The post Resale HDB Flat: Is it Worth Holding in Today’s Market 2023? appeared first on Wing Tai Holdings Singapore.

]]>

Let us look at the Pros and Cons of owning an HDB Flat.

PROs

- Priced at affordable rates.

- Well taken care by HDB policy.

- Provides a decent quality of living.

CONs

- Limited capital appreciation potential.

- Price is indirectly controlled by HDB through releasing supplies.

- Many options are available in the market thus strong competition.

- Require to return the flat back to HDB after 99 years.

- Lease delay due to 99-year leasehold.

From the above, we can see that HDB flat will provide an affordable and worry-free housing option for many.

But but but.. It may not be a good instrument for wealth accumulating asset.

It may seem like it’s good in the current market, but now let us look into the capital appreciation of an HDB Flat.

The majority of HDB buyers will most likely apply for HDB Loan and utilize their CPF monies for HDB purchases and neglect a component called the Accrued Interest.

What Is Accrued Interest?

Accrued interest is the interest amount that you would have earned if your CPF savings had not been withdrawn for housing. The interest is computed on the CPF principal amount withdrawn for housing on a monthly basis (at the current CPF Ordinary Account interest rate) and compounded yearly.

How much is HDB Loan Interest Rate?

This concessionary interest rate is pegged at 0.10% above the prevailing CPF Ordinary Account (OA) interest rate. (2.5%+0.10% which gives us 2.6%)

With all these interest going around, NEGATIVE CASH PROCEEDS CAN HAPPEN!

Based on the current HDB Loan Interest Rate and Accrued Interest, your HDB flat must have an increased minimum of 5% per annum to break even which also means $0 cash proceeds.

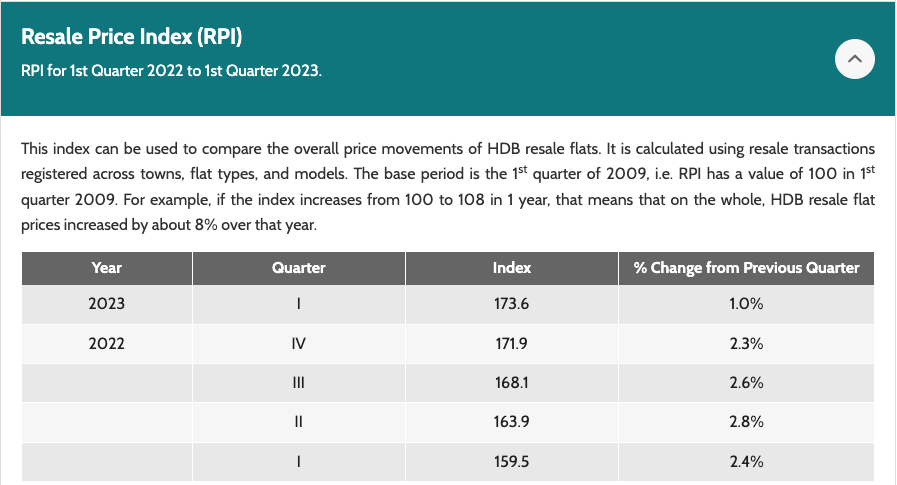

Now let us take a look at the latest HDB Resale Price Index (RPI):

For the first quarter of 2023, the price growth was only 1.0% compared to the 4 quarters in 2022. Mainly because of the cooling measure introduced in September 2022, where MAS raises the Medium-term Interest Rate floor by 0.5%-point to 4% per annum(p.a) for bank loans and 3% Interest Rate floor for HDB loans.

To further dampen the demand and price hike, lower Loan-to-Value(LTV) limit were also implemented, LTV limit for HDB housing loans was lowered by 5%-points from 85% to 80%, which means there will be higher capital outlay, coupled with a Wait-Out Period for Private Residential Property Owners(PPOs) and ex-PPOs to buy non-subsidized HDB Resale Flats.

They will now be required to serve a wait-out period of 15 months after the disposal of their private properties before they are eligible to buy a non-subsidized resale flat. For more information, please refer to the link above.

Are the cooling measures effectively dampening the market demand for HDB?

Is 1% gain per Quarter enough for me to break even?

Is it something that I should worry?

