responsibilities effectively.

8: Assess your availability and willingness to handle tenant inquiries, emergency repairs, and other property-related issues outside of regular business hours.

9: Research and familiarize yourself with local landlord-tenant laws and regulations to ensure you can comply with all legal requirements when self-managing your investment property.

10: Consider the potential benefits of building direct relationships with tenants, such as improved communication, better understanding of tenant needs, and the ability to address issues promptly and personally.

Is it worth to Self Manage my investment property? lets dive in. Investing in residential rental property can be a lucrative endeavor, offering the potential for a steady income stream and long-term appreciation. However, it also comes with its fair share of challenges and responsibilities. From finding the right property to dealing with maintenance issues and managing tenants, being a landlord requires a significant investment of time and effort.

But is it all worth it? Is the return on investment (ROI) worth the hours spent dealing with property management tasks? In this article, we will explore the various aspects of managing a leased out property and help you decide if it’s a venture worth pursuing.

Key Takeaways:

- Managing a leased out property requires a significant investment of time and effort.

- Challenges include finding a suitable property, preparing the rental unit, finding and screening tenants, dealing with hassles, and managing maintenance and expenses.

- Hiring a property manager or can alleviate most of the workload.

- Consider the potential returns and the resources available before deciding to manage the property yourself or outsource it to a professional.

- Evaluating your unique circumstances and goals will help determine the best approach to managing your leased out property.

Challenges of Owning a Rental Property

Investing in a residential rental property can be a lucrative endeavor, but it also comes with its fair share of challenges. As a landlord, you will likely encounter various obstacles that require your attention and resources. Understanding and navigating these challenges is essential for successfully managing your rental property.

Maintenance and Repairs

One of the primary challenges of owning a rental property is dealing with maintenance and repairs. As a landlord, you are responsible for ensuring that the property is in good condition and addressing any issues that arise. This could include plumbing problems, electrical issues, or general wear and tear. These maintenance tasks can be time-consuming and require financial investment, which can impact your overall profitability.

Managing Tenants

Another significant challenge is finding and managing tenants. It is crucial to find reliable and responsible tenants who will pay rent on time and take care of the property. This process involves advertising the property, screening potential tenants, and dealing with tenant-related issues such as late payments or property damage. Managing tenants can be demanding and requires excellent communication and problem-solving skills.

Financial Considerations

Running a rental property also involves financial considerations. Besides the initial investment in purchasing the property, you need to budget for ongoing expenses such as property taxes, insurance, and regular maintenance. Additionally, fluctuations in interest rates can impact your mortgage payments and overall profitability. It is crucial to have a solid financial plan and be prepared for unexpected expenses.

While these challenges may seem overwhelming, they can be mitigated with careful planning and understanding of the rental property market. Hiring a property manager and they usually also have their own tracking system or property management systems to streamline some of the tasks and vast network of contractors to alleviate the burden. Ultimately, being aware of the challenges and having strategies in place to overcome them will enable you to maximize the potential returns of your residential rental property.

The Importance of Finding a Suitable Property

When it comes to investing in a residential rental property, finding a suitable property is of utmost importance. The right property can be the foundation for a successful rental business, while the wrong property can lead to headaches and financial loss. So, what exactly makes a property suitable for rental?

Location

The location of a rental property plays a significant role in its appeal to potential tenants. A property that is situated in a desirable neighborhood, close to amenities such as schools, shopping centers, and public transportation, is more likely to attract quality tenants. It’s essential to research the location thoroughly and consider factors such as safety, accessibility, and the neighborhood’s overall reputation.

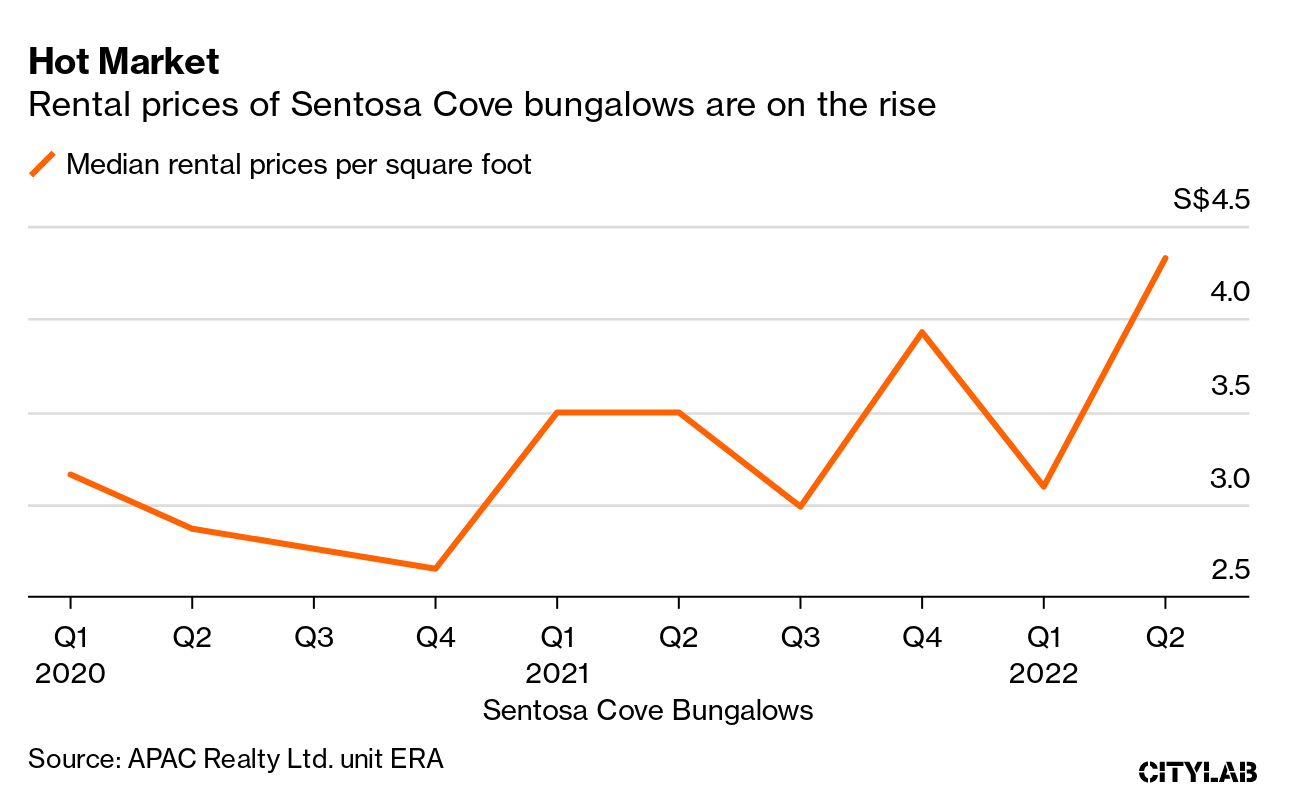

Rental Potential

Assessing the rental potential of a property is crucial for determining its suitability as an investment. Look at the current rental market trends in the area and evaluate the demand and supply dynamics. It’s also important to consider the potential for rental income growth in the future. Analyze the rental rates of similar properties in the vicinity to get an idea of the earning potential.

Renovation and Repair Needs

Before purchasing a property for rental purposes, it’s essential to assess any renovation or repair needs. Consider factors such as the age and condition of the property, the functionality of its amenities, and the overall appeal to potential tenants. Investing in necessary repairs and renovations can increase the property’s value and attract higher-quality tenants.

| Factors to consider when finding a suitable property: |

|---|

| Location |

| Rental Potential |

| Renovation and Repair Needs |

“Finding a suitable residential rental property is crucial for successful property investment. It’s important to consider factors such as location, price, rental potential, and potential renovation or repair needs.”

By thoroughly evaluating these factors, landlords can increase their chances of finding a suitable property that will attract quality tenants and generate consistent rental income. Additionally, hiring a property manager who has expertise in property searches can help streamline the process and ensure that all essential aspects are considered.

