The post How the Gross Floor Area affects prices of new launch condos appeared first on Wing Tai Holdings Singapore.

]]>How the Gross Floor Area affects prices of new launch condos, including an analysis of historical changes, case studies, the influence of GFA on property prices, the harmonization of GFA definitions, the role of BCA Green Mark, and developer strategies amidst GFA changes.

Key takeaways

The gross floor area (GFA) determines the total space a developer can build and sell, impacting the number of units in a project.

The gross floor area (GFA) determines the total space a developer can build and sell, impacting the number of units in a project.

The change in URA guidelines led to a shift in property design, with developers focusing on private and enclosed spaces rather than bay windows.

The change in URA guidelines led to a shift in property design, with developers focusing on private and enclosed spaces rather than bay windows.

The increase in average unit size requirement has led to fewer units being built, resulting in less profit for developers.

The increase in average unit size requirement has led to fewer units being built, resulting in less profit for developers.

The new URA guideline aims to promote environmental friendliness by offering incentives for using lesser aircon and encouraging natural ventilation.

The new URA guideline aims to promote environmental friendliness by offering incentives for using lesser aircon and encouraging natural ventilation.

The new URA guideline change will impact developers’ profit margins and pricing strategies.

The new URA guideline change will impact developers’ profit margins and pricing strategies.

A silent cooling measure is causing condo prices to fall without being announced by the government.

A silent cooling measure is causing condo prices to fall without being announced by the government. Developers will now have to pay a development or Bettlement charge for selling Aircon ledge to buyers, increasing the cost for potential condo owners.

Developers will now have to pay a development or Bettlement charge for selling Aircon ledge to buyers, increasing the cost for potential condo owners. Condo prices fell after the government exempted balcony, planter boxes, and bay windows from GFA, impacting developer profits.

Condo prices fell after the government exempted balcony, planter boxes, and bay windows from GFA, impacting developer profits. Developers no longer have a reason to build large AC ledgers because they have to pay for it.

Developers no longer have a reason to build large AC ledgers because they have to pay for it. The silent cooling measure could lead to a 7-10% drop in selling prices, impacting the real estate market significantly.

The silent cooling measure could lead to a 7-10% drop in selling prices, impacting the real estate market significantly. Developers may be hesitant to launch new projects due to the potential impact on profit margins, leading to a decrease in condo prices.

Developers may be hesitant to launch new projects due to the potential impact on profit margins, leading to a decrease in condo prices. Changes in GFA regulations may lead to developers building smaller areas with higher square footage to avoid additional charges.

Changes in GFA regulations may lead to developers building smaller areas with higher square footage to avoid additional charges.Milestones of URA Guidelines Changes

The URA guideline changed in 2009, and bay windows became part of the GFA. As a result, developers stopped building bay windows and started constructing more private and closed spaces and roof terraces, which are not counted in the GFA.

In 2013, the URA guideline changed again, and all roof terraces, private and closed spaces, and balconies became part of the GFA. To encourage developers to build balconies, URA offered an additional 10% bonus on top of the original GFA.In 2018, Due to the increasing size of new developments, people complained that we were moving towards smaller units like those in Hong Kong. To address this issue, URA increased the average unit size requirements, from 70 square meters to 85 square meters.

The total GFA remained the same, but the number of units developers could build decreased. This meant less profit for developers. Additionally, the previous 10% bonus for balcony space was reduced to 7%, but URA still offered 10% if the developer could achieve the BCA green mark to promote environmental friendliness. The new developments now come with sky gardens, free fans, and metal nets to encourage natural ventilation.

Recently, URA increased the government land sale supply to the highest since 2014. It is speculated that with the lower land price, the selling price may be lower as well. Developers used to take advantage of the fact that aircon ledges were not included in the GFA and build larger ones. However, there is a new URA guideline change that dictates that aircon ledges will eat into the GFA, which means that developers will no longer build oversized ledges.

Gross Floor Area (GFA) and Its Impact on New Launch Condo Prices

Gross Floor Area (GFA) is a critical determinant of new launch condo prices, exerting a direct influence on the valuation and market positioning of these properties. In essence, GFA encompasses the total floor area within the building envelope, including basements, mezzanine floors, and voids, thereby playing a pivotal role in defining the usable space and overall value of a property. For instance, a larger GFA often translates to a more expansive and functional living space, which is highly desirable in the real estate market, consequently contributing to the premium pricing of such properties.

Moreover, the involvement of the Urban Redevelopment Authority (URA) in urban planning, development, and property pricing reinforces the pivotal role of GFA in the real estate landscape. As a central player in shaping property guidelines and regulations, URA’s influence further underscores the criticality of staying informed about GFA-related changes and their potential impact on property prices. Therefore, having a comprehensive understanding of GFA and its implications is essential for all stakeholders, from developers and real estate professionals to prospective buyers and investors, enabling them to make well-informed decisions in the ever-evolving real estate market.

Additionally, historical changes in GFA, such as the 2009 Baywindow, 2013 Roof Terraces, and private enclosed spaces, have left a lasting imprint on property prices, reflecting the adaptability of the real estate market to GFA-related modifications. For instance, the introduction of Baywindows in 2009 led to an increase in property prices due to the additional usable space it provided, thus enhancing the overall value of the condos. Similarly, the 2013 inclusion of Roof Terraces and private enclosed spaces resulted in property pricing adjustments, underscoring the market’s responsiveness to GFA-driven changes and buyer preferences. These historical examples serve as compelling evidence of the tangible influence of GFA on property values and the market’s capacity to adapt to GFA-related adjustments.

Understanding the Influence of GFA on Property Prices

When delving into the influence of Gross Floor Area (GFA) on property prices, it becomes evident that this metric holds substantial sway over the valuation of new launch condos.

GFA, defined as the total floor area within the building envelope, including basements, mezzanine floors, and voids, plays a critical role in determining the market price of new launch condos, as it significantly contributes to the overall living space and amenities offered within a development.

