With the increase of ABSD in the new MAS cooling measures (27 April 2023), there will be greater savings when a singaporean couple to own a condo to do decoupling.

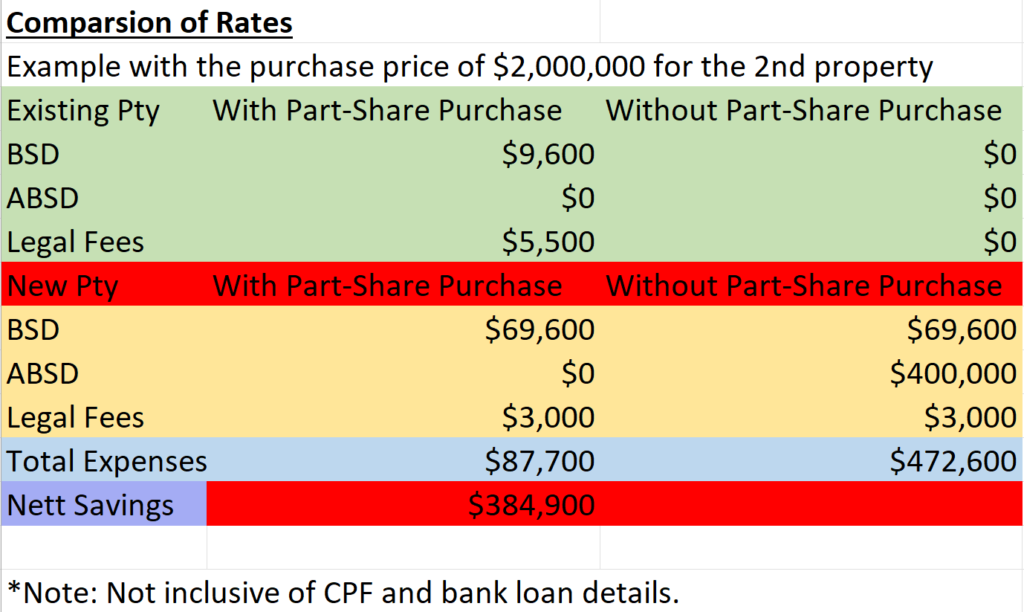

Here is the highlights of a whopping S$384,900 Savings if you purchase the next property at S$2,000,000.

a.The process of buying a share of an existing property between 2 or more parties.

b.Parties usually involved between spouses like Husband & Wife, Siblings, friends

a.To provide a party the opportunity to own his/her 1st property in their own name.

b.Friends who have invested a property together back then decides to get married and purchase their 1st matrimonial home and not incur ABSD in the process.

c.Paying ABSD straight VS conducting of decoupling à Which will be cheaper?

d.Getting maximum loan entitlement, I.e. 75% for 1st property.

a.Option to Purchase (OTP) / Sales & Purchase Agreement (S&P)

i.Purchaser to exercise to indicate formally they are purchasing the share.

b.Additional buyer’s Stamp Duties (ABSD) / Seller’s Stamp Duties (SSD)

i.Required to pay the 3% BSD within 14 days of exercising OTP/S&P.

ii.If at the point of purchasing share, client has more than 1 property, ABSD applies.

iii.If at point of purchasing share, client bought property less than 5 years, SSD applied.

c.CPF

i.Must repay whatever they use via CPF, back to CPF in cash.

d.Bank Loans

i.If property is encumbered, purchaser of share must do refinancing to takeover full remaining loan.

ii.Banks to check on buyer’s TDSR whether buyer capable of handling full loan purchase alone.

iii.3 months redemption period applies, so if client wants to complete fast, will incur interest by the bank.

e.Legal Fees

i.2 law firms to represent 1 seller and 1 buyer.

ii.Law firms to draft OTP/S&P

iii.Application of CPF

iv.Mortgage stamping fee and application documents to bank

a.Step 1: Purchaser need to sign OTP/S&P agreement (Note: Timeline of 10-12 weeks for completion of part-share purchase/decoupling process)

b.Step 2: Purchaser to pay BSD (or ABSD/SSD if any), 14 days from exercising

c.Step 3: CPF will be repaid to seller upon completion, which is reflected in their CPF one(1) – four(4) weeks after completion

d.Step 4: Seller to take note of the following before doing the refinancing for the loans:

i.Breakage fees

ii.Clawback of subsidies like legal fees, insurance premiums

iii.Late payment charges if any

iv.Bank Redemption date

5.Practical illustration as follows (decoupling example):

Part share of 1st property as follows:

- $1,000,000 current property value bought under joint Tenancy (Both Singaporean Citizens)

- Therefore, Sale price of 50% share is $500,000.