Preparing the Rental Unit

Before renting out a property, it is essential to ensure that the rental unit is in good condition and meets the necessary standards. This involves a process of preparing the property to attract potential tenants and provide them with a comfortable living space.

One aspect of preparing the rental unit is conducting necessary renovations or repairs. This may include updating flooring, painting walls, repairing any damaged fixtures, and ensuring that all amenities are in good working order. These preparations not only enhance the appeal of the property but also contribute to its long-term maintenance and durability.

Furthermore, it is important to consider the overall cleanliness and presentation of the rental unit. A well-maintained property sends a positive message to potential tenants, indicating that the landlord values the upkeep of the property and expects the same from their tenants. Cleaning the premises thoroughly and staging the unit with appropriate furnishings and decor can greatly enhance its appeal.

By investing time and effort in preparing the rental unit, landlords can attract high-quality tenants who are more likely to treat the property with care and respect. This can lead to longer tenancies, reduced turnover, and ultimately, greater returns on investment.

Table: Rental Unit Preparation Checklist

| Task | Description |

|---|---|

| Inspect and repair | Identify any maintenance issues and address them promptly. This includes fixing leaks, repairing electrical or plumbing problems, and ensuring that appliances are in working condition. |

| Paint and refresh | Apply a fresh coat of paint to walls and ceilings, as needed. Consider using neutral colors that appeal to a wider range of potential tenants. |

| Clean and sanitize | Thoroughly clean the entire rental unit, including floors, windows, and any installed fixtures. Pay attention to areas such as kitchens and bathrooms to ensure they are hygienic and free from any unpleasant odors. |

| Stage and furnish | Present the rental unit in the best possible light by staging it with appropriate furnishings and decor. This helps potential tenants visualize themselves living in the space and increases its overall appeal. |

| Document condition | Take detailed photographs and notes to document the condition of the rental unit before a new tenant moves in. This will help resolve any disputes or claims for damages that may arise in the future. |

Finding and Screening Tenants

One of the key aspects of managing a residential rental property is finding suitable tenants. The right tenants can help ensure a smooth and profitable rental experience, while problematic tenants can create headaches and financial losses. It’s essential for landlords to take the time to find and screen potential tenants thoroughly.

When it comes to finding tenants, landlords have several options. They can advertise their property on rental listing sites, such as rentalproperty.com or apartmentfinder.com, which attract a wide pool of potential renters. Additionally, real estate companies often have dedicated rental departments that can help landlords find suitable tenants.

Once potential tenants express interest in the property, it is crucial to conduct thorough screenings. This includes checking their credit history, employment status, and references from previous landlords. Landlords may also choose to conduct background checks to ensure that potential tenants have a clean record. This screening process helps to identify responsible tenants who are more likely to pay rent on time and take care of the property throughout their tenancy.

“Finding the right tenants is crucial for the success of a rental property. Thorough screening helps to minimize the risk of non-payment, property damage, and other potential issues.”

Dealing with Rental Property Hassles

Owning a residential rental property comes with its fair share of challenges and occasional headaches. From unexpected maintenance issues to tenant disputes, landlords must be prepared to handle various hassles that can arise. In this section, we’ll explore some common rental property hassles and provide insights on how to effectively address them.

1. Maintenance and Repairs

One of the primary responsibilities of a landlord is to ensure that the rental property is well-maintained and in good condition. However, it’s not uncommon for maintenance issues to occur, such as broken pipes, malfunctioning electrical systems, or leaky roofs. Promptly addressing these issues is crucial to keep tenants satisfied and maintain the value of the property.

Landlords can mitigate maintenance hassles by conducting regular property inspections, scheduling routine maintenance, and promptly responding to repair requests from tenants. It’s also wise to establish relationships with reliable contractors or a maintenance team who can efficiently handle any repairs or maintenance tasks that arise.

2. Tenant-related Issues

While most tenants are respectful and responsible, there may be instances where landlords must deal with difficult tenants. This can include late rent payments, noise complaints, unauthorized alterations to the property, or even eviction proceedings. Resolving tenant-related issues requires clear communication and a firm understanding of tenant rights and local rental laws.

Landlords can minimize tenant-related hassles by carefully screening potential tenants before signing a lease agreement. This includes conducting thorough background and credit checks, contacting references, and verifying employment and income. Additionally, maintaining open lines of communication with tenants and addressing their concerns promptly can help prevent issues from escalating.

3. Legal and Regulatory Compliance

Landlords must navigate various legal and regulatory requirements associated with renting out a property. This can include understanding and adhering to local housing laws, obtaining the necessary permits and licenses, and ensuring compliance with fair housing regulations.

To avoid legal hassles, landlords must stay informed about any updates or changes in rental laws that may affect their obligations. It’s also advisable to consult with legal professionals or join landlord associations that provide guidance and support in navigating legal and regulatory compliance.

By proactively addressing rental property hassles and implementing effective strategies, landlords can minimize the impact of these challenges and ensure a smooth and successful rental experience.

Maintenance and Expenses

Property maintenance is a crucial aspect of owning a residential rental property. Regular upkeep ensures that the property remains in good condition, attracts quality tenants, and protects the landlord’s investment. However, maintenance comes with associated expenses that landlords need to consider when budgeting for their rental property.

Common maintenance expenses include repairs, replacements of appliances, and major projects such as roof repairs. These costs can vary depending on the age and condition of the property. It’s essential for landlords to set aside a portion of their rental income for these expenses to avoid financial strain in the future.

One way to manage maintenance costs more effectively is by conducting regular inspections and addressing any issues promptly. This proactive approach can help prevent minor problems from escalating into more significant and costly repairs. Additionally, establishing a network of reliable and cost-effective contractors can help ensure that maintenance work is carried out efficiently and within budget.

Hiring a Property Manager: Streamlining Rental Property Management

Managing a rental property can be a time-consuming and complex task, requiring landlords to handle various responsibilities such as marketing, tenant selection, maintenance coordination, and rent collection. To alleviate the workload and ensure efficient property management, many landlords opt to hire a property manager. By entrusting these professionals with the day-to-day operations, landlords can focus on other aspects of property investment and enjoy a more passive income stream.

When considering hiring a property manager, there are several key factors to evaluate. Firstly, it’s important to assess the specific roles and responsibilities that the property manager will undertake. This could include tasks such as advertising vacancies, conducting tenant screenings, handling lease agreements, addressing maintenance issues, and collecting rent. A comprehensive agreement should be established to ensure clarity and accountability.

Another crucial consideration is the cost associated with hiring a property manager. Fees is around 4%-6%% of the total rental collected. It’s essential to evaluate the financial impact of these fees on the overall profitability of the rental property. While hiring a property manager comes at a cost, it can be a worthwhile investment for landlords who value their time and prefer a more hands-off approach to property management.

Benefits of Hiring a Property Manager

There are several benefits to hiring a property manager for rental property management. One key advantage is their expertise and experience in the industry. Property managers have extensive knowledge of local rental markets, can effectively market vacancies, and have established networks for tenant screening. They can also handle challenging situations such as eviction processes and legal disputes, ensuring landlords remain compliant with relevant laws and regulations.

Furthermore, property managers can provide peace of mind for landlords by handling the day-to-day operations and responding to tenant needs promptly. They have systems in place to streamline processes, such as online rent collection and maintenance request portals. This level of organization and efficiency can lead to improved tenant satisfaction and retention, reducing vacancies and maximizing rental income.

Overall, hiring a property manager can be a strategic decision for landlords looking to efficiently manage their rental properties. By outsourcing the responsibilities and leveraging the expertise of these professionals, landlords can enjoy the benefits of passive income while ensuring their properties are well-maintained and profitable.

Conclusion – 10 Self-Ask Questions : Is it is worth it to manage your own rental property?

Managing a leased out property requires careful consideration of various factors, including the time and effort involved, potential returns, and available resources. It is crucial for landlords to assess their unique circumstances and goals before deciding on the best approach.

Self-management offers transparency and control over the property but demands a significant investment of time and effort. Landlords must be prepared to handle challenges such as finding a suitable property, preparing the rental unit, finding and screening tenants, addressing maintenance issues, and resolving tenant-related hassles.

