The post Rental Yield vs Capital Gains appeared first on Wing Tai Holdings Singapore.

]]>Understanding Rental Yield and Capital Gains in Property Investment: Exploring the importance of both rental yield and capital gains, their differences, pros and cons, and the benefits of achieving a balanced approach in real estate investment.

Understanding Rental Yield

Rental yield, a fundamental metric in real estate investment, offers valuable insights into the potential return on investment by representing the ratio of the annual rental income to the cost of the property. For instance, consider a property that generates an annual rental income of $50,000 and was purchased for $1,000,000. The rental yield for this property would be calculated as ($50,000 / $1,000,000) * 100, resulting in a rental yield of 5%. This calculation illustrates the significance of rental yield in assessing the income-generating potential of a property in relation to its acquisition cost.

Net rental yield, another crucial aspect of rental yield, measures the rental income against the total costs of the property, including mortgage interest rates, maintenance fees, and stamp duties. For example, if a property incurs $10,000 in annual expenses, the net rental yield can be calculated by deducting these expenses from the annual rental income and then dividing the resulting amount by the total cost of the property. Understanding net rental yield enables investors to gain a comprehensive view of the property’s performance, factoring in all associated costs to determine the actual income generated.

It is important to recognize that rental yield is not the sole aspect of property investment and should be considered in the context of other crucial details, such as rentability, capital gains, foreign influx, and the impact of upcoming supply. For instance, foreign influx and the impact of upcoming supply can significantly affect rental yield, highlighting the need to consider multiple factors in property investment decisions. Therefore, while rental yield is a vital metric, it should be evaluated alongside other essential aspects to make well-informed and strategic investment decisions.

Understanding Capital Gains

Capital gains, a pivotal component of real estate investment, signify the increase in the value of a property or investment over time, presenting an alternative avenue for generating returns aside from rental income. An example of capital gains in action can be observed in a property that was purchased for $1,000,000 and later sold for $1,200,000, resulting in a capital gain of $200,000. This gain showcases the potential for wealth accumulation through the appreciation of property values over time.

Capital gains play a significant role in offsetting low rental yields, as the increase in the property’s value can compensate for lower rental income. For instance, in an instance where a property experiences a modest rental yield due to market conditions, the potential for capital gains can serve as a strategic advantage, enabling investors to realize profits through the appreciation of the property’s value. Understanding the dynamics of capital gains is essential for investors to leverage the long-term wealth accumulation potential offered by property appreciation.

Moreover, capital growth allows an investor to leverage an asset to expand their property portfolio, underscoring its potential for long-term wealth creation and financial growth. For example, an investor who strategically acquires properties in appreciating markets and benefits from substantial capital growth can utilize the accrued wealth to further expand their property portfolio, amplifying their overall investment potential.

Differences between Rental Yield and Capital Gains

Differences between Rental Yield and Capital Gains

The distinction between rental yield and capital gains lies in their focus and purpose within real estate investment. Rental yield primarily centers on the annual rental income and its ratio to the property cost, providing insights into the property’s cash flow potential. In contrast, capital gains emphasize the increase in property value over time, offering potential profits upon the property’s eventual sale. Understanding these differences is essential for investors to leverage both metrics effectively in their investment strategies.

Furthermore, while rental yield is more about cash flow, providing regular income, capital gains focus on the asset’s value appreciation, offering potential profits upon sale. This distinction highlights the complementary nature of these metrics, as rental yield contributes to regular income generation, while capital gains offer the potential for wealth accumulation through property appreciation. By recognizing the unique advantages of each, investors can tailor their investment strategies to optimize their overall returns.

Both rental yield and capital gains are important components of property investment, each serving different purposes and offering distinct advantages. Therefore, investors should recognize the value of integrating both metrics into their investment strategies to capitalize on the diverse benefits they offer.

Pros and Cons of Focusing on Rental Yield

Focusing on rental yield can provide a steady stream of income, which is attractive for investors seeking regular cash flow from their properties. For example, an investor who prioritizes properties with high rental yields may benefit from a consistent income stream that contributes to their overall financial stability. However, there are risks associated with solely focusing on rental yield, such as potential drawbacks in buying properties solely for high yields without considering other critical factors like property condition and location. This scenario emphasizes the importance of maintaining a balanced approach and considering various aspects of a property’s potential rather than solely prioritizing rental yield.

Extreme decisions, such as purchasing very small or aging properties for high yields, can be risky for new investors, highlighting the potential downsides of an overly narrow focus on rental yield. Therefore, while rental yield is an essential consideration, investors should exercise prudence and consider the broader context of a property’s investment potential to mitigate risks and optimize their returns.

Pros and Cons of Focusing on Capital Gains

Focusing on capital gains offers the potential for substantial profits in the long run, especially in appreciating property markets, presenting an opportunity for wealth accumulation. An example of this can be observed in a scenario where an investor strategically acquires properties in a rapidly appreciating market and realizes significant profits upon the sale of these properties due to their increased value. However, relying solely on capital gains may pose challenges in generating regular income, particularly for investors depending on property investments for cash flow. It is crucial for investors to strike a balance between the potential for long-term wealth accumulation and the need for regular income to meet their financial objectives.

Capital growth can earn exponentially more than rental income in the long run, showcasing its potential for significant wealth creation over time. By recognizing the distinct advantages and limitations of focusing on capital gains, investors can strategically integrate this metric into their investment approach to optimize their overall returns.