Furthermore, GFA calculations are not static and can be influenced by various factors, including changes in floor area definitions, which directly impact GFA and, subsequently, property prices and developer strategies.

The fluctuation in GFA due to evolving definitions and measurements is a key consideration for developers and buyers when assessing property values and making investment decisions. Therefore, understanding the dynamic relationship between GFA and property prices is indispensable for navigating the real estate market effectively.

Moreover, the new shared definition of GFA by URA, BCA, SLA, and SCDF as of June 2023 marks a significant shift in the measurement and calculation of GFA for new launch condos and other residential properties. This standardization involves measuring floor areas to the middle of the wall, including all strata areas under the total GFA count, and excluding void spaces from the GFA calculation. The anticipated impact of the harmonized GFA definitions underscores the need for stakeholders in the real estate industry to stay informed and proactive in responding to these changes. By staying abreast of the revised GFA guidelines and understanding their implications, developers and homebuyers can make well-informed decisions when it comes to property pricing, investment, and market participation.

Case Studies: GFA’s Impact on New Launch Condo Pricing

Real-world examples serve as compelling evidence of how Gross Floor Area (GFA) has influenced the pricing of new launch condos. One notable case study involves the incorporation of the 2013 Roof Terraces, which resulted in a notable surge in property prices due to the additional usable space created by these features. The inclusion of roof terraces in the GFA calculation significantly enhanced the value of the properties, leading to a noticeable increase in pricing. This example underscores the direct correlation between GFA considerations and property valuations, showcasing how specific GFA components can impact the overall pricing of new launch condos.

Another compelling case study is the impact of private enclosed spaces on property prices. When private enclosed spaces were incorporated into the GFA calculation, it resulted in a notable uptick in the pricing of new launch condos. The added usable area contributed to the perceived value of the properties, thereby influencing the pricing strategy adopted by developers. This case study exemplifies how GFA-related changes directly influence property pricing strategies, reflecting the market’s responsiveness to GFA-driven adjustments and its implications for property values.

Moreover, the anticipated impact of GFA harmonization on property prices is multifaceted and holds implications for various aspects of the real estate market. The upcoming harmonization of Gross Floor Area (GFA) definitions across different agencies is expected to have a profound impact on property pricing dynamics, particularly in relation to land bid prices during Government Land Sales (GLS). Therefore, understanding the anticipated impact of GFA harmonization on property prices is essential for making informed decisions in the real estate market, whether it pertains to property investments, development strategies, or market projections.

The Role of the BCA Green Mark in GFA and Property Prices

The BCA Green Mark, a green building rating system established by the Building and Construction Authority (BCA) in Singapore, plays a pivotal role in influencing property prices through its impact on Gross Floor Area (GFA). This system focuses on promoting sustainable and environmentally friendly building practices, thereby contributing to the overall valuation of new launch condos. The BCA Green Mark incentivizes developers to adhere to sustainable building standards, encouraging the integration of eco-friendly features and technologies into new developments. This can result in a positive influence on the GFA of properties, as sustainable features such as energy-efficient designs, water-saving measures, and the use of environmentally friendly materials directly contribute to the calculation of GFA. As a result, properties with higher BCA Green Mark ratings may command higher valuations due to their enhanced sustainability and eco-friendliness, ultimately impacting their pricing in the real estate market.

For example, a new launch condo that incorporates solar panels, energy-efficient lighting, and water-saving fixtures to achieve a high BCA Green Mark rating may be perceived as more valuable and desirable by potential buyers. These sustainable features not only contribute to a reduced environmental footprint but also positively impact the GFA calculation, as they enhance the overall utility and efficiency of the property. Consequently, the property may be priced at a premium compared to similar developments with lower sustainability ratings, reflecting the direct correlation between the BCA Green Mark, GFA, and property prices. This example underscores the tangible influence of sustainable building practices on the valuation and pricing of new launch condos, further underscoring the significance of the BCA Green Mark in shaping the real estate landscape.

Moreover, the BCA Green Mark serves as a key driver in shaping the sustainable development of properties and influencing their pricing through its impact on GFA. By encouraging developers to incorporate sustainable features, the BCA Green Mark directly contributes to the overall appeal and valuation of new launch condos, reflecting the growing importance of sustainability in the real estate market.

Developer Strategies Amidst GFA Changes

Developers are encountering significant challenges as a result of GFA changes, with a notable impact on their profit margins and additional costs in the form of higher Land Betterment Charges. These changes are prompting developers to reevaluate their strategies and consider potential adjustments to navigate the evolving landscape of property development. In response to GFA alterations, developers may explore various avenues to mitigate the impact on their projects, including potential price adjustments and a reassessment of their development plans. This highlights the dynamic and adaptive nature of the real estate market, where developers are continuously refining their approaches to align with changing regulations and market conditions, particularly those related to GFA considerations.

For instance, in light of the increased minimum unit size requirements in 2018, developers may have restructured their floor plans and unit configurations to comply with the new regulations while still maintaining the attractiveness and marketability of their projects. This demonstrates the proactive measures taken by developers to adapt to GFA-related changes and align with the evolving property guidelines. Similarly, with the harmonization of GFA definitions set to take effect in 2023, developers are likely to recalibrate their development strategies to account for the standardized measurements and their potential implications on project viability and pricing. These adjustments underscore the strategic acumen and adaptability of developers as they navigate the complex interplay between GFA and property prices, ensuring their projects remain competitive and responsive to market demands.

In conclusion, the evolving landscape of GFA regulations and measurements presents developers with both challenges and opportunities, shaping their strategies and approaches in the dynamic real estate market. This underscores the need for developers to remain agile and innovative in response to GFA-related changes, reflecting the resilience and adaptability of the real estate industry in addressing evolving regulatory frameworks.

Anticipated Impact of GFA Harmonization on Property Prices

The anticipated impact of GFA harmonization on property prices is multifaceted and holds implications for various aspects of the real estate market. The upcoming harmonization of Gross Floor Area (GFA) definitions across different agencies is expected to have a profound impact on property pricing dynamics, particularly in relation to land bid prices during Government Land Sales (GLS).