On the other hand, hiring a property manager can alleviate the workload but will impact profits. Property managers can handle tasks like marketing, tenant selection, maintenance, and rent collection, allowing landlords to focus on other aspects of property investment.

FAQ

Is the time and effort to manage my leased out property worth it?

The decision to manage a leased out property should be based on careful consideration of the time and effort involved, the potential returns, and the availability of resources such as property management system or hiring a property manager. Each landlord should evaluate their unique circumstances and goals to determine the best approach.

What are the challenges of owning a rental property?

Challenges faced by landlords include finding a suitable property, preparing the unit for rental, finding good tenants, addressing maintenance issues, resolving tenant-related hassles, and navigating changes in interest rates. These challenges can be time-consuming, expensive, and require ongoing attention.

How important is finding a suitable property for rental investment?

Finding a suitable residential rental property is crucial for successful property investment. It’s important to consider factors such as location, price, rental potential, and potential renovation or repair needs. Hiring a property manager can assist in the property search process.

What needs to be done to prepare a rental unit?

Before renting out a property, it may require renovations or repairs to ensure it meets the necessary standards. This could include updating flooring, paint, window screens, and conducting maintenance on amenities. These preparations can be time-consuming and require financial investment.

How can I find and screen tenants for my rental property?

Landlords can utilize rental listing sites, real estate companies, and personal networks to advertise their property.

What difficulties might arise when managing a rental property?

Even with good tenants and well-maintained properties, landlords may face various hassles such as broken pipes, maintenance requests, and disputes over damages. Dealing with challenging tenants can add to the stress. Landlords may need to address these issues promptly to minimize the negative impact on their property and tenants.

What expenses should I expect when maintaining a rental property?

Maintaining a rental property can involve significant expenses, including repairs, replacement of appliances, and major maintenance projects like roof repairs. Landlords should budget for these costs and consider how they may impact their profits. Expenses such as landlord insurance and additional stamp duty charges should also be factored in.

Should I consider hiring a property manager?

Hiring a property manager can alleviate the time and effort required to manage a rental property, but it will come at a cost. Property managers can handle tasks such as marketing, tenant selection, maintenance, and rent collection. It’s important to carefully consider the roles and responsibilities of the property manager and assess their fees.

What should be considered when managing a leased out property?

The decision to manage a leased out property should be based on careful consideration of the time and effort involved, the potential returns, and the availability of resources such as property management software or hiring a property manager. Self-management can provide transparency and control but requires significant time investment, while hiring a property manager can alleviate the workload but impact profits. Each landlord should evaluate their unique circumstances and goals to determine the best approach.

The post 10 Self-Ask Questions : Is it is worth it to manage your own rental property? appeared first on Wing Tai Holdings Singapore.

]]>The post Common Tenancy Disputes in Singapore appeared first on Wing Tai Holdings Singapore.

]]>Common Tenancy Disputes in Singapore

Tenancy disputes between landlords and tenants are a common occurrence in Singapore, often arising from various issues that can strain the landlord-tenant relationship. These disputes can escalate and result in legal actions being taken by either party. Some of the most common disputes in Singapore include:

- Failure to pay rent: This occurs when tenants do not fulfill their financial obligations by not paying the agreed-upon rent on time.

- Damages caused to premises: Tenants may cause damage to the property either intentionally or unintentionally, leading to disputes over responsibility for repair costs.

- Refusal to leave after lease termination: Some tenants may refuse to vacate the premises even after their lease has ended, leading to disputes over possession.

- Subletting of premises to a third party: If tenants sublet the premises without the landlord’s consent, it can create disputes regarding unauthorized occupants and potential lease violations.

- Withholding deposit by landlords: Landlords withholding the tenant’s deposit without valid reasons can lead to disputes over the return of the deposit.

These disputes often require legal intervention and can result in financial losses, stress, and strain on both parties involved. It is important for landlords and tenants to be aware of their rights and responsibilities and to take proactive steps to prevent these disputes from escalating.

“Tenancy disputes often require legal intervention and can result in financial losses, stress, and strain on both parties involved.”

To effectively handle these disputes, clear communication and documentation are crucial. Landlords should ensure that they have a comprehensive tenancy agreement in place that outlines the rights and responsibilities of both parties. It is also important for landlords and tenants to maintain open lines of communication and address any issues or concerns promptly. If a dispute does arise, seeking legal advice can help guide landlords and tenants through the resolution process.

By understanding the common tenancy disputes in Singapore and taking proactive measures to address them, landlords and tenants can mitigate the risk of disputes and maintain a harmonious landlord-tenant relationship.

The Tenancy Agreement

The tenancy agreement is a crucial document that outlines the terms and responsibilities of both the landlord and tenant. It serves as a legally binding contract that establishes the rights and obligations of each party throughout the tenancy period.

Within the tenancy agreement, various terms are typically included to ensure a smooth and mutually beneficial relationship between the landlord and tenant. These terms may cover aspects such as:

- The duration of the tenancy

- The amount and frequency of rent payments

- The responsibilities of the landlord, such as property maintenance and repairs

- The tenant’s obligations, including keeping the property clean and not causing damage

- The rules regarding subletting and pets

- The process for terminating the tenancy

By clearly specifying these terms within the tenancy agreement, both parties can have a clear understanding of their rights and responsibilities, which helps prevent disputes and misunderstandings from arising. It is important for both landlords and tenants to carefully review and understand the terms of the agreement before signing it.

Ending a Tenancy Early

When situations arise that necessitate ending a tenancy before the agreed term, both landlords and tenants must follow the appropriate procedures to ensure a smooth transition. The first step is to provide the appropriate notice to quit the tenancy, which varies depending on the duration of the tenancy. Typically, the notice period can be inferred from the frequency of rent payments. For example, if rent is paid on a monthly basis, a one-month notice period is usually required. However, it is crucial for both parties to review the tenancy agreement to determine the specific notice requirements.

If a tenant wishes to terminate the tenancy early, they must seek the landlord’s consent and may be required to provide monetary compensation. This compensation is often referred to as a “break lease fee” and is intended to cover the costs associated with finding a new tenant. The amount of the fee is typically outlined in the tenancy agreement and should be discussed between the landlord and tenant before a decision is made.

“The notice period for ending a tenancy early should always be in accordance with the tenancy agreement. It is important for both landlords and tenants to communicate effectively and reach a mutual agreement to avoid any disputes,” advises John Tan, a property lawyer in Singapore.

Once the notice period has passed, both parties should conduct a thorough inspection of the property to assess its condition and settle any outstanding financial matters, such as the return of the security deposit. It is crucial for the landlord to provide a detailed account of any deductions from the security deposit and for the tenant to inspect the property to ensure that it is left in the same condition as when they first moved in.

Key Takeaways:

- Ending a tenancy early requires the appropriate notice to quit the tenancy, which should be in accordance with the tenancy agreement.

- Tenants wishing to terminate the tenancy early may need to obtain the landlord’s consent and pay a break lease fee.

- A thorough inspection of the property should be conducted by both parties after the notice period has passed to settle any outstanding financial matters.

Evicting Tenants

When tenants breach the terms of a tenancy agreement, landlords may need to evict them to regain possession of the premises. One common method of eviction is through forfeiture, which allows the landlord to repossess the property either through peaceful entry or by applying to the court. However, specific legal proceedings must be followed to ensure a lawful eviction.

The eviction process begins with the inclusion of a right of re-entry clause in the tenancy agreement. If a tenant breaches the agreement – for example, by failing to pay rent – the landlord must serve a notice specifying the breach and the desired remedy. The tenant then has the right to apply to the court for relief against forfeiture, which may result in legal proceedings to determine the outcome.

In order to legally re-enter the premises and regain possession, landlords may need to go through further legal proceedings. These proceedings involve applying to the court for a possession order, which grants the landlord the right to evict the tenant. It is important for landlords to follow the necessary steps and seek legal advice to ensure a proper eviction process.