- Buyer’s Stamp Duty amount: $9,600 (Payable within 2 weeks of exercising of OTP/S&P)

- Check if any Seller’s Stamp Duties incurred

- Legal fees to act for both parties, est. $5,500

- Therefore, total expenses = $15,100

- *Note: CPF and bank loans needs to be repaid

New Property Purchased with Part-Share Purchase as follows:

- E.g. $2,000,000 new property value

- Buyer’s Stamp Duty amount: $69,600

- Legal Fees: $3,000

- Therefore, total expenses = $72,600

- *Note: if use CPF, from completion date of 1st property have to wait 1-4 weeks to reflect in CPF account + 2 – 4 weeks to disburse for new property again

Alternatively, for new property purchased WITHOUT part-Share Purchase:

- E.g. $2,000,000 new property value

- Buyer’s Stamp Duty amount: $69,600

- Additional Buyer’s Stamp Duty (20% as SC) amount: $400,000

- Legal Fees : $3,000

- Therefore, total expenses = $472,600

- *Note: May not get full 75% loan entitlement if 1st property is encumbered, min sum in CPF applicable as well

6.Anything special to take note of? (is decoupling good or bad)

a.Upon exercising S&P and paid total Stamp Duties, The seller (Already deemed to have indicated sold his share) can actually proceed to sign new OTP to buy the new property, without waiting for the full completion.

b.Clients must be clear on whether they have enough cash in hand to:

i.Pay back their CPF used for current property or not?

ii.Capabilities to have refinancing on their own? (inclusive of all TDSR compliance)

iii.For 2nd property, if purchasing a new completed property, stamp duties to be paid solely by cash.

iv.For 2nd Property, if purchasing a new launch property (BUC), stamp duties can have a leeway to be paid by CPF, subjected to bank’s abilities to provide in time:

1.Bank Letter Offer

2.Letter of instructions

3.Valuation report

Otherwise, to pay via Cash.

FAQs

Yes clients can reduce 95% of the time. provided that there is no loan.

It you are willing to be hands on. Here are the Steps.

-

Paying off your CPF and accured interest used. What you need to do is going to CPF website, after log in singpass you can make payment via Internet Transfer. It is immediate.

- Get Valuation Report by a independent Valuer . (1-2 weeks)

- Sign the Sales and Purchase Agreement (S & P) Fix an appointment with the Lawyer firm. (Do furnished the lawyer the required informtion for them to prepare the document before hand),

Completing this 3 Steps, You are good to buy another property without paying Additional ABSD. Find out if you are eligible for ABSD Remission.

We do have clients who did the following to save time and save on some legal fees. Please check with your appointed lawyers to see how they charge. If you leave everything to the Lawyers the Cost of Decoupling can be $5500-$8000.

Generally we will recommended you to take out the name that can take a longer loan to buy the next property.

If there is outstanding loan, It will takes around 10-12 Weeks.

No, You Cant if it is bought under a married couple whether Joint in Tenancy or Tenancy in Common.

If the owners are Siblings, Yes Can. If using CPF to buy over can just go to HDB Branch Office to do it. Dont need to pay Stamp duties.

If the owners are Siblings, Yes Can. If need to use Bank Loan, Will still need to do standard HDB procedure. Issue HDB OTP and doing the steps to apply HFE Application. In the HDB portal, you should state that the sellers and buyers are related. Stamp Duties is applicable.

Yes. You are only allowed to transfer ownership in an HDB flat to people in your immediate family, but they must meet specific eligibility conditions and requirements. In fact, the rules governing the transfer of ownership in HDB flats became more restrictive in 2016. Owners who want to give their ownership in an HDB flat to a family member can now only do so if one of six particular situations exist, including financial hardship and divorce.

With these, I hope that I had helped you to understand better on part-share purchase / decoupling process. Disclaimer above is a guide and interest party shall be referred to our prefer legal partners to assist you. At WING TAI HOLDINGS team we are here to make a decision and making sound property purchases with growth potential.

For more detailed discussion kindly contact us.