Balancing Rental Yield and Capital Gains

Balancing Rental Yield and Capital Gains

Achieving a balance between rental yield and capital gains can offer the benefits of both regular income and long-term wealth accumulation, providing a diversified and robust approach to property investment. For instance, an investor who strategically acquires properties with a balance of rental yield and potential for capital gains can benefit from a consistent income stream alongside the potential for wealth accumulation through property appreciation. This balanced approach fosters a comprehensive investment strategy that aligns with an investor’s financial goals and risk tolerance.

A well-chosen property has the potential to earn rental income and achieve capital growth, emphasizing the advantages of pursuing a balanced strategy. By striking a balance between rental yield and capital gains, investors can mitigate the risks associated with relying solely on one aspect of property investment and capitalize on the unique advantages offered by both metrics. This balanced approach promotes a comprehensive investment strategy that aligns with an investor’s financial objectives and risk tolerance.

Factors to Consider when Choosing between Rental Yield and Capital Gains

When deciding between rental yield and capital gains, investors should consider several crucial factors to make informed investment decisions. Evaluating rentability, high vacancies, turnover rates, surrounding developments, development size, and the overall appreciation of the property is essential for gaining a comprehensive understanding of its investment potential. For instance, an investor considering a property in a rapidly growing area with high potential for appreciation may prioritize capital gains, while another investor focusing on generating consistent income may prioritize rental yield.

Aligning investment strategy with personal financial goals and risk tolerance is crucial, as different investors may prioritize regular income, long-term wealth accumulation, or a balanced approach based on their unique circumstances. Therefore, understanding individual investment objectives and risk appetite is essential for tailoring an investment strategy that aligns with an investor’s specific goals and preferences.

Consulting a trusted property professional is indispensable for sound property investment advice, as experts can provide valuable insights tailored to individual investment objectives and market conditions. By leveraging the expertise of professionals in the real estate industry, investors can gain a deeper understanding of the market dynamics and make well-informed decisions that align with their investment goals and risk appetite.

Conclusion : Rental Yield vs Capital Gains

In conclusion, achieving a balance between rental yield and capital gains is vital for making informed and strategic real estate investment decisions. By understanding the unique advantages and limitations of both metrics and considering various factors such as rentability, property appreciation, and market dynamics, investors can develop a comprehensive investment approach that aligns with their financial objectives and risk tolerance. It is crucial for investors to recognize the value of integrating both rental yield and capital gains into their investment strategies to optimize their overall returns and capitalize on the diverse benefits they offer.

Work with a good Property Manager in Singapore; they will be able to advise you which location has a better chance of getting good tenants and which properties are undervalued.

The post Rental Yield vs Capital Gains appeared first on Wing Tai Holdings Singapore.

]]>The post Loft Apartment in Singapore Price appeared first on Wing Tai Holdings Singapore.

]]>Loft Apartment in Singapore Price

If you are looking for a loft apartment in Singapore, this blog is for you!

Here, we will provide information on all things loft apartments, from an overview of what a loft apartment is and its benefits to which MRT stations are nearby.

We will also cover some of the prices for some loft apartments. So whether you’re in the market for your loft-style apartment or want to learn about what’s available, you’re in the right place!

Overview of The Loft

Loft apartments are a luxurious but affordable option for city dwellers, and they typically feature high ceilings, large windows, and storage space. Some features you may look for in a loft apartment include an outdoor terrace or Balcony, secure parking, and 24-hour security. They’re also perfect for singles or couples who only need a little kitchen or bathroom facilities. Because they are often more expensive than other apartments, shortlisting a suitable Loft apartment can be challenging when the prices can be far-fetched.

Spacious, flexible, and fuss-free living

If you are looking for a spacious, flexible, and fuss-free living space that offers luxury and convenience all in one place, loft apartments in Singapore are the perfect option. These stylish units come with swimming pools and gardens – making them the ideal choice if you want to live in a more contemporary setting or downsize. There are various loft apartments sized from a recommendation of not lesser than 680sqft priced from S$1,400,000 to more than S$2,000,000 available today.

Well, we note that Loft Studio Units are not more than 400sqft, but we will be coming to those there that can offer more.

Community of open-minded professionals

Loft living is becoming a popular choice for professionals who value community and want to live near other like-minded people.

Lofts offer great value for your money while still providing you with all the amenities and luxuries of an upscale apartment.

Furthermore, the loft community comprises highly ambitious individuals always looking for new opportunities. This makes it a great place to network and gain insights into various industries. If you’re seeking open-mindedness, Loft Living should be on your radar!

What type of social status can I expect?

Loft apartments are perfect for young professionals who want to live close to the city. They come with all the amenities you would expect in an apartment – kitchen, living area, and bedroom.

If you are looking for a social life want your own me time or want some peace at home, loft apartments might be a good option! The location is also ideal – it’s close to the city centre. You will need to fork out a bit more than if you were looking for an average studio apartment, but it’s worth it!

What is a loft apartment?

Loft apartments are trending among millennials and young professionals who want to live in an up-and-coming area. They have several benefits, such as spaciousness, easy maintenance, and a modern look.

Prices for lofts have also been rising recently, making them an increasingly attractive option for people looking for luxury housing.

In Singapore, loft apartments offer a unique design and vibe that’s hard to find elsewhere. If you’re interested in living in one of these stylish units down the line – or if you’re just curious about what they are like – read on!

Who are loft apartments for?

Loft apartments are perfect for city living but have the convenience of being close to nature. They offer contemporary design with plenty of space and amenities that you would find in a high-rise building. The loft apartments are popular among young professionals who want to experience urban living without sacrificing privacy or luxury. You can find loft apartments priced for rent from S$3,500 upwards.

Where can loft apartments be found?

Loft apartments are quickly becoming popular in Singapore, as they offer an innovative and unique design that is not found in traditional high-rise buildings.