“Evicting tenants through forfeiture requires careful adherence to legal procedures to avoid potential complications or disputes.”

| Stage | Process |

|---|---|

| 1. | Include a right of re-entry clause in the tenancy agreement. |

| 2. | Serve a notice specifying the breach and desired remedy to the tenant. |

| 3. | Tenant has the right to apply to the court for relief against forfeiture. |

| 4. | Landlord applies to the court for a possession order. |

| 5. | Court grants the possession order, allowing the landlord to evict the tenant. |

The eviction process can be complex and time-consuming. It is essential for landlords to understand their legal rights and obligations, as well as seek professional legal advice when necessary. By following the proper legal procedures, landlords can ensure a smooth eviction process and regain possession of their property.

Collecting Unpaid Rent

In the unfortunate event that a tenant fails to pay rent, landlords have legal options available to them for collecting unpaid rent. One such option is the right to distress, which allows landlords to seize and sell the tenant’s goods in order to recover the outstanding rent.

To exercise the right to distress, landlords must first obtain a writ of distress, which specifies the amount of unpaid rent. Once the writ of distress is obtained, the landlord can send a notice of seizure of goods to the tenant, stating their intention to sell the seized goods to offset the unpaid rent. The tenant then has five days to respond or pay the outstanding amount.

If the tenant fails to respond or pay within the specified time, the landlord can proceed with the sale of the seized goods. However, it is important to note that tenants have the right to apply to the court for a restraining order against the sale of their goods.

| Steps to Collect Unpaid Rent |

|---|

| 1. Obtain a writ of distress |

| 2. Send a notice of seizure of goods to the tenant |

| 3. Tenant has five days to respond or pay the outstanding amount |

| 4. If no response or payment, proceed with the sale of the seized goods |

Landlords should act promptly when it comes to collecting unpaid rent and not delay in exercising their right to distress. By following the proper legal procedures and seeking professional advice if needed, landlords can effectively recover the unpaid rent and protect their financial interests.

Legal Recourse for Landlords in Tenancy Disputes

When facing disputes with difficult tenants, landlords in Singapore have legal recourse to protect their rights and resolve the issues. Understanding the options available can help landlords navigate tenancy disputes effectively and find resolutions. Some of the common legal recourses for landlords in tenancy disputes include:

- Breach of Contract: If a tenant fails to fulfill their obligations as stated in the tenancy agreement, such as paying rent or causing damage to the property, the landlord can sue them for breach of contract. By seeking legal action, landlords can seek damages for any losses incurred.

- Recovery of Premises: Landlords can apply to the court to recover possession of the premises if the tenant fails to pay rent, causes damage to the property, or sublets without consent. This legal recourse allows landlords to regain control of their property.

- Exercise Right to Distress: In the event of unpaid rent, landlords can exercise their right to distress. This allows them to seize goods owned by the tenant to sell in order to recover the unpaid rent. However, landlords must follow the proper legal procedures and serve the necessary notices before proceeding with the sale of seized goods.

It is important for landlords to gather evidence, review the tenancy agreement, and seek legal advice to navigate the legal process effectively. By understanding their legal rights and options, landlords can protect their interests and find appropriate solutions to tenancy disputes.

Table: Legal Recourse for Landlords in Tenancy Disputes

| Recourse Options | Description |

|---|---|

| Breach of Contract | If a tenant fails to fulfill their obligations stated in the tenancy agreement, the landlord can sue them for breach of contract and seek damages for any losses incurred. |

| Recovery of Premises | Landlords can apply to the court to regain possession of the premises if the tenant fails to pay rent, causes damage to the property, or sublets without consent. |

| Exercise Right to Distress | Landlords can exercise their right to distress to seize goods owned by the tenant and sell them to recover unpaid rent. Proper legal procedures and notices must be followed. |

By utilizing these legal recourses, landlords in Singapore can address tenancy disputes effectively and ensure their rights are protected. Seeking professional advice and assistance when necessary can help landlords navigate the legal process with confidence.

Importance of Tenancy Agreements in Resolving Disputes

Tenancy agreements play a crucial role in resolving disputes between landlords and tenants. By clearly outlining the rights and responsibilities of both parties, the agreement serves as a reference point for addressing any issues that may arise during the tenancy. Understanding the terms within the tenancy agreement can help prevent disputes and provide a foundation for resolving any conflicts that do occur. It is important for landlords and tenants to carefully review and understand the terms of the agreement before entering into a tenancy.

The tenancy agreement serves as a legal document that specifies the obligations and expectations of both the landlord and the tenant. It covers important details such as the duration of the tenancy, rental payment terms, maintenance responsibilities, and any specific rules or restrictions. By having a well-drafted and comprehensive agreement in place, both parties have a clear understanding of their rights and obligations. This can help minimize misunderstandings and disagreements, and provide a basis for resolving any disputes that may arise.

In the event of a dispute, the tenancy agreement can serve as evidence to support the claims of either party. It can help establish the agreed-upon terms and determine whether any breaches or violations have occurred. The terms within the agreement can be used to guide negotiations or discussions to reach a resolution. If necessary, the agreement can also be used as a basis for legal recourse, such as filing a breach of contract claim or seeking remedies in court. Overall, the tenancy agreement plays a crucial role in ensuring a fair and smooth rental experience for both landlords and tenants.

Key Terms in a Tenancy Agreement

| Term | Description |

|---|---|

| Term of tenancy | Specifies the duration of the tenancy, whether it is for a fixed term or on a month-to-month basis. |

| Rental payment | Outlines the amount and frequency of rent payments, as well as the acceptable methods of payment. |

| Security deposit | Defines the amount of the security deposit, its purpose, and the conditions for its refund or deduction. |

| Maintenance responsibilities | States the responsibilities of the landlord and the tenant for maintaining the property and making repairs. |

| Termination terms | Specifies the notice period required for terminating the tenancy, as well as any penalties or fees for early termination. |

Benefits of a Well-Drafted Tenancy Agreement

- Provides clarity and prevents misunderstandings

- Establishes legally binding obligations

- Serves as evidence in case of disputes

- Protects the rights and interests of both parties

- Provides a framework for resolving conflicts

Conclusion

In conclusion, demanding tenants can present challenges for landlords, leading them to consider selling their property. However, before making such a decision, landlords should explore various ways to handle demanding tenants and protect their rights. By understanding the types of tenancies in Singapore, the importance of the tenancy agreement, and the legal recourse available, landlords can navigate tenancy disputes more effectively.

One way to handle demanding tenants is by properly ending a tenancy. Landlords and tenants should review their tenancy agreement to determine the specific notice requirements for ending the tenancy early. By providing appropriate notice and, if necessary, obtaining the tenant’s consent and/or requiring monetary compensation, landlords can ensure a smooth transition.

In cases where eviction is necessary, landlords can pursue legal proceedings through forfeiture to regain possession of the premises. By including the right of re-entry in the tenancy agreement and serving a notice of breach and desired remedy, landlords can initiate the eviction process. It’s important to note that tenants have the right to apply to the court for relief against forfeiture.

Another challenge that landlords may face is collecting unpaid rent. Landlords can exercise their right to distress under the Distress Act by obtaining a writ of distress to claim unpaid rent. By following the proper procedures, including sending a notice of seizure of goods to the tenant, landlords can recover the arrears through the sale of seized goods.

Table: Ways to Handle Demanding Tenants

| Approach | Description |

|---|---|

| Properly ending a tenancy | Review the tenancy agreement for notice requirements and obtain necessary consent or compensation. |

| Evicting tenants through forfeiture | Include the right of re-entry in the tenancy agreement and serve a notice of breach and desired remedy. |

| Collecting unpaid rent | Exercise the right to distress by obtaining a writ of distress and following the necessary procedures to recover unpaid rent. |

By considering these various approaches, landlords can effectively handle demanding tenants and protect their property. It is crucial for landlords to stay informed about their rights and seek legal advice when necessary. By taking proactive measures and having a clear understanding of the legal processes involved, landlords can make informed decisions and find solutions to tenant issues.

