Tips for buying a condo here in Singapore

No matter what your financial situation is, it’s not hard to see why people want a condo in Singapore. These more “atas” homes offer state-of the art amenities that many chase after these days and with such impressive properties you know you will get plenty of space for yourself or any family members who may come along during one’s lifetime!

Before you decide to buy, there are a few things that should be considered. You’ll have more peace of mind and freedom in your life once the purchase is final so take these 8 tips into account before making any hasty decisions!

1. Making sure you can pay the 25% down payment

Since condos are so expensive, you might want to think about getting a down payment of at least 20% with your CPF Ordinary Account. This way the total price will be much lower than it would have been if not for this money saving idea!

As long as you keep that minimum 5% cash rule in mind, feel free to fork out more from other savings and cut down on expenses like mortgage or student loans using those funds instead!

Once you’ve covered that down payment amount, it is time to get a housing loan and buy your condo! But before doing so make sure that the bank has approved-in principle for an agreement on how much they will lend. Make certain also if there’s any strings attached with buying this property from sellers or agents who might have set these conditions before selling their condos off of course

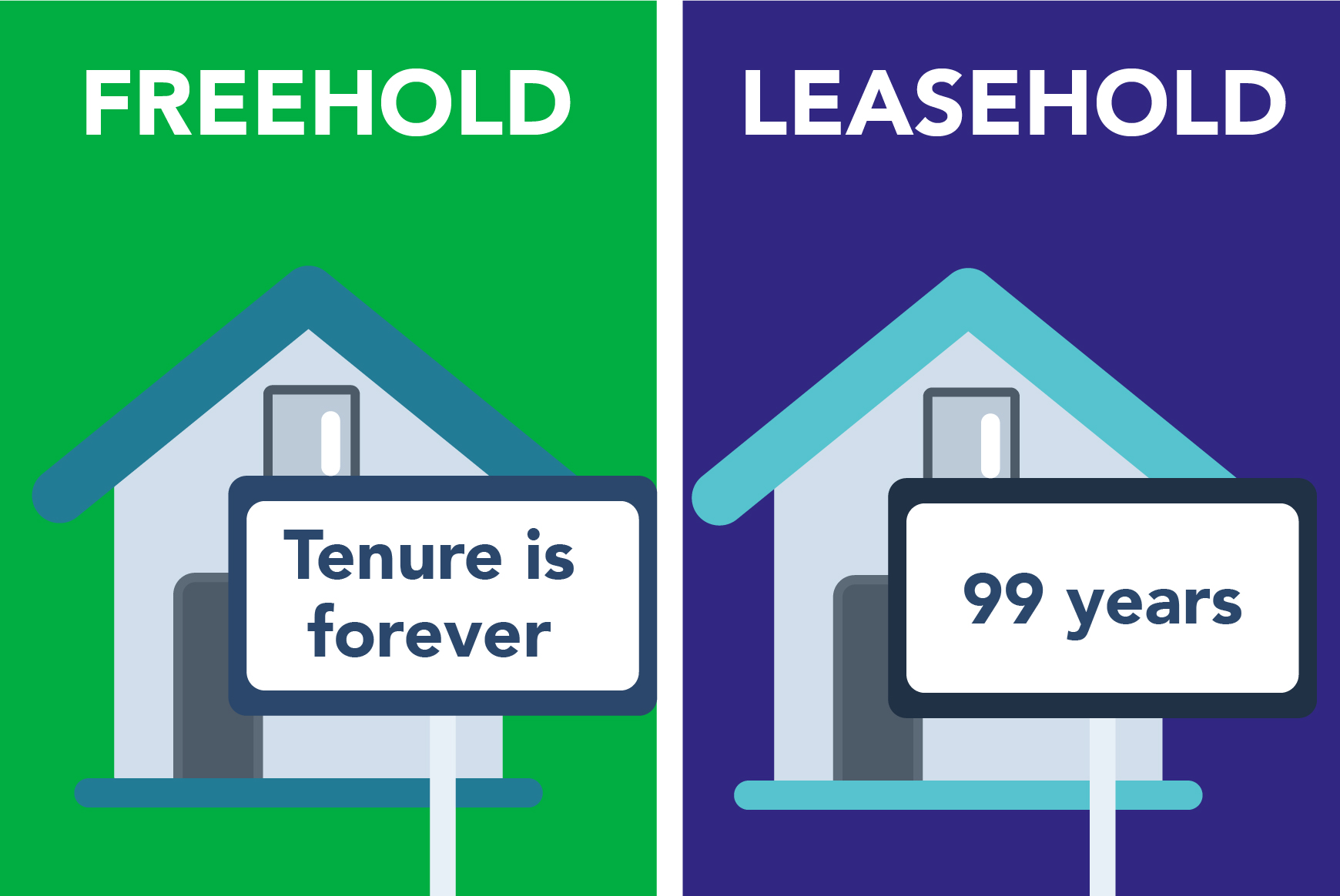

2. Freehold or leasehold unit?

House-hunters are probably familiar with the terms freehold and leasehold, but they don’t know that these two types of property ownership have different advantages. Freeholders can enjoy their homes for as long as they want because there is no time limit on how long it will be theirs whereas those who own leases instead must pay attention to years which are split to 99 years and 999 years.