Browse through various areas where lofts can be found, such as the Central Business District(CBD) South district, Orchard / Holland or East Coast Vicinity.

Often comes with a wide range of amenities and facilities are also available, including a gym and swimming pool.

Who’s it suitable for?

Loft apartments in Singapore are perfect for people who want more space and flexibility than a standard apartment offers.

They’re also great for singles, couples, and families who want an urban oasis close to the city centre. If you’re thinking of living in a loft, it’s essential to know what kind of person it is suitable for. Some loft apartments have their own private pool or garden area, making them even more desirable.

And if that’s not enough, Loft apartments in Singapore are usually quite affordable, making them an excellent option for anyone looking for a home office or space to entertain friends. So what are you waiting for? Check out some of the best loft apartments in Singapore today!

Why choose a loft apartment over other types of apartments?

There’s something about loft apartments that attract a particular type of person. It could be their unique style and character. Maybe it’s the fact that they’re spacious and comfortable. Perhaps it’s the fact that they offer a variety of location and design options.

Whatever the reason, loft apartments are a popular type of apartment choice in Singapore. And for a good reason – they offer all of the benefits you’d expect from a good apartment without the compromises.

That includes the ability to live in an urban environment without feeling cramped or claustrophobic and plenty of space to spread out.

And if you’re looking for an apartment with a creative edge, loft apartments are a great option. Not to mention, they’re also popular because they tend to come with high ceilings and plenty of natural light. So if you’re looking for a different apartment, loft apartments are a great place to start your search.

Where can I find a fantastic loft apartment in Singapore?

Finding a fantastic loft apartment in Singapore can be tricky, but not with help from Wing Tai Holdings Singapore. We have a wide selection of properties in some of the most popular and exclusive areas in town. Some of the best loft apartments can be found in popular central districts like Clarke Quay, Bugis, Orchard / Holland and East Coast.

Pretty loft apartments in Singapore for your home inspiration

If you are looking for an airy and modern loft apartment that will fit perfectly in your home, you should check out the range of properties available in Singapore. Loft apartments offer a stylish and unique living space perfect for people who want to live in a contemporary environment. Whether you’re looking to rent or buy, these properties will not disappoint!

Pros and cons of living in a loft apartment

Loft apartments are a unique and popular type of living space that can be great for some and not for everyone. Considering living in one, it’s essential to carefully consider your needs. While they come with a range of benefits, such as high ceilings and an open view, loft apartments can also be expensive to buy or rent and may require extra decorating work. Additionally, loft apartments may only be suitable for some because they are typically sparsely furnished. If you’re looking for a property that is unique, a loft apartment could be an excellent option!

Listings for Sale with Loft

If you’re in the market for a loft apartment in Singapore, you’ll want to check out The Fulcrum. The Loft offers state-of-the-art design and amenities and a top-notch location – it’s close to the city centre but has plenty of nearby east coast park, and recreation facilities.

Loft apartments in Singapore based on the nearest to MRT Station District and Price

If you’re in the market for a resale loft apartment prices in Singapore:

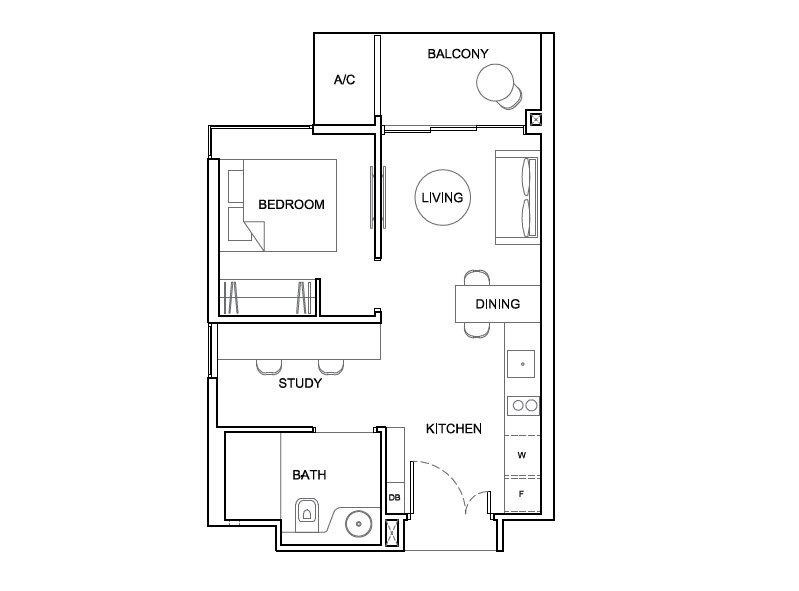

The Fulcrum (D15)- 200m to future Katong Park MRT(TE24) Average $2100psf /Freehold/ Top 2016

One-North Residences (D05) – 390m to One North MRT (CC23) Average $1400psf / 99 years/ Top 2009

The Miro (D11) – 510m to Newton MRT (NS21) Average $1950psf /Freehold/ Top 2012

The Trilinq (D05) – 500m to Clementi MRT (EW23) Average $1650psf /99years / Top 2017

Lincoln Modern (D11) – 533m to Novena MRT (NS20) Average $1641psf /Freehold / Top 2003

The Crest (D03) – 670m to Tiong Bahru MRT (EW17) Average $1750psf /99years / Top 2017

And the List goes on.

It’s a convenient and efficient choice for people who don’t have a car.

Plus, with amenities like an on-site gym, pool, and pet park, the Loft offers tenants everything they need or want in an apartment complex. It’s also stylish and modern, making it an excellent option for people looking for a modern and elegant living space.