Conclusion

Dealing with demanding tenants can be a challenging experience for landlords. The difficulties posed by these tenants may lead to a decision to sell the property. However, it is important for landlords to explore their options and understand their rights before taking such a drastic step.

By terminating the tenancy early, evicting tenants, or collecting unpaid rent, landlords can address the issues caused by demanding tenants effectively. It is crucial for landlords to carefully review the tenancy agreement, seek legal advice, and maintain open communication with the tenants. These proactive steps can help in finding the best solution for the property while protecting the landlord’s rights.

While property sales due to challenging tenants may seem like the only option, it is advised that landlords exhaust all available avenues before making such a drastic decision. Understanding the reasons for selling the property and exploring ways to handle demanding tenants can help landlords make informed choices and find the most suitable resolution.

FAQ

What is a tenancy agreement?

A tenancy agreement is a legal document that transfers the interest in a property from the landlord to the tenant, giving the tenant exclusive possession of the premises for a specific term at a determined rent.

What types of tenancies are there in Singapore?

The types of tenancies in Singapore include leases and licenses. Leases give tenants more rights and the ability to sue for certain issues, while licenses are personal arrangements for short periods of time.

How can a tenant terminate a tenancy early?

To terminate a tenancy early, either the landlord or tenant must provide appropriate notice to quit the tenancy. The length of the notice period is usually inferred from the rent payment frequency and can be found in the tenancy agreement.

How can a landlord evict a tenant?

Landlords can evict tenants who breach the tenancy agreement through forfeiture. This requires a written demand and, if necessary, legal proceedings to regain possession of the premises.

What can landlords do to collect unpaid rent?

Landlords can exercise their right to distress under the Distress Act, which allows them to claim up to 12 months of unpaid rent by seizing and selling the tenant’s goods.

What are some common tenancy disputes in Singapore?

Common tenancy disputes include failure to pay rent, damages caused to the premises, refusal to leave after lease termination, subletting without consent, and withholding of the tenant’s deposit without valid reasons.

What legal recourse do landlords have in tenancy disputes?

Landlords can take legal action through breach of contract claims, applying to the court for possession of the premises, and exercising the right to distress to recover unpaid rent.

How important are tenancy agreements in resolving disputes?

Tenancy agreements are crucial in resolving disputes as they outline the rights and responsibilities of both the landlord and tenant. They serve as a reference point for addressing issues that may arise during the tenancy.

The post Common Tenancy Disputes in Singapore appeared first on Wing Tai Holdings Singapore.

]]>The post Landlord who is considering renting their apartments to Co-living companies | Co-Living Operators in Singapore appeared first on Wing Tai Holdings Singapore.

]]>2. What are the benefits of co-living and how does it work.

3. How do I know if my property would be a good fit for co-living.

4. What should I consider before signing up with a company that offers co-living services.

5. Is there anything else you would like me to think about before making this decision for my building.

6. Thank you, landlord! We hope to hear from you soon!

CO-LIVING operators in Singapore are largely unfazed by the Covid-19 pandemic crisis. They say that their expansion strategies remain on track, despite not being able to expand at full force for now due a moderation of business activities and some mothballing plans from companies who cannot afford such luxuries right now as they recover financially or wait out this major setback with optimism about its endgame outcome.

Residing business owners express confidence about how well things will turn around eventually, thanks primarily because there’s no need for drastic cuts back when you have so many other opportunities ahead, which makes more sense than closing down completely while waiting indefinitely.

For those living in Singapore, the idea of co-living has become more and more appealing. With an expanding demographic that is young or mobile but not too bothered about expensive housing prices;

The number of operators here is growing fast, tapping into this growing demographic looking for hassle-free accommodations without having much time on their hands because work takes up so much energy these days.

This means not having to deal with meticulous landlords, security deposits and long leases! The company takes on the responsibilities of designing an interior apartment from scratch while also redesigning it stylishly before marketing it as its brand to attract tenants who want nothing but style. The co-living business model is a win/win for all involved and provides an affordable option for young professionals or expats who want to live close.

Property Fit for Co-Living: Is Yours Ideal?

As the co-living trend gains momentum in Singapore, landlords need to evaluate whether their property aligns with the requirements of this burgeoning housing concept.

To tap into the growing demand for hassle-free living among professionals and expatriates, consider the following factors when determining if your property is well-suited for co-living arrangements:

Space Utilisation and Scalability

Co-living spaces thrive on efficient space utilisation. Assess whether your property has ample communal areas and well-defined private spaces. A balance between shared and individual spaces is crucial to creating a harmonious co-living environment.

You should also assess if your property can accommodate multiple tenants without compromising comfort. The scalability of your property determines its potential to generate higher rental income through co-living.

Location Advantage

Proximity to business districts, universities, and transportation hubs is crucial. Co-living residents seek convenience, so a property near essential amenities and easy commuting options holds significant appeal.

Alt text: co-living in SG with easy transportation access

Amenities and Facilities

Evaluate the amenities your property offers. Co-living spaces often have shared facilities such as lounges, kitchens, and recreational areas. A property with versatile amenities enhances the co-living experience.

Properties with modern furnishings and stylish aesthetics have a higher appeal. Co-living providers often focus on visually appealing interiors that create a comfortable and attractive living environment.

Accessibility, Safety, and Security

Ensure that your property is accessible to individuals with varying mobility needs. Elevators, ramps, and appropriate entryways create an inclusive and welcoming co-living environment.

Safety and security are also paramount in co-living spaces. Adequate lighting, secure entry points, and functional fire safety measures are essential to reassure residents about their well-being.

Privacy and Noise Management

Consider how the property layout affects privacy and noise levels. Well-designed private spaces and soundproofing measures ensure that co-living residents can enjoy both communal interactions and quiet moments.

Maintenance and Management

Co-living arrangements require efficient maintenance and management. Consider whether your property management processes can support co-living demands, including timely repairs and regular upkeep.

By critically evaluating these factors, you can gauge whether your property is a suitable candidate for co-living arrangements. Catering to the needs and preferences of professionals and expatriates seeking hassle-free living experiences positions your property for success in the co-living market.

Choosing a Co-living Partner: Key Considerations

Partnering with a co-living management service team can be a strategic move to optimise your property investment while offering stylish and convenient housing options. However, before taking this step, evaluating potential partners is crucial. Here are the key considerations to ensure a successful and mutually beneficial collaboration:

Reputation and Track Record

Research the reputation and track record of the co-living service provider. Look for reviews, testimonials, and their history in the industry to gauge their credibility and reliability.

Tenant Profile and Compatibility

Understand the tenant profile that the co-living partner attracts. Ensure it aligns with your property’s target audience to maximise occupancy and tenant satisfaction.

Property Maintenance and Upkeep

Inquire about how the co-living partner manages property maintenance and repairs. A well-maintained property ensures tenant satisfaction and protects your investment.

Lease Terms and Agreements

Review the lease terms and agreements thoroughly. Ensure they protect your rights as a landlord and outline clear responsibilities for both parties.

Marketing and Tenant Acquisition

Discuss the co-living partner’s marketing strategies for tenant acquisition. A robust marketing approach ensures a steady stream of tenants for your property.

Financial Transparency

Transparent financial practices are essential. Understand how rental income is shared, expenses are managed, and how financial matters are communicated.

Legal and Regulatory Compliance

Ensure that the co-living partner adheres to local laws and regulations. Compliance is crucial to avoid legal issues that could impact your investment.

Tenant Screening Process

Inquire about the tenant screening process the co-living partner employs. A rigorous screening process ensures reliable and responsible tenants.

Communication and Accessibility

Clear and open communication is vital. Choose a partner who is responsive, accessible, and maintains effective communication channels.

By carefully considering these factors, you can make an informed decision when choosing a co-living partner.

Conclusion

Landlords, if you are tired of renting your property to numerous tenants, seeking to lease your property or a company within the co-living industry aiming to expand, our team of property management experts is here to assist you. With extensive knowledge of residential and corporate spaces, we exceed current tenants’ needs in location, size, and amenities on each floor plan.