For example, the recent successful bid by Sim Lian Group for a land site at Jalan Tembusu at a rate of $1,069 per square foot per plot ratio (psf ppr) reflects the potential influence of GFA harmonization on land bid prices, as it was approximately $300 psf ppr cheaper than neighboring projects.

Furthermore, the anticipation of a potential decline in land bid prices post-June 2023, due to GFA harmonization, has raised concerns about developer confidence and their strategies for future property developments. The interconnected dynamics between GFA harmonization, land bid prices, and property values are expected to shape the future trajectory of the real estate market, prompting stakeholders to closely monitor and adapt to the evolving landscape of property pricing dynamics.

Moreover, the forthcoming harmonization of GFA definitions underscores the need for industry professionals, potential homebuyers, and other stakeholders to stay informed about the evolving GFA definitions and their potential implications on property values.

Understanding the anticipated impact of GFA harmonization on property prices is essential for making informed decisions in the real estate market, whether it pertains to property investments, development strategies, or market projections. Therefore, staying abreast of these developments can empower individuals to navigate the real estate landscape effectively and make informed decisions regarding property transactions and investments.

In Conclusion : How the Gross Floor Area affects prices of new launch condos

it is evident that the Gross Floor Area (GFA) plays a crucial role in determining the prices of new launch condos in the real estate market. The direct influence of GFA on property pricing is a reflection of the usable space and overall value of a property, making it an essential factor for both developers and prospective buyers to consider. Historical changes in GFA, such as the 2009 Baywindow, 2013 Roof Terraces, and private enclosed spaces, have significantly impacted property prices over the years, showcasing the adaptability of the real estate market to GFA-related modifications.

Therefore, readers are encouraged to explore the Urban Redevelopment Authority (URA) website for further insights into urban planning, property guidelines, and the evolving influence of GFA on property pricing. By staying informed, stakeholders can make well-informed decisions and navigate the real estate market effectively in light of GFA-related changes.

The post How the Gross Floor Area affects prices of new launch condos appeared first on Wing Tai Holdings Singapore.

]]>The post 8 Simple Steps to Buy A New Launch Condo Before Selling Your HDB Flat appeared first on Wing Tai Holdings Singapore.

]]>This not only simplifies the timeline but also reduces concerns about potential homelessness during the transition.

In the best case, rental income from the flat can help the mortgage process for the condo. However, for some people, affordability remains a big question.

Therefore, this blog provides simple steps to help you check your current situation and prepare well to assure seamless moving from an HDB flat to a new launch condo.

Step 1: Make sure you reached the MOP (Minimum Occupation Period)

The Minimum Occupation Period (MOP) for an HDB flat in Singapore is the minimum duration that homeowners must live in their flat before they are allowed to sell it in the open market or buy private property.

Most HDB flats have a standard MOP of five years from the date of key collection.

During this period, residents need to physically occupy the flat.

Exceptions may apply in certain schemes or situations, such as the Prime Location Public Housing (PLH) scheme, the Selective En bloc Redevelopment Scheme (SERS), or when buying resale flats without CPF Housing Grants.

You can check your remaining MOP by visiting HDB resale portal and registering Intent to Sell.

| HDB flat type | Minimum Occupation Period (MOP) |

| New HDB flats (including BTO, EC & DBSS) | 5 years |

| New flats under the HDB Prime Location Housing (PLH) Model | 10 years* |

| Resale HDB flats* (2-room or larger, applied on or after 30 Aug 2010) | 5 years |

| Flats purchased under the Fresh Start Housing Scheme | 20 years |

| SERS flats | 5 years from the effective date of the replacement flat, or 7 years from the date of selection of the replacement flat |

You can find the full list of HDB MOPs in the Housing & Development Board, Eligibility webpage.

Step 2: Begin financial planning for home loans and CPF

You’ll likely need a loan in case you don’t have enough ability to afford a new condo.

The maximum loan you can get depends on your Total Debt Servicing Ratio (TDSR) and Loan-to-Value (LTV) ratio:

- TDSR is the percentage of your income used to pay debts, capped at 55%.

- LTV determines the maximum bank loan and minimum downpayment, based on your age, loan tenure, and outstanding housing loans.

Understanding these ratios helps you figure out if the new home fits your budget.

| Outstanding housing loans | LTV limit | Minimum cash downpayment |

| None | 75% or 55% |

|

| 1 | 45% or 25% | 25% |

| 2 or more | 35% or 15% | 25% |

Step 3: Make a list of new launch condos and visit them

After knowing the amount of loan you can receive, you should now visit potential new homes to help envision the space and plan any renovations. Note that some interior decorations and furniture may not be included. Besides, having an unbiased property agent during viewings will help you compare options objectively. Guided tours, professional advice and information about the latest condos are always updated on our website buycondo.sg.

Step 4: Pay a 5% deposit for your chosen new launch condo

Once you’ve chosen your desired home, you must secure it by paying a 5% booking fee in cash. This triggers the issuance of the Option to Purchase (OTP) by the developer.OTP is a written agreement, signifying your commitment to purchasing the property. Ensure you’re entirely certain at this stage, as backing out after receiving the OTP may lead to forfeiting up to 25% of the initial booking fee.

Step 5: Sign the Sale and Purchase Agreement (S&P) and activate the Option to Purchase (OTP)

After you receive the Option to Purchase (OTP), your property developer will issue the Sales & Purchase Agreement (S&P) within two weeks.

Once you receive both documents, you will need to sign them and make relevant payments within a stipulated period of time to make sure the property transaction will be convenient.

The following table breaks down the payment timeline during this period.

| Timeline | Your tasks |

| 2 weeks after receiving OTP | Receive S&P |

| 3 weeks after receiving S&P | Sign S&P and enable OTP before three-week period lapses |

| 2 weeks after signing S&P | Pay the Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) before two-week period lapses |

| 8 weeks after buyer signs OTP | Buyer to foot the 15% downpayment (exercise fee) in cash or CPF before eight week period lapses |

BSD is calculated according to the following formula:

- 1% for the first $180,000

- 2% for the next $180,000

- 3% for the next $640,000

- 4% for the remaining amount

For example, a condo costing $1,700,000 will charge a BSD of about $52,600.

