The post Promising Condo Resale Market In 2023: 6 Top-rated MOP ECs appeared first on Wing Tai Holdings Singapore.

]]>With relatively low prices, Executive Condominiums (EC) have consistently been a popular choice in Singapore’s real estate market, since they provide an opportunity for more people to own a private home.

In this blog, Wing Tai Holdings will introduce the most promising executive condominium plans in Singapore’s condominium resale market for 2023. These 6 top-performing projects will MOP (Minimum occupation period) in this year, and will be privatized after 5 years. Don’t miss this golden opportunity!

Top 6 MOP Resale Executive Condominium in 2023

Treasure Crest: Hidden Gem in Condo Resale Market

Location: Anchorvale Crescent

Quantity of units: 504

Nearest MRT/LRT stations: Cheng Lim LRT (269m), Sengkang MRT (849m)

Average price PSF: S$1,350-S$1,400

Treasure Crest is an executive condominium located in Sengkang’s Anchorvale area. It offers 3 and 4-bedroom units, making it a perfect choice for big families with more than two children.

There are countless conveniences, notably near amenities such as a Sheng Siong supermarket, a coffee shop, and the Sengkang General Hospital, which has a food court and various dining options. For only one LRT stop away, you can see Compass One shopping mall and Kopitiam Square, which owns a hawker center and wet market.

This EC is the best choice for families with young children, as there are five primary schools situated within a 1km radius. These include Springdale Primary, Nan Chiau Primary, Punggol Green Primary, Anchor Green Primary, and Compassvale Primary.

Residents can also enjoy the nearby Sengkang Riverside Park for a relaxing stroll and the amenities at Sengkang Sports Complex. Additionally, a park connector links to Punggol Waterway Park and Coney Island.

Have you loved this apartment already? Explore more in this blog: Treasure Crest (EC) Condominium

Sol Acres: Highlight in Condo Resale Market

Location: Choa Chu Kang Grove

Quantity of units: 1327

Nearest MRT/LRT stations: Teck Whye LRT (267m)

Average price PSF: S$1,300-S$1,400

Up to two executive condominiums are set to MOP in Choa Chu Kang this year, offering a range of units suitable for families, couples and investors. Sol Acres is the first development, with 1 to 5-bedroom units. There is only one unit containing 1 bedroom.

This condo is conveniently located near Sheng Siong at Teck Whye Shopping Centre and FairPrice Xpress at Keat Hong Mirage, which serves a range of food and beverages stores. 3 primary schools within 1km of Sol Acres include South View Primary, Choa Chu Kang Primary, and Teck Whye Primary.

Though this building is not situated near an MRT station, residents can easily access Bukit Panjang MRT or Choa Chu Kang stations via the nearby Teck Whye or Keat Hong LRT stations.

Has this lovely condo won your heart? Secure a free consultation from us now to decide the best choice for your investment: Sol Acres Condominium

The Visionaire

Location: Canberra Drive

Quantity of units: 632

Nearest MRT/LRT stations: Canberra MRT (503m)

Average price PSF: S$1,088-S$1,300

Located just a 7-minute stroll from the Canberra MRT station, The Visionaire which features 2, 3, and 4-bedroom units suits families of various sizes. Its prime location is opposite the newly launched Bukit Canberra, a sports and community hub with a polyclinic, gym, and an 800-seat hawker center.

Another plus point is within walking distance to Canberra Plaza, Sun Plaza and Sembawang Shopping Centre. All of which offer an array of F&B outlets, shopping malls, and other facilities. Additionally, Wellington Primary and Sembawang Primary are both located within 1km of the property.

Every detail information, price and rental comparison are all included in this blog: The Visionaire Condominium

Parc Life

Location: Sembawang Crescent

Quantity of units: 628

Nearest MRT/LRT stations: Sembawang MRT (666m)

Average price PSF: S$1,280-S$1400

Parc Life with 2, 3, 4 and 5-bedroom units, is situated just a short distance from The Visionaire. It is also MOP-ing this year and located a 10-minute walk from Sembawang MRT station.

Residents can find supermarkets and eateries nearby, such as Prime and Kimly Coffee Shop at the HDB Sun Breeze development, which is just a 3-minute walk away. Sun Plaza and Sembawang Shopping Centre are within walking distance for more shopping options.

For school options, Canberra Primary, Sembawang Primary and Wellington Primary are located near Parc Life.

Every detail information, price and rental comparison are all included in this blog: Parc Life EC

Wandervale

Location: Choa Chu Kang Ave 3

Quantity of units: 534

Nearest MRT/LRT stations: Choa Chu Kang MRT (647m)

Average price PSF: S$1,250-S$1,350

Wandervale, situated closer to Choa Chu Kang Central, offers 3 and 4-bedroom units suitable for families from four to six members.