Furthermore, our real estate agency’s reputable management oversight ensures tenant satisfaction during their stay and long after. However, suppose you’re still deciding whether to rent out rooms on your own or entrust the task to a property manager or co-living operators. In that case, we invite you to read our article before deciding.

One option for landlords is Co-living options in Singapore! An agency like us with pools of clients that we can trust and recommend will be a lot more safeguarded, especially when they are worth millions of dollars or more at risk.

We can shortlist the appropriate ones for your property and ensure that everything goes smoothly in this process by being professional throughout it all!

If you are a landlord looking to lease out your property or companies in the co-living industry looking to expand, our team of experts can help. We have extensive knowledge in residential properties and corporate spaces that exceed current needs for tenants across various areas such as location, size and amenities available on each floorplan; what’s more, they provide reputable management oversight that ensures tenant satisfaction not only now but long after their stay has ended!

The post Landlord who is considering renting their apartments to Co-living companies | Co-Living Operators in Singapore appeared first on Wing Tai Holdings Singapore.

]]>The post Maximize Rental Income: 6 tips to Increase Rent Without Losing Tenants in Singapore appeared first on Wing Tai Holdings Singapore.

]]>As a landlord, it’s important to periodically review the rental rates of your properties in order to ensure that you’re receiving fair compensation for your investment.

However, increase rent can be a delicate balancing act – you don’t want to risk losing your tenants, but you also don’t want to leave money on the table.

In this article, Wing Tai Holdings will give you some tips for raising the rent without alienating your tenants.

1. REVIEW THE RENTAL MARKET

Before raise the rental, it’s important to do your research and make sure that your proposed rent increase is in line with the market.

Check out rental listings for similar properties in your area to get an idea of what your competition is charging.

You can also have a look at this blog, where we update latest information about rental market in Singapore 2023:

Rental Market in Singapore 2022-2023

2. GIVE AMPLE NOTICE

In Singapore, landlords are required to give tenants at least one month’s notice before raising the rent.

However, it’s a good idea to give tenants even more notice than that – aim for at least two to three months.

This gives your tenants time to prepare for the increase and decide whether they want to renew their lease or seek out a new rental.

3. BE TRANSPARENT (how to raise rent without losing tenants)

When notifying your tenants of the rent increase, be transparent about your reasons for doing so.

Explain any increases in operating costs, property taxes, or other expenses that have led you to raise the rent.

By being upfront about the reasons for the increase, you can help alleviate any resentment or mistrust that your tenants may feel.

4. OFFER INCENTIVES

One way to soften the blow of a rent increase is to offer your tenants some incentive for renewing their lease.

You can benchmark the current asking prices in the same project and offer a rent out slightly lower.

By sweetening the deal, you may be able to convince your tenants to stay despite the higher rent. It will still be advisable to work with an active property agent that knows

how the market is moving and to get inside information of the transactions that is not known to the public data yet.

5. CONSIDER A GRADUAL INCREASE (Increase Rent)

If you’re hesitant to raise the rent too much at once, you could consider a gradual increase over time.

For example, you could raise the rent by 5% every year for the next three years.

This allows your tenants to adjust to the higher rent slowly rather than being hit with a large increase all at once.

6. MAINTAIN GOOD COMMUNICATION

Throughout the rent increase process, it’s important to maintain good communication with your tenants.

Encourage them to voice any concerns or questions they may have, and be responsive to their needs.

By fostering a positive and open relationship with your tenants, you may be able to mitigate any negative feelings about the rent increase.

7. CONSIDER OFFERING A PAYMENT PLAN

If your tenants are struggling to pay the higher rent, consider offering them a payment plan.

This could involve splitting the increase into smaller monthly payments, or delaying the increase for a few months to allow your tenants to get their finances in order.

By being flexible and accommodating, you may be able to retain your tenants despite the rent increase.

You may have many questions when persuading renters to accept the new price.

This blog contains common Q&A and tips for landlords who want to increase rent:

Q&A for Landlord who wants to raise rent

Raising the rent can be difficult for landlords,

but with the right approach, it doesn’t have to mean losing tenants.

Besides raising the rent, there are other tips to maximize your rental income:

https://buycondo.sg/maximise-rental-income-singapore/

We hope you found this helpful and wish you success in your rental business!

If there is any difficulty in managing your property, feel free to contact us at the phone number +65 94507545 or email info@wingtaiholdings.sg to get free advice from our professional team!

The post Maximize Rental Income: 6 tips to Increase Rent Without Losing Tenants in Singapore appeared first on Wing Tai Holdings Singapore.

]]>The post Expert Advice on Renting Out Property When Relocating Overseas: 8 Essential Steps appeared first on Wing Tai Holdings Singapore.

]]>Q&A: My family and I are temporarily relocating overseas because of work, 3-5 years in a neighboring country. I plan to rent out my property but I’m not sure about what I should prepare. Can you give me some advice?

RE: Renting out your property during your overseas relocation. You are looking for a Property Manager to assist you.

There are numerous motivations to gather your belongings and embark on a new adventure elsewhere, but the process of renting out your home while you’re away doesn’t always come with an easy solution.

Whether your relocation takes you across the country or to a different corner of the globe, changing your place of residence can present an exciting opportunity. However, it also brings along its fair share of challenges and anxieties.

For individuals moving overseas, the pre-departure checklist can be extensive and exhausting. On top of that, homeowners face the additional pressure of finding suitable tenants to occupy their house during their absence.

Your Property can be resale property that you have been staying or newly purchased.

There are numerous things to be prepared by Landlord:

First, Identify a Real Estate Salesperson that offers professional advice with social proof. He/she needs to be equipped with a portfolio of rental properties to ensure one is experienced in handling all situations, such as damages, theft, or loss of rental income. If they have a team of Insider Sales would be highly recommended because of the intensity of the work involved. One individual may not be able to cope with juggling tasks concurrently. The insider sales team can help to supervise and deal with paperwork and coordination. The property is ready to be rented out after completing this checklist, which our staff will support you along the way:

Checklist of Renting Out Your Property when Relocating Overseas

1) Photos are taken for marketing purposes. They should clearly show the apartment’s inside, outside, overview and details.

2) Make good your Fixtures and Fittings, such as loose cabinet doors or shower hoses to create and better impression to the tenants and earn better rental income. The curtain and AC also need to be dry cleaned with receipts before handing over.

3) Decide what you will bring overseas or leave behind, Carousell it or give it away? Whether you want just to provide basic appliances, such as fridge, oven, and washing machine. if you are leaving behind your pieces of furniture, or to make it-is basis or you want to explore having a list of to buy furniture to make it a complete fully furnished apartment staged and to create a good impression on potential renters. Usuaully the appointed property agent will assist in preparing an inventory list of the fixtures, fittings, and furniture provided in the rental property.

4) Appointments between landlords and tenants are arranged for the consent letter provided by CEA (Council for Estate Agencies). It specifies the terms and conditions of the tenancy, including the rent, security deposit, duration of the lease, and other provisions related to the use and occupancy of the property. You can find further information about listing market price in this blog:

Rental Market in Singapore 2022-2023

or detailed instruction about CEA form by the Singapore government:

CEA form detailed instruction 2023

5) Conduct tenant screening, including background checks and credit checks, to ensure that the tenant is reliable and can afford the rent.

6) Prepare two access cards ( Ideally Min 2 set even for Studio apartments, More for larger units) and keys for the future tenant, and explain the Condo rules and regulations they must follow.

7) Remind the prospective tenant to insure their own personal chattels because the landlord will usually only have fire insurance with basic coverage in case of any hazards.

8) Virtual Tour to Represent the property correctly and another window to reach out to expats tenants that are looking for properties in Singapore. You will be surprised that some tenants is willing to commit just based on the Virtual Tours and a walkthrough Video Q&A.

Here is just an overview of the renting-out process. There will be more things to do depending on your specific cases. Please contact us at the phone number (+65) 9450 7545 to receive A to Z guidelines and support.

Property Manager in Singapore.

FAQ:

Do you also Lease out HDB and Commercial Properties?

