Singapore Real Estate Market Outlook 2023

In the period from 2022 to 2023, rental prices have been vigorously pursuing resale prices, narrowing the gap between them.

This indicates that the surge in property prices is well-supported by a corresponding increase in rental prices.

However, it is crucial to acknowledge that current rental prices are exorbitant and not sustainable in the long run unless there is a matching growth in income.

If rental prices stabilize and grow at a relatively similar pace to income, it will ensure that future property price hikes remain sustainable from a rental standpoint.

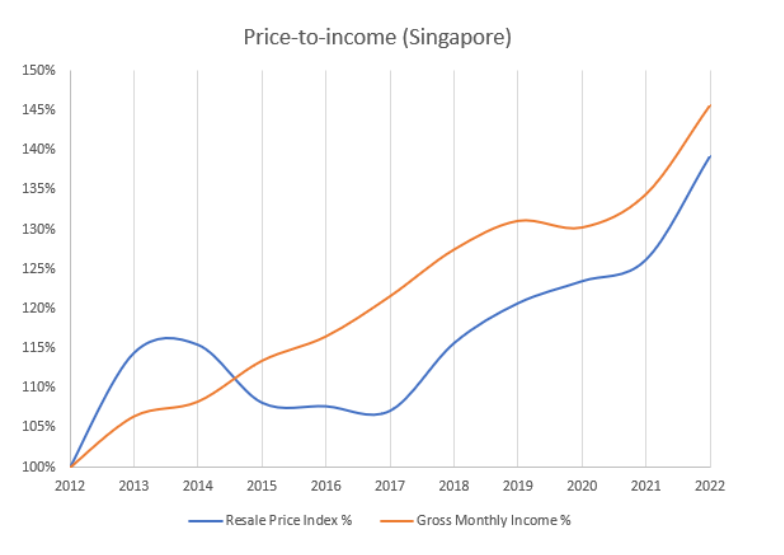

Price-to-rent and price-to-income ratios remain favourable, indicating a healthy property market.

These two metrics hold immense significance as they provide insights into the sustainability of buyers’ mortgages.

Considered as “bubble” indicators for the residential property market, they play a crucial role.

Mortgage payments rely on rental income and personal earnings.

Therefore, if property prices rise significantly faster than rent and income, it becomes evident that buyers are driven by the fear of missing out (FOMO).

Unfortunately, such behavior leads to financially unsound purchases and excessive reliance on rental income and personal earnings.

In their pursuit of catching the hype train, individuals disregard their own financial stability.

Private Residential Market

Will Property Prices Drop in 2024 Singapore

Singapore Real Estate Market Analysis for 2023-2028

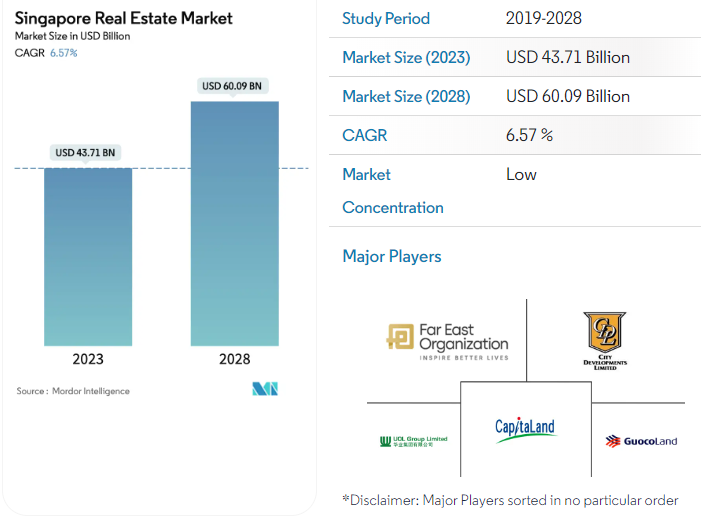

The Singapore Real Estate Market size is estimated at USD 43.71 billion in 2023, and is expected to reach USD 60.09 billion by 2028, growing at a CAGR of 6.57% during the forecast period (2023-2028).

Affordable housing projects in the country drive the market. Furthermore, the market is driven by the demand for logistics and industrial real estate.

- Singapore’s real estate market is a haven for foreign investors, and property value is growing steadily. Amidst COVID-19, the Singapore real estate market recorded growth in 2021. According to sources, there were 28,734 non-landed residential transactions in 2021, registering sales of USD 2 billion. This was a 57% increase from 2020 when the total transaction volume reached 18,295. Of the transactions, 12,574 were new launch properties, while 15,677 were resale properties.

