The post Private residential units sales increased by about 32 per cent for January 2021 compared to December 2020. appeared first on Wing Tai Holdings Singapore.

]]>

Urban Redevelopment Authority (URA) on Monday (Feb 15), a total of 1,609 private residential units were sold in January, compared with 1,217 in December 2020.

A total of 2,600 private residential units were launched in January. The Rest of Central Region (RCR) led new home sales, with 1,108 units sold, while the Core Central Region (CCR) and Outside Central Region (OCR) saw 83 and 418 units sold respectively.

On a year-on-year basis, new home sales in January surged by 159.5 per cent from 620 units in the same month a year earlier.

Ms Christine Sun, head of research and consultancy at OrangeTee, said that the figure was the strongest January sales since 2013, when 2,028 units were transacted.

She attributed the buying rush to speculation of potential cooling measures.

“Even if cooling measures were not implemented, buyers may still be in a better position to ink a unit sooner rather than later as prices of homes are likely to rise further since the global economy is expected to pick up this year,” said Ms Sun.

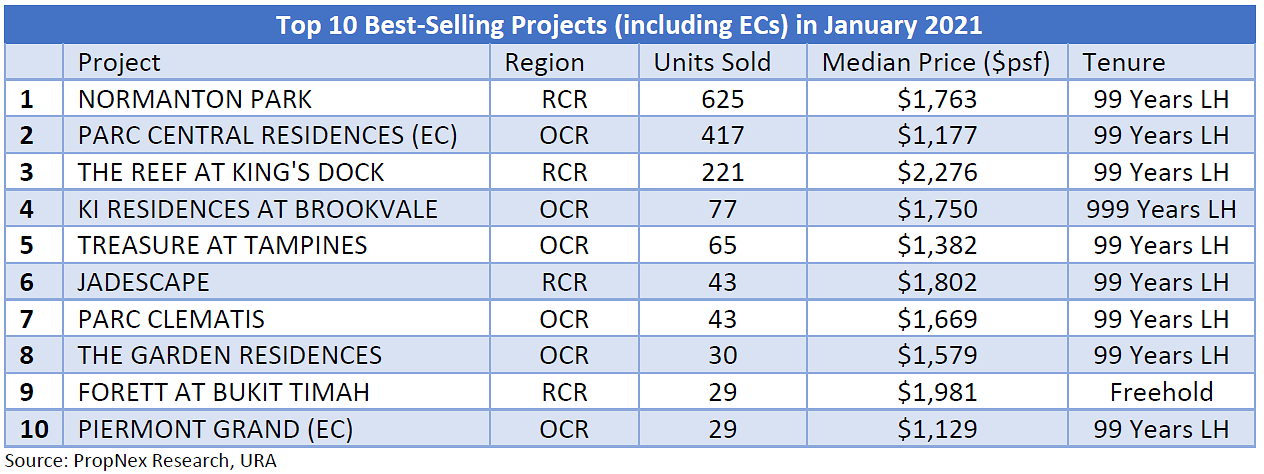

These sales also coincided with a few launches last month with a high number of units. The best-selling project was the 1,862-unit Normanton Park, which sold 625 units. This was followed by the 700 unit-Parc Central Residences EC which sold 417 units, and the 429-unit The Reef at King’s Dock which sold 221 units.

More luxury home launches are expected in the coming months, added Ms Sun.

“It is key to note that despite the upswing in private new home sales in January, this is not a reflection of a surging demand,” said Propnex CEO Mr Ismail Gafoor.

Mr Ismail compared the buying rush to July 2018, when a similar rush to outrun property cooling measures saw a total of 1,724 private new homes transacted.

“What we have observed is that location, attractive product attributes, and right pricing are the key factors in driving good take-up rates,” he said.

We believe most buyers are discerning and are entering the market to buy properties after they have carefully considered their options and finances.”

Local buyers accounted for nearly 83 per cent of new private home sales transactions last month, with demand from foreign buyers potentially seeing a gradual increase this year, said Ms Wong Siew Ying, PropNex head of research and content.

This is likely to be driven by several upcoming launches in the CCR, which tend to attract such buyers.

“On the whole, we expect the residential property market to remain healthy, but downside risks persist, including the resurgence of COVID-19 and uncertain macroeconomic conditions,” said Ms Wong.

“In addition, there is also the risk of further cooling measures by the Government, should it judge that home prices are getting ahead of the underlying economic fundamentals.”

Reference: CNA / Propnex Research

The post Private residential units sales increased by about 32 per cent for January 2021 compared to December 2020. appeared first on Wing Tai Holdings Singapore.

]]>The post Private New Home Vs Private Resale Non-Landed Performance for 2019 vs 2020. appeared first on Wing Tai Holdings Singapore.

]]>Private New Home Property Volume vs Value for 2019 and 2020.

Private Resale Non-Landed (Include EC) Transaction Volume Transaction Value ($Bn) 2019 9,375 $13.5 Billion 2020 * 10,093 $14.6 BillionPrivate Resale Property Volume vs Value for 2019 and 2020.

Private Resale Non-Landed (Include EC) Transaction Volume Transaction Value ($Bn) 2019 8,328 $14.9 Billion 2020 * 8,820 $14.0 BillionCore Centre Region (CCR) Private Resale Property Volume vs Value for 2019 and 2020.

Private Non-Landed-New-CCR Sale Transaction Volume Transaction Value 2019 858 $2.5 Billion 2020** 1,146 $2.4 BillionPrivate Rental Non-Landed Transaction Volume vs Value for 2019 and 2020.

Private Resale Non-Landed (Include EC) Transaction Volume Transaction Value 2019 89,647 $317.5 Million 2020 * 79,464 $279.5 Million Source: URA Realis*** Figures for 12M 2020At Wing Tai Holdings we are glad to present to you the performance of the Singapore Private New Homes, Private Resale and Private Rental for 2019 and 2020.

The post Private New Home Vs Private Resale Non-Landed Performance for 2019 vs 2020. appeared first on Wing Tai Holdings Singapore.

]]>