Yes We Do. Please note if you own a HDB and relocate to Overseas. You will need to Appoint a POA to sign the documents on your behalf. Even though if you can do E-signing, HDB still wants the Home Owner to appoint a POA to have a point of contact when comes to emergencies. It is not compulsory if you own a Private Property and you want to lease or sell your property.

Best luck to you!

The Wing Tai Holdings Team

The post Expert Advice on Renting Out Property When Relocating Overseas: 8 Essential Steps appeared first on Wing Tai Holdings Singapore.

]]>The post Aircon Not Cold issues. Tips to Landlords and the Tenants. appeared first on Wing Tai Holdings Singapore.

]]>WING TAI HOLDINGS Team is doing property management for Property Owners since 2009; these are common issues occurring to properties, especially when the age of the property increases.

Often the time, landlords will have concerns, and the first few questions are usually to be asked if the tenant has maintained the Quarterly Servicing as per contract and if they have kept the receipts history.

Property Management service will include liaising, coordinating and addressing the cause and problem before we provide efficient solutions.

Action steps is usually the following to resolve the issue.

- Topping Up of Gas.

- Chemical Cleaning of Fancoil /Ducted and Outdoor Condenser.

- Pressure test or straight to replace the whole aircon system with/out the insulation pipes.

Before that, Consider the Troubleshooting Process and Resolutions.

- 1st Step would be checking the condition of the Air-conditioning.

- 2nd Step would be to propose Chemical Cleaning and Topping Up of Gas.

- If the Aircon is not cold after one or two months later,

- 3rd Step-Pressure Test. ( During this test, 2-3 Days not able to turn on the air-con)

- 4th Step-Results will show if the current pipes/Condenser has any gas leaks. Usually at this point, contractors will not propose to mend/repair the pipes and will suggest replacing and running conceal pipes whenever possible and partially with exposed pipe when it has to. (Especially for Condos, Contract will need to do a Site visit to see how the existing insulation and drainage pipes is being set up previously. ( Pls note that Site Inspections can be chargeable depending on relationships with the Aircon Contractors)

- Replace the whole system and or the whole system with new insulation pipes. (Some landlords may consider replacing with 2nd condensers/fancoils depending on the problems)

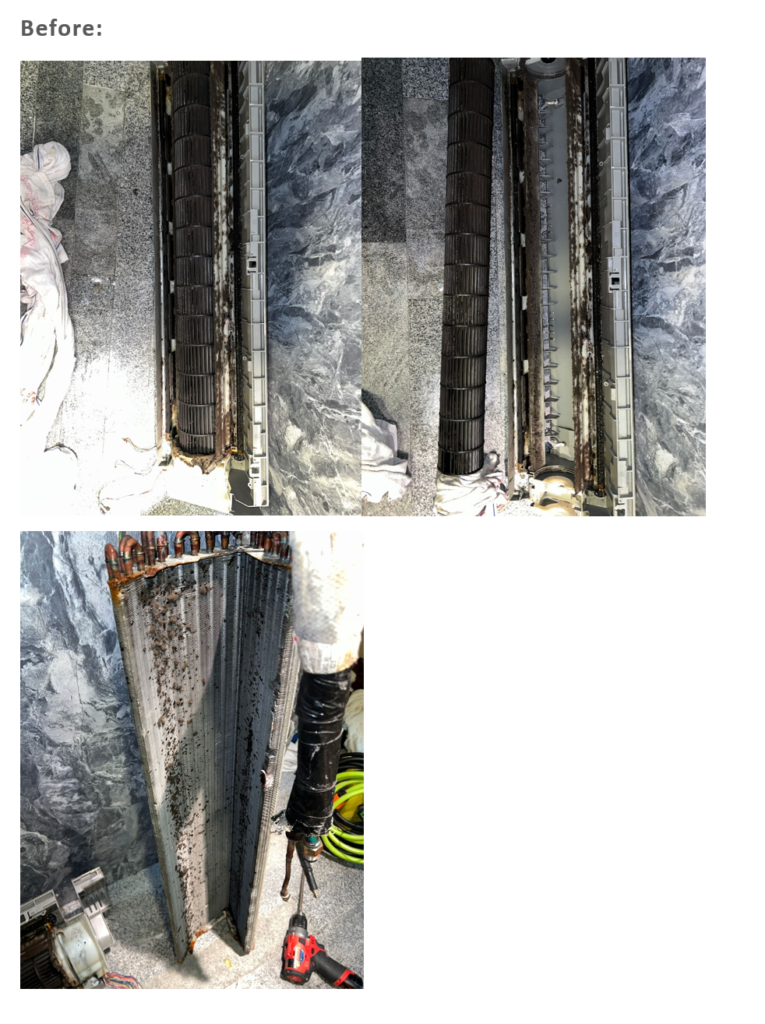

1 Bedroom apartment, 8 at Mount Sophia, when we assisted in achieving a good settlement between to the tenant and landlord.

We opted for the Professionals to do a Chemical Cleaning for the fancoil units.

Existing State of Fancoil ( With rust, dirt and “Jelly”)

Cleaning in Process ( The Fancoil is dismantle totally from the wall mount)

Other Aircon Common Problems

- Aircon not cooling could be due to a dirty air filter, blocked condenser, or low refrigerant levels. Try cleaning or replacing the air filter, removing any debris from the condenser unit, and checking the refrigerant levels.

- Strange noises: If you hear unusual sounds coming from your aircon, such as rattling, buzzing or grinding, it could be due to loose parts or a malfunctioning fan motor. Turn off your aircon and call a technician to inspect and repair the issue.

- Aircon not turning on: If your aircon is not turning on, check the circuit breaker and ensure that the thermostat is set to the correct temperature. If these things seem to be in order, it could be an issue with the electrical wiring or the compressor.

- Foul smell: If you notice a bad odour coming from your aircon, it could be due to mould or bacteria growth in the unit. Clean the air filter and the evaporator coils, and use an aircon cleaning spray to eliminate any remaining odour.

- Leaking water: If your aircon is leaking water, it could be due to a clogged drain line or a faulty condensate pump. Turn off your aircon and call a technician to unclog the drain or replace the pump.

Remember, if you’re not comfortable troubleshooting your aircon on your own, it’s always best to call a professional technician to avoid causing further damage.

If you are a busy landlord/investor, these are things that you would not want to get involved in.

From fact-finding, getting multiple quotes, applying to mcst, putting in a cheque deposit until the Job is finished, submitting for online warranty.

Let our WING TAI HOLDINGS team assist you from screening to securing a tenant and help to maintain a good relationship between the tenant and landlord. Contact us and give us the information of your investment property, well assure in giving landlord an ease of mind when it comes to tenancy matters and trust that your property is in good hands.

The post Aircon Not Cold issues. Tips to Landlords and the Tenants. appeared first on Wing Tai Holdings Singapore.

]]>The post Loft Apartment in Singapore Price appeared first on Wing Tai Holdings Singapore.

]]>Loft Apartment in Singapore Price

If you are looking for a loft apartment in Singapore, this blog is for you!

Here, we will provide information on all things loft apartments, from an overview of what a loft apartment is and its benefits to which MRT stations are nearby.

We will also cover some of the prices for some loft apartments. So whether you’re in the market for your loft-style apartment or want to learn about what’s available, you’re in the right place!

Overview of The Loft

Loft apartments are a luxurious but affordable option for city dwellers, and they typically feature high ceilings, large windows, and storage space. Some features you may look for in a loft apartment include an outdoor terrace or Balcony, secure parking, and 24-hour security. They’re also perfect for singles or couples who only need a little kitchen or bathroom facilities. Because they are often more expensive than other apartments, shortlisting a suitable Loft apartment can be challenging when the prices can be far-fetched.

Spacious, flexible, and fuss-free living

If you are looking for a spacious, flexible, and fuss-free living space that offers luxury and convenience all in one place, loft apartments in Singapore are the perfect option. These stylish units come with swimming pools and gardens – making them the ideal choice if you want to live in a more contemporary setting or downsize. There are various loft apartments sized from a recommendation of not lesser than 680sqft priced from S$1,400,000 to more than S$2,000,000 available today.