Which District has the best Loft Apartment prices?

Choosing a suitable loft apartment in Singapore can be a daunting task. With so many different neighbourhoods to choose from and a wide range of prices, it can take time to decide which one is best for you. To make things easier, we’ve compiled a list of the best loft apartment prices in Singapore by District. Contact Us.

Finally, remember to compare Loft Apartment prices before settling on one. There is a lot of variation, so it’s crucial to find the right deal!

Which Condo is the Top Choice with Growth Potential for the Price

When it comes to loft apartments in Singapore, it’s essential to consider the area’s growth potential. By doing so, you can make an informed decision about which condo development is best for you. The best place to invest is an area projected to experience high demand over the next few years. Plus, many condo developments are being built now that offer top-quality amenities at competitive prices. Buying a loft apartment now allows you to enjoy luxury living conditions for years to come! Prices for lofts have been rising recently, so it’s essential to find one that’s affordable but has potential for expansion. So, whether you’re looking for a luxurious escape or a place to start your own business, loft apartments in Singapore are an excellent investment.

Trends and Analysis

There’s no doubt that apartments are a hot property in Singapore these days. With population growth and increased demand for rental units, loft apartments have become the go-to choice for many people living here.

Particularly popular among families and businesses with a need for spaciousness, loft apartments offer an ideal blend of modernity and convenience. The Entrant loft units may be around S$1430psf, while the Luxury Loft Apartments should be in the region of S$2000psf – $2500psf; they can be Collectable Property Assent Class too. So if you’re looking to invest in real estate in Singapore – or anywhere else around the world – loft apartments should be on your list, especially for Singles or Couples.

Frequently Asked Questions

What is the best loft apartment in Singapore?

When choosing a suitable loft apartment in Singapore, deciding which is the best option can be challenging. To help simplify things for you, we have put together a list of some of the best loft apartments in Singapore that are popular among urbanites like yourself.

Here are some of the locations

– Newton/ Novena : If living near public transportation is vital, then Newton MRT is your go-to spot. The station is only a few minutes from most loft apartments and is well-connected to other parts of the city.

– East Coast : Definitely be at the top of your list for those who want an urban setting with a peaceful atmosphere.

Prices vary depending on location, demand and unit mix. Usually, it should be in the development to be overly crowded as the sought is for luxury and exclusivity.

How much does it cost to rent a loft apartment in Singapore?

Prices for loft apartments in Singapore can range from $3000 to $6,000 per month. The most popular neighbourhoods with hidden gems that offer luxury lofts include Clarke Quay, Bugis and Orchard Road and the not to be forgotten East Coast Area, especially with the upcoming Katong Park MRT Station (TE24) under the Phrase 4 stations of TEL in 2024.

Which is better: renting or buying a loft apartment?

There’s no right or wrong answer when deciding whether to buy or rent an apartment in Singapore, and it all depends on your individual needs, preferences, and budget.

When renting, you can often try out a loft before purchasing it. You can also rent an apartment for a specific period and then determine if you want to switch to owning one.

Buying is the better option if you’re looking for long-term occupancy, which will give you peace of mind and stability during your stay in Singapore. On the other hand, renting may be a better option if you’re looking for a place to call home for a short period.

Is it cheaper to live in a studio than rent a private space like a loft apartment?

There are pros and cons to renting a loft instead of living in a private space like a loft apartment.

However, it is cheaper to live in a studio apartment on average. The main reason is that studios tend to come with lower monthly rent; however, they are also Loft Apartments within walking distance of public transport and nightlife options, making it easy for you to move around.

When you’re looking to rent a loft space in Singapore, it’s essential to consider the location and price. A studio costs anywhere from $2500 to $5,000 per month, while an open-plan flat can range between $3,000 and $6,000.

What are the benefits of living in a loft apartment?

Living in a loft apartment has many benefits, and we’ll go over a few below.

1. You’ll feel like you’re living in a new, exciting city with an ever-changing view from your window.

2. You’ll be able to experience natural light and fresh air throughout the day without the need for windows or screens.

3. You’ll have plenty of storage space for your worldly possessions, and there won’t be any crowded walls or ceilings to contend with.

4. You’ll have ample room to decorate and express your unique personality, and no one will be able to tell that you live in a loft apartment.

5. Loft apartments are typically more energy-efficient than traditional apartments, as they allow more natural light and ventilation into the building. This means that you’ll save money on your energy bill every month! ( Unless You are one that On 24 by 7 Air-condition)

What are the benefits of buying a loft apartment in Singapore?

There are many benefits to buying a loft apartment in Singapore. Some of the primary reasons include the following:

– The Niche for loft apartments in Singapore means that prices is expected to be higher than traditional housing options.

– Loft apartments often come with unique and innovative design features you might not find in other properties.

– Since they’re newer and more up-to-date, loft apartments tend to be more energy efficient and feature updated facilities and amenities.

– Loft apartments often come with ample space and comfortable living environments, making them perfect for single residents or couples.

– Buying a loft apartment in Singapore can also provide a good investment opportunity, as prices tend to rise over time.

How much does it cost to build a loft in Singapore?

The prices for building a loft in a High Ceiling Apartment should be within range of $10,000 – $20,000. You can use online calculators like this one to get an idea of the average price for a loft apartment in Singapore.

Which kind of property is suitable for WFH in Singapore …

WFH in Singapore is an excellent option for those looking to live close to the city centre and who don’t want to splurge on expensive monthly rent or live in a cramped condominium.

Property owners typically charge additional monthly rent for WFH, making loft-style apartments an affordable housing solution. You can find properties like this by searching for “loft” or “apartment on the top floor” in your desired region – be sure to read reviews and compare prices before making a decision.