The EC is conveniently located just a 9-minute walk away from Choa Chu Kang MRT station on the North-South line. Residents can also walk to Lot One shopping mall, which offers a FairPrice supermarket and a range of dining outlets. Teck Whye Shopping Centre is also nearby, offering a variety of coffee shops and restaurants.

Wandervale is within 1km of primary schools such as Choa Chu Kang Primary, South View Primary, and Teck Whye Primary. Additionally, residents can enjoy a stroll to Choa Chu Kang Park and the newly-built SAFRA Choa Chu Kang, which features a sheltered swimming area, futsal court, running track, and other services.

Choose Wandervale : Wandervale Executive Condominium

The Criterion

Location: Yishun Street 51

Quantity of units: 505

Nearest MRT/LRT stations: Khatib MRT (1.4km)

Average price PSF: S$1,250-$1,350

One of the three ECs that will MOP in the Yishun and Sembawang area this year is The Criterion. It offers 2 to 5-bedroom units for couples, young families, and even multi-generational families.

Naval Base Primary, Hua Min Primary and Northland Primary stay within 1km of The Criterion, with half of its blocks within 1km of North View Primary.

Furthermore, Sheng Siong supermarket is just a 5-minute walk away, while Wisteria Mall has a FairPrice Finest, as well as food and drink outlets, hair and beauty salons, enrichment centers and more. Additionally, several coffee shops are available in nearby HDB apartments.

While The Criterion is not located near an MRT station, it can be reached in less than 15 minutes by bus to Khatib MRT.

Has The Criterion met your criteria? Read this blog for more information: The Criterion Executive Condominium for Sale

We have recently sold a ground floor unit at The Criterion at a good price for the home owner. They can progress towards their next property near to their child’s primary school.

And still not sure which EC is best for your budget and requirements?

Leave a message to receive a prompt and free valuable advice from our professional team!

The post Promising Condo Resale Market In 2023: 6 Top-rated MOP ECs appeared first on Wing Tai Holdings Singapore.

]]>The post Timeline of upgrading from HDB to Private Condo in Singapore appeared first on Wing Tai Holdings Singapore.

]]>Here are several option property owners should consider before making a decision

Option 1 : Own both HDB Flat and Private Condominium

Choosing to keep both HDB and the newly purchased Private Condo. Property owners have the choice between renting out the HDB or the new condo. Several Pros and Cons to this option are this options allows you to generate rental income. However, you will have to pay for 20% Additional Buyers Stamping Fee (ABSD). In addition, a higher expense is required to purchase the new condominium as you can only take 45% loan for the private condo if you still have an outstanding HDB loan. Finally, HDB flat value is likely to depreciate over the years.

What is ABSD?

‘Additional Buyers Stamping Fee’ is a fee required to be paid on top of the Buyer’s Stamp Duty (BSD). Several criteria will determine if you will have to pay ABSD, one of which is a Singapore citizen that has more than one residential property. The rate for a second residential property owner is 20%.

Timeline for buying a private condo

If you have fulfilled your five years Minimum Occupation Period (MOP), you are allowed to keep your HDB flat and buy a condo. You can choose to continue staying in your HDB flat or move into your new condo. Maybe you are thinking, why not keep your HDB and rent it out since the rental yield is very attractive? Then with the rental income, you can use it to finance your new purchase. Sounds very logical?

But do take a step back and consider the disadvantages. Firstly, since the new purchase will be your second property (HDB doesn’t allow part-sale or is commonly known as ‘decoupling’), you would need to pay an Additional Buyer Stamp Duty (ABSD) of 20%. Yes, no kidding! 20% is a lot of money. Many people loathe the thought of throwing away this considerable sum of money. If you were to buy a $1.2 million condo, a 20% ABSD amounts to $240,000. Suppose you rent out your flat at $3,500 a month or $30,000 a year, the $240,000 ABSD will set you back by 5.7 years in rent. Oh no! It’s like going through another round of M.O.P.!

Secondly, your HDB flat may likely depreciate over time. (Although HDB has been proven resilient, HDB owners usually enjoy the luxury of spaciousness and capital appreciation over time.

Just for illustration if some feel that HDB will still depreciate over time.

Suppose your HDB flat is worth about $600,000 now, and it depreciates at 2% a year, in 5.8 years you would have lost about $68,400. So, does it make economic sense to earn $42,000 of annual rental income from your HDB flat, while losing almost $240,000 in terms of ABSD and depreciation? You would also need to fully clear your HDB loan to enjoy the maximum 75% loan for your condo purchase. Otherwise, you can only borrow 45%.

So, does it make economic sense to earn $42,000 of annual rental income from your HDB flat, while losing almost $240,000 in terms of ABSD and depreciation?

Hence, to buy a $1.2 million condo without selling your HDB flat, you would need at least 25% (5% down + 20% ABSD) in cash, which is $300,000, together with the Buyer Stamp Duty (BSD) $32,600 , you would total need to have $320,600 of cash/cpf. This upfront capital outlay may make it look like it is out of reach for many people. However you maybe surprised that there are a good bandwidth of Singaporeans sitting on a large amount of Cash and CPF!