Well, we note that Loft Studio Units are not more than 400sqft, but we will be coming to those there that can offer more.

Community of open-minded professionals

Loft living is becoming a popular choice for professionals who value community and want to live near other like-minded people.

Lofts offer great value for your money while still providing you with all the amenities and luxuries of an upscale apartment.

Furthermore, the loft community comprises highly ambitious individuals always looking for new opportunities. This makes it a great place to network and gain insights into various industries. If you’re seeking open-mindedness, Loft Living should be on your radar!

What type of social status can I expect?

Loft apartments are perfect for young professionals who want to live close to the city. They come with all the amenities you would expect in an apartment – kitchen, living area, and bedroom.

If you are looking for a social life want your own me time or want some peace at home, loft apartments might be a good option! The location is also ideal – it’s close to the city centre. You will need to fork out a bit more than if you were looking for an average studio apartment, but it’s worth it!

What is a loft apartment?

Loft apartments are trending among millennials and young professionals who want to live in an up-and-coming area. They have several benefits, such as spaciousness, easy maintenance, and a modern look.

Prices for lofts have also been rising recently, making them an increasingly attractive option for people looking for luxury housing.

In Singapore, loft apartments offer a unique design and vibe that’s hard to find elsewhere. If you’re interested in living in one of these stylish units down the line – or if you’re just curious about what they are like – read on!

Who are loft apartments for?

Loft apartments are perfect for city living but have the convenience of being close to nature. They offer contemporary design with plenty of space and amenities that you would find in a high-rise building. The loft apartments are popular among young professionals who want to experience urban living without sacrificing privacy or luxury. You can find loft apartments priced for rent from S$3,500 upwards.

Where can loft apartments be found?

Loft apartments are quickly becoming popular in Singapore, as they offer an innovative and unique design that is not found in traditional high-rise buildings.

Browse through various areas where lofts can be found, such as the Central Business District(CBD) South district, Orchard / Holland or East Coast Vicinity.

Often comes with a wide range of amenities and facilities are also available, including a gym and swimming pool.

Who’s it suitable for?

Loft apartments in Singapore are perfect for people who want more space and flexibility than a standard apartment offers.

They’re also great for singles, couples, and families who want an urban oasis close to the city centre. If you’re thinking of living in a loft, it’s essential to know what kind of person it is suitable for. Some loft apartments have their own private pool or garden area, making them even more desirable.

And if that’s not enough, Loft apartments in Singapore are usually quite affordable, making them an excellent option for anyone looking for a home office or space to entertain friends. So what are you waiting for? Check out some of the best loft apartments in Singapore today!

Why choose a loft apartment over other types of apartments?

There’s something about loft apartments that attract a particular type of person. It could be their unique style and character. Maybe it’s the fact that they’re spacious and comfortable. Perhaps it’s the fact that they offer a variety of location and design options.

Whatever the reason, loft apartments are a popular type of apartment choice in Singapore. And for a good reason – they offer all of the benefits you’d expect from a good apartment without the compromises.

That includes the ability to live in an urban environment without feeling cramped or claustrophobic and plenty of space to spread out.

And if you’re looking for an apartment with a creative edge, loft apartments are a great option. Not to mention, they’re also popular because they tend to come with high ceilings and plenty of natural light. So if you’re looking for a different apartment, loft apartments are a great place to start your search.

Where can I find a fantastic loft apartment in Singapore?

Finding a fantastic loft apartment in Singapore can be tricky, but not with help from Wing Tai Holdings Singapore. We have a wide selection of properties in some of the most popular and exclusive areas in town. Some of the best loft apartments can be found in popular central districts like Clarke Quay, Bugis, Orchard / Holland and East Coast.

Pretty loft apartments in Singapore for your home inspiration

If you are looking for an airy and modern loft apartment that will fit perfectly in your home, you should check out the range of properties available in Singapore. Loft apartments offer a stylish and unique living space perfect for people who want to live in a contemporary environment. Whether you’re looking to rent or buy, these properties will not disappoint!

Pros and cons of living in a loft apartment

Loft apartments are a unique and popular type of living space that can be great for some and not for everyone. Considering living in one, it’s essential to carefully consider your needs. While they come with a range of benefits, such as high ceilings and an open view, loft apartments can also be expensive to buy or rent and may require extra decorating work. Additionally, loft apartments may only be suitable for some because they are typically sparsely furnished. If you’re looking for a property that is unique, a loft apartment could be an excellent option!

Listings for Sale with Loft

If you’re in the market for a loft apartment in Singapore, you’ll want to check out The Fulcrum. The Loft offers state-of-the-art design and amenities and a top-notch location – it’s close to the city centre but has plenty of nearby east coast park, and recreation facilities.

Loft apartments in Singapore based on the nearest to MRT Station District and Price

If you’re in the market for a resale loft apartment prices in Singapore:

The Fulcrum (D15)- 200m to future Katong Park MRT(TE24) Average $2100psf /Freehold/ Top 2016

One-North Residences (D05) – 390m to One North MRT (CC23) Average $1400psf / 99 years/ Top 2009

The Miro (D11) – 510m to Newton MRT (NS21) Average $1950psf /Freehold/ Top 2012

The Trilinq (D05) – 500m to Clementi MRT (EW23) Average $1650psf /99years / Top 2017

Lincoln Modern (D11) – 533m to Novena MRT (NS20) Average $1641psf /Freehold / Top 2003

The Crest (D03) – 670m to Tiong Bahru MRT (EW17) Average $1750psf /99years / Top 2017

And the List goes on.

It’s a convenient and efficient choice for people who don’t have a car.

Plus, with amenities like an on-site gym, pool, and pet park, the Loft offers tenants everything they need or want in an apartment complex. It’s also stylish and modern, making it an excellent option for people looking for a modern and elegant living space.

Which District has the best Loft Apartment prices?

Choosing a suitable loft apartment in Singapore can be a daunting task. With so many different neighbourhoods to choose from and a wide range of prices, it can take time to decide which one is best for you. To make things easier, we’ve compiled a list of the best loft apartment prices in Singapore by District. Contact Us.

Finally, remember to compare Loft Apartment prices before settling on one. There is a lot of variation, so it’s crucial to find the right deal!

Which Condo is the Top Choice with Growth Potential for the Price

When it comes to loft apartments in Singapore, it’s essential to consider the area’s growth potential. By doing so, you can make an informed decision about which condo development is best for you. The best place to invest is an area projected to experience high demand over the next few years. Plus, many condo developments are being built now that offer top-quality amenities at competitive prices. Buying a loft apartment now allows you to enjoy luxury living conditions for years to come! Prices for lofts have been rising recently, so it’s essential to find one that’s affordable but has potential for expansion. So, whether you’re looking for a luxurious escape or a place to start your own business, loft apartments in Singapore are an excellent investment.

Trends and Analysis

There’s no doubt that apartments are a hot property in Singapore these days. With population growth and increased demand for rental units, loft apartments have become the go-to choice for many people living here.

Particularly popular among families and businesses with a need for spaciousness, loft apartments offer an ideal blend of modernity and convenience. The Entrant loft units may be around S$1430psf, while the Luxury Loft Apartments should be in the region of S$2000psf – $2500psf; they can be Collectable Property Assent Class too. So if you’re looking to invest in real estate in Singapore – or anywhere else around the world – loft apartments should be on your list, especially for Singles or Couples.

Frequently Asked Questions

What is the best loft apartment in Singapore?

When choosing a suitable loft apartment in Singapore, deciding which is the best option can be challenging. To help simplify things for you, we have put together a list of some of the best loft apartments in Singapore that are popular among urbanites like yourself.

Here are some of the locations

– Newton/ Novena : If living near public transportation is vital, then Newton MRT is your go-to spot. The station is only a few minutes from most loft apartments and is well-connected to other parts of the city.

– East Coast : Definitely be at the top of your list for those who want an urban setting with a peaceful atmosphere.