Also, starting from May 9, 2022, new laws regarding residential properties transferred into a living trust have been implemented:

- An Additional Buyer’s Stamp Duty (ABSD) of 35% will now be applied to any transfer of residential property into a living trust.

- ABSD will be payable even if there is no identifiable beneficial owner at the time the residential property is transferred into a trust.

Step 6: Promote marketing activities for the HDB flat

To market your flat, we can help you effortlessly do so by making a post on buycondo.sg website and virtual showroom.

During 10 years in the market, we have sold 138 properties, promising to bring you the most pleasant experience.

Step 7: Pass the HDB flat keys to the new occupants

Once you sell your flat successfully, moving out and handing over the keys by the HDB completion appointment date is compulsory.

If your new condo is not ready, applying for a Temporary Extension of Stay for up to three months can be considered, subject to new HDB flat owner’s approval.

Another option is temporary accommodation with friends or relatives to avoid legal issues and additional charges.

Step 8: Receive the keys to your dream condo

The day you receive the keys to your new property is mentioned on the Temporary Occupation Permit (TOP), an official document indicating government approval for residence.

This marks the completion of purchasing your new condo after selling your HDB.

The TOP, provided by the developer, specifies the key collection date, concluding the process of acquiring your new condo before selling your HDB flat. Congratulations!

The post 8 Simple Steps to Buy A New Launch Condo Before Selling Your HDB Flat appeared first on Wing Tai Holdings Singapore.

]]>The post Showflat Viewing Guide appeared first on Wing Tai Holdings Singapore.

]]>

Introduction: Factors to Consider when Viewing a Show Flat in Singapore

Purchasing a property in Singapore is a significant financial decision, and viewing a show flat is an integral part of this process. A show flat allows potential buyers to get a feel of their future home and make an informed choice. However, it’s vital to approach this step with a strategic mindset, well-armed with relevant information and prepared for the viewing. This article aims to provide a comprehensive guide on the factors to consider when viewing a show flat in Singapore, thus enabling you to maximize the benefits of your visit.

The first key aspect to consider before visiting a show flat is financial preparation. This involves setting a realistic budget and securing an Approval in Principle (AIP) from a bank. An AIP provides an estimate of the loan amount a bank is willing to offer, allowing you to understand your financial limits. Familiarity with the Normal Progressive Payment Scheme (NPS), commonly used for property purchases in Singapore, is also beneficial. The NPS breaks down the payment process into stages, letting you plan your cash flow better.

Moreover, leveraging reliable resources like WING TAI HOLDINGS Team can significantly enhance your property buying experience journey that provides in-depth analysis, reviews, and insights on various properties in Singapore, empowering you to make a more informed decision.

When viewing a show flat, it’s important to focus on several key factors. The location and accessibility of the property should be a top priority as it directly impacts your daily life. For instance, you might want to consider the property’s proximity to your workplace, schools, healthcare facilities, and other amenities[Additional Context]. Evaluating the floor plan and layout of the unit is essential to ensure it aligns with your lifestyle needs and preferences. For example, a home office might be a necessity if you frequently work from home[Additional Context].

Natural lighting and ventilation in the unit also hold significant importance. A well-lit and ventilated home can enhance your comfort and well-being. You might want to check the direction the windows face and if there are any obstructions blocking natural light[Additional Context]. Furthermore, assessing the quality of materials and finishes used in the show flat is integral. The quality of materials directly impacts the durability and maintenance needs of the property. For instance, you might want to check the type of flooring used and its resistance to wear and tear[Additional Context].

Preparing for a Showflat Viewing Guide

As mentioned earlier, financial preparation is an absolute necessity before visiting a show flat. This involves setting a definite budget, acquiring an Approval in Principle (AIP), and familiarizing yourself with the Normal Progressive Payment Scheme (NPS). For instance, an AIP can help you avoid the disappointment of falling in love with a property outside your financial reach.It’s also essential to understand the NPS as it allows you to plan your finances and anticipate future payment obligations.

Research also plays a vital role in the preparation process. It’s recommended to investigate the sale prices and rental rates of nearby properties. This information can provide a benchmark for comparison and negotiation. For instance, if a similar property in the same location has a lower price, you might want to question the higher price of the show flat. Researching and Comparing Properties

Once you’re adequately prepared, the next step is to research and compare various properties. It’s crucial to leverage resources such as the URA Master Plan to study future development plans for the area.This information can give you an idea about potential changes in the neighbourhood, which could impact your property’s value and livability. For instance, upcoming amenities like shopping malls or transport hubs can significantly enhance the convenience and appeal of your property.

Understanding the property market’s prices and trends is also important. It’s advisable to gather data on current market prices and historical trends. This can help you assess whether the property is priced competitively and anticipate potential price movements. For example, if the prices in the area have been steadily increasing over the years, it could indicate a high-demand location, which can be beneficial for property appreciation.

Effective Strategies for Showflat Viewing

Viewing a show flat is more than just a casual walkthrough. To make the most out of your visit, it’s crucial to adopt effective strategies. One such strategy is to prepare a list of questions to ask the property agents. This could include queries about the property’s maintenance fees, nearby construction work, future area developments, carpark layout, and more. For instance, you might want to ask about the number of carpark lots available per unit, especially if you own multiple vehicles.

Another strategy is to visualize your personal belongings in the space. This can help you assess whether the unit can accommodate your lifestyle and needs. For example, if you have large furniture items, you might want to check if they can fit comfortably in the unit. Furthermore, it’s important to understand space layout and design techniques. Some show flats might use mirrors or special lighting to make the unit appear larger. Being aware of these techniques can help you evaluate the actual size and layout of the unit accurately.