A loft-style property can be perfect if you want extra space but can’t afford a traditional house or condominium. They come in different sizes from 90 square feet up to 350 square feet and can be found at prime locations all over Singapore.

Please share some insights on the current loft apartment market in Singapore.

The loft apartment market in Singapore is increasing, and with good reason! The city is experiencing unprecedented growth rates, and there’s a lot of potential for even more expansion in the years to come.

With so many people moving to Singapore for work or study, the demand for loft apartments has been high – making it an ideal investment opportunity. Developers are starting to cater to luxury seekers who want a more urban living experience, and the loft apartment market will only keep heating up.

In addition to rising prices, the loft apartment market in Singapore is also attracting a new wave of buyers looking for something unique and different in terms of housing options. Although the city isn’t known for its natural beauty or greenery, many people see loft apartments as an alternative to traditional housing options.

Although there are few true experts in predicting the direction of the global real estate market, it’s safe to say that the loft apartment market in Singapore is showing strong.

Should I expect to pay more for a loft apartment if I want to live close to the city centre?

If you have decided to live close to the city centre, you should expect to pay more for a loft apartment. This is because loft apartments in cities often command a higher price due to their location in upmarket areas.

What is the average price for a loft apartment in Singapore?

Average prices for loft apartments start at S$4,500 per month in the Central Business District (CBD), and other locations that have seen increased demand include Orchard, Marina Bay Sands and River Valley. The average price for a loft apartment in Singapore is around S$1.7 million.

Which neighbourhoods in Singapore are best suited for luxury lofts?

When finding luxury lofts in Singapore, you can start by checking out popular areas like Holland and The Central Business District.

Make sure to factor in your budget before choosing an area, as high prices sometimes equate to high quality. Also, be sure to take into account the environment, infrastructure, and commuting distance when selecting a loft neighbourhood.

Some other factors you should consider when looking for luxury lofts in Singapore are Location (near transport hubs or central business districts), Architecture (modern or sleek designs), Amenities (a gym, pool, etc.), and Price range.

To find luxurious loft apartments in Singapore, you must research and look for neighbourhoods with a high concentration of wealthy people.

Is it worth investing in an urban loft apartment?

Owning a Loft apartment in one of the world’s most vibrant and culturally rich cities. They are located in some of the most beautiful and sought-after areas and come with many other benefits.

These benefits include easy access to public transportation, excellent city views, and more. Plus, with an ever-growing population density, this type of property is becoming even more scarce and expensive to find. For now, it’s still early days for lofts in Singapore – so be sure to act fast if you’re interested!

Conclusion

Thank you for reading this blog on The Loft apartment in Singapore. From the overview of the Loft to the different districts where the Loft is located, we have covered everything. In addition, we also reviewed some of the top condo choices that are currently available with growth potential. We have researched for you if you’re looking for a fantastic loft apartment in Singapore. Contact us for suitable units.

For Home Owners, we have sold numerous Loft Apartments in Singapore. Click here -> home valuation estimate

The post Loft Apartment in Singapore Price appeared first on Wing Tai Holdings Singapore.

]]>The post 4 Methods to Avoid Paying ABSD when Buying Condo in Singapore appeared first on Wing Tai Holdings Singapore.

]]>(ABSD is ADDITIONAL BUYER STAMP DUTY)

How Proper Planning can help you save in paying Less ABSD, regardless of whether you’re a Singapore Citizen, PR, Or Foreigner. This is right for You.

With the recent cooling measures implemented, there was an increase in ABSD with properties purchased on or after 16th Dec 2021.

– For Singapore citizens, There is no need to pay any ABSD on their first property for Singapore citizens, but it will be 17% ABSD on their second property and 25% on their third or subsequent property purchase.

– For Singapore Permanent Residents need to pay 5% ABSD on their first property purchase, 25% per cent on their 2nd property and 30% for the third and subsequent purchase.

– For Foreigners will need to pay 30% ABSD on all property purchases.

– Lastly, Entities such as corporate companies will have to fork out 35% ABSD on all property purchases.

So how should we Minimize the ABSD Cost that we need to pay in buying property LEGALLY?

You can kick start with these 4 methods:

Buying a property under single ownership so that the spouse can buy another under their own name.

– Although this topic is common, it’s straightforward, direct, and 100% guaranteed works. For example, husband and wife each purchase a property under their name. So legally, they can two properties without paying ABSD. Short & simple, right!

In the case of an HDB or Executive condominium, you can choose to list your spouse as an occupier instead of a co-owner. Once you fulfil the five years (MOP), the occupier can purchase a property.

– However, in the eyes of the Law, only the listed owner has the legal obligation to pay the monthly mortgage. Therefore, you would have to plan ahead on the repayment and financial obligation and monthly bills for each party.

For this to work please bear in mind:

– Only CPF Ordinary Account funds of the listed owner can be used.

– The sole owner must meet the income requirements to qualify for the home loan

– For brand new executive condominiums and HDB flats, the mortgage servicing ratio for loan repayments cannot exceed 30% of the sole borrower’s gross monthly income.

– For private properties and resale executive condominiums, the home loan – plus all existing debt obligations – cannot exceed 55% of the sole borrower’s gross monthly income or what we call it the total debt servicing ratio.

– If both spouses have a similar income, we will usually advise the younger spouse to hold the higher value property, which will help when it comes to refinancing options such as property gearing after two years of the purchase.

If you Already Owned a property under ( Joint Ownership or Tenancy in Common)

You can buy over your spouse’s share and free up your name from the title deed, also known as Decoupling.