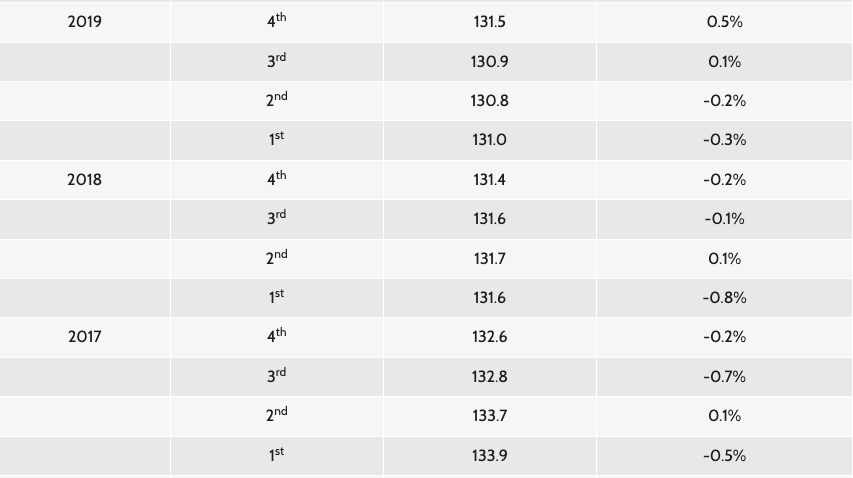

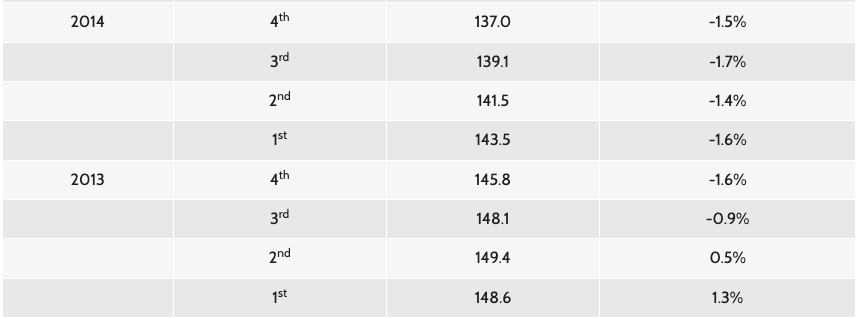

Let us take a walk back to the past and look at the history of HDB Resale Price Index(RPI) when demand was well controlled before the pandemic(Covid 19):

As we can see from the past statistic, the growth during the pandemic seems illogical, let us find out why it is acting this way.

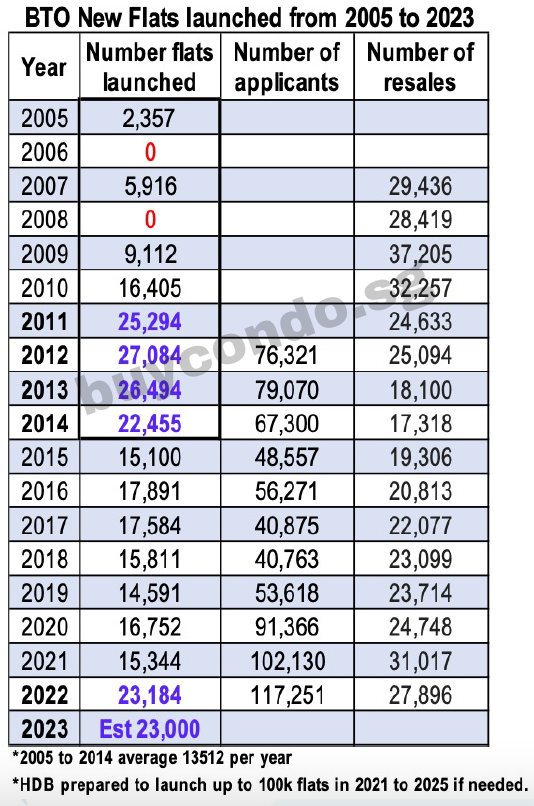

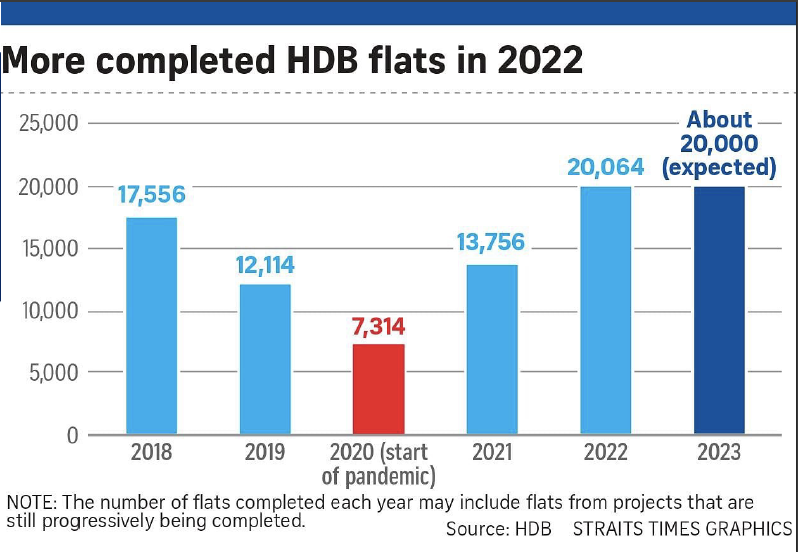

It all boils down to the Supply & Demand behavior of the market that drives the general prices of property in Singapore. The surge in the demand for HDB came in during the pandemic period coupled with the delay in the construction of the new BTO that was supposed to be completed on time.

HDB to Ramp Up Flat Supply by 35% Over Next Two Years

HDB will ramp up the supply of new Build-To-Order (BTO) flats over the next two years to meet the strong housing demand from Singaporean households. We plan to launch up to 23,000 flats per year in 2022 and 2023 across mature and non-mature towns. Looking ahead, we are prepared to launch up to 100,000 flats in total from 2021 to 2025, if needed, subject to prevailing demand.

Will There Be An Impending Over Supply Issue In The Near Future?

Are There Still Opportunities for Capital Appreciation?

So now we know that HDB will be ramping up supplies of new BTO Flats coupled with the delayed BTO Flats that will be completed in due time flooding the HDB market supply, what will we see in the market in the near future?

Will we still see a price hike like in 2021 and 2022 or repeated behavior like in 2013 and 2014?

Many Home Owners often have plans to leave their inheritance to their children, including property for most people.

But will the property they left behind be an ASSET or a LIABILITY?

What is the best plan for your future then?

Would you prefer to be sitting on a property that is fully paid, valued at $600,000, or one that is valued at $1,500,000?

“A Person’s most useful asset is not the head full of knowledge, but a heart full of love, an ear ready to listen, and a hand willing to help.”

Let us know what is your take on the sharing, you may also connect with any of our writers here to learn more about how you can value add to your retirement portfolio!

To learn more about upgrading to Executive Condominium, Click here!

For more similar articles, check out our blog section!

The post Resale HDB Flat: Is it Worth Holding in Today’s Market 2023? appeared first on Wing Tai Holdings Singapore.

]]>