Unseen Considerations during Showflat Viewing

While the aesthetics and layout of a show flat are important, it’s equally crucial to consider unseen factors. For instance, asking about the number of lifts serving the units can provide insights into potential wait times during peak periods. Similarly, the location of the rubbish chute is worth checking as it can affect the cleanliness and odor around your unit. You might want to ask about these factors during your visit to ensure a comfortable living experience.

Moreover, it’s important to inquire about provisions not included in the show flat. Some show flats might display premium fixtures or appliances that are not included in the actual unit. For example, the show flat might showcase high-end kitchen appliances, but the actual unit might come with standard ones. Therefore, it’s beneficial to clarify what is included in the unit to avoid any surprises later on.

Key Factors to Consider when Viewing a Show Flat

Location and accessibility are undoubtedly paramount factors to consider when viewing a show flat. The property’s proximity to public transportation, amenities, and essential services can significantly impact your quality of life. For instance, a Condo near MRT stations or bus stops can make commuting easier, while proximity to supermarkets or healthcare facilities can add convenience.

When evaluating the floor plan and layout of the unit, focus on the practicality and functionality of the space. Consider your lifestyle needs and preferences to ensure the layout suits you. For example, an open-plan living area might be desirable if you frequently entertain guests. Conversely, if you value privacy, a layout with distinct, separate rooms might be more appropriate[Additional Context].

Natural lighting and ventilation are critical for a comfortable and healthy living environment. Check the orientation of the unit and the placement of windows to assess the amount of natural light and airflow. For instance, units facing North or South often receive consistent, indirect sunlight, which can keep the unit well-lit without causing excessive heat.

The quality of materials and finishes used in the show flat is also a key consideration. High-quality materials enhance the durability and aesthetics of the property. Check the type of flooring, countertops, bathroom fittings, and other finishes to assess their quality and durability.

Potential Hazards and Pitfalls

Being aware of potential hazards and pitfalls is crucial when viewing a show flat. By researching similar developments, you can gain insights into any potential issues or concerns. For example, if previous projects by the same developer have had issues with poor construction quality or delayed completion, it might be a red flag.

In addition, make sure to examine the actual floor plan layout for details on facilities and communal spaces. The layout of these spaces can impact your living experience. For instance, if the gym or swimming pool is located close to residential units, it might lead to noise complaints. Similarly, if the communal areas are too small compared to the number of units, it might lead to overcrowding.

Quality and Finishing in Show Flats

The quality and finishing of a show flat can provide insights into the overall quality of the development. Understanding the defects-free period and procedures for rectifying defects is important. For instance, if the defects-free period is only twelve months.

In addition, verify the inclusion of appliances and check the quality of bathroom fittings. Some developers may display premium appliances in the show flat, but the actual unit may come with different brands or models. Similarly, the bathroom fittings’ quality can reflect the property’s overall quality and durability. For example, good-quality faucets and showerheads can last longer and require less maintenance.

Making an Informed Decision

After all the research and viewing, it’s time to make a decision. However, it’s important not to rush into committing. If you feel hesitant, take a short break and reassess. This can help you make a more objective decision. For example, taking a step back can provide the clarity you need if you feel pressured by the sales agent or are unsure about certain aspects of the property.

Remember, buying a property is a significant decision, and it’s essential to feel confident and comfortable with your choice. Don’t feel obliged to make a decision on the spot. It’s perfectly acceptable to take your time, revisit your notes, or even view the show flat again to ensure that it’s the right fit for you.

Financial Considerations and Legal Aspects

Finally, understanding the financial considerations and legal aspects is crucial when viewing a show flat. Check how much of your CPF savings you can use for the property purchase and understand the Additional Buyer’s Stamp Duty (ABSD) bracket that you fall into. For example, first-time buyers and Singapore citizens are exempted from ABSD, while others may have to pay a significant amount.

It’s also important to understand the payment process under the Normal Progressive Payment Scheme (NPS) and the balloting process. The NPS breaks down the payment into various stages, while the balloting process determines the order of unit selection among buyers. Understanding these processes can help you navigate the property buying process with ease.

Conclusion and Call to Action

Viewing a show flat in Singapore involves consideration of various factors, from financial preparedness to detailed property assessment. By being well-prepared and informed, you can make a more informed decision about your property purchase. At Wingtaiholdings.sg provides valuable resources and information to assist you throughout the process, ensuring that you have all the necessary tools to make a well-informed decision.

In conclusion, remember that buying a property is a significant decision and should not be rushed. Take your time to consider all factors, ask questions, and make an informed choice.

The post Showflat Viewing Guide appeared first on Wing Tai Holdings Singapore.

]]>The post ALTURA EC Launching: Why is everyone going crazy about EC in Singapore? appeared first on Wing Tai Holdings Singapore.

]]>

The Rising Craze of Executive Condominiums in Singapore: Affordable Luxury and Exclusive Living

Executive condominiums (ECs) are highly sought-after residential options in Singapore, standing out as a more upscale choice compared to other HDB flats such as BTO flats, Sale of Balance Flats (SBF) units, and Open Booking of Flats (OBF) units.

Referred to as “sandwich flats,” executive condominiums in Singapore represent a unique housing category combining public and private housing elements. They cater to middle-income Singaporeans who are ineligible for an HDB flat due to the income ceiling, yet consider private condominiums financially out of reach. What sets ECs apart is their attractive pricing in comparison to private condominiums while still offering comparable amenities and designs.

“Wait, Sooooooo What’s so good about Executive Condominium then?”

“Isn’t Private Condo still superior over Executive Condo?”

LET’S TAKE A LOOK AT THE COMPARISON BELOW

Advantages of Buying Executive Condos in Singapore

1. Executive Condos Are Priced lower Compared to Private Condos

Executive Condominiums buyers get to enjoy the perks of living in private property as subsidized by the government, provided that they fulfill the eligibility requirements. In addition, first-time Executive Condo buyers may be entitled to CPF housing grants. Even though the lower price tag, EC owners also get to enjoy the full condo facilities and fully equipped kitchens and bathrooms that are comparable to condominiums.

“Considering buying at subsidized rates, and can be sold freely in open market after 10 year!”

