ABSD Remission/Refund

- Count of properties: Dependent on the date of contract (i.e. date of exercise of option)

- When there are multiple purchasers, higher ABSD applies

What is the difference between remission and refund?

• Remission: When ABSD does not need to be paid at all

• Refund: When ABSD needs to be paid, but can be claimed back later

ABSD Remission

Remission is applicable in the following scenarios:-

• Purchase of HDB flats and EC units

• Purchase by married couples

• Purchase by foreigners under Free Trade Agreements

A Singapore Citizen (SC) who purchases an HDB flat or EC as his first property does

not pay any ABSD. A Singapore PR (SPR) who purchases an HDB flat as his first

property pays ABSD of 5%.

ABSD remission is granted in the following scenarios:

•For purchase of HDB flat/new EC by a household which comprises SC(s) and

SPR(s) co-owners

• For purchase of HDB flat/new EC in cases where HDB grants the household a 6-

month or such other period as may be stipulated by HDB to dispose of its existing

property(ies)

• A lower ABSD rate of 5% (instead of 30%) will apply for purchase of HDB flat by

SPR household where HDB grants the SPR a 6-month or such other period as may

be stipulated by HDB to dispose of the existing property(ies)

• Usually, when there are multiple purchasers to a property, the higher

applicable rate applies. However, for married couples with at least one SC,

ABSD remission may apply (only for their first property).

Eg. SC-SPR buying first property

If not married, 5% ABSD

If married, no ABSD

Eg. SC-FR buying first property

If not married, 60% ABSD

If married, no ABSD

• Usually, foreigners would have to pay 60% ABSD. However, due to

free trade agreements that Singapore has with certain countries, their

nationals and/or residents are accorded the same treatment as SCs

• Nationals and Permanent Residents of:-

• Iceland

• Liechtenstein

• Norway

• Switzerland

• Nationals of:-

• United States of America

ABSD Refund

• Purchase of second residential property by a married couple involving

at least one SC spouse may qualify for ABSD refund subject to the

following conditions:-

• ABSD has been paid on the second residential property

• The first property (co-owned or owned separately) is sold within 6 months

from the date of purchase of the second property (if it is a completed

property) or TOP/CSC (whichever is earlier) of the second property (if it is an

uncompleted property)

• The married couple has not purchased or acquired a third or subsequent

property from the date of purchase of second property to the date of sale of

the first property

• Rationale: No need to pay ABSD if it is a matrimonial home

Procedure for Remission/Refund

• All applications for remission/refund (except for purchase of HDB flats

and new EC units) must be submitted to Commissioner of Stamp

Duties for consideration

• For purchase of HDB flats and new EC units, automatic remission

• Usually done by the solicitors for the purchasers

Scenerio 1

Q: A US citizen (who is also a SPR) buys his first property in Singapore. Is ABSD payable (and if so, how much)?

A: No ABSD payable. ABSD is remitted.

Scenerio 2

Q: Husband and wife (both Singaporeans) own one property. The

husband buys a 2nd property and pays 20% ABSD. They then sell

their 1st property. Can ABSD be refunded?

A: No. The 2nd property has to be owned by both husband and

wife.

Scenerio 3

Q: Husband and wife (both Singaporeans) own 2 properties. They

then buy a 3rd property together, and pay 30% ABSD, and sell the

1st and 2nd property. Can ABSD be refunded?

A: No. ABSD refund is only applicable for the 2nd property

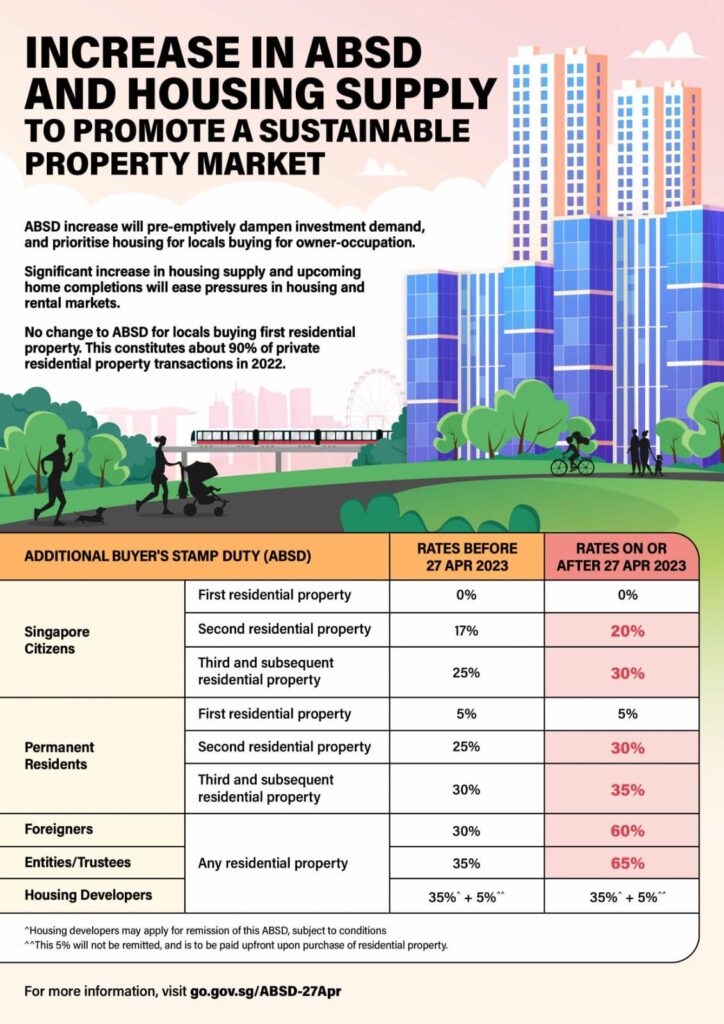

Also check the Budget for 2023 Housing Policies.

Top 10 FAQ from CEA on ABSD Remission.