Decoupling

– Decoupling sounds like a big word, but simply, it is the removal of 1 owner from the property through the “buy out” by the other party. One co–owner buys or sells their share of ownership to the other co-owner(s).

So legally, only one owner in 1 title deed, only then they will be counted as a first-time homebuyer.

Do note that Decoupling does not apply to HDB owners with effect from 4th May 2016 unless you have a special case to appeal to HDB, subject to their approval.

– Some other terms used are known as part-sale or part purchase too. Which will require buying out the share portion and doing a new bank loan. Other considerations such as CPF outlay used and accrued interest if any.

– I would suggest having workout the sums carefully for the Decoupling method. It may not be suitable for all couples, and it comes to some risk factors involved. Decoupling will incur higher legal costs due to the complexity.

– Couples can also buy a condo under tenants-in-common. This method allows you to split property ownership so that both incomes can support the home loan application, and both parties’ CPF Ordinary Account funds can be used for the down payment and ongoing mortgage instalments.

However, the Pre-Requisition is :

– You must have sufficient cash/CPF to return the exiting party’s CPF used plus accrued interest (Unless you have obtained a written reply by CPF that allows a waiver of this refund.)

– You must also have sufficient income to take over the full loan single-handedly.

Buying Under a Property Trust for children below 21 years old

– Buying Under Trust is just like buying a Legacy for your descendants. Some call this method for the cash-rich as No housing loan, or CPF usage is allowed.

– You can set up a property trust for your child below 21 years old and buy a property under it with you as the Trustee. Legally speaking, the property you purchase is not “yours”; it belongs to the beneficiary (your child). This means you are not legally the property owner; it does not add to your property count.

If you were to buy a second home with this method, you wouldn’t be subject to ABSD. You need to be prepared to part away from the money for the future planning for your child and any actions you act for such for the interest of your child and not for your own benefit.

– A trustee takes legal ownership of the assets held by a trust and assumes fiduciary responsibility for managing those assets and carrying out the purposes of the Trust.

– The Trustee should make a habit of keeping all the receipts and records of the payments they make. A trustee should know that all the income coming from the property, whether it be rents or any sales, are the property of the beneficiary. A trust account should be opened in a reputed bank so that all the transactions can be easily made, monitored, and checked by the Trustee. However, bear in mind that the final accounts belong to your child but not you.

You might wonder when does the Trust end?

– The Trust ends when the child is of the legal age, i.e., 21 years old.

– Once, the Trust ends, the child is now the complete owner of the property, including all of its taxes and mortgages. Of course, once reach the legal age, the child has the right to sell the property and decide on his own. Do not need to seek any approval, full ownership.

– The actual owner of the property is the beneficiary and not the Trustee. So, using the trust method, you can buy property for anyone as young as a toddler or right after the baby is born at birth.

– Another advantage of a trust is that since the courts regards the child as the beneficiary, if the parents or Trustee should become bankrupt many years after the Trust is created, the child’s ownership is safe from the parents’ creditors. The parents would not be able to act as trustees but some other relative could step it.

– Note that under the Bankruptcy Act, any gifts within 5 years of a person becoming bankrupt might be cancelled by the relevant bankruptcy official (usually the Official Assignee).

Buying a property in the name of someone that you can entrust with. (Such as your Family or Relative that is already in the workforce.)

– Relative or family members may have a good stable income but may not be willing to part with the vast 25% down payment or stamp duty. So that’s when you strike an agreement to buy a condo in their name in the title deed, whereby you can be contributing to the cash part for the down payment and monthly repayment.

– Only applicable for first-time home Singaporean home buyers, with NO ABSD.

But there are some other Considerations you might be aware of :

If your relative is planning to get married and buy a condo as their Matrimonial home, it may affect their family planning in the future.

– If your relative is planning to buy a Build to Order (BTO) flat or Executive Condominium, they would have to dispose of the private property at least 30 months before their application, so advanced planning is required.

– In Trust, your child is the legal owner of the property; they can sell it, use it as collateral for a loan, call the shots on who stays in it, etc. Some real-life cases can result in ugly family disputes or even escalate to court cases.

So, which method works best for you? There isn’t a single best method, and it depends on your financial situation and risk appetite in life. Advanced structuring strategies consist of layering methods in different orders to help investors own more properties, obtain higher financing, and save on tax and expenses.

However, it is a more in-depth analysis and customized plan for different needs that we may not be able to explain through article or video.

If you do need advice on such matters, feel free to contact us right now to get a free consultation call.

We make buying and selling a property in Singapore easy and seamless.

Also read up on ABSD refund and subscribe to our YouTube Channel: https://www.youtube.com/watch?v=jOW55_AlTiY

Also can subscribe to our Youtube Channel:

https://www.youtube.com/watch?v=jOW55_AlTiY

The post 4 Methods to Avoid Paying ABSD when Buying Condo in Singapore appeared first on Wing Tai Holdings Singapore.

]]>The post 8 Tips For Buying A Condo In Singapore For First Time Home Buyers appeared first on Wing Tai Holdings Singapore.

]]>No matter what your financial situation is, it’s not hard to see why people want a condo in Singapore. These more “atas” homes offer state-of the art amenities that many chase after these days and with such impressive properties you know you will get plenty of space for yourself or any family members who may come along during one’s lifetime!

Before you decide to buy, there are a few things that should be considered. You’ll have more peace of mind and freedom in your life once the purchase is final so take these 8 tips into account before making any hasty decisions!

1. Making sure you can pay the 25% down payment

Since condos are so expensive, you might want to think about getting a down payment of at least 20% with your CPF Ordinary Account. This way the total price will be much lower than it would have been if not for this money saving idea!