2. Privatised After 10-Year Mark.

Given their more affordable cost and the 10-year privatization rule, numerous buyers of executive condominiums (ECs) hold the belief that these properties may experience higher capital appreciation compared to private condominiums after the 10-year mark. Don’t forget that you will be buying from HDB at a subsidized price. *Grin*

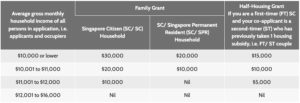

3. CPF Housing Grants for First-Timer Applicants (EC)

Households comprising SC and SPR individuals are eligible for an additional $10,000. This amount can be obtained when the SPR member converts to an SC and applies for the Citizen Top-Up within 6 months of meeting the eligibility criteria.

4. Favorable Housing Option for Middle-Income Singaporeans Designed for Own Stay

Executive condominiums (ECs) were primarily designed to serve as residences rather than investment assets. As part of this intention, specific regulations exist for EC owners. Firstly, the buyer must reside in the EC for a minimum of five years before it can be sold. Furthermore, even after the five years, there are restrictions on the sale, allowing only Singapore Citizens or Singapore Permanent Residents to purchase the property. However, once reaches the 10-year mark, the EC is effectively transformed into a private condominium and can be freely sold to anyone on the open market!

These measures aim to provide context to the nature of ECs, which are subsidized by the state and intended to facilitate homeownership for Singaporeans rather than serving as investment opportunities for real estate investors. While the Minimum Occupation Period (MOP) may be seen as a constraint, it does not pose any obstacles for those who view an EC primarily as a place to call home and have genuine intentions of residing in it.

5. No ABSD payable

Good news! Due to the recent implementation of hefty ABSD increment, many HDB upgrades face issues with forking out the ABSD upfront though it can be remission after selling the previous home within six months of getting the new one. But if you purchase an Executive Condominium (EC), you don’t need to pay the ABSD first, you do still need to dispose of your flat within six months but at least there is no need for extra cash or CPF savings upfront. Yay!

disadvantages of buying EXECUTIVE CONDOS IN SINGAPORE

1. Limited to Bank Loans for Executive Condo Purchase

In contrast to an HDB loan, when obtaining a bank loan, the Loan-to-Value (LTV) limit is set at 75% of the property’s valuation or price, whichever is lower. This implies that you will need to contribute a minimum of 25% of your funds for the down payment of your executive condominium (EC). Out of this amount, 5% must be paid in cash, while the remaining 20% can be financed through a combination of CPF funds and cash.

Furthermore, you will also need to consider the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR) rules. Under the MSR rule, you are only allowed to allocate a maximum of 30% of your monthly income toward servicing your home loan. Regarding the TDSR rule, the total amount dedicated to debt repayments, encompassing obligations such as car loans, credit cards, and student loans, cannot exceed 55% of your monthly income.

2. HDB Rules Apply

As previously mentioned, executive condominiums (ECs) are classified as HDB properties in the initial 10 years. During this duration, it is mandatory to adhere to HDB regulations, including the Minimum Occupation Period (MOP) requirement. The MOP entails residing in your EC for five years before you can consider selling or renting it out, limited to Singapore Citizens (SCs) and Permanent Residents (PRs) only. It’s important to note that the MOP period commences once the development has obtained its Temporary Occupation Permit (TOP).

3. New EC Launches Are Limited

Due to the high demand and scarcity of EC launches in Singapore, whenever there is a new EC launch, it tends to spark a frenzied rush among potential buyers.

Upcoming EC launch for 2023

ALTURA EC

1st EC launch in Bukit Batok after more than 20 Years, 1KM from the future ACS Primary, Princess Elizabeth, Dulwich College, and more!

Number of Units: 360

Size: 134,004 Sqft

Location: D23 – Hillview, Dairy Farm, Bukit Panjang, Choa Chu Kang

Address: Bukit Batok West Ave 8

Developer: TQS (2) Development PTE LTD

Visit ALTURA EC Site for more information. Learn more.

For more EC eligibility & property inquiries, please feel free to connect with us to learn more!

Looking for more similar articles? Check out BuyCondo’s Blog section!

The post ALTURA EC Launching: Why is everyone going crazy about EC in Singapore? appeared first on Wing Tai Holdings Singapore.

]]>The post Tips for Checking Defects In a New Condo Upon Obtaining TOP appeared first on Wing Tai Holdings Singapore.

]]>Purchasing a new condo is an exciting milestone, offering the promise of modern living in the heart of Singapore’s urban landscape. As the city continues to evolve with new developments, it’s essential for new condo owners to ensure that their investment meets the highest standards of quality and craftsmanship. This is especially true when considering the financial commitment that comes with it – a commitment that can often reach $1,000 per square foot or more.

Unlike houses with lower prices, where buyers might be more forgiving of imperfections, the expectations for a premium condo are understandably much higher. After all, with a property investment of over $1,000,000 for a condominium, owners should rightfully demand excellence in every aspect. However, the unfortunate reality is that developers might sometimes allocate fewer resources towards ensuring top-notch quality in the rush to launch new sales.

Source: Unsplash

Discovering Defects in New Condos During the Development Phase

Contractors and sub-contractors are commissioned to build these luxury condominiums; sometimes, corners are cut to meet tight schedules. What exacerbates the situation is that, unlike completed properties that can be thoroughly inspected before purchase, buyers of new construction homes are often limited to viewing a show flat. This show flat, while indicative of potential quality, may not always be fully representative of the actual unit’s workmanship.

This discrepancy between what’s promised and what’s delivered can lead to real frustration among home buyers. The issue becomes even more complicated as developers may shift responsibility for poor workmanship defects to main contractors, who in turn might try to pass it on to the new homeowners.

For those who eagerly purchased a new construction home during one of these thrilling launch events, a vigilant eye for defects is paramount. It’s a matter of not just preserving your investment but also demanding the quality you’ve paid for. After all, compromising on construction quality would only compound any concerns about already inflated prices.

