ALTURA EC Launching: Why is everyone going crazy about EC in Singapore?

The Rising Craze of Executive Condominiums in Singapore: Affordable Luxury and Exclusive Living

Executive condominiums (ECs) are highly sought-after residential options in Singapore, standing out as a more upscale choice compared to other HDB flats such as BTO flats, Sale of Balance Flats (SBF) units, and Open Booking of Flats (OBF) units.

Referred to as “sandwich flats,” executive condominiums in Singapore represent a unique housing category combining public and private housing elements. They cater to middle-income Singaporeans who are ineligible for an HDB flat due to the income ceiling, yet consider private condominiums financially out of reach. What sets ECs apart is their attractive pricing in comparison to private condominiums while still offering comparable amenities and designs.

“Wait, Sooooooo What’s so good about Executive Condominium then?”

“Isn’t Private Condo still superior over Executive Condo?”

LET’S TAKE A LOOK AT THE COMPARISON BELOW

Advantages of Buying Executive Condos in Singapore

1. Executive Condos Are Priced lower Compared to Private Condos

Executive Condominiums buyers get to enjoy the perks of living in private property as subsidized by the government, provided that they fulfill the eligibility requirements. In addition, first-time Executive Condo buyers may be entitled to CPF housing grants. Even though the lower price tag, EC owners also get to enjoy the full condo facilities and fully equipped kitchens and bathrooms that are comparable to condominiums.

“Considering buying at subsidized rates, and can be sold freely in open market after 10 year!”

2. Privatised After 10-Year Mark.

Given their more affordable cost and the 10-year privatization rule, numerous buyers of executive condominiums (ECs) hold the belief that these properties may experience higher capital appreciation compared to private condominiums after the 10-year mark. Don’t forget that you will be buying from HDB at a subsidized price. *Grin*

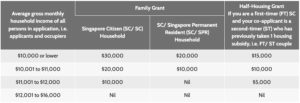

3. CPF Housing Grants for First-Timer Applicants (EC)

Households comprising SC and SPR individuals are eligible for an additional $10,000. This amount can be obtained when the SPR member converts to an SC and applies for the Citizen Top-Up within 6 months of meeting the eligibility criteria.

4. Favorable Housing Option for Middle-Income Singaporeans Designed for Own Stay

Executive condominiums (ECs) were primarily designed to serve as residences rather than investment assets. As part of this intention, specific regulations exist for EC owners. Firstly, the buyer must reside in the EC for a minimum of five years before it can be sold. Furthermore, even after the five years, there are restrictions on the sale, allowing only Singapore Citizens or Singapore Permanent Residents to purchase the property. However, once reaches the 10-year mark, the EC is effectively transformed into a private condominium and can be freely sold to anyone on the open market!

These measures aim to provide context to the nature of ECs, which are subsidized by the state and intended to facilitate homeownership for Singaporeans rather than serving as investment opportunities for real estate investors. While the Minimum Occupation Period (MOP) may be seen as a constraint, it does not pose any obstacles for those who view an EC primarily as a place to call home and have genuine intentions of residing in it.

5. No ABSD payable

Good news! Due to the recent implementation of hefty ABSD increment, many HDB upgrades face issues with forking out the ABSD upfront though it can be remission after selling the previous home within six months of getting the new one. But if you purchase an Executive Condominium (EC), you don’t need to pay the ABSD first, you do still need to dispose of your flat within six months but at least there is no need for extra cash or CPF savings upfront. Yay!

disadvantages of buying EXECUTIVE CONDOS IN SINGAPORE

1. Limited to Bank Loans for Executive Condo Purchase

In contrast to an HDB loan, when obtaining a bank loan, the Loan-to-Value (LTV) limit is set at 75% of the property’s valuation or price, whichever is lower. This implies that you will need to contribute a minimum of 25% of your funds for the down payment of your executive condominium (EC). Out of this amount, 5% must be paid in cash, while the remaining 20% can be financed through a combination of CPF funds and cash.

Furthermore, you will also need to consider the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR) rules. Under the MSR rule, you are only allowed to allocate a maximum of 30% of your monthly income toward servicing your home loan. Regarding the TDSR rule, the total amount dedicated to debt repayments, encompassing obligations such as car loans, credit cards, and student loans, cannot exceed 55% of your monthly income.

2. HDB Rules Apply

As previously mentioned, executive condominiums (ECs) are classified as HDB properties in the initial 10 years. During this duration, it is mandatory to adhere to HDB regulations, including the Minimum Occupation Period (MOP) requirement. The MOP entails residing in your EC for five years before you can consider selling or renting it out, limited to Singapore Citizens (SCs) and Permanent Residents (PRs) only. It’s important to note that the MOP period commences once the development has obtained its Temporary Occupation Permit (TOP).

3. New EC Launches Are Limited

Due to the high demand and scarcity of EC launches in Singapore, whenever there is a new EC launch, it tends to spark a frenzied rush among potential buyers.

Upcoming EC launch for 2023

ALTURA EC

1st EC launch in Bukit Batok after more than 20 Years, 1KM from the future ACS Primary, Princess Elizabeth, Dulwich College, and more!

Number of Units: 360

Size: 134,004 Sqft

Location: D23 – Hillview, Dairy Farm, Bukit Panjang, Choa Chu Kang

Address: Bukit Batok West Ave 8

Developer: TQS (2) Development PTE LTD

Visit ALTURA EC Site for more information. Learn more.

For more EC eligibility & property inquiries, please feel free to connect with us to learn more!

Looking for more similar articles? Check out BuyCondo’s Blog section!