As long as you keep that minimum 5% cash rule in mind, feel free to fork out more from other savings and cut down on expenses like mortgage or student loans using those funds instead!

Once you’ve covered that down payment amount, it is time to get a housing loan and buy your condo! But before doing so make sure that the bank has approved-in principle for an agreement on how much they will lend. Make certain also if there’s any strings attached with buying this property from sellers or agents who might have set these conditions before selling their condos off of course

2. Freehold or leasehold unit?

House-hunters are probably familiar with the terms freehold and leasehold, but they don’t know that these two types of property ownership have different advantages. Freeholders can enjoy their homes for as long as they want because there is no time limit on how long it will be theirs whereas those who own leases instead must pay attention to years which are split to 99 years and 999 years.

If you’re thinking about buying property, it’s important to understand the differences between freeholds and leasehold. FreeHold properties often come with a higher price tag but can offer more stability than their lessee counterpart in terms of location as well as cost-of living adjustments throughout one’s lifetime (10-15%).

Leaseholds are a great way of saving money upfront and getting rid of that pesky responsibility as soon as possible! The only downside is that over time there will be less value left in your home–so think carefully if this interests you because it could turn out not so well after all.

3. MRT and transport lines

Staying near an MRT or transport line is always a good idea. Not only can you commute easily, but there are plenty of amenities like malls and community centres nearby that aren’t easy to come by in more ulu condos.

If you’re thinking about selling or renting out your condo in the future, think carefully if it’s near any upcoming MRT stations. The value of a property will soar over time!

4. Check whether all the amenities are useful for you

It’d be nice to live right next the tennis court or an infinity pool, but they also beg the question: will you really be using them?

In order to avoid any surprises in the future, it’s important that you take some time before signing up for a complex. Walk around and survey as many amenities available so there aren’t any big surprises down the line! You might find something better than what was originally planned when surveying all of these extravagant condo complexes with their beautiful facilities but also high maintenance fees. I’d recommend trying not only less expensive options first if possible because even though they may not come equipped with luxuries like marble floors or state-of-the art fitness centers; at least then we’ll know exactly where our money goes each month without having an unknown surprise show up on our bills every other week due solely from living somewhere over luxurious.

5. Set aside extra budget for taxes and stamp duty

You finally saved up enough cash to get your condo. You move in and revel in the novelty of owning such a luxurious new place, until one day when you wake up with an unexpected bill that just wasn’t part of what was agreed upon by all parties involved…

For many people, paying for a condo is just the beginning of their financial worries. This includes not only paying in full up front and taking on monthly maintenance fees but also having enough money set aside each month to cover property tax bills which can be as high at $2,100 per year

If you’re looking to invest in real estate and have multiple properties, note that the additional Buyers Stamp Duty (ABSD) will be charged if your condo purchase is seen as a second property. As such, it may cost 12% on top of what’s being spent for your home.

6. Is the size of the condo is suitable for future plans?

You may think that condo living is a simple affair, but it’s important to remember the size of your home and what you’ll need in order for it be suitable. If space isn’t an issue – single-bedroom condos are perfect for singles or young couples who want their own private haven without having too much upkeep on larger homes with kids coming up next door! On the other hand if family life is already planned than bigger properties might better suit all parties involved

If you’re looking for a place to call home, take the time to consider every detail. Check out what’s included in your purchase and don’t forget how important location can be- condo fitting may make all of the difference between life on campus or downtown!

7. Showflat dimensions vs yours

Developers often go to great lengths to make their showflat stand out. The units are typically decorated with large mirrors, plush furniture and pretty decor to impress you as much as possible.

Normally show flats on the ground floor is that they tend to have higher ceilings and larger balconies, so ask beforehand if these dimensions match up with what you’re looking for in a condo. If possible, get your hands on an overview plan as this gives a better sense without all distractions – but make sure not just settle!

8. Know the pros and cons of each unit position

It’s important to think about the pros and cons of each condo before you make your decision. For instance, living on top floor is a total dream but can come at higher expense due in part because it has better views that don’t get blocked by other buildings or trees

One thing to consider when buying a unit near your refuse station is that it may be cheaper. However, this might not make up for the smell and you will need more space than what’s available in close proximity so keep these points in mind before purchasing!

If you think that your family would enjoy having amenities such as tennis courts, gyms and swimming pools in close proximity to one another consider picking a unit on the property. Remember walks back can be long when using these facilities so do check on the ground size around the condo.

Speak to our Property Advisors call 94507545, let us advise you over the phone we can be the bridge to a solution that can be less painful and time-consuming. Leave the work to us.

The post 8 Tips For Buying A Condo In Singapore For First Time Home Buyers appeared first on Wing Tai Holdings Singapore.

]]>The post Property Virtual Tour appeared first on Wing Tai Holdings Singapore.

]]>Introducing virtual property tours — get a clear 360° view of the property from every angle, all from the comfort of your home! Besides being a practical option during this new normal of social distancing, this modern technology offers a range of benefits that will revolutionise your property search. Read on to learn more!

Save Money and Time

Prospective clients can save time by viewing properties online without having to take a single step out of the house. Between commuting, searching for parking, and the actual visit, you end up saving a lot of precious time and money.

Your property search doesn’t have to be exclusively online. By utilising virtual property tours, you can browse through hundreds of properties quickly and identify some that catch your eye. Once you have a list of properties you like, you can request for a physical viewing. This way, you can make good use of your time on the properties that matter the most to you.