Source: Pexels

Common New Condo Defects to Look Out For

When taking over a new condo, it’s vital to adopt a meticulous approach to identifying defects. Here are some common areas to focus on during your inspection:

Finishing and Fixtures

Examine walls, ceilings, and floors for cracks, uneven surfaces, and paint irregularities. Of all the defects you might expect when taking possession, an uneven layering of floor tiles might be the most surprising. Even in an unfurnished space, poorly laid tiles are apparent, posing a safety hazard, especially for children. This oversight reflects the developer’s commitment to quality and your peace of mind. Look out for gaps between tiles as well, as these can become homes for unwanted pests. Should you encounter such defects, demand prompt repairs or replacements.

Windows and Doors

Inspect windows for scratches, dirt patches, and paint marks. Don’t forget to examine window frames, which are prone to damage during transport. Open and close all windows to ensure hinges and locks function properly. Similarly, check doors for smooth operation.

Source: Freepik

Carpentry and Cabinetry

Assess built-in cabinets, wardrobes, and kitchen fittings for proper alignment. Uneven fixtures, particularly inside cabinets and wardrobes, can disrupt the aesthetic appeal. Such misalignments are signs of poor workmanship that shouldn’t be tolerated.

Flooring

Scrutinise the flooring for uneven tiles and gaps. Make sure to check for warped table tops that might result from low-quality materials or subpar workmanship.

Air Conditioning and Ventilation

Switch on the air conditioning units in every room immediately upon entering. By the time you finish inspecting the unit, the air-conditioning system will have warmed up, revealing air-conditioner leaks, if any. Examine the air-con ledge for signs of leaks.

Source: Freepik

Plumbing

Check all taps and flushes, not just for functionality but also for drainage efficiency. Plumbing issues can manifest as slow drainage, suggesting defects or bottlenecks. Listen for unusual sounds as water flows down the pipes.

Water Flow and Drainage

Modern design focusing on dedicated shower areas ensures proper drainage isn’t neglected in other bathroom zones. Test the drainage outside the shower area by pouring water onto the bathroom floor. Water should flow smoothly into drainage openings, and any water ponding should be addressed.

Electrical Outlets and Lighting

Verify that electrical outlets provide power and that lighting points are sufficient. Inspect connections for installing your lighting fixtures. Count the number of lighting points to plan for your lighting needs.

Source: Freepik

Warped table tops

This type of defect might escape an untrained eye, but when you view them at eye level, the unevenness becomes evident. This defect, often found in lower-grade granite kitchen tops, results from shoddy workmanship rather than external factors. Don’t accept this compromise in quality.

Checking for Defects

As a new condominium owner, you have the right to demand quality workmanship. Don’t hesitate to document any defects you find and communicate them to the developer promptly. Many developers have defect rectification periods during which they are obligated to address these issues.

Before you sign off on the defect inspection, take your time and be thorough. If defects are identified later, rectifying them might become more challenging. Work closely with the developer or their representatives to properly address all identified issues.

Remember, purchasing a new condo is a significant investment, and you deserve to have your expectations met. By staying vigilant and knowledgeable about the defect liability of condos in Singapore, you can ensure that your new launch condo lives up to its promise of luxury, comfort, and quality craftsmanship.

Understanding Defect Liability

When you acquire a new condo in Singapore, it’s crucial to understand the concept of defect liability. This period, usually ranging from a few weeks to a few months after taking possession, places the responsibility on the developer to rectify any defects discovered within the unit. It’s essential to thoroughly inspect your condo before this period expires, as addressing defects afterwards might become more challenging.

Engaging Professionals

While conducting your own inspection is important, considering the involvement of professionals such as property inspectors or engineers is a wise step. These experts have a trained eye for detecting even the most subtle defects that an untrained eye might miss. Their insights can provide you with a more comprehensive assessment of the condo’s condition, helping you make informed decisions about rectification requests.

Source: Freepik

Documenting and Prioritising

Throughout your inspection, meticulously create a checklist and capture photographs or videos of the defects you uncover. This documented evidence can serve as proof when discussing defects with the developer. Prioritize defects based on their severity – issues impacting safety and functionality or that could lead to further damage should take precedence.

Effective Communication

Once you’ve compiled your list of defects, communicate them to the developer or their representatives clearly and promptly. Specify the issues you’ve identified and provide supporting documentation. Transparent and respectful communication is essential to ensuring that the defects are resolved to your satisfaction.

Being Persistent

In some instances, developers might attempt to downplay certain defects or delay their rectification. Don’t hesitate to exhibit persistence in pursuing defect rectification. Your investment warrants top-tier quality, and you possess the right to demand it.

Final Thoughts

Acquiring a new condo is an exciting venture, yet it requires meticulous attention to detail to ensure you’re getting the value you paid for. By adhering to these recommendations and taking a proactive approach to defect inspection, you’re protecting your investment and asserting your rights as a homeowner.

Keep in mind that the defect liability period offers a crucial opportunity to address issues. Make the most of this period.

Finding someone to manage your property rental? Contact our Property Manager in Singapore and check out our article on Important Landlord Tips and Tricks For Managing Rental Property Easily.

The post Tips for Checking Defects In a New Condo Upon Obtaining TOP appeared first on Wing Tai Holdings Singapore.

]]>The post NEW CONDO LAUNCHING IN 2021 appeared first on Wing Tai Holdings Singapore.