- Affordable projects dominated the market in Q3 2021, with 9 out of 10 best-selling projects in the Outside Central Region (OCR). This was mainly due to the excellent performance from launches in the past two years and the preference for larger homes due to enduring work-from-home arrangements. The sustained growth over the past one and a half years of the private property market in Singapore is a strong signal of property sellers’ unwavering confidence in the market. The property price growth is likely to continue, but it shows signs of slowing down alongside decreasing transaction volumes.

- In the office sector, more occupiers have been eyeing locations farther away from the city centre to woo talent. In contrast, others rejig their real estate footprint to enable employees to work in less-dense spaces. Large technology firms in Singapore are further set to drive office demand and co-working space shortly as Singapore is emerging as a technology hub. In the hospitality industry, the Singapore Tourism Board (STB) launched BOOST (Building On Opportunities to Strengthen Tourism), i.e., a USD 90 million initiative to increase the tourist influx within Singapore. Business Travel, Meetings, Incentive Travel, Conventions, and Exhibitions (BTMCE) are some of the significant sources of revenue for the country’s hotel real estate industry.

- The extended low-interest-rate environment will increase the attractiveness of commercial real estate in Singapore, especially those that can provide stable returns. The outlook of an improving property market in Singapore, affordable loans, and relatively more inexpensive small apartments have attracted many investors to real estate. As for industrial real estate, the robust growth momentum has persisted. New warehouse supply is slated to come online, with notable projects in Singapore’s western region, including Logos EHub, which accommodates a broad spectrum of e-commerce uses.

Singapore Real Estate Market 2022-2023

The real estate market refers to selling real estate services by entities (organizations, sole traders, and partnerships) that rent, lease, and allow the use of buildings and land. A complete background analysis of the Singapore Real Estate Marke, including the assessment of the economy and contribution of sectors in the economy, market overview, market size estimation for key segments, and emerging trends in the market segments, market dynamics, and geographical trends, and COVID-19 impact is included in the report.

The Singapore Real Estate Market is segmented By Property type (Residential, Retail, Logistics/Industrial, Hospitality, and Office) and Value (Premium, Luxury, and Affordable). The report offers the market size and forecast values (USD billion) for all the above segments.

By Property Type

Retail

Logistics/Industrial

Hospitality

Office

By Value

Premium

Luxury

Affordable

Singapore Real Estate Market Trends

This section covers the major market trends shaping the Singapore Real Estate Market according to our research experts:

Rise in the Residential Segment of the Singapore Real Estate Market

Despite a struggling economy caused by the COVID-19 pandemic, Singapore’s housing market remains healthy. According to the Urban Redevelopment Authority (URA), prices of private residential properties increased by 5.0% in Q4 2021, compared with a 1.1% increase in Q3 2021. For the whole of 2021, prices of private residential properties increased by 10.6%, compared with the 2.2% increase in 2020. Prime properties at preferred locations are still expected to be the hotspot locations with the high asking prices. The rise of the middle class creates a desperate need for urban real estate, including residential housing.

Growth in the Retail Sector in Singapore

Store expansions and openings are expected to advance as retailers adapt to the new retail environment post-COVID-19. Retail market recovery is expected to be long-drawn, given the risks and uncertainties still lingering. However, it will be mitigated by the moderate level of upcoming supply.

The number of retail properties listed for mortgagee sale jumped by 62% in 2021 to 84 from 52 in 2020. There were also 101 owner-sale listings of strata retail units in 2021, soaring from just 17 in 2020.

The widening of the two-tier market is anticipated to continue the hold, although rental corrections and vacancies for the secondary locations and floors in prime locations could present opportunities. Retail logistics has remained a resilient asset class amid the pandemic, with stable rental growth expected in line with the gradual recovery of Singapore’s economy. The subdued supply pipeline will continue to lend support to occupancy.

Singapore Real Estate Market Overview

Singapore’s real estate market is moderately competitive, with prominent domestic players having a presence in this sector and a sizeable number of foreign investors. Some major players are UOL Group Limited, CapitaLand, City Developments Limited, GuocoLand Limited, Far East Organization, and many more. The housing market has an overall positive sentiment, and investors are eyeing prime locations in the country. Moreover, post-pandemic, the government expects more upcoming projects offering real estate companies lucrative opportunities for investment and construction. With the increasing property prices, Singapore’s real estate market provides a competitive market to developers, buyers, and investors alike.