Get a Realistic Representation of Properties

As a homebuyer or renter, there’s nothing more frustrating than arriving at the property and realising it looks nothing like what it looks like online. From wide lens photos to deceptive angles, property photos can sometimes be deceiving.

However, with 3D virtual house tours, you get to experience realistic representations of the property in an immersive way. You can move around the property and gauge its true size and appearance, just as if you are physically there. In fact, Estate Agent research shows that 75% of potential real estate buyers prefer interactive virtual tours over normal photographs.

Have More Time to Consider

Buying or renting a property is a huge decision, and you will likely need some time to consider. It doesn’t help that physical property viewings typically only last 20-30 minutes, so you’re likely to forget many details shortly afterward. What does the kitchen look like? How is the condition of the roof? What about the outdoor area?

With a 3D virtual house tour, it allows potential buyers to revisit the property unlimited times and get their questions answered without having to disturb the homeowner. Buyers can take their time to analyse all aspects of the premises before making any decisions and be rest assured that they can view the property anytime, anywhere.

Virtual Property Tours Are Becoming Crucial

There’s no doubt that technology is revolutionising the property search process for potential homebuyers and renters alike. Virtual property tours streamline the property journey, offering greater convenience and flexibility when it comes to finding your new home.

Don’t waste more time on countless visits that lead to nowhere. Take our virtual tours and discover your new home.

Looking for properties but not sure where to start? Check out our extensive property listings in Singapore and you’ll be sure to find one that catches your eye.

The post Property Virtual Tour appeared first on Wing Tai Holdings Singapore.

]]>The post Is it a Good time to Wing Tai Holdings in Singapore now? appeared first on Wing Tai Holdings Singapore.

]]>

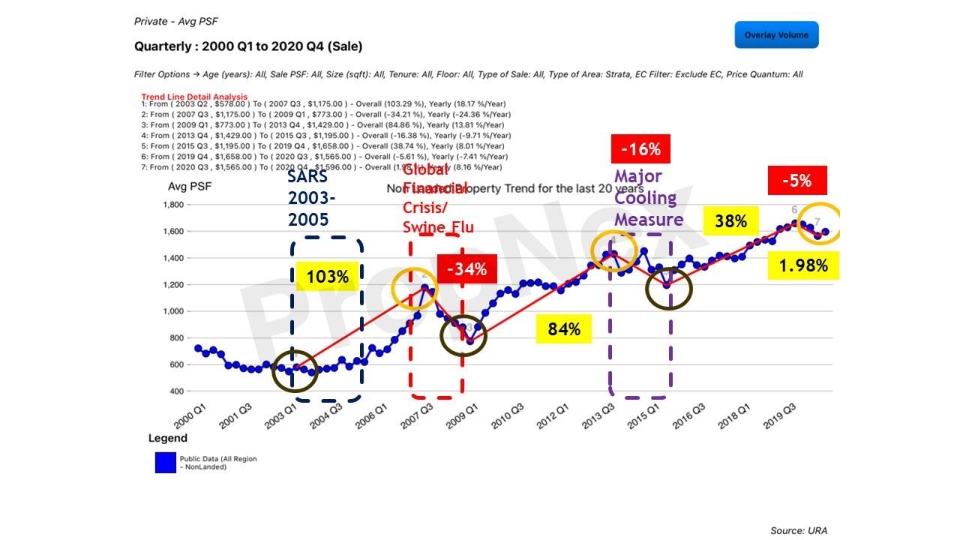

The million-dollar question people are asking these days” Is it a Good time to Wing Tai Holdings in Singapore now? “Political stability and harmony make Singapore’s real estate a dependable place to invest in. Coupled with the strength of the Singapore dollar, which makes property investment rock solid.

On top of that, the government has also shown that when it comes to property, it is proactive in implementing measures that keep the market stable and prevent a dangerous bubble from forming. This sort of control and emphasis on stability is rare in other markets and keeps property from swinging.

Furthermore, the government also imposes measures that regulate the quality of housing, such as the latest URA guidelines on maximum unit sizes. This commitment to keeping Singapore housing and neighbourhoods liveable is reassuring to investors over the long-term as it reduces uncertainties such as finding out that a once-quiet neighbourhood has been transformed into a traffic nightmare ten years later.

On a more fundamental level, simple facts such as land scarcity along with a need to grow the population and the national GDP support a consistent demand for Singapore real estate.

With a pandemic causing financial markets to tank and lots more uncertainties still on the horizon, investors have been flocking to keep their cash in Singapore, with bank deposits in foreign currencies reaching an all-time high.

Long-standing political crisis around the world, trade war between major counties and uncertainties over the Covid-19 pandemic have led investors to direct their funds here. The Singapore banks are the only banks in the Asia-Pacific region rated as a stand-alone in the double ‘AA’ range and therefore more likely to attract funds in times of stress. This “AA” rating means that the financial institution has a very low risk of defaulting.

As a result, Singapore has recently become home to a list of global technology giants that have been setting up regional hubs with plans to invest billions of dollars and hire thousands in Singapore.

Of which are Zoom Video Communications, with plans on doubling its data centre capacity by opening a research and development centre.

Twitter is setting up its first Asia-Pacific engineering centre in Singapore, covering software and data engineering and data science.

ByteDance, owner of TikTok platform plans to invest billions of dollars in Singapore after opting to base its regional headquarters here and many more with plans to expand and strengthen their presence in ASEAN region.

In the current climates, where interest rates are lower, owning property has become accessible and more attractive as it is an investment that can provide ongoing income through rent payments and capital growth as housing prices rise.

The post Is it a Good time to Wing Tai Holdings in Singapore now? appeared first on Wing Tai Holdings Singapore.

]]>