If you’re thinking about buying property, it’s important to understand the differences between freeholds and leasehold. FreeHold properties often come with a higher price tag but can offer more stability than their lessee counterpart in terms of location as well as cost-of living adjustments throughout one’s lifetime (10-15%).

Leaseholds are a great way of saving money upfront and getting rid of that pesky responsibility as soon as possible! The only downside is that over time there will be less value left in your home–so think carefully if this interests you because it could turn out not so well after all.

3. MRT and transport lines

Staying near an MRT or transport line is always a good idea. Not only can you commute easily, but there are plenty of amenities like malls and community centres nearby that aren’t easy to come by in more ulu condos.

If you’re thinking about selling or renting out your condo in the future, think carefully if it’s near any upcoming MRT stations. The value of a property will soar over time!

4. Check whether all the amenities are useful for you

It’d be nice to live right next the tennis court or an infinity pool, but they also beg the question: will you really be using them?

In order to avoid any surprises in the future, it’s important that you take some time before signing up for a complex. Walk around and survey as many amenities available so there aren’t any big surprises down the line! You might find something better than what was originally planned when surveying all of these extravagant condo complexes with their beautiful facilities but also high maintenance fees. I’d recommend trying not only less expensive options first if possible because even though they may not come equipped with luxuries like marble floors or state-of-the art fitness centers; at least then we’ll know exactly where our money goes each month without having an unknown surprise show up on our bills every other week due solely from living somewhere over luxurious.

5. Set aside extra budget for taxes and stamp duty

You finally saved up enough cash to get your condo. You move in and revel in the novelty of owning such a luxurious new place, until one day when you wake up with an unexpected bill that just wasn’t part of what was agreed upon by all parties involved…

For many people, paying for a condo is just the beginning of their financial worries. This includes not only paying in full up front and taking on monthly maintenance fees but also having enough money set aside each month to cover property tax bills which can be as high at $2,100 per year

If you’re looking to invest in real estate and have multiple properties, note that the additional Buyers Stamp Duty (ABSD) will be charged if your condo purchase is seen as a second property. As such, it may cost 12% on top of what’s being spent for your home.

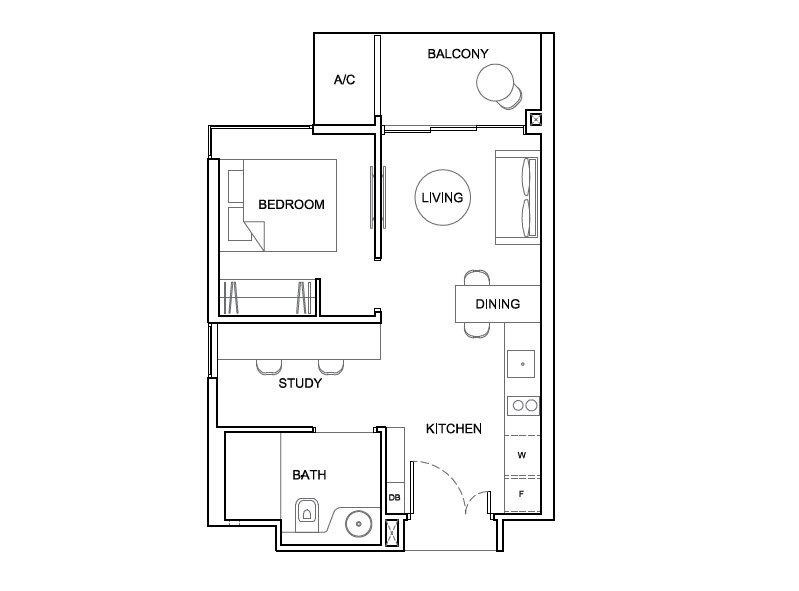

6. Is the size of the condo is suitable for future plans?

You may think that condo living is a simple affair, but it’s important to remember the size of your home and what you’ll need in order for it be suitable. If space isn’t an issue – single-bedroom condos are perfect for singles or young couples who want their own private haven without having too much upkeep on larger homes with kids coming up next door! On the other hand if family life is already planned than bigger properties might better suit all parties involved

If you’re looking for a place to call home, take the time to consider every detail. Check out what’s included in your purchase and don’t forget how important location can be- condo fitting may make all of the difference between life on campus or downtown!

7. Showflat dimensions vs yours

Developers often go to great lengths to make their showflat stand out. The units are typically decorated with large mirrors, plush furniture and pretty decor to impress you as much as possible.

Normally show flats on the ground floor is that they tend to have higher ceilings and larger balconies, so ask beforehand if these dimensions match up with what you’re looking for in a condo. If possible, get your hands on an overview plan as this gives a better sense without all distractions – but make sure not just settle!

8. Know the pros and cons of each unit position

It’s important to think about the pros and cons of each condo before you make your decision. For instance, living on top floor is a total dream but can come at higher expense due in part because it has better views that don’t get blocked by other buildings or trees

One thing to consider when buying a unit near your refuse station is that it may be cheaper. However, this might not make up for the smell and you will need more space than what’s available in close proximity so keep these points in mind before purchasing!

If you think that your family would enjoy having amenities such as tennis courts, gyms and swimming pools in close proximity to one another consider picking a unit on the property. Remember walks back can be long when using these facilities so do check on the ground size around the condo.

Speak to our Property Advisors call 94507545, let us advise you over the phone we can be the bridge to a solution that can be less painful and time-consuming. Leave the work to us.