Option 2: Wing Tai Holdings First Then Sell HDB

When buying your first condo you could carefully choose the right property. Once you made a choice, make sure you have the time to renovate and move into the new house.

But there is a catch! You will have to pay ABSD first and then claim back if new purchase is a matrimonial home (i.e. buy under husband and wife’s names) and sell off the HDB flat within six months. This upfront financial commitment may present some cash flow problems for some people. If you still have an outstanding HDB loan, the maximum amount you can borrow is 45%, so you would need more capital outlay to buy a condo.

If you choose to buy a condo first then sell your HDB, you will face some issues with ABSD and loan. Similarly, the initial capital outlay is very high. However, though you have to pay the ABSD first, if you are able to sell your HDB flat within six months, you can apply for remission and get back your money. This remission only applies to the matrimonial home; the property must be in both husband and wife’s names. There is no remission for singles, widows/widowers, and divorcees. Overall this option gives you a pressureless way to shop for your new condo.

Buy a condo first before you sell your HDB will incur ABSD

Option 3: Sell HDB First Then Wing Tai Holdings

What is good about is option is that there is no ABSD. You can slowly take your time to find your dream home. There won’t be any cash flow problem like option 2. Your HDB can be sold at a higher price now than letting it depreciate to a lower price at a later time. However, you might need to find temporary accommodation meanwhile looking for a new condo after selling off your HDB. Temporary accommodation means extra expenses during the interim period.

Some do not like the idea of having to move twice and having to rent for say, two to three years before the new place is ready. On the positive side, the value of your flat may likely depreciate over the two to three years while you are renting. So you are selling at a higher price NOW. This should offset the cost of renting. It would be wise to book a new condo during launch to enjoy early bird discounts and first mover advantage. So, selling your flat first will free you from the time to buy a new condo.

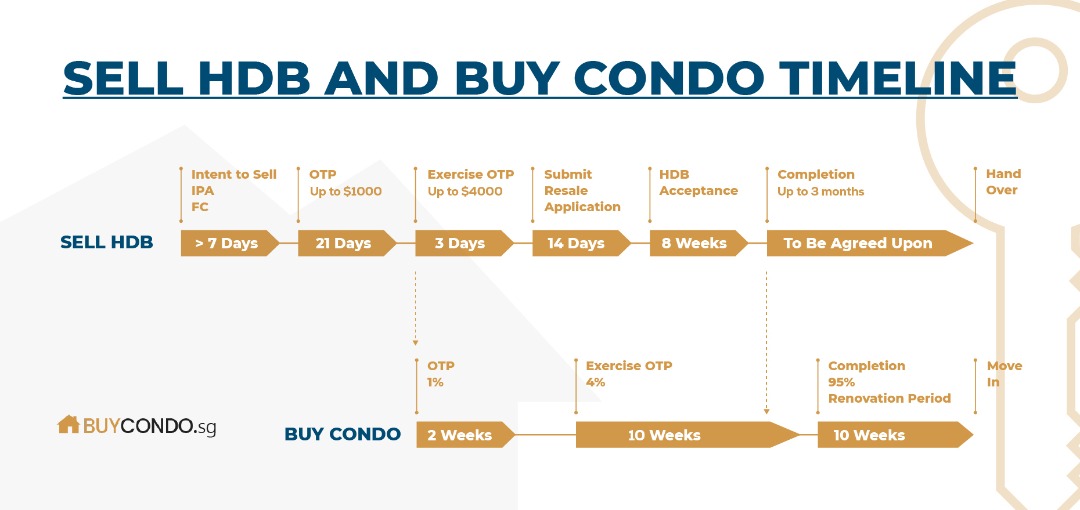

Option 4: Sell Your HDB Flat And Buy A Condo At The Same Time

Another option is to sell your HDB and buy a condo at around the same time. By doing this, you still have have the time to find the ideal house you are looking for cause selling off the HDB takes time (around 8 -10 weeks). Meanwhile, you can search for your next dream home while selling off your HDB. The best if you could match up the OTP at around the same time so you could move out and move in to the new condo immediately. By doing that, you could save some cash from hiring movers or renting a temporary accommodation plus no ABSD if it is planned well.

The only downside is that you will need sufficient cash to pay the 5% cash and buyer stamp duty. Some experience is needed to plan properly from selling HDB and buying your condo. And also, some buyers may not be willing to grant you the extension of stay when selling off your HDB.

All of the options need experience and knowledge. If you are still confused, feel free to contact us at buycondo.sg and we will gladly assist you in whatever way possible to ease your selling or buying of any condo here in Singapore!

The post Timeline of upgrading from HDB to Private Condo in Singapore appeared first on Wing Tai Holdings Singapore.

]]>