]]>| S/N | Project Name | Location | District | Type of Sale | Tenure | Developer | No. of Units^ |

Launch Date* |

| 1 | Parc Central Residences (executive condo) | Tampines Avenue 10 | 18 | Government Land Sale | 99-years | Hoi Hup Realty and Sunway Development | 700 | 1Q2021 |

| 2 | Normanton Park (retaining its former name) | Normanton Park | 5 | Collective Sale | 99-years | Kingsford Development apartments | 1,840 & 22 strata terraced houses | 1Q2021 |

| 3 | Cairnhill 16 (former Cairnhill Heights) | 16 Cairnhill Rise | 9 | Collective Sale | Freehold | Tiong Seng Holdings and Ocean Sky International | 39 | 1Q2021 |

| 4 | The Reef at King’s Dock | Harbourf ront Avenue | 4 | Keppel Bay land parcel | 99-years | Mapletree and Keppel Land | 429 | 1Q2021 |

| 5 | New condo at Jalan Bunga Rampai | Jalan Bunga Rampai/Bartley | 19 | Government Land Sale | 99-years | Wee Hur (Bartley) Pte Ltd | 115 | 1Q2021 |

| 6 | Midtown Modern | 16 & 18 Tan Quee Lan Street | 7 | Government Land Sale | 99-years | GuocoLand, Hong Leong Holding and Hong Realty | 558 | 1Q2021 |

| 7 | Les Maisons Nassim (former bungalow site at 14 & 14A Nassim Road) | Nassim Road | 10 | Private treaty sale | Freehold | Shun Tak Holdings | 14 | 1Q2021 |

| 8 | The Atelier (former Makeway View) | 2 Makeway Avenue | 9 | Collective Sale | Freehold | Bukit Sembawang Estates Limited | 120 | 1Q2021 |

| 9 | One-North Eden | One-north Gateway | 5 | Government Land Sale | 99-years | TID Pte Ltd (joint venture between Hong Leong Group and Mitsui Fudosan) | 165 | 1Q2021 |

| 10 | Rymden 77 | Lorong H Telok Kurau | 15 | Collective Sale | Freehold | Quek Hock Seng Development | 31 | 1Q2021 |

| 11 | Peak Residence (former Peak Court) | Thomson Road | 11 | Collective Sale | Freehold | Tuan Sing Holdings Limited | 90 | 1Q2021 |

| 12 | Perfect Ten (former City Towers) | Bukit Timah Road | 10 | Collective Sale | Freehold | CK Asset Holdings | 230 | 1Q2021 / 2Q2021 |

| 13 | Klimt Cairnhill (former Cairnhill Mansion) | Cairnhill Road | 9 | Collective Sale | Freehold | Low Keng Huat | 138 | 1Q2021 / 2Q2021 |

| 14 | EDEN (former Hampton Court) | Draycott Park | 10 | Collective Sale | Freehold | Swire Properties | 20 | 1Q2021 / 2Q2021 |

| 15 | New condo at Canberra Drive (Land Parcel B) | Canberra Drive | 27 | Government Land Sale | 99-years | UOL Group and UIC | 448 | 1Q2021 / 2Q2021 |

| 16 | Irwell Hill Residences | Irwell Bank Road | 9 | Government Land Sale | 99-years | City Developments Ltd (CDL) | 540 | 2Q2021 |

| 17 | Park Nova (former Park House) | Tomlinson Road | 10 | Collective Sale | Freehold | Shun Tak Holdings | 54 | 2Q2021 |

| 18 | One Bernam | Bernam Street/Tanjong Pagar | 2 | Government Land Sale | 99-years | Hao Yuan Investment and MCC Land | 351 | 2Q2021 |

| 19 | Provence Residences (executive condo) | Canberra Link | 27 | Government Land Sale | 99-years | MCC Land | 413 | 2Q2021 |

| 20 | New condo at Canberra Drive (Land Parcel A) | Canberra Drive | 27 | Government Land Sale | 99-years | JBE Holdings | 220 | 2Q2021 |

| 21 | New executive condo | Fernvale Lane | 28 | Government Land Sale | 99-years | Frasers Property | 500 | 2Q2021 |

| 22 | Amber Sea (former Amber Glades) | Amber Gardens | 15 | Collective Sale | Freehold | Far East Organization | 132 | 2Q2021 / 3Q2021 |

| 23 | New residential-commercial project (former Realty Centre) | Enggor Street | 2 | Collective Sale | Freehold | The Place Holdings | N.A. | 2Q2021 / 3Q2021 |

| 24 | Canninghill Square (Liang Court) | Clarke Quay | 6 | Phased Acquisition | 99-years | CapitaLand and City Developments Ltd (CDL) | 700 | 3Q2021 |

| 25 | La Mariposa (former Tian Court) | Mangis Road | 15 | Collective Sale | 99-years | Lakeview Investments | 17 | 3Q2021 |

| 26 | Pollen Collection | Nim Road/Ang Mo Kio Avenue 5 | 28 | Legacy Land Bank | 99-years | Bukit Sembawang Estates Limited | 132 | 3Q2021 |

| 27 | New mixed-use development | Pasir Ris Central | 18 | Government Land Sale | 99-years | Allgreen Properties and Kerry Properties | 487 | 3Q2021 / 4Q2021 |

| 28 | New condominium (former Kovan Lodge) | Kovan Road | 19 | Collective Sale | Freehold | Soon Lian Realty | 50 | 3Q2021 / 4Q2021 |

| 29 | The Cairnhill (retaining its former name) | Cairnhill Rise | 9 | Legacy Land Bank | Freehold | Far East Organization | N.A. | 3Q2021 / 4Q2021 |

| 30 | LIV @ MB (former Katong Park Towers) | Arthur Road/Mountbatten Road | 15 | Collective Sale | 99-years | Bukit Sembawang Estates Limited | 298 | 4Q2021 |

| 31 | Grange 1866 (former iliv@Grange) | Grange Road | 10 | Redevelopment | Freehold | Grange 1866 Pte Ltd | 60 | 4Q2021 |

| 32 | Sunstone Hill | Balmeg Hill/Pasir Panjang Road | 5 | Collective Sale | Freehold | Sunstone Properties (Pasir Panjang) Pte Ltd | 28 | 4Q2021 |

| 33 | New executive condo | Yishun Avenue 9 | 27 | Government Land Sale | 99-years | Sing Holdings | 600 | 4Q2021 / 1Q2022 |

| 34 | New residential project (redevelopment of Royal Oak Residence) | Anderson Road | 10 | Collective Sale | Freehold | FEC International | 110 | 4Q2021 / 1Q2022 |

The post NEW CONDO LAUNCHING IN 2021 appeared first on Wing Tai Holdings Singapore.

]]>